$2,000 Social Security Checks Scheduled for July 16: If you’re among the millions of Americans relying on Social Security, circle Wednesday, July 16, 2025, on your calendar. That’s when the next wave of $2,000 checks is scheduled to go out — but only for certain recipients. These payments are part of the Social Security Administration’s staggered schedule and could bring much-needed relief, especially during these inflationary times. So who gets these checks? What can you expect? And how do you protect your benefit? This article breaks it all down for you in plain English, whether you’re new to Social Security or a seasoned retiree.

$2,000 Social Security Checks Scheduled for July 16

If your birthday falls between the 11th and 20th of any month, your $2,000 Social Security check is coming your way on Wednesday, July 16, 2025. For millions of Americans, these payments are essential for covering rent, medication, groceries, and more. Understanding how payments work, what to expect, how to avoid overpayments, and how to maximize your benefits is crucial — not just for your wallet, but for your peace of mind. Stay informed and don’t hesitate to seek help when needed. Social Security is your earned benefit — you’ve worked for it, and you deserve to get every dollar you’re owed.

| Feature | Details |

|---|---|

| Payment Date | Wednesday, July 16, 2025 |

| Who Gets Paid | Birthdays between 11th–20th of any month |

| Average Check Amount | ~$2,002.39 (2025 national average) |

| Maximum Monthly Benefit (2025) | $5,108 (age 70 retirees) |

| SSI Recipients | Paid July 1 |

| Pre-May 1997 Beneficiaries | Paid July 3 |

| Dual Beneficiaries (SSI + SS) | Paid July 1 (SSI) and July 3 (SS) |

| Source | Social Security Payment Schedule – SSA.gov |

Understanding the July 16 Payment Schedule

If your birthday falls between the 11th and 20th of any month, and you’re receiving Social Security retirement, disability (SSDI), or survivor benefits, you are scheduled to receive your July payment on Wednesday, July 16, 2025.

This is part of the Social Security Administration’s tiered payment calendar, which spaces out payments based on your birth date to manage processing volumes. Here’s the full July breakdown:

| Birth Date Range | Payment Date |

|---|---|

| 1st–10th | July 9, 2025 |

| 11th–20th | July 16, 2025 |

| 21st–31st | July 23, 2025 |

| SSI Only | July 1, 2025 |

| Dual Benefits (SSI + SS) | July 1 and July 3 |

| Started Before May 1997 | July 3, 2025 |

How Much Will You Get?

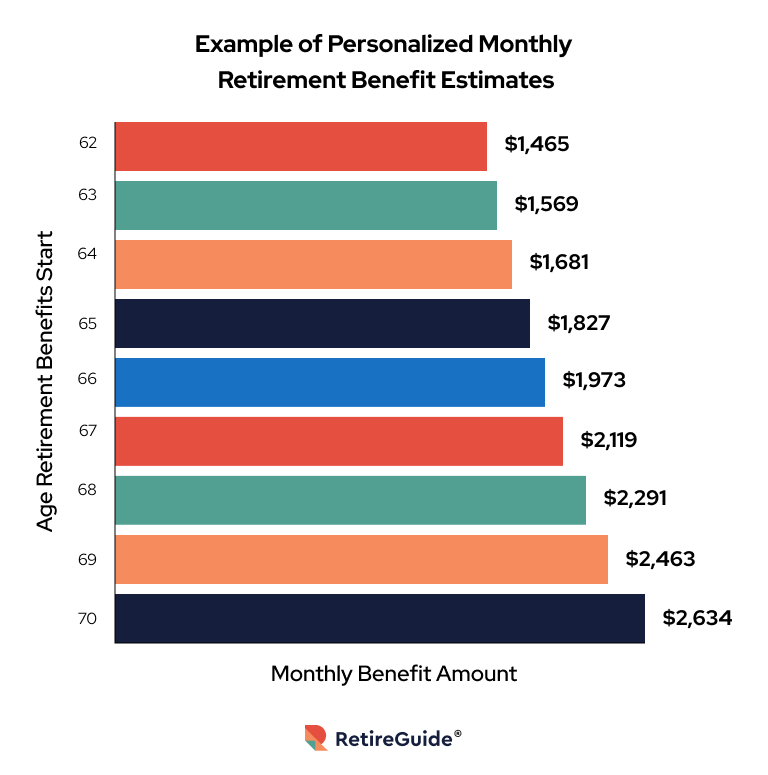

The average monthly Social Security retirement benefit for 2025 is $2,002.39, up from $1,848 in 2023, thanks to a 3.2% cost-of-living adjustment (COLA). However, the exact amount depends on several factors:

- Work history (number of years worked and wages earned)

- Age you started benefits

- Inflation adjustments

- Tax withholdings or garnishments

Example Scenarios

- Luis, 68, retired after 40 years of high-wage employment. His monthly benefit is $3,200.

- Angela, 62, retired early and receives $1,350/month.

- James, a disabled veteran, gets SSDI of $1,780/month and receives it the third Wednesday — July 16.

The maximum benefit in 2025 is $5,108/month for someone who earned maximum taxable wages and delayed benefits until age 70.

What Is Social Security and Why Does It Matter?

Social Security is a federally run insurance program that pays monthly benefits to eligible retirees, people with disabilities, and survivors of deceased workers. Created in 1935 during the Great Depression, it was designed to provide financial security to Americans later in life or during hardship.

Today, over 70 million people receive benefits from Social Security each month. It is often the primary income source for seniors and disabled individuals.

How Social Security Is Funded?

