Interest on SAVE Plan Student Loans Resumes Soon: The U.S. Department of Education has made a major announcement that will affect millions of student loan borrowers. Interest on federal student loans under the Saving on a Valuable Education (SAVE) plan is set to resume starting August 1, 2025. After over a year of zero interest, borrowers may soon see their balances grow due to the accrual of interest once again. This development could catch some borrowers off guard, so it’s crucial to understand what this means for you, how to manage it, and what actions you can take to minimize the impact. Whether you’re a student loan borrower, a financial advisor, or a concerned family member, understanding these changes will help you navigate the transition smoothly. In this article, we’ll break down the key facts, give you practical advice, and offer a step-by-step guide on how to manage your loans as interest resumes.

Interest on SAVE Plan Student Loans Resumes Soon

The resumption of interest accrual on SAVE plan student loans is a significant event for millions of borrowers, but it doesn’t have to be a cause for concern. By understanding your options, acting proactively, and staying informed about future changes, you can manage your loan effectively and avoid any unexpected increases in your balance. Remember to explore alternative repayment plans, use helpful tools like the Loan Simulator, and reach out to your loan servicer for personalized guidance. The Department of Education is there to help you navigate this process, so take advantage of all the resources at your disposal.

| Topic | Details |

|---|---|

| Resumption Date | August 1, 2025 – Interest resumes on SAVE plan student loans. |

| Affected Borrowers | Over 7.7 million borrowers enrolled in the SAVE plan will be impacted. |

| Why is This Happening? | Legal decisions and the expiration of a zero-interest forbearance period. |

