Updates to Retirement Plans for Government Employees: The South Carolina government is reevaluating the retirement plans for its public employees, sparking conversations across the state about how to improve, update, and sustain the state’s retirement systems. With changes on the horizon, government officials are looking at ways to address funding shortfalls, provide better options for retirees, and make the system more flexible for a workforce that’s always evolving.

Updates to Retirement Plans for Government Employees

The future of South Carolina’s retirement system is undergoing a transformation that could have a lasting impact on state employees. With the proposed changes, there’s hope that the state can create a more sustainable, flexible, and secure retirement system for everyone involved. Whether you’re planning for retirement or just starting your career in public service, understanding these changes is key to making informed financial decisions.

These changes, although still in the works, point to a brighter future for South Carolina’s government employees. By offering more options and greater flexibility, the state hopes to address its funding issues while providing workers with a retirement that suits their needs. Keep an eye on these developments, because they could directly affect how you plan for your future.

| Topic | Details |

|---|---|

| Current Retirement System | South Carolina currently offers the South Carolina Retirement System (SCRS) and Police Officers Retirement System (PORS). |

| Proposed Changes | Bills S.107 and S.622 propose changes like removing earnings caps for retirees, introducing new plans, and shifting towards shared-risk models. |

| Financial Changes (2017) | Changes made in 2017 included raising employee contributions to 9% (SCRS) and 9.75% (PORS), and lowering the assumed rate of return from 7.5% to 7.25%. |

| Contribution Changes | Employer contribution rates for SCRS and PORS systems also increased by 2%. |

| Key Proposals for Reform | New retirement plans like the Shared-Risk Defined Benefit Plan and WealthBuilder-Primary Savings Plan. |

| Impact on Future Retirees | Potential for more flexible retirement options that could be tailored to individual needs, helping public employees plan for a more secure future. |

| Official Resources | For more details, visit South Carolina Statehouse. |

South Carolina is home to a diverse and hardworking public workforce. Whether you’re a teacher, a police officer, or a state employee in another field, many public servants in the Palmetto State rely on the state’s retirement systems for long-term financial security. The state’s retirement systems—South Carolina Retirement System (SCRS) and Police Officers Retirement System (PORS)—have long been in place to support state workers, but officials are starting to realize that change is necessary.

For years, South Carolina has faced funding challenges, and like many states across the country, the pressure to ensure a sustainable retirement system is mounting. But here’s the twist: These updates aren’t just about tinkering around the edges. They’re about fundamentally rethinking how retirement is handled for public employees.

Why Updates to Retirement Plans for Government Employees Important?

The idea behind a retirement system is pretty simple: to give government workers peace of mind when they retire after years of service. But lately, questions have been raised about whether South Carolina’s retirement systems can continue to provide adequate benefits. Some workers and policymakers argue that the systems are no longer sustainable in their current form.

