What New Social Security Data Suggests About the Future of Monthly Benefits? Social Security is an essential part of retirement planning for millions of Americans. It provides a safety net for retirees, disabled individuals, and survivors of deceased workers. But with new data and reports coming out, there are increasing concerns and questions about the future of Social Security benefits. What does this new data tell us? Will monthly benefits remain steady, or is there a storm on the horizon? In this article, we’ll break down the latest Social Security trends, changes, and what it means for your future benefits.

What New Social Security Data Suggests About the Future of Monthly Benefits?

Social Security remains a critical program for millions of Americans, and while the future of monthly benefits is uncertain, recent data provides both opportunities and challenges. From increased payments to potential fund depletion, it’s clear that planning for retirement requires more than just Social Security. By diversifying income sources, staying informed, and preparing for changes, you can ensure a more secure financial future.

| Key Topic | Details | Source |

|---|---|---|

| Cost-of-Living Adjustment | Benefits have increased by 2.5% for 2025 | SSA.gov |

| Average Monthly Benefit | $2,002.39 for retired workers as of May 2025 | Kiplinger |

| Windfall Elimination Act | Repeal increases benefits for 3 million retirees | AP News |

| Trust Fund Depletion | Projected depletion of OASI Fund by 2033 | Kiplinger |

| Proposed Reforms | CBO suggests a flat $1,660 benefit for all retirees | MarketWatch |

Understanding Social Security: The Basics

Social Security benefits are essentially a monthly income for those who have worked and paid into the system during their careers. When you retire, become disabled, or pass away, your family members may be eligible for these benefits. The amount you receive is based on your earnings history. For many, Social Security is a critical source of income, especially as other retirement savings like 401(k)s or pensions may not be enough to cover all living expenses.

How Does Social Security Work?

In simple terms, Social Security is a form of social insurance. As you work and earn income, you pay Social Security taxes (FICA taxes) which are then put into the Social Security Trust Fund. When you retire, you start drawing from this fund. The amount you receive depends on how much you’ve earned during your working years.

The Social Security Administration (SSA) uses a formula to determine your monthly benefit, which is designed to replace a certain percentage of your average lifetime earnings. The higher your income, the higher your benefit – but it’s capped.

Key Social Security Data Suggests About the Future of Monthly Benefits?

Social Security has been a reliable program for decades, but recent data and projections are raising questions about its future. Let’s dive into some of the latest statistics and what they mean for beneficiaries.

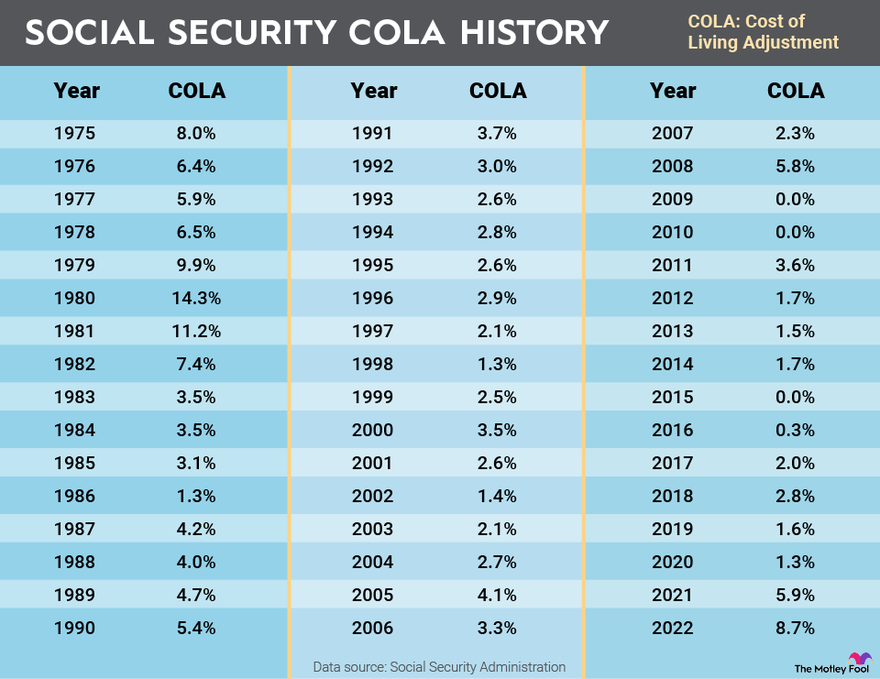

Cost-of-Living Adjustment (COLA)

Each year, Social Security benefits are adjusted for inflation through the Cost-of-Living Adjustment (COLA). This adjustment helps keep benefits in line with the rising cost of living. For 2025, COLA increased by 2.5%, which means a modest boost in the monthly checks for millions of Americans. On average, retirees will see an increase of about $50 per month.

