Social Security Projected to Cut Benefits: The future of Social Security is a hot topic in the United States today. If you’re like many Americans, Social Security is a cornerstone of your retirement plan. It’s been there for decades, providing income to retirees and disabled workers, as well as their families. But recent projections are sending a shockwave through the retirement landscape. The Social Security Administration (SSA) has warned that, unless changes are made, the program may need to cut benefits by 2033. This news has many asking: What does this mean for retirees? Should we be worried? And how can we prepare?

This article will dive deep into the current state of Social Security, explain why it’s facing challenges, and offer practical advice on how you can plan for a future where benefits might not be as reliable. Whether you’re nearing retirement or just starting your career, understanding how these changes might affect you is crucial for your financial future.

Social Security Projected to Cut Benefits

Social Security has been a bedrock of retirement income for millions of Americans, but with the program’s future uncertain, it’s crucial to take action now. With the potential for significant cuts to benefits by 2033, retirees and workers alike need to plan ahead. Diversifying your retirement savings, staying informed about policy changes, and seeking professional financial advice can help ensure that you’re ready for whatever the future holds. While there are proposals for reform, no one can predict for sure what will happen with Social Security. But by taking proactive steps, you can secure your financial future, even in uncertain times.

| Key Fact | Data/Source |

|---|---|

| Social Security Trust Fund Depletion | The OASI Trust Fund is projected to run out of money by 2033, with benefits reduced by 23%. |

| Expected Benefit Cuts | By 2033, retirees could see a 23% cut in monthly Social Security benefits. |

| Monthly Benefit Loss | A $2,000/month benefit could drop by $460, reducing annual income by $5,520. |

| Proposals for Reform | Senators Bill Cassidy and Tim Kaine have proposed a new investment fund to support Social Security. |

| Average Monthly Benefit | The average Social Security benefit for retired workers in 2024 is around $1,900. |

| Action Required | Experts emphasize the need for reforms to ensure Social Security remains sustainable. |

The State of Social Security Today: Why the Crisis?

