How Social Security May Evolve: Social Security is one of the most critical safety nets for millions of Americans, offering financial support to retirees, people with disabilities, and survivors of deceased workers. However, in recent years, proposed changes have sparked debate about the future of this essential program. Under President Donald Trump’s administration, various reforms and proposals have been put forward to reshape Social Security, creating both hope and concern among Americans. This article will break down how these changes may evolve, offering you practical insights, data, and tips on what to expect moving forward. In this article, we’ll explore President Trump’s proposals for Social Security, including tax changes, administrative adjustments, and potential benefits for seniors. We will also discuss the implications for beneficiaries, as well as what you can do to stay informed and prepared for these changes.

How Social Security May Evolve

President Trump’s proposed changes to Social Security bring both opportunity and uncertainty. While some initiatives, such as tax relief for seniors, may provide immediate benefits, others—such as administrative changes and the risk of accelerated insolvency—pose long-term challenges for the program’s sustainability. It’s crucial for both current beneficiaries and future retirees to stay informed and plan accordingly. By staying ahead of these changes, you can make sure that you and your family are prepared for whatever the future holds.

| Key Point | Details | Source/Link |

|---|---|---|

| Proposed Tax Relief for Seniors | Seniors may see tax cuts, with deductions up to $6,000 for individuals, $12,000 for couples. | Investopedia |

| Changes to Social Security Administration (SSA) | Streamlining and office closures could cause longer wait times and reduce services. | Washington Post |

| Accelerated Insolvency Risk | The proposed tax cuts could push Social Security insolvency from 2034 to 2031. | CRFB |

| Potential Benefit Cuts | Without further action, benefits could be reduced by 33% by 2035. | CRFB |

The Social Security Landscape Under Trump’s Proposals

Social Security provides vital financial support to over 65 million Americans each month. This includes retirees, people with disabilities, and survivors of deceased workers. The system is funded primarily through the Federal Insurance Contributions Act (FICA) taxes, where workers contribute a portion of their income to ensure the program’s viability.

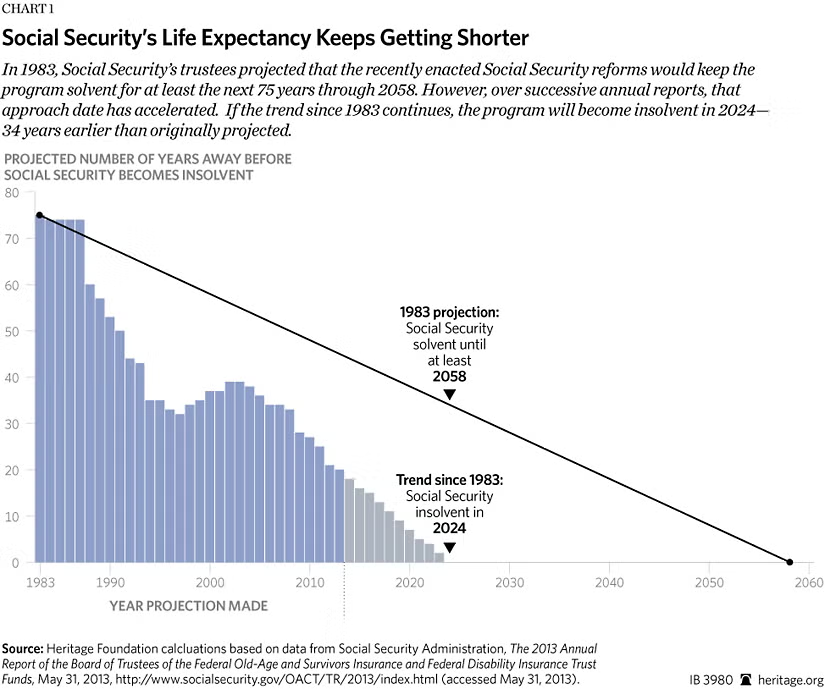

However, Social Security is facing significant financial pressure. The program’s trust funds are projected to be depleted by 2034 unless reforms are made. President Trump’s proposals could change how this program works—some of these changes may help seniors, while others could reduce benefits and potentially make the program less accessible for many.

Tax Relief for Seniors: A Short-Term Win?

One of the most discussed proposals under Trump’s administration is tax relief for seniors. The idea is to reduce or eliminate taxes on Social Security benefits, which can be a significant burden for older Americans. Under the “One Big Beautiful Bill Act”, seniors could see deductions of up to $6,000 for individuals and $12,000 for couples. This would reduce or eliminate federal income taxes on Social Security benefits for many recipients.

This proposal might sound appealing, especially for those on a fixed income, but there are limits and concerns. First, the deductions phase out for individuals making over $75,000 and couples earning over $150,000. Additionally, this change is only temporary—it expires in 2028. Critics argue that while the change provides short-term relief, it doesn’t eliminate taxes on Social Security benefits entirely and may lead to confusion among recipients.

This proposal could be beneficial for middle-income retirees, but it doesn’t do much for the long-term sustainability of the program itself. And in the grand scheme of things, fixing Social Security’s long-term funding is a bigger issue that needs to be addressed.

