Expert Offers Guidance for Couples Planning Retirement: Retirement planning might seem like an overwhelming task, especially if you’re starting with limited savings. For many couples, the idea of spending their golden years without a comfortable nest egg can feel daunting. But don’t worry, you’re not alone, and with the right guidance, there are still plenty of ways to plan for a happy and secure retirement, no matter how small your current savings are. Whether you’re in your 30s, 40s, or 50s, it’s never too late to start strategizing.

In this article, we’ll break down practical steps that couples with limited savings can take to create a retirement plan that works for them. From setting realistic goals and exploring investment options to optimizing Social Security benefits and planning for healthcare, we’ll cover it all. Along the way, we’ll provide expert advice, useful tips, and real-life examples to make the process easier to understand. Let’s dive in!

Expert Offers Guidance for Couples Planning Retirement

Planning for retirement on a limited budget doesn’t have to be a stressful, insurmountable task. By following a few key steps—assessing your situation, setting goals, maximizing contributions, and planning for healthcare—you can make your retirement dreams a reality, no matter where you start. Whether it’s delaying Social Security benefits or downsizing your home, every decision you make will add up over time. Just remember: the earlier you start, the better prepared you’ll be. And if you ever need help, don’t hesitate to consult with a financial advisor to get expert advice. Your future self will thank you!

| Key Topic | Key Data/Stats | Resources |

|---|---|---|

| Importance of Early Planning | 72% of Americans have less than $1 million saved for retirement | SmartAsset |

| Recommended Savings Goal | Aim to replace 70%-80% of pre-retirement income annually | Fidelity |

| Social Security Tips | Delaying benefits can increase payouts by up to 8% per year | |

| Healthcare Costs in Retirement | Retirees may need over $300,000 for healthcare costs | |

| Financial Advisor’s Role | Working with a pro can increase retirement savings success by 40% |

Step 1: Assessing Your Current Situation

Before you start making decisions, take a good look at where you stand financially. You can’t make an effective plan if you don’t know where you are right now.

Start by answering these key questions:

- How much do we currently have saved for retirement?

- What are our monthly expenses, both now and what we expect in the future?

- Do we have any debts, and if so, how much?

By putting everything on paper, you’ll have a clearer picture of your starting point. You’ll also want to take inventory of your assets, including your home, cars, and any other investments. Knowing where you stand is the foundation of a solid retirement plan.

For instance, let’s say you and your partner have $100,000 saved, but you still owe $50,000 on your mortgage. Subtracting that debt means you have $50,000 in liquid retirement savings, which might not seem like enough. This is why assessing your situation is so crucial—it lets you see the gaps you need to fill.

Step 2: Setting Realistic Goals

Once you have a clear understanding of your current financial state, it’s time to set some realistic goals for the future.

