Gen X Could See a Big Payday Soon With Upcoming Financial Changes: If you’re a Gen Xer—born between 1965 and 1980—it’s time to pay close attention. America is in the early stages of the largest wealth transfer in history, and you’re next in line to benefit. According to top researchers, Generation X is poised to inherit over $1.4 trillion per year from their Baby Boomer parents over the next decade.

This financial shift is part of what experts call the Great Wealth Transfer—a tidal wave of cash, assets, homes, businesses, and investments moving from older Americans to their children and grandchildren. And while Millennials might inherit more in the long run, Gen X is first in line to receive a massive slice of the pie. Whether you’re dealing with aging parents, feeling behind on retirement, or just curious about what this means for your money—this article is your roadmap. We’ll break down what’s happening, what it means for you, and how to prepare for what could be the biggest financial shift of your lifetime.

Gen X Could See a Big Payday Soon With Upcoming Financial Changes

| Topic | Details |

|---|---|

| Who’s Affected | Generation X (Born 1965–1980) |

| Estimated Inheritance | $1.4 trillion per year over the next decade |

| Total Wealth Transfer | $84 trillion through 2045 |

| Main Opportunity | Inheritance from Baby Boomers |

| Top Financial Concern | Underprepared for retirement |

| Common Risks | Probate delays, poor planning, taxes, scams |

| Authoritative Sources | Cerulli Associates, AARP, IRS, Fidelity |

What’s Happening: The Great Wealth Transfer and Gen X

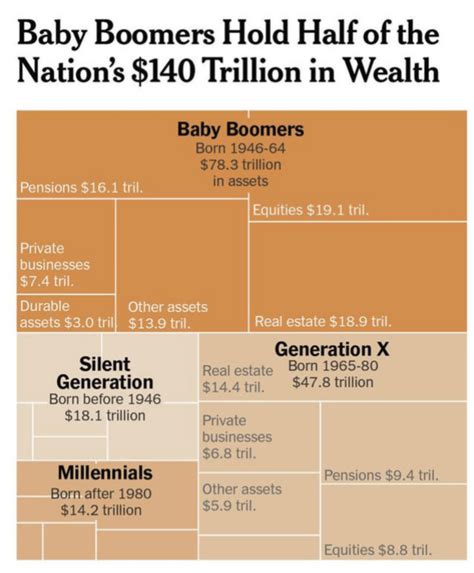

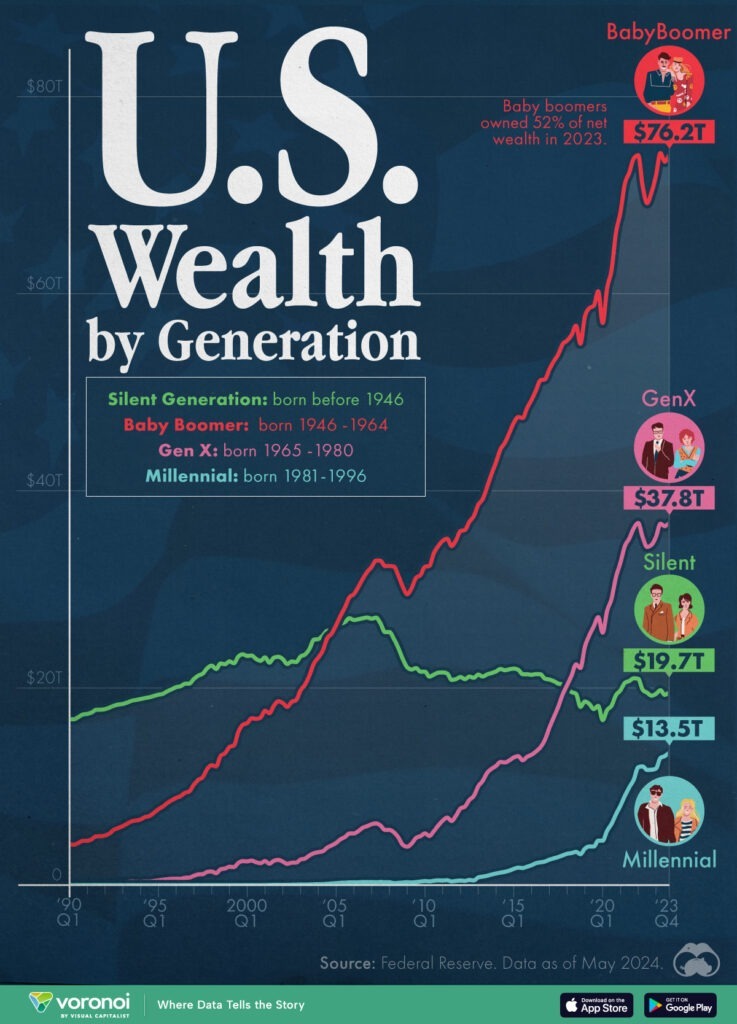

According to data from Cerulli Associates, an estimated $84 trillion will be transferred across generations between now and 2045. Of that, $72.6 trillion will go directly to heirs—mostly adult children—while the rest goes to charities.

