Social Security Taxes Could Be Impacting Your Retirement Income: How Social Security Taxes could be impacting your retirement income today is a topic that’s flying under the radar for many Americans. With more seniors working part-time, drawing from retirement accounts, and facing rising living costs, many are surprised to learn that Uncle Sam could tax up to 85% of their Social Security benefits. That’s not a typo. And in 2025, new tax rules and temporary deductions have created both relief—and confusion. Whether you’re currently retired, planning your retirement in the next few years, or advising others on their finances, understanding these rules can help you save thousands in unnecessary taxes and optimize your lifetime retirement income.

Social Security Taxes Could Be Impacting Your Retirement Income

Social Security may feel like a guaranteed, tax-free safety net—but the truth is far more complicated. With up to 85% of your benefits subject to taxes and rising Medicare premiums tied to your income, it’s never been more important to plan ahead. Thankfully, with a little strategy—like delaying benefits, using Roth accounts, timing withdrawals, and taking advantage of new deductions—you can maximize your retirement income and reduce your tax bill. Taxes are part of the retirement game—but with the right tools and timing, you stay in control.

| Highlight | Details |

|---|---|

| Taxable Portion of Benefits | Up to 85% of your Social Security income may be subject to federal income tax. |

| Income Thresholds | Singles: $25k–$34k, Married: $32k–$44k; above this, up to 85% is taxable. |

| New Deduction (2025–2028) | Extra $6,000 for singles 65+, $12,000 for married couples, phases out at $75k/$150k. |

| Medicare IRMAA Impact | Higher income increases Medicare premiums, costing retirees hundreds more yearly. |

| Trust Fund Warning | Social Security’s primary fund may run out of money by 2032–2033. |

| Planning Strategy | Smart income planning, Roth conversions, and delaying benefits can reduce tax burden. |

How Did We Get Here? A Quick History

When Social Security began in 1935, it was entirely tax-free. But as the program expanded and retirement income diversified, Congress decided to tax benefits for higher-income individuals.

- 1983: Up to 50% of Social Security became taxable

- 1993: That cap was raised to 85% for upper-income recipients

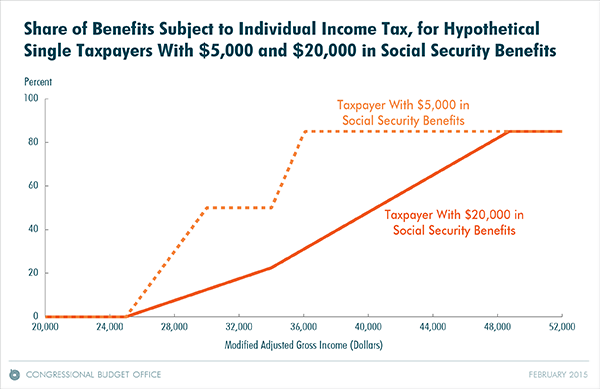

Here’s what hasn’t changed since then: the income thresholds that determine how much of your benefit is taxable. They’re still stuck at $25,000 for single filers and $32,000 for married couples—levels that haven’t been adjusted for inflation in over 30 years.

So now, thanks to inflation and rising investment income, more retirees than ever fall into taxable brackets—many without realizing it.

How Social Security Taxes Work in 2025?

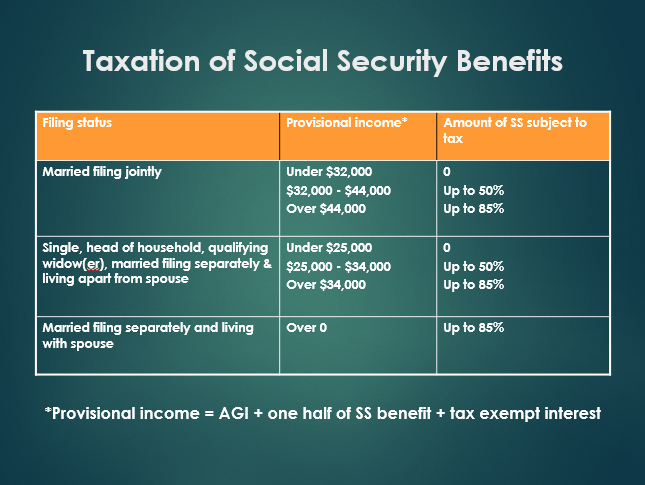

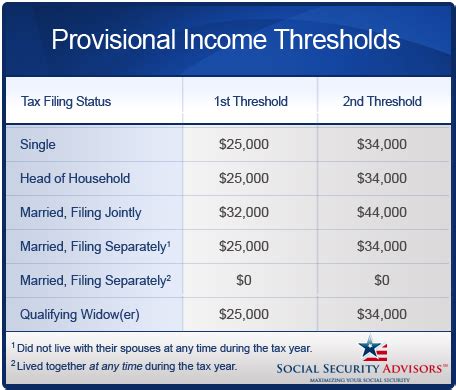

The IRS uses a formula called provisional income to determine how much of your benefits are taxable:

Provisional Income = Adjusted Gross Income (AGI) + Tax-Exempt Interest + ½ of Social Security Benefits

What That Means:

- If your provisional income is below $25,000 (single) or $32,000 (married), your benefits are not taxed.

