California Lawmakers Review Potential State Worker Retirement Shifts: California has always been a state that prides itself on progress and fairness. But like any major public sector system, its pension and retirement benefits for state workers have faced some serious scrutiny in recent years. With looming budget deficits, rising pension liabilities, and a growing need to attract and retain talented public servants, lawmakers are exploring new proposals to shift how retirement benefits work for California’s state workers. So, what’s at stake here? Let’s break down the latest potential changes and what they could mean for the state’s workforce, its pension system, and most importantly, its future financial health.

California Lawmakers Review Potential State Worker Retirement Shifts

As California lawmakers continue to review proposals aimed at addressing the state’s public worker retirement systems, it’s clear that there are no easy solutions. While these proposed changes may help attract and retain talented workers in key public service roles, they also present significant fiscal challenges. California’s pension liabilities are already at an all-time high, and any changes to the retirement system must be carefully considered to avoid exacerbating the problem. Lawmakers will need to balance the need for fiscal responsibility with ensuring the long-term stability of the state’s workforce. In the coming months, as these bills move through the legislative process, it will be essential to keep an eye on how they evolve. The final outcome will have a lasting impact on both the financial health of California and the wellbeing of its public employees.

| Proposal | Key Point | Potential Impact |

|---|---|---|

| Assembly Bill 569 | Allows local governments to negotiate supplemental retirement benefits | Could attract more talent for key public service roles, but raises concerns about worsening pension liabilities. |

| AB 1383 | Offers enhanced retirement formulas for new public safety employees | Aims to improve retirement security, but risks adding pressure to the state’s pension system. |

| AB 3025 | Mandates review of pensionable compensation | Focuses on preventing “pension spiking” to maintain fairness and control pension costs. |

| Governor’s Budget | Freezes pay increases and suspends retiree health contributions | Short-term cost-saving measures but adds to long-term pension liabilities. |

| Union Response | State worker unions advocate for better compensation and retirement benefits | Ensures that changes are made through good-faith negotiations, maintaining worker trust. |

California’s Pension Crisis: A Growing Challenge

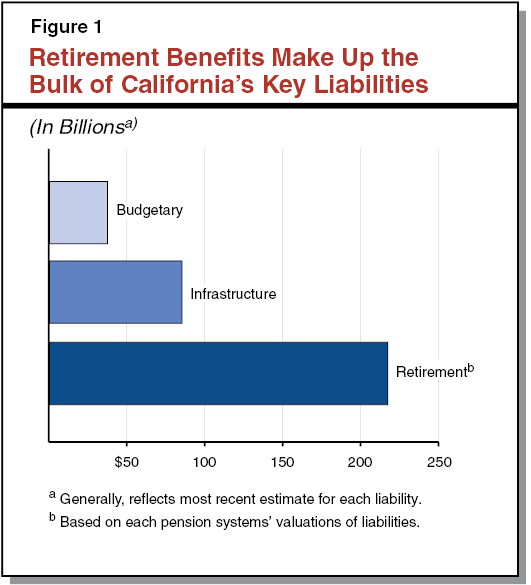

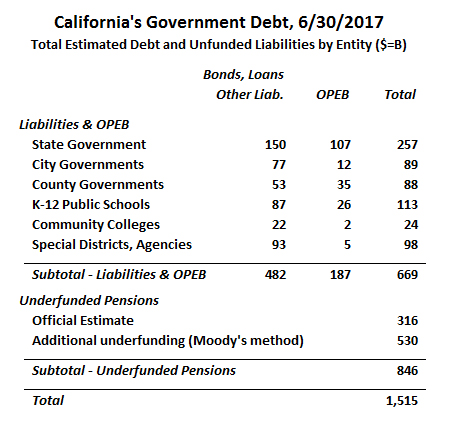

California’s public pension system has been under increasing pressure for years. The state’s retirement liabilities have ballooned to staggering figures. According to estimates, the unfunded pension liabilities are well over $250 billion, with an additional $85 billion in retiree health benefits owed.

