New Report Reveals Britons May Need £300k in Retirement Savings: When it comes to planning for retirement, there’s one big question that hangs over many of us: How much do I really need to save to enjoy the lifestyle I want after I retire? In the UK, the state pension is a vital safety net, but the latest reports suggest that it may not be enough to cover the lifestyle you’ve been dreaming of. In fact, many Britons may need as much as £300,000 in additional savings to match or even surpass the income provided by the state pension. In this article, we’re going to break down the numbers, explain what this means for you, and give you practical advice on how to plan for retirement in a way that ensures you live your best life once you hang up your boots.

New Report Reveals Britons May Need £300k in Retirement Savings

The reality is that the UK state pension alone is unlikely to provide the lifestyle many people dream of in retirement. To match the income provided by the state pension, many Britons will need to save between £300,000 and £800,000—depending on their desired lifestyle. While this may seem daunting, early planning and smart saving can make this goal more achievable. By diversifying your investments, contributing regularly to your pension, and tracking your progress, you can ensure a comfortable and secure retirement. Start today, and you’ll be one step closer to living the retirement you’ve always imagined.

| Key Topic | Details |

|---|---|

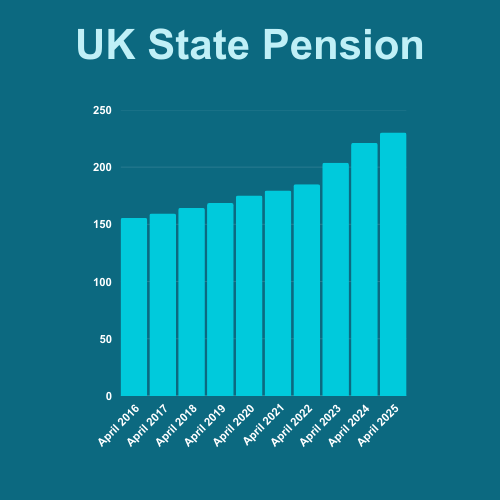

| State Pension Amount | £11,973 per year (as of 2025). |

| Required Savings for Comfortable Retirement | Around £300,000 – £800,000, depending on lifestyle. |

| Moderate Retirement Lifestyle | £31,700 annually needed; approx. £493,175 in savings. |

| Comfortable Retirement Lifestyle | £43,900 annually needed; approx. £798,175 in savings. |

| Couple’s Retirement Savings | £246,000 for moderate, £399,000 for comfortable lifestyle per person. |

| Annuity Rate for Calculations | 4% |

| Recommendation | Start planning early, increase savings, diversify investments. |

Understanding the State Pension and Its Limitations

The state pension in the UK is the cornerstone of retirement income for millions of citizens. But let’s get real: it’s not enough to live the way many of us expect during our golden years. The current full state pension is £11,973 a year, which sounds like a decent chunk of change — but once you factor in living costs, it doesn’t go as far as you might think.