- If it falls between $25k–$34k (single) or $32k–$44k (married), up to 50% is taxable.

- Over $34k (single) or $44k (married), up to 85% of your benefits are taxable.

Example:

Let’s say you’re married and filing jointly. Your income includes:

- $35,000 from IRA withdrawals

- $1,500 in tax-free municipal bond interest

- $24,000 in Social Security

Your provisional income would be:

35,000 + 1,500 + (0.5 × 24,000) = $48,500

That puts you over the $44,000 threshold, so 85% of your benefits are included in taxable income.

What’s New in 2025: The Senior Deduction

The recently passed “Big Beautiful Bill” introduced a temporary deduction:

- $6,000 extra deduction for individuals 65+

- $12,000 for couples 65+

- Phases out once income reaches $75,000 (single) or $150,000 (joint)

- Applies only between 2025 and 2028

This deduction reduces your taxable income, which can help avoid the higher tiers of benefit taxation. However, it doesn’t change the formula for calculating provisional income—it simply lowers your total tax bill.

This can be especially helpful for retirees with modest IRA distributions, investment income, or those taking part-time work.

The Hidden Danger: COLA Increases and Medicare Premiums

COLA Raises Can Trigger Higher Taxes

Each year, Social Security benefits are adjusted based on inflation. In 2025, the COLA increase was 3.1%, pushing monthly checks up for millions of seniors. But here’s the catch: those higher benefits can push your provisional income over key tax thresholds.

So while you’re technically earning more, you could also:

- Owe more federal income tax

- Pay higher Medicare premiums (due to IRMAA)

- Lose eligibility for income-based state benefits

IRMAA Penalties Add Up

The Income-Related Monthly Adjustment Amount (IRMAA) is another tax trap. If your Modified Adjusted Gross Income (MAGI) exceeds certain limits, your Medicare Part B and D premiums go up—sometimes dramatically.

In 2025, IRMAA kicks in at:

- $103,000 (individual)

- $206,000 (married couple)

Each tier adds $66–$400/month to your Medicare premium. Even a $1 bump in income can push you over the edge.

Social Security’s Future: Can You Count on Your Full Benefit?

Social Security is largely funded through payroll taxes and income taxes on benefits. But those funds are running low.

According to projections, the OASI Trust Fund (Old Age and Survivors Insurance) will be depleted by 2032–2033 if Congress doesn’t act. If that happens, benefits could be cut by 23% across the board.

That’s a big motivator to optimize your retirement income now, while tax laws are still relatively favorable.

Planning Smarter: Strategies to Minimize Social Security Taxes Could Be Impacting Your Retirement Income

1. Delay Claiming Benefits

Waiting until Full Retirement Age (FRA) or age 70 can increase your monthly benefits significantly. Plus, delaying can reduce the number of years those benefits are taxed—especially if you’re drawing income from other sources.

2. Use Roth IRAs and Tax-Free Accounts

Distributions from Roth IRAs are not included in provisional income. That makes Roth withdrawals a great tool for reducing or avoiding Social Security taxes.

3. Time Your IRA Withdrawals

Start withdrawing from traditional IRAs before claiming Social Security—ideally during the gap between retirement and age 70. This spreads your income across more years, lowering your provisional income during peak years.

4. Qualified Charitable Distributions (QCDs)

If you’re over 70½, you can donate up to $100,000 per year from your IRA directly to charity. This reduces your AGI—and therefore, your provisional income.

5. Consider Filing Separately (Carefully)

If one spouse has significant medical expenses or other deductions, married filing separately could lower the couple’s overall tax bill. However, it may result in more of your Social Security becoming taxable, so consult a tax advisor.

Real-Life Case Studies

Case Study 1: Bob & Susan

- Age: 68 and 66

- Income: $40,000 IRA withdrawals + $25,000 Social Security

- Provisional income = $40,000 + $12,500 = $52,500

- Social Security taxed at 85%, higher IRMAA tier triggered

Fix: They delay Susan’s Social Security to 70 and take more Roth IRA distributions now to lower future taxes.

Case Study 2: Linda (Single Retiree)

- Income: $18,000 pension + $16,000 Social Security

- Provisional income = $18,000 + $8,000 = $26,000

- In the 50% taxable zone

Fix: She uses QCDs for her charitable giving and switches to Roth conversions during low-income years.

What You Should Do Today: A Retirement Tax Checklist

- Open or log in to your SSA account at www.ssa.gov

- Calculate your provisional income

- Check your Medicare IRMAA thresholds

- Talk to a CPA or financial advisor before year-end

- Rebalance investments to manage capital gains

- Set up Roth conversions during low-income years

- Review withholding from pensions or IRA distributions

Trump’s New Tax Bill Could Reshape How Social Security Benefits Are Taxed

Social Security Sends Out Urgent Email Over Trump Tax Bill Confusion – Check Details!

Recent Adjustment to Social Security Benefits Raises Questions- Check Details!