Upcoming Social Security Changes Require Immediate Action: If you’re receiving Social Security benefits, a major change is coming — and ignoring it could seriously delay your money. The U.S. Treasury and the Social Security Administration (SSA) have announced that all federal benefit payments must be made electronically starting September 30, 2025. Paper checks are being completely phased out. This move is part of a larger modernization effort, and while it’s designed to increase efficiency and reduce fraud, it puts the responsibility on recipients to act now. If you still get your benefits by check in the mail and don’t switch to an electronic payment method by the deadline, you may face delays, interruptions, or even suspended payments.

Upcoming Social Security Changes Require Immediate Action

The federal government’s decision to end paper checks for Social Security and other federal benefits is a long-awaited step toward a more secure, efficient system. However, for millions of Americans, it requires action — and the clock is ticking. By switching to direct deposit or a Direct Express card well before September 30, 2025, you’ll ensure your benefits continue without delay or disruption. Whether you’re a retiree, a veteran, or someone helping a loved one, this is a change that can’t be ignored. Don’t wait until the last minute. The sooner you act, the smoother your transition will be.

| Detail | Information |

|---|---|

| Policy Change | Paper checks for Social Security and federal benefits will end |

| Deadline | September 30, 2025 |

| Who Is Affected | Anyone receiving Social Security, SSI, SSDI, VA, or federal benefits by check |

| Action Required | Must enroll in electronic payments: Direct Deposit or Direct Express card |

| Risk of Inaction | Payment delays, suspension, or fraud |

| Estimated Annual Savings | $750 million (U.S. Treasury) |

| Where to Act | GoDirect.gov, SSA office, or 1-877-874-6347 |

Why the Government Is Ending Paper Checks?

The move to eliminate paper checks isn’t new. In fact, the federal government has been phasing in electronic payments since the early 2000s. The U.S. Treasury’s Go Direct® campaign initially required most new enrollees to receive benefits electronically as early as 2013. However, exceptions remained for those with hardships or who never updated their payment preferences.

But now, the exception is ending — and everyone must comply.

The reasons are rooted in security, cost, and modernization:

- Paper checks are more vulnerable to theft, fraud, and delivery delays.

- Over 115,000 checks were reported as lost or stolen in 2023 alone.

- The cost of replacing lost checks and investigating fraud drains taxpayer money.

- Electronic payments are faster, more reliable, and less expensive to administer.

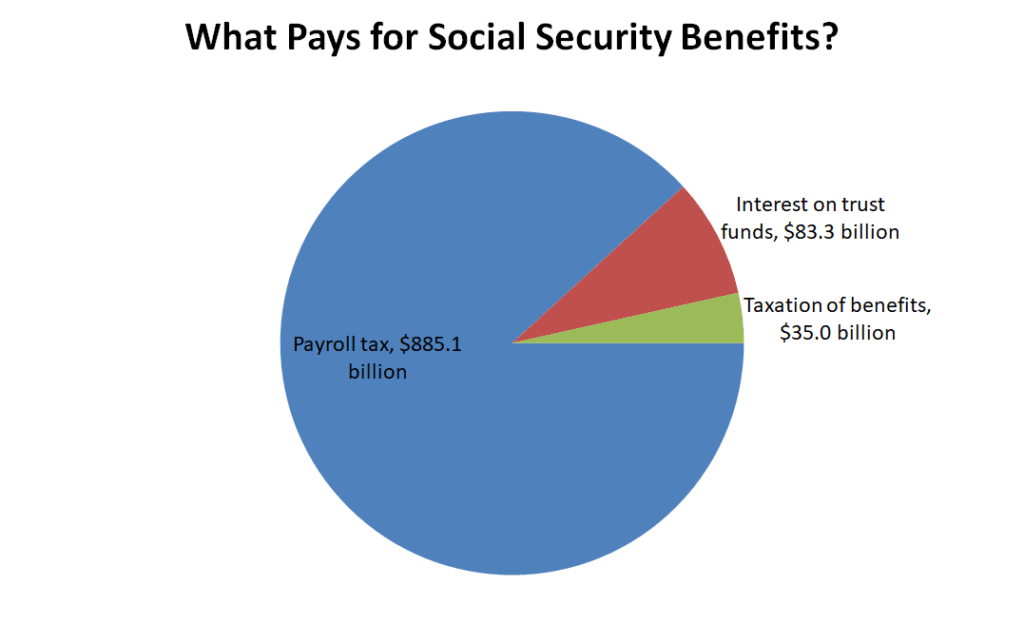

According to the U.S. Department of the Treasury, transitioning fully to digital payments will save approximately $750 million per year — money that can be redirected to essential federal services and programs.

Who Is Affected?