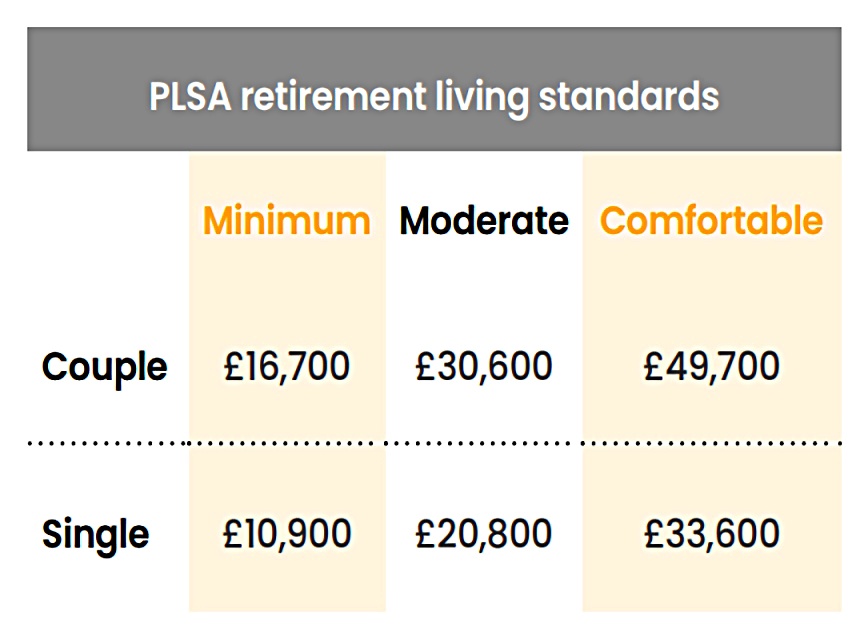

According to the Pensions and Lifetime Savings Association (PLSA), the average retiree looking for a comfortable lifestyle — think of regular holidays, dining out, and taking part in hobbies and leisure activities — would need an annual income of around £43,900. So, if you’re relying solely on the state pension, there’s a big gap to fill. And that’s where extra savings come into play.

To match the state pension’s shortfall, you would need to save a substantial amount of money. A comfortable lifestyle requires a savings pot of approximately £798,175, assuming an annuity rate of 4%. If that seems high, well, it is. But that’s the reality of retirement planning today.

What Does This Mean for Single Retirees?

For single retirees, the situation can be even more pressing. Without the benefit of shared living expenses (like couples have), it can be harder to make ends meet on just the state pension. A moderate lifestyle for a single retiree, including one holiday abroad per year and the ability to dine out occasionally, requires an annual income of £31,700. This comes to a lump sum of about £493,175.

While that’s still a lot of money, it’s more achievable with early and consistent saving. If you’ve got a few decades to go before retirement, it’s still possible to work towards these goals.

The Impact of State Pension vs. Savings on Couples

When it comes to couples, the numbers are a bit more forgiving. Since couples can share living expenses and potentially other costs, each person needs to save a bit less than a single retiree. However, the gap between state pension income and what’s needed to enjoy a comfortable retirement is still significant.

For couples, the combined savings required for a comfortable retirement would be around £798,000. That’s £399,000 per person. For a moderate lifestyle, couples would need to save around £492,000 in total, or £246,000 per person.

It’s clear that planning for retirement, especially as a couple, is a joint effort that requires regular saving, investing wisely, and sometimes even adjusting your lifestyle to meet your financial goals.

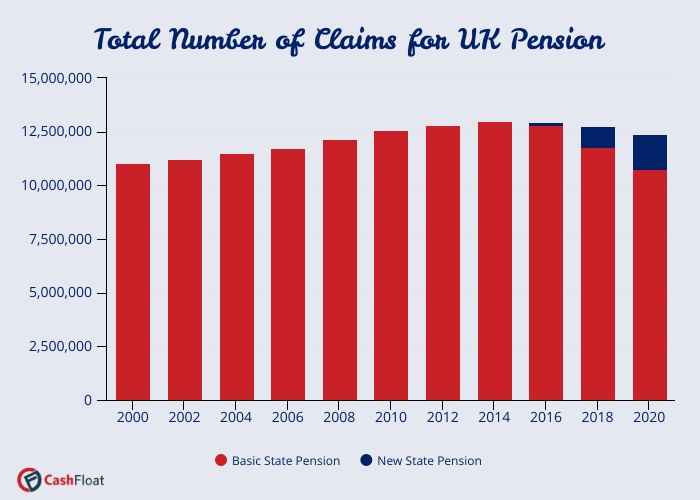

Different Types of Pensions You Should Know About

When planning for retirement, it’s important to understand the various types of pensions that are available to you:

1. State Pension

This is the foundation of most people’s retirement income, but as we’ve seen, it’s not enough to rely on alone.