This transfer will primarily come from Baby Boomers, many of whom built substantial wealth during the post-war economic boom, real estate expansion, and stock market growth. Gen X, their children, are now in their late 40s to early 60s. Many Boomers are already retired or nearing the end of life, meaning this transfer is happening now—not decades from now.

Here’s the twist: While Millennials (born 1981–1996) are expected to inherit the largest total share over time, Gen X is receiving most of the early action.

Why Gen X Could See a Big Payday Soon With Upcoming Financial Changes Matters?

Let’s be honest: Gen X has had it rough financially. Sandwiched between Boomers and Millennials, they’ve been largely ignored by politicians and marketers, and have faced unique financial headwinds:

- Dot-com bust (early 2000s)

- 2008 financial crisis

- COVID-19 economic disruptions

- Rising costs of living, housing, and education

In fact, a 2023 study by Investopedia revealed that over 60% of Gen Xers are worried they won’t have enough money to retire. Most have less than $100,000 saved for retirement, far short of what’s needed for a secure future.

So yes, this incoming wealth? It’s not just welcome—it’s necessary.

What Gen X Can Do With This Windfall?

The truth is, a six-figure or even seven-figure inheritance could be life-changing. But that depends on how you use it. Below are several high-impact strategies Gen Xers can consider:

1. Pay Down High-Interest Debt

If you’re carrying credit card balances with interest rates north of 20%, there’s no better use of inheritance money. Paying off high-interest debt is like giving yourself a guaranteed return on investment.

2. Boost Retirement Contributions

Use the inheritance to max out your 401(k) or IRA—especially if you’re over 50 and eligible for catch-up contributions. In 2025, people over 50 can contribute an extra $7,500 to their 401(k).

3. Invest in Passive Income

Buy rental property, dividend-paying stocks, or invest in a business that generates recurring income. Passive income means peace of mind, especially during retirement.

4. Help Your Kids

Use a portion of the inheritance to help your children with college tuition, start a business, or make a down payment on a home. Just make sure it doesn’t jeopardize your own financial health.

5. Create or Update Your Own Estate Plan

Receiving an inheritance is the perfect time to get your own affairs in order. Set up a will, consider a trust, and review beneficiary designations. Protect your own legacy now.

Common Risks and How to Avoid Them

Money can be a blessing—or a curse—depending on how it’s handled. Here are key risks Gen Xers should watch for.

Probate and Legal Delays

If your parents die without a will or trust, their estate could get stuck in probate court. This process can take months or years, and cost up to 10% of the estate value in legal fees. Encourage your parents to create a living trust to avoid this.

Sudden Wealth Syndrome

Studies show that up to 70% of people who receive large inheritances blow through them within a few years. Don’t make impulsive financial decisions—get a plan in place.

Scams and Financial Abuse

Fraudsters target inheritors with too-good-to-be-true investment offers and fake “urgent” requests. If someone pressures you to send money or invest quickly, it’s likely a scam.

Tax Consequences

While most inheritances are tax-free, some inherited assets—like traditional IRAs—can trigger income taxes. It’s critical to meet with a tax advisor to understand what you owe and when.

Emotional and Psychological Factors

Inheriting money often comes after the loss of a loved one. That can create complicated emotions:

- Guilt over “benefiting” from someone’s death

- Anxiety about making the “right” financial choices

- Family tensions or disputes over who gets what

Give yourself time to grieve. You don’t need to make any big financial decisions immediately. In fact, most advisors recommend parking the money in a high-yield savings account for a few months while you figure things out.

Real-World Case Study: Mike from Ohio

Mike, 54, received a $280,000 inheritance from his father’s estate in 2024. Initially, he planned to buy a luxury car and remodel his kitchen.

But after speaking with a financial advisor, Mike decided to:

- Pay off his mortgage

- Contribute $50,000 to his 401(k)

- Invest $80,000 in a diversified portfolio

- Set up a $5,000 emergency fund

Now, he has financial stability, no mortgage, and a growing nest egg. His story is a textbook example of how to turn inheritance into long-term success.

What You Should Do Right Now: A Step-by-Step Plan

- Talk with Your Family

Start the estate planning conversation with your parents. Find out if they have a will, trust, or named beneficiaries. - Take Inventory of Your Finances

List all your debts, income, retirement accounts, and expenses. Knowing your financial position helps guide your decisions. - Hire a Financial Advisor

Look for a fee-only fiduciary—someone who is legally required to act in your best interest. - Review Legal Documents

Check your own will, power of attorney, and healthcare directives. Update as needed. - Protect the Money

Keep the money safe while planning. Don’t let emotions or pressure lead to reckless spending. - Make a Long-Term Plan

Prioritize debt reduction, retirement, emergency savings, and then lifestyle upgrades.

Gen Z Is Saving for Retirement Early, But Employers May Be Falling Behind

Millennial Who Achieved Early Retirement Reveals Harsh Truth About FIRE Lifestyle

4 Financial Mistakes Americans Keep Making That Wreck Their Budgets