The change applies to anyone currently receiving federal benefit payments by paper check, including:

- Social Security Retirement (OASDI)

- Social Security Disability Insurance (SSDI)

- Supplemental Security Income (SSI)

- Veterans Affairs (VA) Compensation or Pension

- Railroad Retirement Board (RRB) payments

- Civil Service Retirement System (CSRS) payments

Whether you’re newly retired, disabled, receiving survivor benefits, or caring for someone who does — if you haven’t switched to direct deposit or the Direct Express® card, you must do so by September 30, 2025.

Historical Background: A Shift Years in the Making

The federal push toward digital benefits began under the Electronic Funds Transfer (EFT) Act, which mandates electronic disbursement of government funds when possible. Since 1999, every federal agency has been working toward 100% compliance.

In 2010, the U.S. Treasury issued a final rule stating that all federal benefit recipients must receive payments electronically by March 1, 2013. However, due to outreach limitations, especially in rural and underbanked areas, paper checks were still issued to around 1 million Americans.

Now, with financial fraud increasing in the digital age — especially check theft and “check washing” scams — the SSA is taking the final step in enforcing full electronic compliance.

Upcoming Social Security Changes Require Immediate Action: How to Switch to Electronic Payments

Option 1: Direct Deposit

Direct deposit is the preferred and most widely used method. It sends your Social Security or federal benefits directly to your checking or savings account.

Steps to enroll:

- Gather your banking information (account number and routing number).

- Visit SSA.gov/myaccount and log in.

- Select “Update Direct Deposit.”

- Follow the on-screen instructions to enter your bank details.

Alternatively:

- Call 1-800-772-1213

- Visit your local SSA office

- Provide a voided check or official bank letter for verification

Option 2: Direct Express® Debit Card

For those without a traditional bank account, the Direct Express® Mastercard® is a prepaid debit card backed by the federal government. It works like a bank card and is insured by the FDIC.

How to enroll:

- Apply at www.USDirectExpress.com

- Call 1-877-212-9991

Benefits:

- No minimum balance

- No credit check required

- Free access to funds at in-network ATMs and retail locations

- Cardholder support and fraud protection

What Happens If You Miss the Deadline?

Failing to switch before the September 30, 2025 deadline could have serious consequences:

- Your benefit payments could be delayed or suspended.

- You may need to manually request reissuance of benefits through SSA.

- Exceptions will be rare and only granted under approved hardship conditions.

- If your check is lost or stolen during the transition, recovery may take weeks.

Keep in mind: SSA will not call or email you to “update your direct deposit.” Any such contact is likely a scam.

Real-World Impact: Who’s at Risk?

While the change aims to enhance efficiency, it presents challenges for certain populations:

- Rural communities with limited internet or banking access

- Seniors unfamiliar with online systems or digital banking

- Native American reservations with remote delivery infrastructure

- Unbanked individuals or those with unstable housing

According to the FDIC’s National Survey of Unbanked and Underbanked Households, approximately 5.9 million U.S. households were unbanked as of 2021. Many of these households include individuals who rely on federal benefits.

Help and Support Resources

If you or someone you care for needs help making the switch:

- Call the Go Direct Enrollment Center: 1-877-874-6347

- Contact your local Social Security office

- Visit a community action center, senior center, or tribal administration office

- Request help through nonprofits like AARP or legal aid clinics

Additionally, SSA now offers:

- In-language support in 10+ languages

- TTY phone services for the hearing-impaired

- In-person appointments for individuals without internet access

Expert Perspective

Lorie Schmidt, a senior financial policy advisor at the Social Security Administration, shared this:

“Digital payments aren’t just a convenience — they’re a safety measure. Fraud rates drop dramatically with electronic payments. Our goal is to protect Americans’ benefits while providing the support they need to adapt.”

Trump’s ‘Big Beautiful Bill’ Sparks Debate Over Social Security and Benefits

Republican Senator Lays Out Social Security Changes That Could Reshape Future Benefits