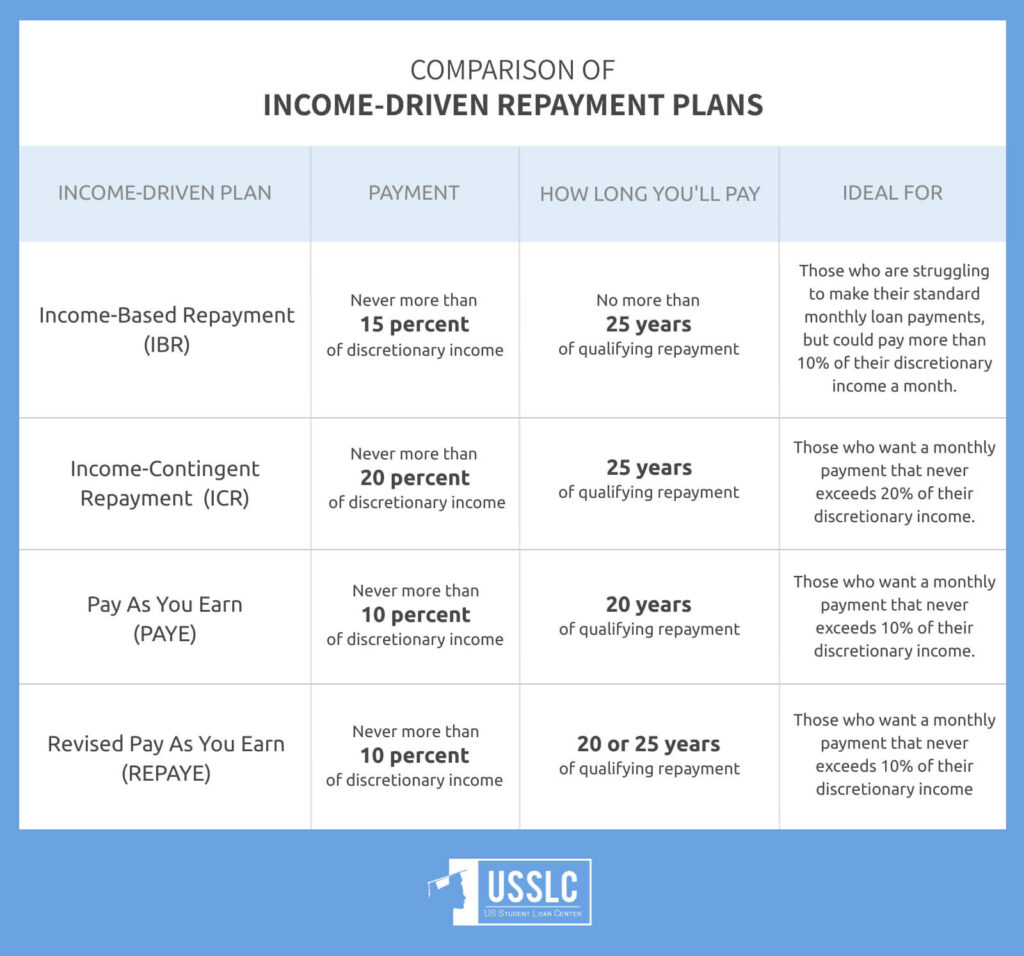

| Alternatives to SAVE Plan | Consider switching to Income-Based Repayment (IBR) to avoid accruing more interest. |

| Next Big Change | The One Big Beautiful Bill act will eliminate current plans by 2028. |

| Borrower Assistance | Department of Education provides resources like the Loan Simulator tool. |

| Official Department of Education Link | For full details and updates from the Department of Education. |

Understanding the Saving on a Valuable Education (SAVE) Plan

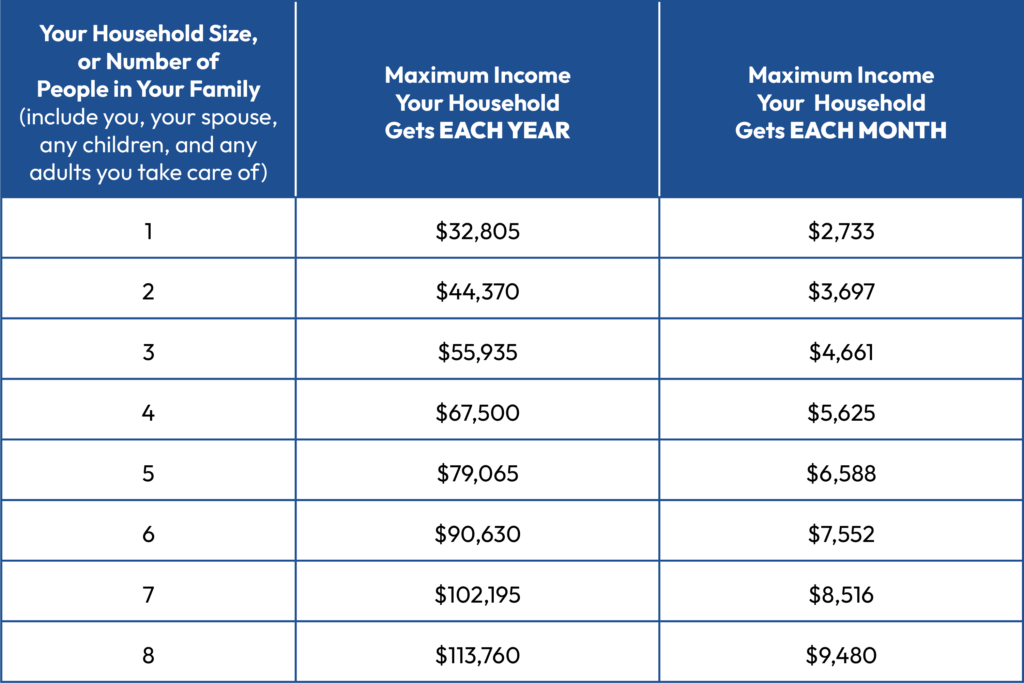

The SAVE Plan is an income-driven repayment option introduced by the U.S. Department of Education to help borrowers with federal student loans. This plan ties your monthly payment to your income and family size, ensuring that your payments are affordable. It also promises forgiveness after 20-25 years of qualifying payments. However, under this plan, borrowers were not required to pay interest for a period due to legal challenges.

