Waze Co-Founder Shares Candid Retirement Advice: Retirement might feel like a distant dream for some, especially for those hustling to build their careers or businesses. But as time passes, it’s crucial to start thinking about what life after work will look like. Uri Levine, the co-founder of Waze — the popular navigation app acquired by Google for $1.1 billion — is here to share some valuable retirement advice based on his years of entrepreneurial success. His advice isn’t just for business owners; it’s something that everyone, no matter their job or career path, can benefit from. Let’s dive into what he’s learned about financial planning and retirement, and why starting early could be the best decision you’ll ever make.

Waze Co-Founder Shares Candid Retirement Advice

Starting your retirement savings early is one of the best financial decisions you can make. As Uri Levine, the co-founder of Waze, shares through his own experience, the earlier you start, the more time your money has to grow — thanks to compound interest. By following simple steps like setting up a retirement account, contributing regularly, and seeking professional advice, you can build a solid financial future. Whether you’re just starting your career or well into your journey, take these tips to heart. Remember, it’s not about how much you make today, but about how much you save and invest for tomorrow. Secure your future, one step at a time.

| Topic | Key Points |

|---|---|

| Who is Uri Levine? | Co-founder of Waze, a mapping and navigation company sold to Google for $1.1B. |

| Key Retirement Advice | Start saving early, ideally at age 18, to benefit from compound interest. |

| Why Start Early? | The earlier you begin saving, the more time your money has to grow. |

| Practical Tips | Make use of employer-sponsored retirement plans, create an investment strategy, and seek financial advice when needed. |

| Stats | According to a 2023 survey, 66% of Americans regret not saving for retirement earlier. |

| Further Reading | Business Insider – Uri Levine’s Retirement Tips |

The Value of Early Retirement Planning

Imagine you’re just starting out in your career. The future feels far off, and retirement seems irrelevant. Most of us spend the early years of our working lives focused on the present — paying bills, saving for short-term goals, or simply enjoying our youth. But as Waze co-founder Uri Levine says, it’s never too early to begin thinking about your financial future. The earlier you start, the better your chances of retiring comfortably.

Why Saving Early is Crucial?