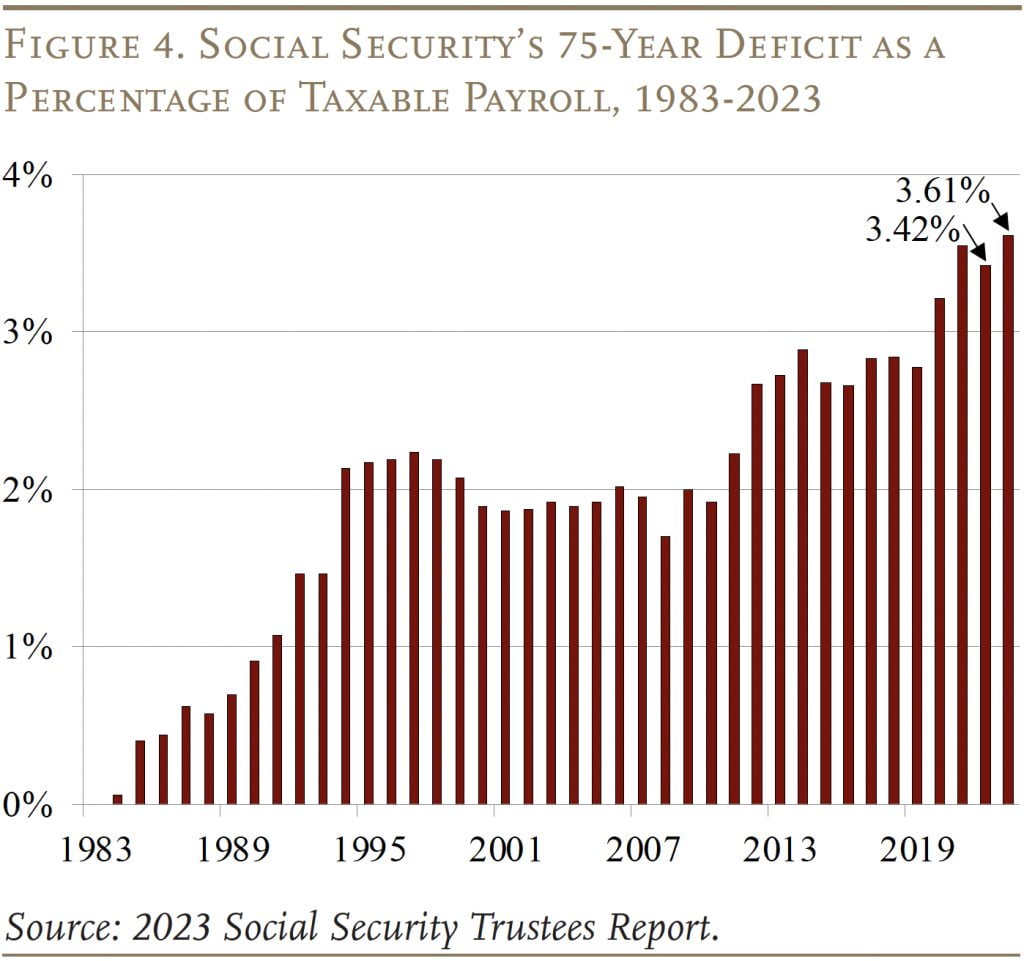

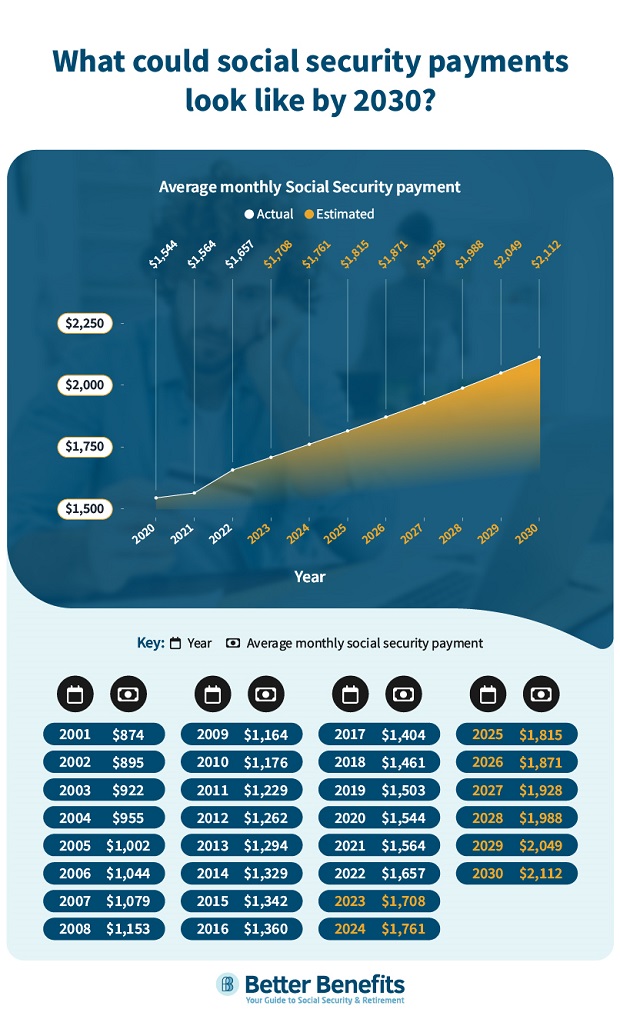

Social Security Projected to Cut Benefits by 2033, Affecting Retired Workers

What You Can Do Today

- Check how you currently receive your benefits. If it’s by paper check, you must act.

- Gather your documents. You’ll need your SSN, bank info, or valid ID.

- Choose your payment method. Direct deposit or Direct Express.

- Enroll through SSA.gov, GoDirect.gov, or by phone.

- Help someone else. Seniors and others may need help navigating the system.