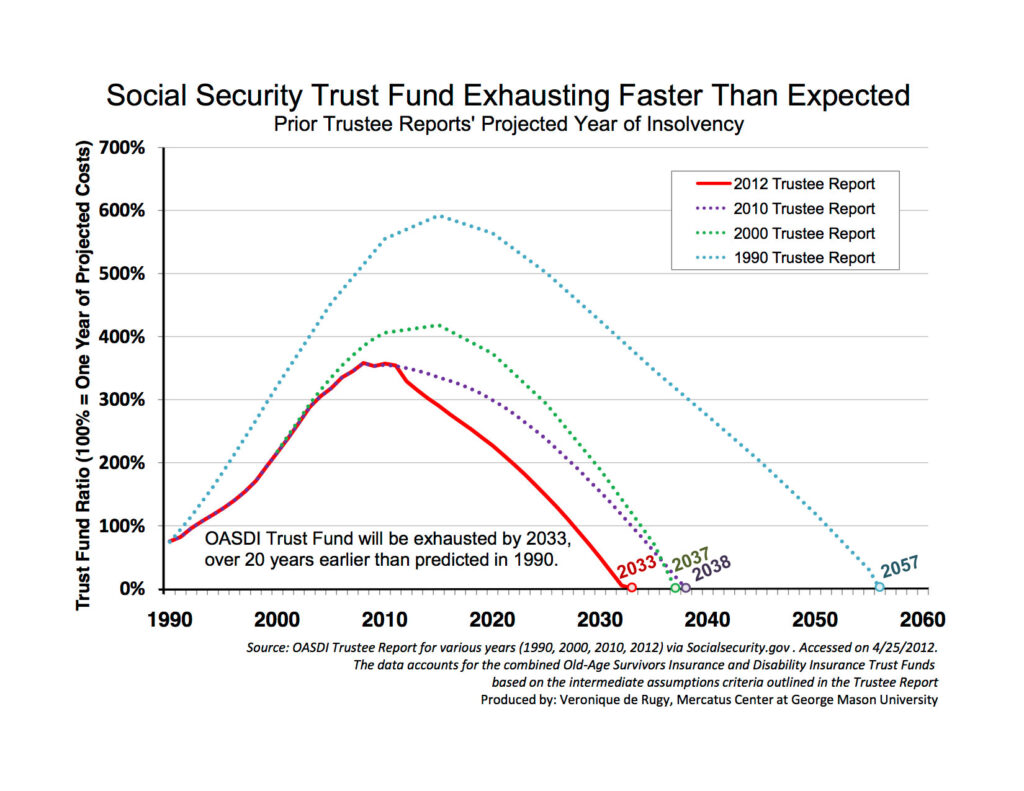

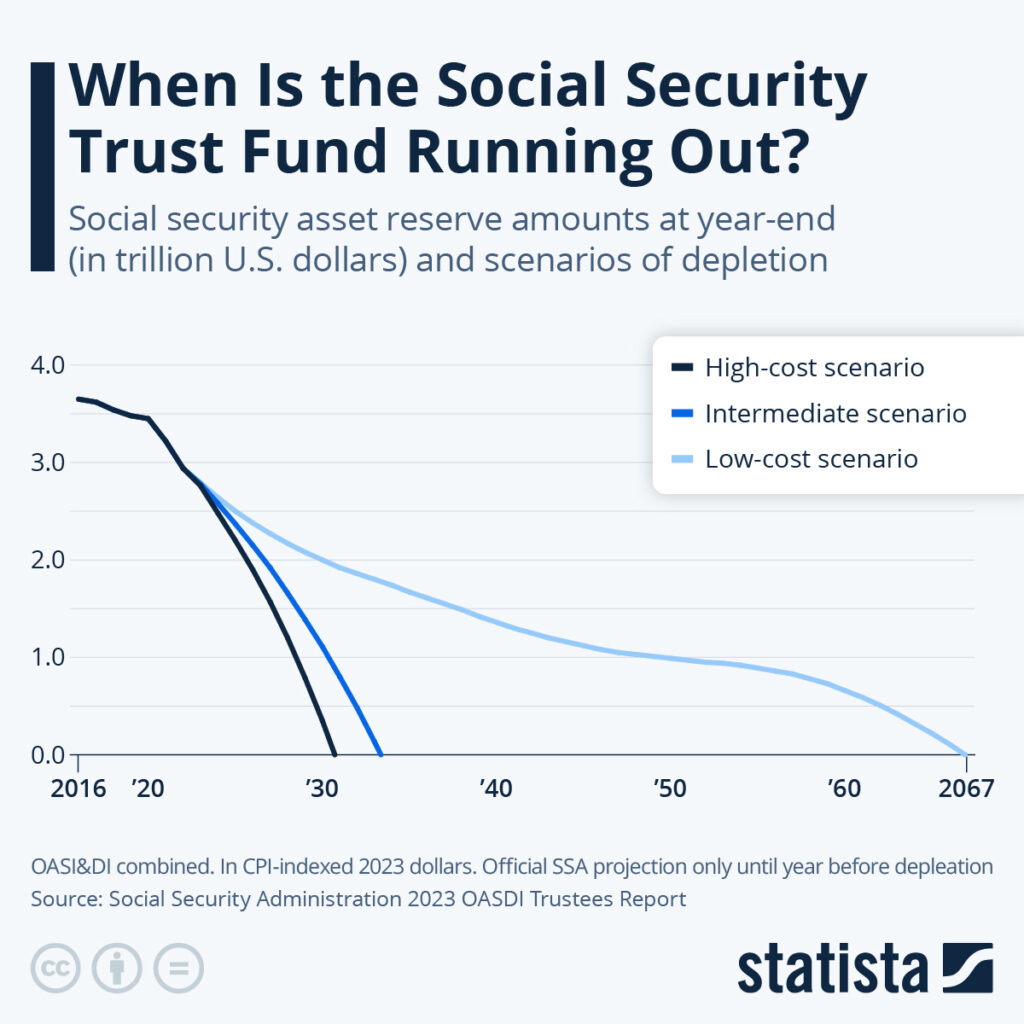

Social Security has long been a dependable lifeline for millions of Americans. But recent projections paint a troubling picture. The trust fund that finances Social Security is projected to run out by 2033, at which point the program will only be able to pay about 77% of the scheduled benefits. That means unless action is taken, you might see a 23% reduction in your monthly benefits.

So, why is this happening? There are several factors at play, including demographic changes and the aging of the Baby Boomer generation. More people are retiring and living longer than ever before, which means the program is paying out more than it’s taking in through payroll taxes. Additionally, legislative changes, like the repeal of the Windfall Elimination Provision, have increased the amount of benefits paid out, putting even more pressure on the system.

How the System Works Today?