Social Security is primarily funded through the FICA payroll tax:

- Employees pay 6.2%

- Employers match that with another 6.2%

- Self-employed individuals pay 12.4% total

These funds go into trust accounts managed by the U.S. Treasury, and today’s taxes pay today’s beneficiaries — not your future self. That’s why the program’s sustainability depends on an active workforce.

SSI vs SSDI: What’s the Difference?

While both provide monthly payments, SSI and SSDI are different programs:

| Feature | SSI | SSDI |

|---|---|---|

| Eligibility | Low-income seniors/disabled | Disabled workers with work history |

| Based On | Financial need | Work credits and payroll taxes |

| Monthly Avg | ~$943 in 2025 | ~$1,537 in 2025 |

| Funded By | General federal taxes | Payroll taxes |

You can qualify for both, called concurrent benefits, but your SSI amount may be reduced if your SSDI is too high.

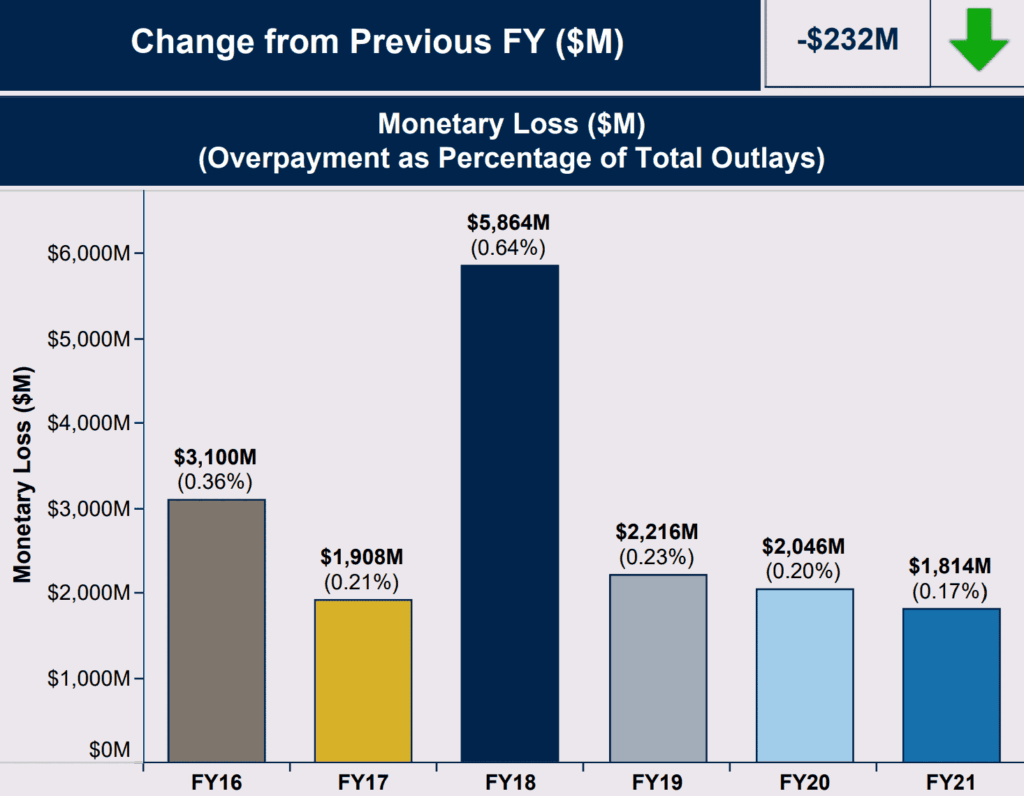

Overpayment Withholding: Why Your Check Might Be Lower

The SSA has recently changed its overpayment policy, which could affect your July payment.

Starting in April 2025, the agency may withhold up to 50% of your monthly benefit if they believe you’ve been overpaid and the notice was sent after April 25, 2025. Prior to this change, the default withholding was 10%.

What Can You Do?

- If you’re struggling, request a waiver of the repayment: Waiver Form

- File a reconsideration appeal if you believe SSA made a mistake

- Always report income or living changes promptly to avoid triggering overpayment

How to Apply for $2,000 Social Security Checks Scheduled for July 16?

If you’re not receiving benefits yet and think you’re eligible, here’s how to apply:

- Check eligibility at ssa.gov/benefits

- Gather documents: SSN, birth certificate, W-2s or tax returns, proof of citizenship

- Apply online, by phone at 1-800-772-1213, or at your local SSA office

- Set up your My Social Security account to track your application and payment status

Mobile Banking and Direct Deposit Tips

To make sure you get your check quickly and securely:

- Set up direct deposit through your SSA account or bank

- Use mobile banking apps to monitor when funds hit

- Set up alerts or auto-transfer to savings to manage monthly expenses

- Don’t use prepaid debit cards unless they’re officially SSA-approved

Real-Life Experience: How It Helps Everyday People

Tom, a 72-year-old Native American elder from Oklahoma, shared:

“Social Security isn’t just a number. It’s how I afford my medicine, my groceries, and help send my granddaughter to school. That check every month? That’s my dignity.”

Millions of Americans — young, old, rural, urban — depend on that monthly deposit to stay housed, clothed, and fed. This is more than a program; it’s a promise.

Tips to Maximize Your Social Security Benefits

- Delay claiming benefits until age 70 for the highest monthly payout

- Work at least 35 years — SSA averages your 35 highest-earning years

- Keep checking your Social Security Statement to ensure earnings are correct

- If you get divorced after 10 years of marriage, you might be eligible for spousal benefits

Trump’s New Tax Bill Could Reshape How Social Security Benefits Are Taxed

Recent Adjustment to Social Security Benefits Raises Questions- Check Details!

Republican Senator Lays Out Social Security Changes That Could Reshape Future Benefits