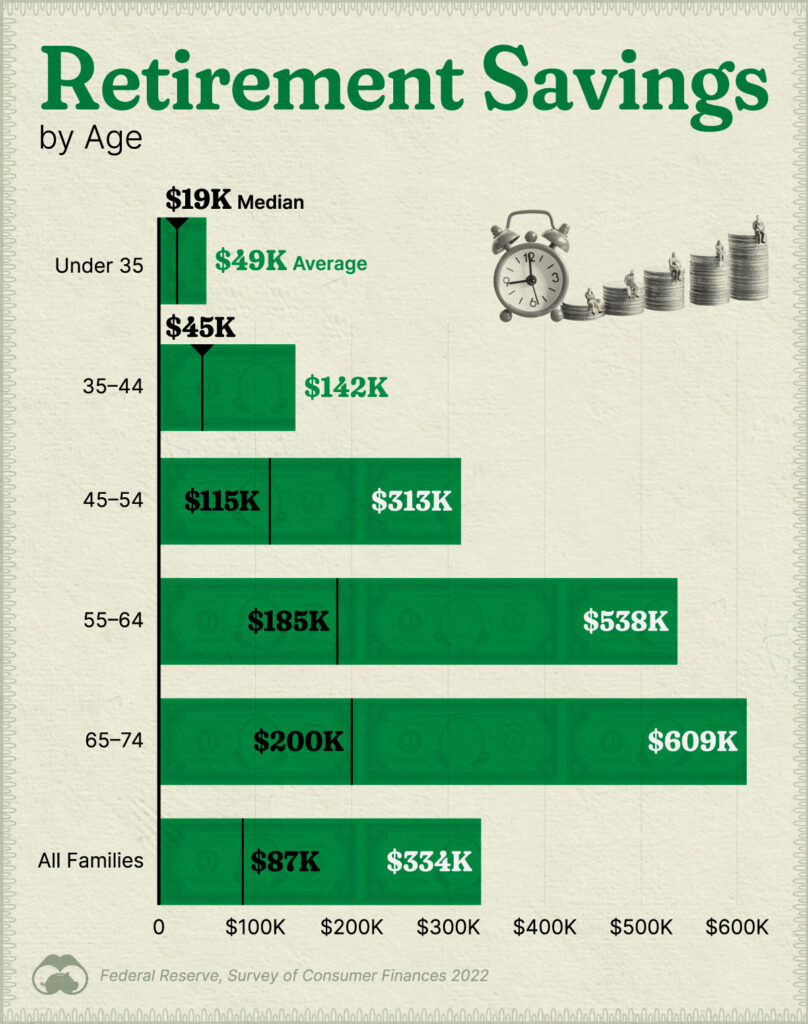

How much money do you need for a comfortable retirement? This number will vary based on lifestyle preferences, location, and healthcare needs, but a good rule of thumb is that you’ll want to replace 70%-80% of your pre-retirement income annually.

For example, if you and your partner are earning $80,000 a year, you’ll want to aim for $56,000 to $64,000 a year in retirement. To determine how much you need to save to reach that goal, there are plenty of retirement calculators available online.

Step 3: Maximizing Your Retirement Contributions

Even if you’re starting with limited savings, there are still opportunities to make your money work harder for you. Here are a few ideas:

- 401(k) Contributions: If your employer offers a 401(k) plan, make sure you’re contributing enough to take full advantage of any employer match. If you don’t contribute at least up to the match, you’re leaving free money on the table.

- IRA Contributions: Both Traditional and Roth IRAs are great ways to save for retirement. They allow you to save tax-free or tax-deferred, depending on which one you choose.

- Catch-up Contributions: If you’re 50 or older, you can contribute an additional $6,500 to your 401(k) and $1,000 to your IRA. This can give your savings a nice boost.

Even small contributions can add up over time, especially with compound interest working in your favor.

Step 4: Delaying Social Security Benefits

One strategy to maximize your retirement income is to delay claiming Social Security benefits until you reach the age of 70. While you can start claiming as early as age 62, waiting will increase your monthly payments.

For example, if you start collecting at age 62, your monthly benefit might be 30% lower than if you wait until age 70. If you and your spouse can afford to wait, this is a great way to ensure you get the highest possible benefit.

Additionally, understanding the Social Security spousal benefit can make a huge difference. If one of you earned significantly more than the other, the lower-earning spouse can claim up to 50% of the higher-earning spouse’s benefit. This can help stretch your Social Security income further.

Step 5: Planning for Healthcare and Long-Term Care

Healthcare is one of the biggest costs you’ll face in retirement, and for many couples, it’s often overlooked in the planning process. It’s estimated that a 65-year-old couple retiring today could need over $300,000 to cover healthcare costs throughout their retirement.

Additionally, you’ll need to think about long-term care, which can be even more expensive. About 70% of people over 65 will need some form of long-term care. That could include nursing home stays, assisted living, or even home healthcare services.

Consider purchasing long-term care insurance or investing in a Health Savings Account (HSA). These options can help you manage healthcare costs while you enjoy your retirement years. You can also explore Medicare, which will cover many healthcare needs for those over 65, but it’s important to understand what’s not covered, such as dental or vision care.

Step 6: Cutting Costs & Downsizing

Sometimes the best way to boost your retirement savings is to reduce your current expenses. If you’re still carrying a large mortgage, consider downsizing to a smaller, more affordable home. You can free up money that can be redirected into retirement accounts or other investments.

Other ways to cut costs include reducing discretionary spending (like eating out or expensive vacations), eliminating debt, and being mindful of everyday purchases. This will not only help you save more but also reduce the amount you need in retirement.

Step 7: Consult with a Financial Advisor

If you’re feeling overwhelmed, it might be time to sit down with a professional financial advisor. A financial planner can help you navigate the complexities of retirement planning, such as choosing between different retirement accounts, optimizing Social Security benefits, and determining how much you need to save to meet your retirement goals.

According to NerdWallet, working with a financial advisor can increase the likelihood of retirement savings success by as much as 40%. So, if you’re feeling uncertain, it might be worth seeking expert guidance.

Additional Tips for Expert Offers Guidance for Couples Planning Retirement

Understanding the Power of Compound Interest

The earlier you start saving, the more you can benefit from compound interest. This is where the interest on your savings starts to earn its own interest, leading to exponential growth. Even if you’re just putting away small amounts of money, over time, compound interest can make a big difference in how much you have saved by the time you retire.

Retirement Strategies for Self-Employed Couples

If you’re self-employed or own a business, there are unique retirement savings options available. SEP IRAs, Solo 401(k)s, and Simple IRAs are great ways to save for retirement while taking advantage of tax deductions. They allow for higher contribution limits than traditional IRAs.

Gen Z Is Saving for Retirement Early, But Employers May Be Falling Behind

Millennial Who Achieved Early Retirement Reveals Harsh Truth About FIRE Lifestyle

4 Financial Mistakes Americans Keep Making That Wreck Their Budgets