Penalties for Not Enrolling Staff in State Retirement Program: Starting in 2025, Connecticut employers who fail to enroll their eligible employees in the state’s mandatory retirement savings program, MyCTSavings, will face stiff penalties. This move aims to ensure that more workers in Connecticut are prepared for retirement, even if their employers don’t offer traditional retirement plans like 401(k)s. So, what does this mean for employers, and how can they avoid these penalties? Let’s break it down.

Penalties for Not Enrolling Staff in State Retirement Program

Connecticut’s new MyCTSavings program is an important step in ensuring that all workers, regardless of where they work, have a path to save for retirement. As an employer, you need to understand your responsibilities, register by the deadline, and stay compliant to avoid penalties. Remember, it’s not just about avoiding fines—this program can be a valuable resource to help your employees secure their financial future. Take the time now to get familiar with the process and get registered before the deadlines hit. By taking these steps, you’re not only protecting your business from penalties but also investing in your workforce’s long-term well-being.

| Key Points | Details |

|---|---|

| Program Name | MyCTSavings |

| Penalties for Noncompliance | Fines ranging from $500 to $1,500 depending on company size. |

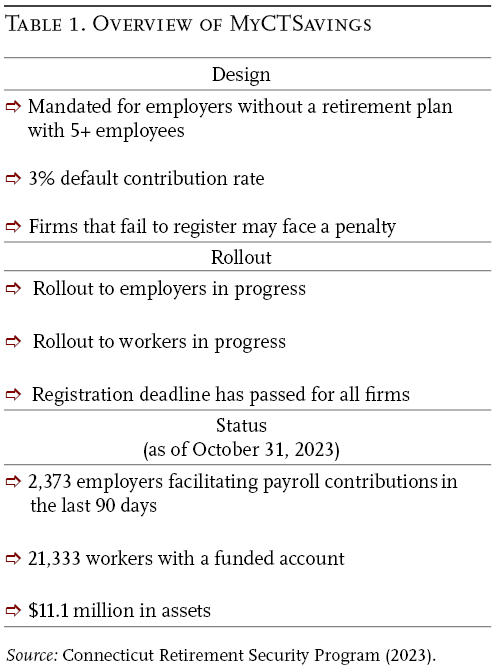

| Eligible Employers | Employers with 5+ employees who earn over $5,000 annually. |

| Contribution Rate | Employees contribute 3% of their gross pay (automatic enrollment). |

| Deadline for Registration | Employers with 5-25 employees: August 31, 2024. |

| Official Website for Employers | MyCTSavings Website |

| Additional Resources | OnPay Guide on MyCTSavings |

What Is MyCTSavings?

MyCTSavings is Connecticut’s state-sponsored retirement savings program, designed to help private-sector workers who don’t have access to employer-sponsored retirement plans. If you’re a Connecticut employer with five or more employees, you’re required to enroll your workers in the program, unless you already offer a qualified plan like a 401(k).

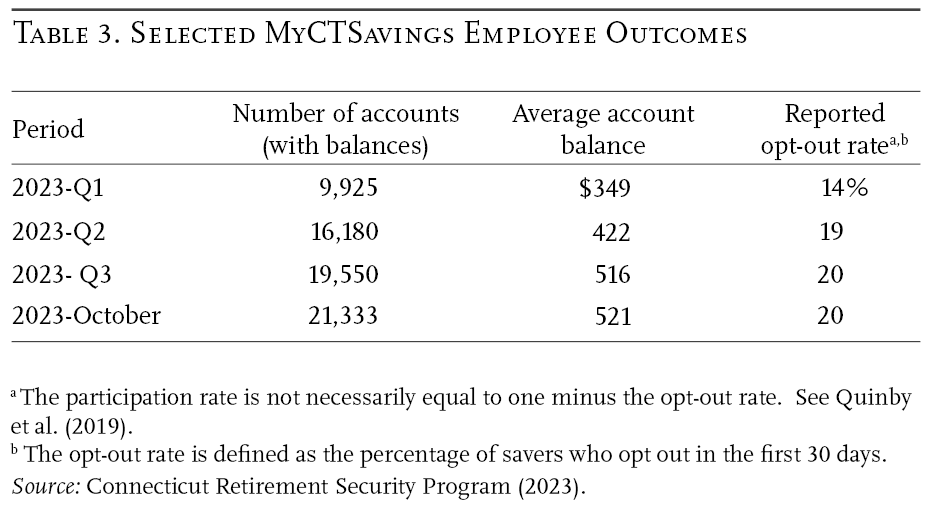

Eligible workers will be automatically enrolled in MyCTSavings, and 3% of their gross pay will be deducted for their retirement savings. Workers can change their contribution rates or opt out at any time. Employers aren’t required to make contributions, but they are responsible for managing the employee deductions and submitting them to the state.

