Trump’s “Big, Beautiful Bill” Could Reshape Social Security: The passing of Donald Trump’s highly anticipated “Big, Beautiful Bill” has sparked plenty of discussions, especially among retirees who are trying to navigate how the new law impacts their Social Security benefits. The bill promises to reshape the landscape of Social Security and taxes, both for those already in retirement and those planning ahead. While the legislation claims to bring immediate tax relief and long-term benefits, it’s crucial to understand both the pros and cons before making any assumptions.

In this article, we’re going to break down the good and bad news surrounding the bill and provide a clear, easy-to-understand guide to how it affects you and your future. We’ll discuss the key provisions, share important stats and facts, and give practical advice that every retiree should know. By the end of this article, you’ll have a better understanding of whether Trump’s “Big, Beautiful Bill” is truly a game-changer for Social Security or if it’s just another political move that brings more harm than good.

Trump’s “Big, Beautiful Bill” Could Reshape Social Security

The “Big, Beautiful Bill” brings some immediate relief to higher-income seniors, offering tax deductions and creating Trump Accounts for future generations. However, for many retirees, the claims of eliminating Social Security taxes are misleading, and the bill’s overall impact on Social Security’s long-term solvency could be problematic. While the bill might seem appealing at first glance, retirees should consider its long-term effects carefully, especially when it comes to Social Security’s future funding. In the end, the Big, Beautiful Bill may offer temporary benefits, but whether it helps or hurts Social Security in the long run remains uncertain.

| Key Information | Description | Reference |

|---|---|---|

| Bill Overview | Signed into law on July 4, 2025, promises tax relief for retirees and restructures Social Security. | White House Official Site |

| Seniors’ Tax Relief | Tax deductions for seniors up to $12,000 per couple by 2028. | MarketWatch |

| Trump Accounts | $1,000 investment account for every child born between 2025-2028. | Washington Post |

| Potential Tax Effects | Misleading claims about eliminating Social Security taxes. | The Daily Beast |

| Social Security Deficit | Bill is expected to add $3.4 trillion to the deficit over the next decade. | The Guardian |

What is Trump’s “Big, Beautiful Bill”?

The “Big, Beautiful Bill” was designed to overhaul significant aspects of the American economy, particularly focusing on taxes and Social Security. Signed into law on July 4, 2025, the bill brings several changes, some of which could greatly affect how Social Security is funded and distributed. But what does this really mean for retirees?

Key Features of the Bill

- Tax Deduction for Seniors: One of the standout features of the bill is a temporary tax deduction for seniors. This deduction allows people over the age of 65 to reduce their tax burden, which could be a lifesaver for many retirees, particularly those living on fixed incomes. By 2028, seniors can deduct up to $6,000 ($12,000 for married couples). However, the deduction phases out for individuals earning over $75,000 and couples earning over $150,000.

- Trump Accounts: The bill also introduces Trump Accounts. This provision provides every child born between 2025 and 2028 with a $1,000 investment account. Parents can contribute up to $5,000 annually, promoting long-term savings. These accounts could set future generations on a solid financial path and help them avoid the same struggles older generations face.

- Tax Treatment of Social Security Benefits: The law has been widely advertised as a solution to taxing Social Security benefits. However, the bill does not eliminate these taxes. Many retirees were hoping for a complete tax-free Social Security benefit, but in reality, only higher-income seniors will see any real change in this regard.

What’s in the Bill for Social Security?

The Social Security Tax

A large portion of the bill’s focus is on Social Security, though not in the way many retirees hoped. One of the most misleading claims about the bill is that it will completely eliminate Social Security taxes for retirees. While it’s true that the bill offers some tax breaks for seniors, particularly higher-income earners, it doesn’t eliminate Social Security taxes as some may have believed.

Here’s the reality:

- Social Security benefits will still be subject to federal taxes, although the tax rate could change for higher earners.

- For lower-income seniors, the bill does not have a significant impact, as they already don’t pay taxes on their benefits.

Social Security’s Financial Future

Another big concern is how the bill will impact the financial health of Social Security. The Congressional Budget Office (CBO) estimates that the bill will add $3.4 trillion to the federal deficit over the next decade. This could weaken the financial foundation of Social Security, as it relies heavily on tax revenue for funding.

