This Week’s Social Security Checks: Social Security is a vital part of financial security for many retirees in the United States. It’s one of the most important programs ensuring that people who have worked hard all their lives can retire with some sense of stability. But did you know that some retirees could receive up to $5,108 in their monthly Social Security benefits? This hefty sum is a game-changer for many people, but not everyone is eligible for it. In this article, we will break down how you can qualify for such a large payout and what you can do to maximize your benefits. Whether you’re a retiree planning for your future, someone thinking about starting to receive benefits, or just curious about Social Security in general, this guide is for you. We will explain all the details, answer your most pressing questions, and provide practical advice on how to make the most of your Social Security checks.

This Week’s Social Security Checks

Understanding how to get the maximum Social Security benefit is crucial for anyone planning for retirement. Whether you’re looking to receive up to $5,108 a month or just want to ensure you’re getting the most out of your Social Security, it’s important to consider factors like retirement age, work history, and earnings record. By following the advice in this guide and making strategic decisions, you can maximize your benefits and retire with financial peace of mind.

| Key Information | Details |

|---|---|

| Maximum Social Security Benefit (2025) | Up to $5,108 per month at age 70 |

| Qualifying Work History | 40 quarters (10 years) of work required |

| Retirement Age Options | Benefits can be claimed from age 62 to 70 |

| Full Retirement Age (FRA) | 67 years old for people born in 1960 or later |

| Earnings Record Impact | Highest 35 years of earnings used to calculate benefits |

| Payment Schedule | Payments distributed based on birth date (July 2025) |

| SSA Official Website | Link to official Social Security Administration site |

Introduction: What’s the Deal with Social Security?

Social Security, established in 1935, is a federal program that provides financial assistance to people who are retired, disabled, or survivors of deceased workers. In short, it’s meant to ensure that people who can no longer work due to age or disability can still maintain a basic income. The amount you receive in Social Security checks depends on several factors, including your work history, retirement age, and earnings. The more you’ve worked and the higher your lifetime earnings, the more you can potentially receive.

For 2025, retirees who wait until age 70 to claim Social Security can receive up to $5,108 a month. Now, that’s a significant sum, and it’s not available to everyone. To help you understand how to achieve this, let’s dive into the specifics.

How to Qualify for Up to $5,108 in Social Security Benefits

1. Retirement Age and Its Impact

Your Social Security payout depends largely on when you decide to start receiving benefits. You can start receiving benefits as early as age 62, but the longer you wait, the more you will receive each month.

- Age 62: The minimum age for receiving benefits, but if you start here, your monthly check will be smaller.

- Full Retirement Age (FRA): For most people born in 1960 or later, the FRA is 67. If you wait until this age to claim benefits, you’ll receive a full monthly payout based on your lifetime earnings.

- Age 70: If you can delay claiming until age 70, your monthly benefits will be maximized. For 2025, the maximum payout for a person waiting until 70 is $5,108 per month. This is the highest possible amount you can get.

2. Work History and Required Earnings

To qualify for Social Security benefits, you need to have worked for at least 10 years, or 40 quarters. The Social Security Administration (SSA) tracks the amount of money you’ve earned each year, and over the course of your career, you will earn credits toward your Social Security benefits.

- Work 35 Years: To get the maximum payout, you should aim to have worked for 35 years, earning at or above the maximum taxable income for Social Security during those years. The SSA uses your 35 highest-earning years to calculate your benefits.

For example, if you’ve worked for 40 years, but your earnings were only high for 10 of those years, the SSA will use those 10 years, but they’ll replace the remaining 25 years with a $0 earning. To ensure you qualify for the maximum benefits, make sure that you consistently earn at a level high enough to maximize your contributions to Social Security.