The idea behind MyCTSavings is to increase the number of workers in Connecticut saving for retirement. Without a program like this, many employees—especially those working for smaller companies—might not have any retirement savings at all.

Penalties for Employers Who Don’t Enroll Employees

If you’re an employer in Connecticut and you don’t comply with this law, you could be looking at fines based on the size of your workforce. Here’s the breakdown:

- $500 for employers with 5 to 24 employees

- $1,000 for employers with 25 to 99 employees

- $1,500 for employers with 100 or more employees

These penalties apply after employers have received three notices of noncompliance from the state. The state is giving employers ample opportunity to get in line with the program, so there’s no need to panic just yet.

Why Is This Program Important?

Connecticut isn’t the first state to implement a state-run retirement savings program. California, Oregon, and Illinois have also rolled out similar programs. The reason for these state initiatives is clear: many workers aren’t saving enough for retirement.

According to a report from the National Institute on Retirement Security, about half of U.S. workers have less than $25,000 saved for retirement. For many low- and middle-income workers, a lack of employer-provided retirement plans leaves them without a way to save. The MyCTSavings program helps address that gap, ensuring that every worker in Connecticut has a chance to save for the future.

In addition, the program helps combat the looming retirement crisis by providing a convenient and automatic option for employees to begin saving. With auto-enrollment, employees will start saving without needing to take action, which increases their likelihood of building a retirement nest egg.

Benefits for Employers

While you, as an employer, may not have to make contributions, MyCTSavings offers a no-cost, low-effort solution to ensure your employees are saving for retirement. The program can be an attractive benefit to potential hires, showing your commitment to their long-term financial health.

Moreover, complying with the program can help you avoid the headache of penalties and fines that can pile up if you delay registration or fail to take the necessary steps.

Here’s why it can actually be beneficial to your business:

- Improved Employee Retention: When employees feel their employer is helping secure their future, they are more likely to stay loyal to the company. Offering MyCTSavings ensures that you’re taking steps to secure their financial future, which builds trust and goodwill.

- Attracting Talent: Many workers are looking for jobs that offer retirement benefits. By participating in MyCTSavings, you can make your business more attractive to candidates who are thinking long-term.

- Simple Administration: The state handles the management of the program, so as an employer, you don’t need to worry about creating, managing, or adjusting the retirement accounts yourself. It’s pretty much “set it and forget it.”

How to Avoid Penalties for Not Enrolling Staff in State Retirement Program: A Step-by-Step Guide

Now that we know why this program is important and the penalties employers face for noncompliance, let’s go through a practical guide for employers on how to stay in the clear.

Step 1: Determine Eligibility

- Who Needs to Enroll? Employers with at least five employees who each earn more than $5,000 per year must participate.

- Already Offering a Plan? If your company already offers a qualified retirement plan like a 401(k) or a Simple IRA, you don’t need to enroll in MyCTSavings. However, you will need to certify your exemption on the program’s portal.

Step 2: Register with MyCTSavings

- Deadline: Employers with 5-25 employees must be fully registered by August 31, 2024.

- Visit the MyCTSavings website to create an account and start the registration process.

- You’ll need basic company details such as your Employer Identification Number (EIN), number of employees, and payroll data.

Step 3: Automatic Enrollment and Employee Contributions

Once registered, employees will be automatically enrolled in MyCTSavings. Each eligible employee’s contribution rate will start at 3% of their gross pay. This rate can be adjusted or declined by employees, but the employer must ensure the contributions are deducted and submitted to the state.

Step 4: Educate Your Employees

While you, the employer, are responsible for making sure the contributions happen, it’s important to educate your employees. Let them know:

- They are automatically enrolled unless they choose to opt out.

- They can change their contribution rate at any time.

- They can choose to opt out if they don’t want to participate.

Step 5: Submit Contributions

Once employee deductions are made, employers are responsible for submitting those contributions to the MyCTSavings system on a regular basis.

Thousands in South Carolina Could Lose SNAP Benefits Under GOP Medicaid Cuts

Recent Adjustment to Social Security Benefits Raises Questions- Check Details!

4 Financial Mistakes Americans Keep Making That Wreck Their Budgets