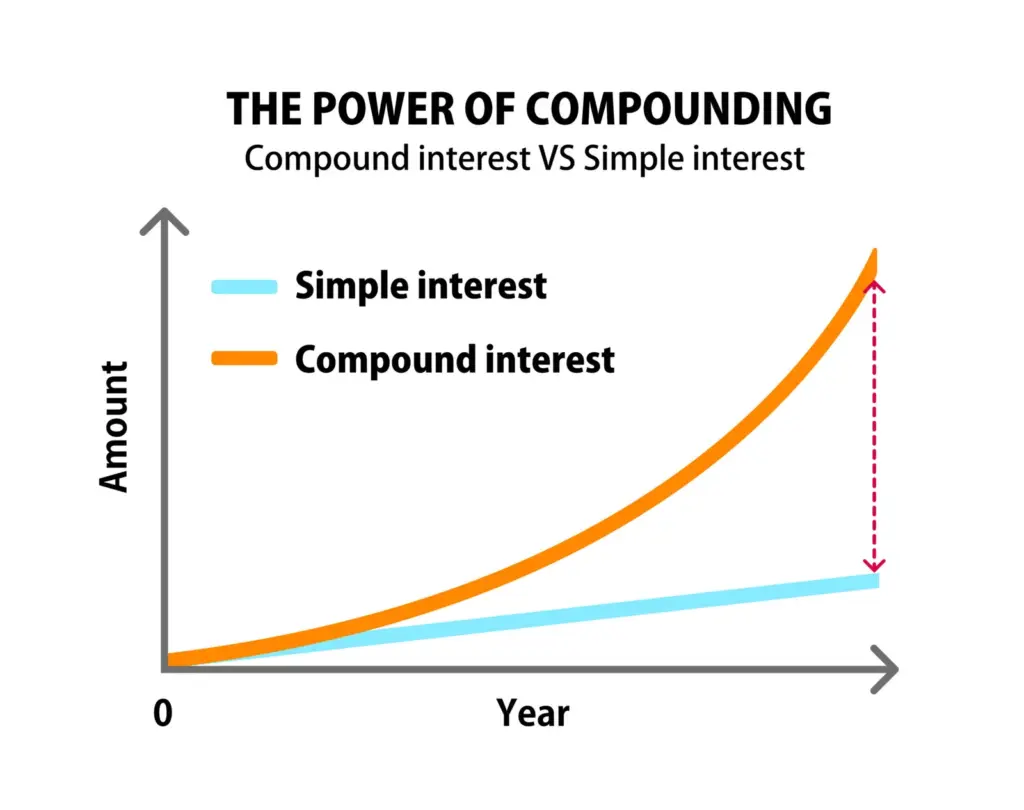

One of the key pieces of advice Levine shares is the importance of starting to save for retirement as early as possible. Whether you’re 18 or 28, every year you wait to start building your retirement savings means a missed opportunity to let your money grow. Why? Compound interest. It’s like putting your money on a turbocharger, making it work harder for you over time. The sooner you begin, the more time your savings have to snowball.

Example: Let’s say you start saving $200 a month at age 18 and continue doing so until you’re 65. Assuming an average annual return of 7%, you could have over $600,000 by retirement. If you wait just 10 years and start at 28, you might only have around $400,000. That’s $200,000 you could miss out on by waiting too long.

The Importance of Financial Planning

Levine also stresses that retirement isn’t just about saving; it’s about planning. Having a solid retirement plan means knowing how much you need to save, where you should invest your money, and when to make adjustments. While some people may opt for traditional savings accounts, those with longer-term goals might consider investing in stocks, bonds, or mutual funds.

Example: Take advantage of employer-sponsored retirement plans like a 401(k) if available. Many employers match your contributions, meaning free money for you. If you’re not sure where to start, talking to a financial advisor can help you create a personalized retirement strategy based on your unique needs and goals.

Waze Co-Founder Shares Candid Retirement Advice: Practical Tips for Starting Your Retirement Fund

Starting your retirement savings is easier than you think. Here’s a simple guide to get you on the right track:

1. Set Up a Retirement Account

- 401(k): If your employer offers a 401(k), sign up! It’s a tax-advantaged way to save for retirement, and many employers will match your contributions, which is essentially free money.

- IRA: If a 401(k) isn’t an option, consider opening an Individual Retirement Account (IRA). A Roth IRA allows for tax-free growth, and a traditional IRA offers tax deductions on contributions.

- Self-employed? Look into options like a SEP IRA or Solo 401(k).

2. Start Contributing Regularly

- Even if you can’t contribute a lot right now, start small and increase your contributions as your salary grows.

- Automatic Contributions: Set up automatic contributions so that you’re saving without even thinking about it.

3. Invest Wisely

- Don’t just park your money in a savings account earning minimal interest. Look for opportunities to invest in low-cost index funds or ETFs (Exchange-Traded Funds) to grow your wealth.

4. Don’t Touch Your Savings

- Resist the temptation to withdraw from your retirement fund for short-term needs. The longer you leave it untouched, the more your money will grow.

5. Seek Professional Advice

- If you’re unsure where to start, consider speaking to a financial planner or advisor. They can help you make a strategy that works for your personal circumstances.

Common Mistakes to Avoid

While starting early is key, there are a few common mistakes many people make when saving for retirement that can hurt their future plans:

1. Underestimating How Much You Need

- Many people think that Social Security will cover most of their retirement needs, but that’s not always the case. Make sure to do the math and figure out how much you’ll realistically need in retirement, considering factors like healthcare and housing.

2. Procrastinating

- Waiting until later in life to start saving can be a costly mistake. The earlier you begin, the less you’ll need to save each month to reach your goal.

3. Making Poor Investment Choices

- Investing in individual stocks or high-risk assets without proper knowledge can hurt your retirement fund. Stick to diversified portfolios to lower your risk and ensure steady growth over time.

4. Not Taking Advantage of Employer Matching

- If your employer offers a matching contribution to your 401(k), it’s essentially free money. Don’t leave that on the table!

Expert Offers Guidance for Couples Planning Retirement With Limited Savings

Millennial Who Achieved Early Retirement Reveals Harsh Truth About FIRE Lifestyle

Gen Z Is Saving for Retirement Early, But Employers May Be Falling Behind