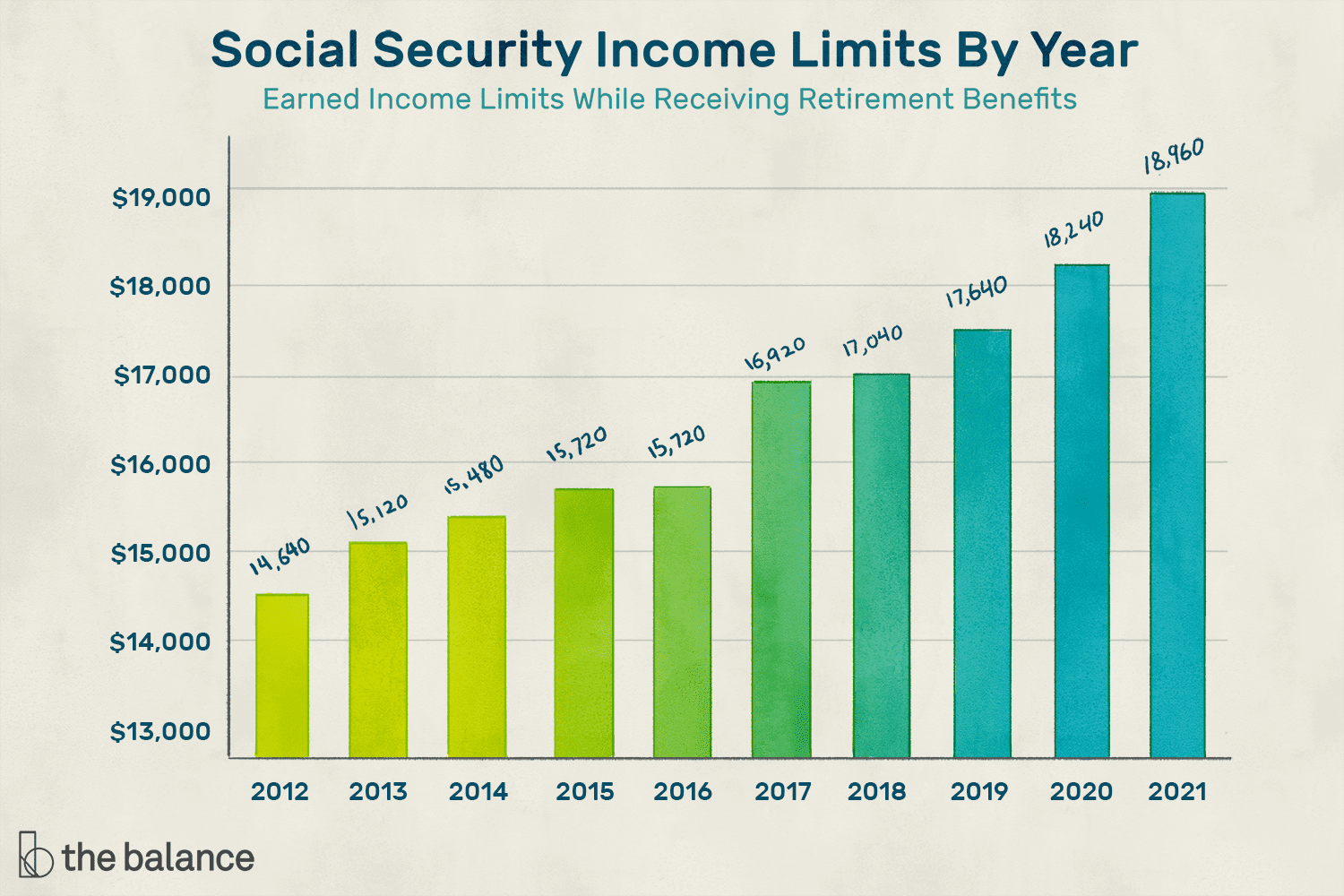

3. Social Security Earnings Cap

Each year, there is a limit to how much of your income is taxable for Social Security purposes. This is called the Social Security Earnings Cap, and it changes yearly. For example, in 2025, the cap for taxable income will be $160,200. That means any income above that amount won’t count towards your Social Security benefits for that year.

If you consistently earn at or above this cap for 35 years, you’ll maximize your potential benefits. If you’re a high earner, this can be a significant factor in reaching the $5,108 monthly maximum.

Social Security Payment Schedule

When you qualify to start receiving Social Security, it’s important to know when the payments will arrive. The payments are distributed based on your birth date each month. In July 2025, for example:

- Born on 1st–10th: Payment issued on July 9.

- Born on 11th–20th: Payment issued on July 16.

- Born on 21st–31st: Payment issued on July 23.

If you began receiving benefits before May 1997, or you receive both Social Security and Supplemental Security Income (SSI), your payment might arrive earlier, typically around the 3rd of the month.

How Inflation Affects Your Social Security Benefits?

Inflation can have a significant impact on the purchasing power of your Social Security benefits. To help retirees keep up with rising prices, the Social Security Administration (SSA) automatically adjusts benefits each year based on inflation. This is known as the Cost-of-Living Adjustment (COLA).

For example, if inflation increases by 2% in a given year, Social Security benefits will typically rise by that same percentage. The COLA ensures that retirees’ benefits keep pace with inflation, but it’s important to note that COLA increases are not guaranteed and may vary from year to year.

While this system helps to counteract the negative effects of inflation, it’s crucial to plan your retirement finances with this factor in mind.