This interest freeze is ending on August 1, 2025, which means borrowers need to prepare for the return of interest charges on their loans. Without the interest-free benefit, your monthly payments may not reduce your loan balance as much as before. Understanding how this works will help you make informed decisions moving forward.

How Interest Accrual Works: What Borrowers Should Know

When it comes to student loans, interest accrual means that the amount you owe on your loan grows as time passes. Interest is usually calculated on the remaining principal balance of the loan.

Here’s how it works:

- Daily Interest: Interest is typically calculated on a daily basis, based on the outstanding loan balance. For example, if you have a $10,000 loan with a 5% interest rate, you’ll be charged about $1.37 per day in interest.

- Capitalization: If you don’t make payments for an extended period, such as during forbearance, the unpaid interest can be “capitalized,” or added to your loan balance. This means you’ll pay interest on a higher amount, leading to even more interest charges in the future.

Understanding how interest works will help you figure out how to reduce your loan balance effectively, even with interest accruing.

What Happens If You Don’t Take Action?

Failing to make adjustments now could result in higher loan balances down the road. If you don’t adjust your repayment plan, the resumption of interest will lead to:

- Higher Monthly Payments: Interest will accumulate, and you’ll owe more each month to keep up with the growing loan balance.

- Longer Repayment Period: As the loan grows, your repayment period may stretch out, leading to more years of paying off your debt.

- Increased Overall Loan Cost: Interest can significantly increase the total amount you will end up paying over the life of the loan.

It’s essential to take action now to avoid these negative outcomes.

Case Study: How Switching Plans Can Help

Let’s say Emma, a graduate who owes $50,000 in student loans under the SAVE plan, has an income-driven payment of $200 per month. If her loan interest is accruing at a rate of 4%, her loan balance will grow by $2,000 over the next year—just from interest.

By switching to an Income-Based Repayment (IBR) plan, Emma might be able to lower her monthly payments, but more importantly, she can ensure that interest doesn’t grow uncontrollably. By taking proactive steps, Emma can prevent unnecessary interest accumulation and keep her loan manageable.

Tips for Financial Planning and Managing Student Loan Debt

To avoid the financial strain of accruing interest, consider these financial planning tips:

- Set up Automatic Payments: This can help you stay on top of your payments and might even give you a small interest rate reduction in some cases.

- Make Partial Payments: Even if you can’t afford full payments, making smaller, consistent payments can prevent interest from piling up too quickly.

- Use Your Tax Refund: If you receive a tax refund, consider using it to make a lump sum payment on your loan, reducing your principal balance and preventing more interest from accruing.

- Reassess Your Budget: Taking a hard look at your finances and making adjustments can free up funds to make larger payments, helping you pay down your loan faster.

Impact on Loan Forgiveness

For borrowers pursuing loan forgiveness programs like Public Service Loan Forgiveness (PSLF), it’s important to understand how interest accrual can affect your progress. As interest resumes, it may extend the time you need to make payments before qualifying for forgiveness, particularly if you were hoping to rely on the zero-interest period.

However, qualifying payments for forgiveness are based on the amount of time you’ve been making payments, not the amount you’ve paid. So, staying on track with your repayment plan, even if interest resumes, is crucial for keeping your loan forgiveness timeline intact.

How to Contact Your Loan Servicer for Help Regarding Interest on SAVE Plan Student Loans Resumes Soon

If you have any questions or need assistance with switching repayment plans, the first step is to contact your loan servicer. Your servicer can help you:

- Understand your repayment options.

- Guide you through the process of switching plans.

- Answer any questions you may have about the resumption of interest.

To contact your servicer, visit their official website and look for the contact or customer service page. Make sure to ask about any potential delays due to the backlog of applications, and take note of any required documents for plan changes.

Social Security Projected to Cut Benefits by 2033, Affecting Retired Workers

Millions of Americans Could See Their Social Security Checks Cut by 50 Percent

Expert Offers Guidance for Couples Planning Retirement With Limited Savings