This adjustment is crucial for maintaining the purchasing power of retirees, as inflation can erode the value of fixed incomes over time. According to the Social Security Administration, this COLA increase will impact over 72.5 million beneficiaries, including retirees and those on Supplemental Security Income (SSI).

Growth in Beneficiaries and Monthly Payments

Social Security continues to grow as more people retire. As of 2025, around 73.9 million Americans receive Social Security benefits. Of this number, 52.6 million are retired workers. As more baby boomers reach retirement age, this number will only continue to rise, adding pressure to the Social Security system.

In May 2025, the average monthly benefit for retired workers surpassed $2,000, reaching $2,002.39. This increase is a reflection of the COLA adjustment, as well as changes to how benefits are calculated. For some retirees, Social Security may be the largest source of income in retirement, so these increases can make a big difference in their quality of life.

Windfall Elimination Provision (WEP) Repeal

A major change in 2025 is the repeal of the Windfall Elimination Provision (WEP). The WEP was designed to reduce Social Security benefits for people who worked in jobs not covered by Social Security, such as certain government positions. However, many felt this was unfair, especially those who had worked in both government jobs and jobs that paid into Social Security.

With the repeal of the WEP under the Social Security Fairness Act, nearly 3 million retirees will see an increase in their monthly benefits. This is a win for public service workers and teachers who were negatively impacted by this provision.

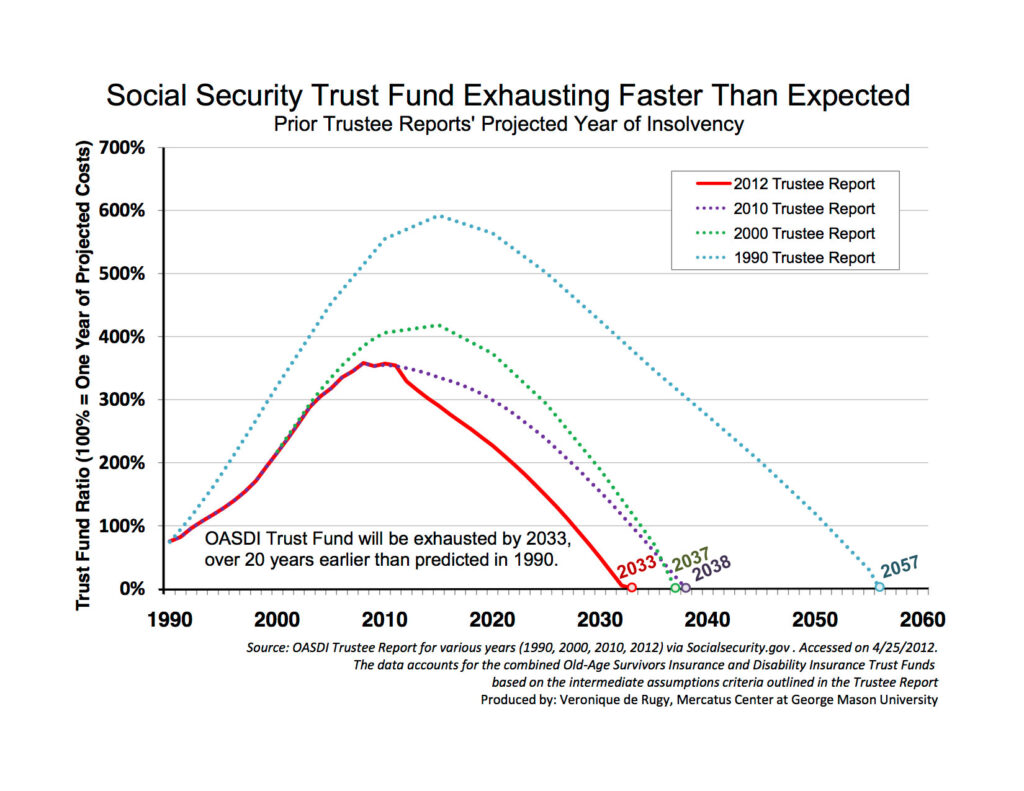

Concerns About the Future: Trust Fund Depletion

Despite the positive news regarding COLA increases and benefit adjustments, there are significant concerns about the future sustainability of the Social Security program.