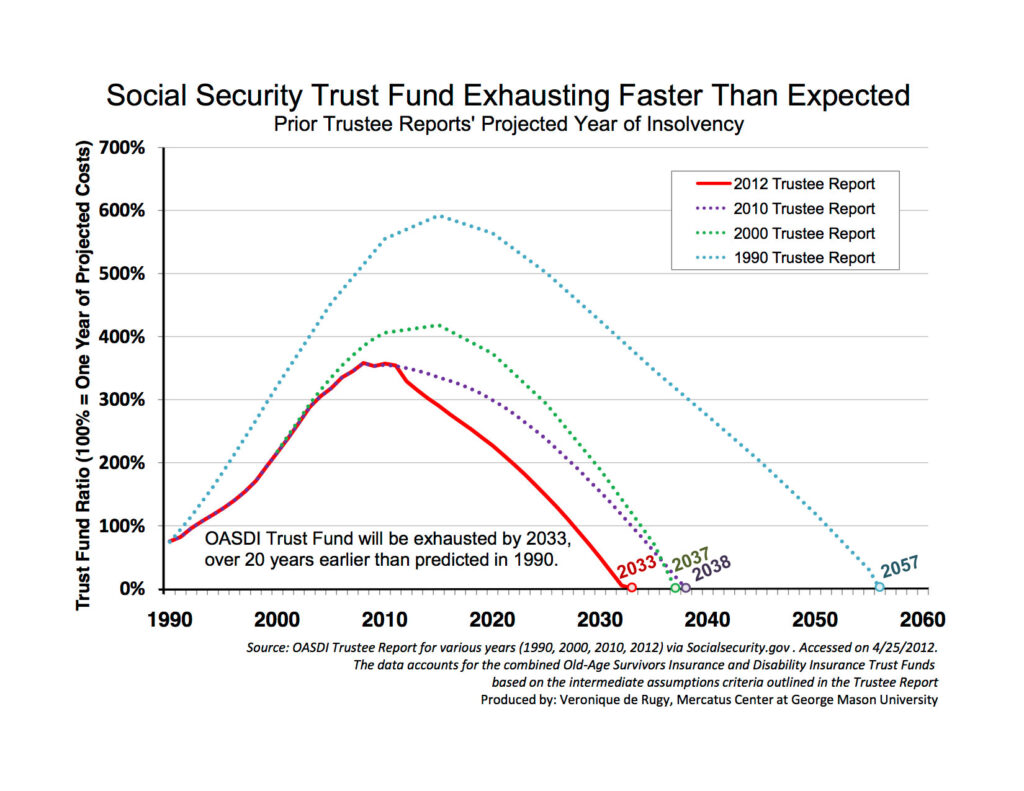

For context, the Social Security Trust Fund is already projected to be depleted by 2034 unless significant reforms are made. While Trump’s bill may offer short-term relief, the long-term implications for Social Security’s solvency are worrying.

How Trump’s “Big, Beautiful Bill” Could Reshape Social Security Affects You: Good, Bad, or Just Complicated?

So, does the “Big, Beautiful Bill” actually help you, as a retiree? The answer depends on your situation. Let’s break it down:

The Good: Tax Relief for Many Seniors

- Immediate Tax Deductions: Seniors who qualify for the tax deductions will immediately see relief. This is especially useful for those who have been squeezed by rising costs but haven’t seen corresponding increases in their retirement income. A couple with $12,000 in deductions could save a substantial amount, especially if their income is on the higher side.

- Trump Accounts for Kids: If you’re a parent or grandparent, this might be the best part of the bill. Every newborn gets a $1,000 Trump Account, and families can contribute up to $5,000 each year. This encourages financial literacy from a young age and could provide a solid financial foundation for future generations.

The Bad: No Full Elimination of Social Security Taxes

- Misleading Claims: If you were hoping for the elimination of Social Security taxes altogether, you’re out of luck. The taxes on Social Security benefits remain, and low-income seniors will likely see little to no difference. Even for those who benefit from the tax breaks, they may not be as substantial as anticipated.

- Potential Deficit Impact: The bill’s estimated $3.4 trillion cost could add significant pressure on Social Security’s long-term solvency. If we continue adding to the deficit without addressing the underlying funding problems, Social Security may face even greater challenges down the road.

Additional Concerns: Long-Term Sustainability of Social Security

While the short-term relief might be welcome, many experts are raising questions about the long-term sustainability of Social Security under the new provisions of the bill. With $3.4 trillion added to the national deficit, it’s hard to ignore the potential harm this could cause the Social Security Trust Fund. The Trust Fund is already on track to run out by 2034, and additional financial burdens could push this timeline forward, affecting not only future retirees but also current beneficiaries.

It’s also important to note that higher-income seniors may benefit more from the bill’s provisions, while low-income seniors might not see any real difference. The hope that Social Security will become more financially secure is fading, especially as the federal deficit continues to rise.

Alternative Solutions for Social Security’s Future

Given the bill’s shortcomings and the ongoing financial challenges facing Social Security, what are some alternative solutions?

- Raising the Social Security Tax Rate: One way to ensure that Social Security remains funded is to raise the tax rate for all workers. While this may be unpopular, it could help guarantee that future retirees will continue to receive their benefits.

- Raising the Wage Cap: Currently, Social Security taxes are only applied to income up to a certain level (about $160,000). Increasing or eliminating the cap would help generate more revenue for the program.

- Means Testing: Another option would be to implement means testing, which would reduce or eliminate Social Security benefits for those with higher incomes. While controversial, this could help focus the funds on those who need them most.

July 2025 Social Security Payments: Important Dates Every Washington State Resident Should Know

Trump’s ‘Big Beautiful Bill’ Sparks Debate Over Social Security and Benefits