2. Workplace Pension

Many employers offer a pension scheme, where both the employer and employee contribute to the fund. It’s important to make sure you’re enrolled in this scheme and consider increasing your contributions for a larger retirement fund.

3. Personal Pension

If you’re self-employed or want to contribute more than the basic pension schemes allow, a personal pension (or SIPP) is a flexible option. You can choose how much to invest and where, often through a variety of funds.

Understanding these pension types, their benefits, and how they work will give you a clearer view of your retirement options.

New Report Reveals Britons May Need £300k in Retirement Savings: Why the £300k-£800k Figure?

You might be wondering, why such a wide range? The answer lies in your desired lifestyle. Retirement can look different for everyone. Some people want to live modestly, with just the basics covered. Others want to travel the world, go out to eat often, or even treat their grandchildren. Here’s a breakdown of typical retirement lifestyles:

- Modest Lifestyle: This lifestyle includes only the essentials—basic living expenses, one holiday per year, and maybe some hobbies. It requires less money but still needs a good cushion of savings to avoid financial stress.

- Comfortable Lifestyle: For those who want a bit more luxury—regular holidays, dining out, enjoying leisure activities—a larger savings pot will be necessary. This is where the £300k to £800k estimates come in.

- Luxurious Lifestyle: If you’re dreaming of an extravagant retirement, like constant travel or owning a second home, you’ll need even more than the average estimate. This could push your savings well over £1 million.

For most people, aiming for a moderate to comfortable lifestyle is the sweet spot. But that still requires proper financial planning and consistent savings.

Understanding the Impact of Inflation

Another factor that’s often overlooked is inflation. Inflation refers to the increase in the cost of living over time, which means that the purchasing power of your savings will decrease. A pound today won’t stretch as far in 20 or 30 years.

For example, if you plan for a £300k savings goal today, the equivalent of that amount in 20 years could be far less due to inflation. On average, inflation runs at about 2% per year, which can add up quickly. Factor this into your retirement plan by regularly reviewing your savings goals and adjusting your strategy to compensate for inflation.

Tax Benefits of Pensions and Savings Accounts

Many retirement accounts in the UK come with tax advantages. For instance, contributions to your pension plan are made before tax is deducted, reducing your taxable income for the year. Additionally, any returns you earn on your pension fund are tax-free until you begin drawing them at retirement age.

Other accounts, like ISA savings accounts, allow you to save up to a certain limit each year without paying tax on any interest or returns. These accounts can serve as an extra layer of security for your retirement savings.

How to Bridge the Gap: Practical Steps for Retirement Planning

1. Start Early

Time is one of your greatest allies in retirement planning. The earlier you start, the less pressure you’ll face as you approach retirement age. If you begin saving in your 20s or 30s, your investments have decades to grow, potentially compounding interest and providing you with a comfortable cushion by the time you retire.

2. Increase Your Savings

If you’re already behind, don’t panic. It’s never too late to start saving more aggressively. You can increase your contributions to pension schemes or personal savings accounts. You can also take advantage of employer pension matching programs to maximize your savings potential.

3. Diversify Your Investments

Putting all your money into low-interest savings accounts might not get you to that £300k figure. Consider exploring investments that offer higher returns, like stocks, bonds, or mutual funds. While investing comes with risks, it can also significantly boost your retirement fund over time.

4. Track Your Progress

Monitor your savings regularly. Use online calculators or work with a financial advisor to track your progress. Make sure your contributions are on track to meet your goals and adjust them if necessary.

5. Consider Other Income Sources

Aside from pension savings, think about other ways to earn income in retirement. This could include part-time work, renting out property, or starting a small business. Having multiple income streams can help you live more comfortably without draining your savings.

Integrated Pension Rules May Reduce State Pension for Some, Confirms DWP

UK Set to Raise State Pension Age Beyond 67 as Life Expectancy Grows

State Pension Payment Increase for Those Receiving Disability Benefits- Check Details!