Social Security is funded by payroll taxes, which employees and employers pay. Workers pay 6.2% of their wages into the program, while employers match that with another 6.2%. This money goes into the Social Security Trust Fund, which is then used to pay benefits to retirees, disabled workers, and survivors. The system has been a reliable source of income for millions of people for decades, but the fund is now facing a shortfall.

The Growing Threat of Social Security Projected to Cut Benefits

Let’s break down what will happen if the Social Security Trust Fund runs out of money by 2033. The program will still have money coming in from payroll taxes, but it won’t be enough to pay full benefits. The SSA estimates that only 77% of benefits will be paid out, meaning a potential 23% cut across the board for retirees.

This isn’t just theoretical – if you’re retired, you could see a significant drop in your monthly check. For example, if you’re currently receiving $2,000 per month, a 23% reduction would lower your benefit by $460, leaving you with just $1,540 each month. That’s a loss of $5,520 annually, which could make a big difference in your financial security.

How Demographic Changes Contribute to the Problem?

The main driver behind the Social Security crisis is the aging population. As more Baby Boomers retire and live longer, there are fewer workers contributing to the system. According to the SSA, the number of retirees has increased, while the number of workers paying into the system has decreased. In fact, the ratio of workers paying into Social Security compared to retirees drawing benefits has dropped from about 16:1 in 1950 to just 2.8:1 today.

That’s a huge gap, and it’s only expected to grow in the coming years. By 2035, it’s estimated that the ratio will fall to just 2:1. Simply put, the system is not built to sustain that many retirees for such a long period of time.

The Economic and Social Impact of Benefit Cuts

A potential 23% cut in Social Security benefits by 2033 is not just a personal financial issue; it’s a broader economic and social problem. Social Security accounts for around 40% of the average retiree’s income. For many, it’s the difference between a comfortable retirement and struggling to make ends meet.

What happens if benefits are slashed? It could lead to increased poverty rates among seniors, forcing more people to rely on other government assistance programs like Medicaid or food stamps. Additionally, the psychological toll of losing this reliable income source can’t be understated—many retirees may face unnecessary stress and anxiety in their later years.

Broader Economic Impact

With retirees making up a substantial part of the consumer economy, a reduction in Social Security payments would likely have a ripple effect. Many seniors will cut back on spending, leading to reduced demand for goods and services. This could slow down the economy, affecting businesses, workers, and even younger generations who depend on healthy economic conditions for their own jobs and retirement savings.

Potential Reforms: Is There a Way Out?

With the Social Security system on the brink of a crisis, many lawmakers are proposing reforms to ensure its survival. One such proposal comes from Senators Bill Cassidy (R-Louisiana) and Tim Kaine (D-Virginia), who have introduced a plan to create a new investment fund that would supplement the current trust fund. This new fund would invest in higher-return assets like stocks and bonds, and its goal is to grow over the next 75 years to help cover the program’s shortfall.

While this proposal has its merits, experts are divided on its feasibility. The plan’s reliance on market returns could expose Social Security to the risks of market volatility. Plus, critics argue that this approach avoids addressing the structural reforms that are truly necessary to ensure the program’s long-term solvency.

Another potential reform could involve raising payroll taxes or increasing the retirement age. These options would help bring more money into the system and reduce the pressure on the trust fund.

What Should Retirees Do Now?

If you’re approaching retirement or are already living on Social Security, you’re probably wondering: What does this mean for me? Should I be worried? Here’s what you can do to prepare:

- Diversify Your Retirement Savings: Social Security may not be enough to cover all of your retirement expenses. It’s a good idea to supplement your Social Security income with other retirement savings, like a 401(k), IRA, or personal savings. Aim to save as much as possible in tax-deferred accounts that can grow over time.

- Consider Delaying Retirement: The longer you wait to claim Social Security, the larger your monthly benefit will be. If you can afford to delay taking benefits until you’re 70, you’ll receive a higher monthly check.

- Keep an Eye on Policy Changes: Stay informed about proposed reforms to Social Security. Keeping track of potential changes will help you adjust your retirement planning accordingly.

- Consult a Financial Advisor: If you’re unsure about your retirement plan, consider speaking with a financial advisor. They can help you navigate the complexities of Social Security and develop a strategy that works for your unique financial situation.

Recent Adjustment to Social Security Benefits Raises Questions- Check Details!

Trump’s ‘Big Beautiful Bill’ Sparks Debate Over Social Security and Benefits

Deadline Alert—July 2025 Social Security Cutoff Is Closer Than You Think