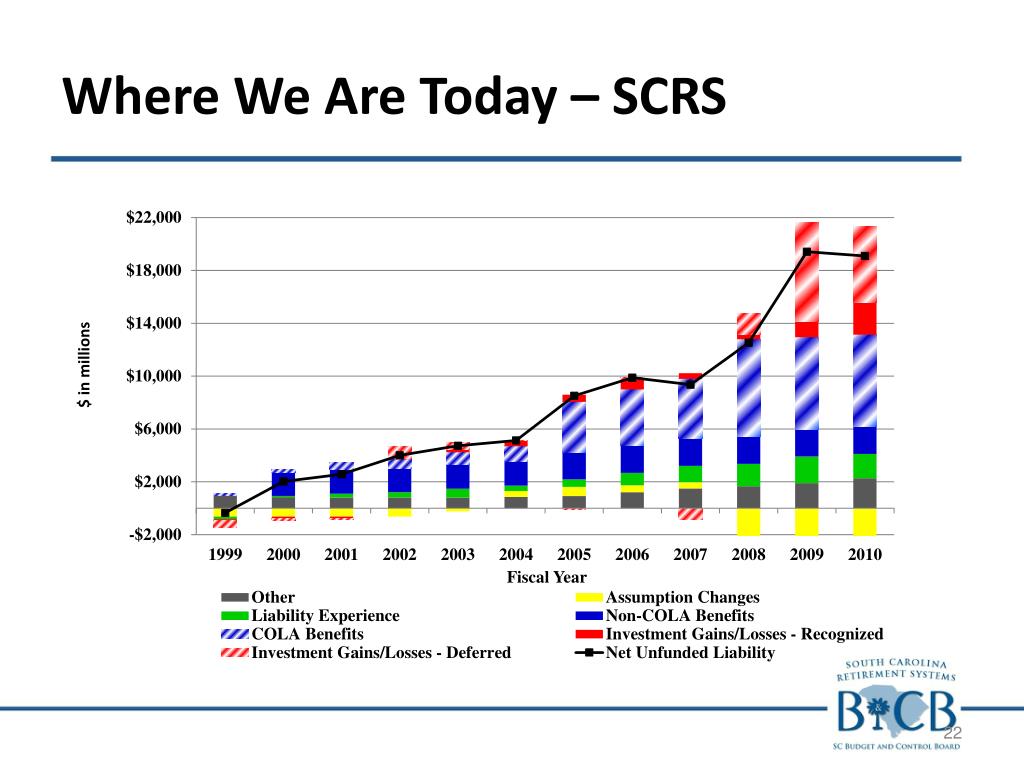

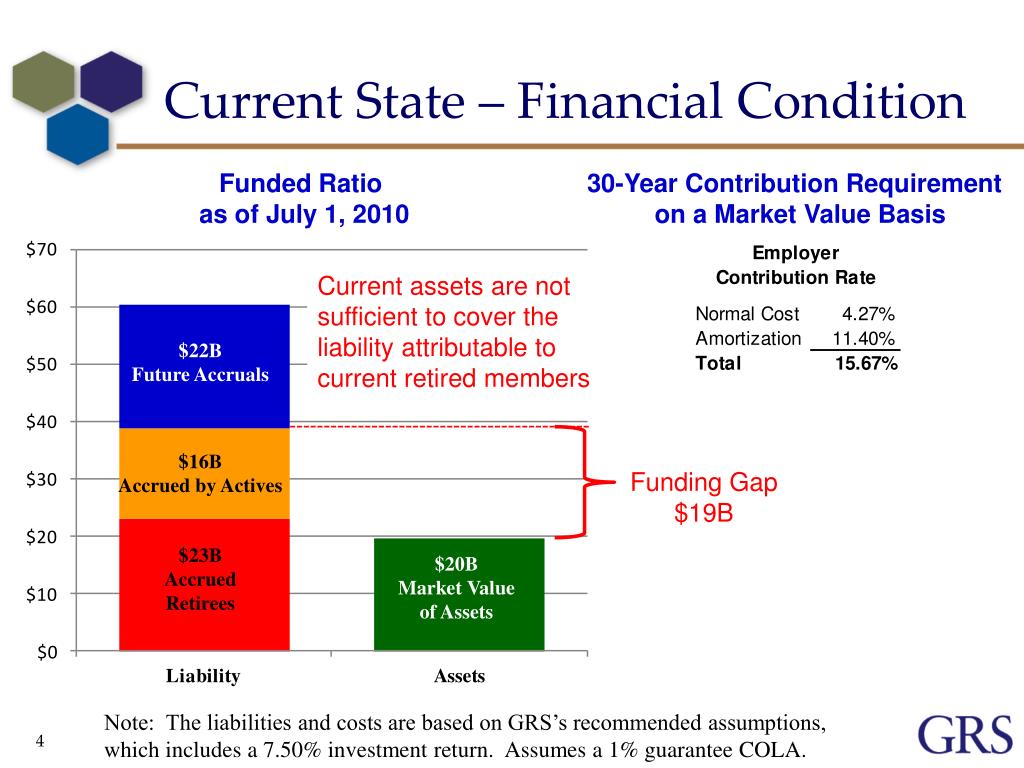

South Carolina’s retirement systems are underfunded, which means there’s not enough money saved up to cover all future retirement benefits. This is a big deal because when public employees retire, they depend on these systems to make sure they can live comfortably. If those systems are running low on cash, future retirees may face lower-than-expected benefits.

The Push for Reform: What’s Changing?

The Proposed Bills: S.107 and S.622

Two important bills—S.107 and S.622—are currently being discussed in the South Carolina legislature. These bills would reshape the retirement landscape in a big way.

- S.107 is all about giving more flexibility to retirees who return to work. Right now, there’s a cap of $10,000 on how much a retired public employee can earn without affecting their retirement benefits. The new bill would remove that cap, allowing retirees to earn more income without losing out on their pension checks. This is a big deal for those who want to keep working part-time after retiring but don’t want their pensions reduced.

- S.622, on the other hand, looks to go even further by introducing a whole new retirement structure. This bill proposes closing the SCRS system to new members and establishing two new retirement options:

- South Carolina Shared-Risk Defined Benefit Plan – A cost-sharing plan that would provide employees with retirement benefits but also share the investment risk between the state and the employees.

- WealthBuilder-Primary Retirement Savings Plan (WPRS) – A defined contribution plan, which means employees would have more control over their retirement savings and could choose between a guaranteed benefit or a portable benefit plan.

These changes aim to create a more flexible, sustainable system that meets the needs of both current employees and future retirees.

What About the Numbers? Here’s Where It Gets Real

In 2017, South Carolina took some steps to address the funding issues in its retirement system. These adjustments weren’t small, and they impacted both employees and employers:

- The assumed rate of return on investments was lowered from 7.5% to 7.25%. This might seem small, but it reflects a more cautious approach to how the system expects to earn money from its investments.

- Employee contribution rates were increased to 9% for the SCRS and 9.75% for PORS.

- Employer contribution rates also went up by 2% for both systems.

- The goal was to reduce the funding period for the system, pushing it from 30 years to 20 years starting in 2027.

These changes were meant to help stabilize the system’s finances. But there are still long-term questions about whether those steps will be enough.

A More Flexible Retirement: Why It Matters

For South Carolina’s public employees, the flexibility proposed in the new bills could be a game-changer. Right now, many state workers don’t have the freedom to choose a retirement plan that works best for their needs. By offering two new plans—the Shared-Risk Plan and the WealthBuilder Plan—employees could get more control over their futures. If you’re someone who prefers to have more say in how your retirement is invested, the WealthBuilder Plan might appeal to you.

For others who want the security of a defined benefit but with less risk, the Shared-Risk Plan might be a good option. This move toward offering employees a choice is part of a broader trend to give workers more power over their financial futures.

Thousands in South Carolina Could Lose SNAP Benefits Under GOP Medicaid Cuts

4 Financial Mistakes Americans Keep Making That Wreck Their Budgets

Millions of Americans Could See Their Social Security Checks Cut by 50 Percent