Social Security Administration (SSA) Restructuring: Changes to the Agency’s Operations

Another major shift under Trump’s proposed changes involves how the Social Security Administration (SSA) functions. Over the past few years, the SSA has undergone a streamlining process, which has led to staff reductions and office closures. Approximately 7,000 SSA employees have been laid off as part of broader government efficiency measures. Some SSA offices have closed, and certain services have been eliminated or reassigned.

For those who rely on in-person visits to manage their benefits or resolve issues, these changes can be frustrating. Long wait times, reduced office hours, and limited access to services have been common complaints. New identity verification requirements mandate that certain applicants must visit SSA offices in person, making access more difficult for older Americans or those with mobility issues.

These administrative changes might save money in the short term, but they risk reducing the quality of services and making it harder for beneficiaries to manage their benefits. As the SSA cuts staff and closes offices, increased wait times and delays in processing claims could become more common.

The Financial Outlook: The Risk of Insolvency

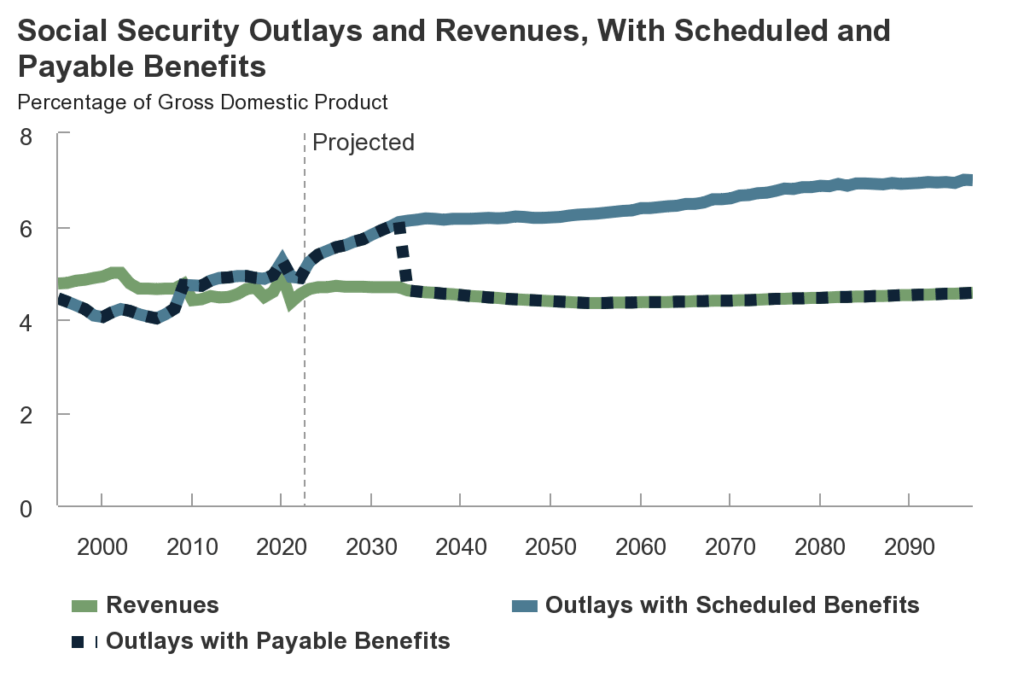

Perhaps the most concerning aspect of President Trump’s proposals for Social Security is their potential impact on the program’s long-term viability. While the proposed tax relief measures may provide some immediate benefits, they could accelerate Social Security’s insolvency. The proposals would eliminate taxes on Social Security benefits for many seniors, but this could create a $2.3 trillion shortfall in the program’s trust funds.

This shortfall could cause Social Security to become insolvent earlier than expected. The current projection is that the program will be fully depleted by 2034, but these proposed tax cuts could push the date up to 2031, meaning beneficiaries could face significant cuts in their payments.

If the trust funds run dry, the program will only be able to pay out about 75% of promised benefits. Without action, beneficiaries could see a 33% reduction in their monthly Social Security checks by 2035. These cuts would have a devastating impact on seniors who rely on Social Security as their primary source of income.

What Does How Social Security May Evolve Mean for You?

For the average American, especially those who rely heavily on Social Security benefits, these proposed changes could have a significant impact. If you’re a senior, a future retiree, or a family member of someone who depends on Social Security, it’s essential to stay informed and prepared. Here’s what you can do:

- Understand the Proposed Changes: Stay updated on the latest proposals and reforms related to Social Security. Look to reliable sources, such as the Social Security Administration (SSA.gov), for updates.

- Plan for Possible Cuts: While changes to Social Security may take years to fully unfold, it’s wise to plan for potential cuts. Consider other forms of retirement savings, such as a 401(k) or IRA, to help supplement your income.

- Stay Engaged with Your Representatives: If you’re concerned about the potential cuts or changes to Social Security, it’s important to contact your representatives in Congress. Let them know how these changes will affect you and urge them to support policies that ensure the program’s long-term sustainability.

- Look for Tax Relief: If the tax relief proposals are passed, make sure to take advantage of any available deductions that could reduce your overall tax burden. Talk to a tax professional to understand how these changes will affect your taxes.

Recent Adjustment to Social Security Benefits Raises Questions- Check Details!

Social Security Projected to Cut Benefits by 2033, Affecting Retired Workers

Trump’s ‘Big Beautiful Bill’ Sparks Debate Over Social Security and Benefits