Spousal and Survivor Benefits

Another aspect of Social Security that many people overlook is spousal benefits. If you are married, your spouse can receive up to 50% of your monthly benefit if they have reached full retirement age and their benefit is smaller than yours.

In the case of survivor benefits, if you pass away, your spouse or dependent children may be eligible to receive your Social Security benefits. This could be especially important if your spouse has limited work history or a lower lifetime earnings record.

Understanding the rules around spousal and survivor benefits is crucial in making the most of your Social Security.

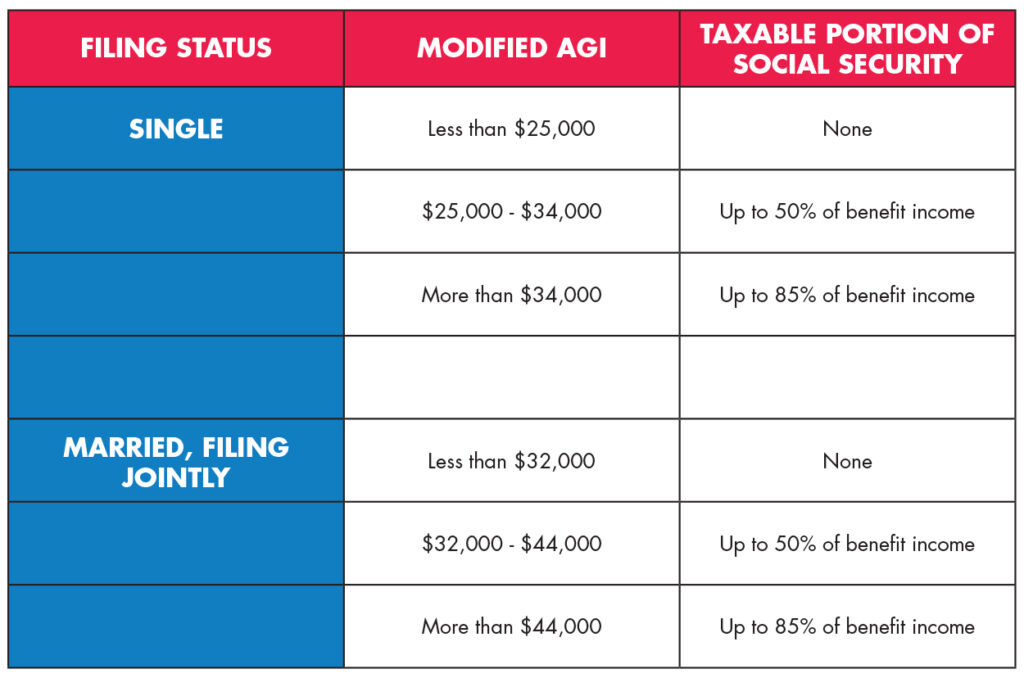

How Taxes Impact Your Social Security Benefits?

While Social Security benefits are intended to provide financial security, they are still subject to federal income taxes under certain circumstances. If you have substantial income from other sources (like pensions, savings, or investments), a portion of your Social Security benefits may be taxed.

The IRS uses a formula to determine whether your benefits will be taxed. If your combined income (which includes your adjusted gross income, nontaxable interest, and half of your Social Security benefits) exceeds certain thresholds, you could pay taxes on up to 85% of your benefits.

For example:

- Single filers: If your combined income is between $25,000 and $34,000, up to 50% of your benefits may be taxed.

- Joint filers: If your combined income exceeds $32,000, up to 85% of your benefits may be taxable.

You can calculate the potential tax on your benefits using tools available on the IRS website, or consult with a tax professional for more detailed guidance.

How to Maximize This Week’s Social Security Checks?

Here are some actionable steps to increase your Social Security benefits and ensure you get as much as possible each month.

1. Delay Retirement

The longer you can delay claiming your benefits, the more you will receive. If you’re in good health and can afford to wait, delaying until age 70 is the best way to maximize your Social Security check.

2. Work 35 Years

If you’ve worked less than 35 years, your Social Security benefits will be calculated with zeros for the years you didn’t work. By working a full 35 years, you’ll avoid those zeros and increase your payout.

3. Maximize Your Earnings

If you’re close to retirement and haven’t been consistently earning at the highest taxable limit, consider making extra efforts to increase your income. Whether it’s through overtime or taking on higher-paying job opportunities, earning at or near the Social Security earnings cap will boost your future benefits.

Recent Adjustment to Social Security Benefits Raises Questions- Check Details!

Social Security Projected to Cut Benefits by 2033, Affecting Retired Workers

Trump’s New Tax Bill Could Reshape How Social Security Benefits Are Taxed