This mounting debt has placed a significant strain on California’s budget, and lawmakers are scrambling to find solutions. The state’s pension system, which provides retirement benefits to millions of public employees, including teachers, police officers, firefighters, and state workers, was designed to offer generous benefits in exchange for relatively low salaries. However, in recent years, the costs of these benefits have outpaced projections, leading to rising costs that could impact the state’s ability to fund other critical services.

While there is no simple fix, California lawmakers are now considering several bills aimed at reshaping retirement benefits to ease this financial burden.

Assembly Bill 569: Allowing Local Governments Flexibility

One of the most significant proposals on the table is Assembly Bill 569, authored by Assemblymember Catherine Stefani. This bill proposes to allow local governments to negotiate supplemental retirement benefits for employees. Currently, under the California Public Employees’ Pension Reform Act (PEPRA) of 2013, such negotiations are heavily restricted.

Advocates for AB 569 argue that providing more flexibility could help attract and retain talent in public service roles, especially in high-demand areas such as law enforcement, emergency services, and education. Local governments would have the ability to offer additional benefits to compete with private sector job offers.

However, critics warn that this approach could worsen the state’s pension liabilities. The concern is that by offering these supplemental benefits, California could end up increasing its pension obligations even further, creating even more financial strain in the long term.

AB 1383: Enhanced Retirement Benefits for Public Safety Workers

Another proposal, AB 1383, aims to offer enhanced retirement formulas for new hires in public safety jobs after January 1, 2026. The bill suggests more generous pension formulas such as 2.5% at age 55, 2.7% at age 55, or 3% at age 55, compared to the current formula of 2.7% at age 57.

This proposal is designed to improve retirement security for public safety workers, many of whom risk their lives on the job every day. The idea is to ensure they have enough financial stability after retiring. However, the issue arises in how much this could cost the state. Critics believe this could place even greater strain on the pension system, which is already facing a funding gap.

AB 3025: Preventing Pension Spiking

AB 3025 focuses on an issue called “pension spiking,” which occurs when employees increase their final compensation in ways that artificially inflate their retirement benefits. This can happen when employees work extra overtime in their final years or receive large bonuses, boosting their pension payouts far beyond what they would normally receive.

This bill mandates that any proposed labor agreements that could affect pension calculations be reviewed for consistency with pension system guidelines. The goal is to ensure fairness and maintain control over the system’s long-term costs, which could help prevent pension abuses.

The Governor’s Budget and Immediate Cost-Saving Measures

Governor Gavin Newsom’s administration has already taken several actions aimed at addressing California’s fiscal challenges, such as freezing pay increases and suspending contributions to retiree health care funding for two years. These steps are designed to reduce immediate costs and help plug a projected $12 billion budget deficit.

However, these measures also contribute to the state’s growing unfunded liabilities. The freeze on pay increases, for example, could help in the short term but doesn’t do much to address the larger pension issue. Furthermore, suspending retiree health contributions puts off addressing a massive $85 billion in healthcare liabilities, potentially making the issue even harder to solve down the road.

Union Reactions and Negotiations on California Lawmakers Review Potential State Worker Retirement Shifts

The state’s worker unions, such as SEIU Local 1000, have been vocal in their opposition to many of these proposed changes. Unions argue that the state should focus on increasing compensation for workers rather than cutting benefits or freezing wages. They also emphasize that any changes to pension systems should be made through fair, good-faith bargaining with workers, rather than unilaterally imposed by lawmakers.

Unions are critical players in these negotiations, as they represent millions of state employees. Their involvement ensures that changes are made in a way that balances the needs of the state’s fiscal health with the rights and security of workers.

Trump’s New Law Will End Electric Car Incentives in Just Three Months—What This Means for Buyers

4 Financial Mistakes Americans Keep Making That Wreck Their Budgets

Millions of Americans Could See Their Social Security Checks Cut by 50 Percent