The Social Security Trustees Report has warned that the Old-Age and Survivors Insurance (OASI) Trust Fund could be depleted by 2033. If this happens, Social Security will only be able to pay about 77% of scheduled benefits unless something changes.

This depletion could be caused by several factors:

- Increased life expectancy: As people live longer, they’re drawing benefits for more years.

- Baby boomer retirement: A large number of people are retiring and claiming benefits.

- Slower workforce growth: Fewer younger workers are entering the workforce compared to the number of retirees.

Without intervention, Social Security will have to reduce benefits for all recipients, which could lead to a 23% cut in monthly payments by 2033.

Proposed Reforms: Flat Benefit Structure

To address these challenges, the Congressional Budget Office (CBO) has suggested a flat $1,660 monthly benefit for all retirees, regardless of their lifetime earnings. While this could provide more consistent payouts, it would reduce benefits for about 75% of current beneficiaries, particularly high earners. This proposal is one of many that Congress is considering to stabilize Social Security’s finances, but it remains a topic of significant debate.

What Can You Do to Prepare?

Given the uncertainty surrounding Social Security’s future, it’s important for individuals to plan ahead and diversify their retirement income sources. Here are some practical steps you can take to protect yourself:

- Start Saving Early: The earlier you start saving for retirement, the more you can rely on other sources of income besides Social Security. Consider opening a 401(k) or IRA to supplement your Social Security income.

- Understand Your Social Security Benefits: Use the SSA’s online calculator to estimate your future benefits based on your current earnings.

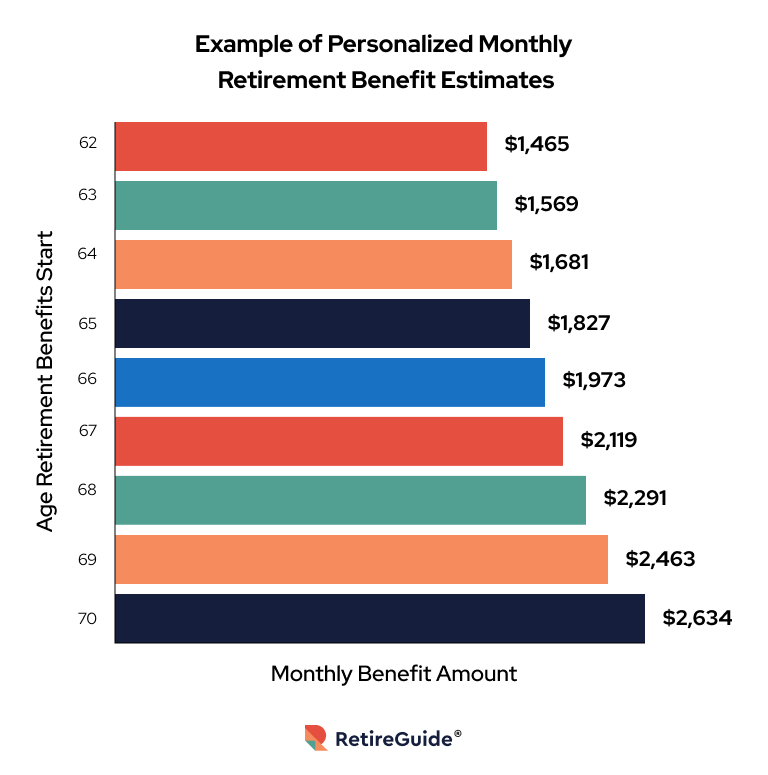

- Consider Delaying Retirement: You can start collecting Social Security benefits at age 62, but the longer you wait (up until age 70), the higher your monthly benefit will be.

- Stay Informed: Social Security rules and benefits can change, so it’s important to stay up-to-date with any legislative changes or policy shifts. Regularly check the SSA website or follow trusted news sources for updates.

Social Security Projected to Cut Benefits by 2033, Affecting Retired Workers

Trump’s ‘Big Beautiful Bill’ Sparks Debate Over Social Security and Benefits

Some Social Security Recipients Could See Payments Slashed in Half— Check Why!