UK Set to Raise State Pension Age Beyond 67: The UK government has announced plans to increase the state pension age beyond 67, aiming to adapt to longer life expectancies and the growing number of retirees. With more people living longer and fewer working-age individuals contributing to the pension system, changes are necessary to ensure the system remains sustainable. This news has stirred up both concerns and debates. In this article, we will break down the situation, explaining the facts, what these changes mean, and how they might affect you. Whether you’re planning for retirement, working in the financial sector, or just curious, this guide will offer practical advice and clear insights.

UK Set to Raise State Pension Age Beyond 67

The UK’s plan to raise the state pension age beyond 67 comes as no surprise in light of the nation’s increasing life expectancy. While these changes are necessary to ensure the long-term sustainability of the pension system, they pose challenges for those who may face health disparities or financial difficulties. By preparing early, staying informed, and making smart financial decisions, you can ensure a more comfortable and secure retirement, no matter when you start claiming your pension.

| Key Points | Data/Information | Source |

|---|---|---|

| Current Pension Age | 66 for both men and women | Fidelity.co.uk |

| Pension Age Increase | Rise to 67 between May 2026 and March 2028 | The Guardian |

| Further Projections | Pension age may rise to 68 between 2044 and 2046 | |

| Expert Recommendation | Pension age might need to rise to 71 by 2050 | |

| Health Concerns | Only top 10% remain healthy into their 70s | |

| Government Review | Regular pension age reviews every 5 years | Gov.uk |

Introduction: Why UK Set to Raise State Pension Age Beyond 67?

The state pension age in the UK is the age at which individuals can start receiving their state pension. Currently, people can begin collecting this pension at age 66, but due to rising life expectancy, the government is considering pushing this age even further—beyond 67 and potentially to 71 by 2050.

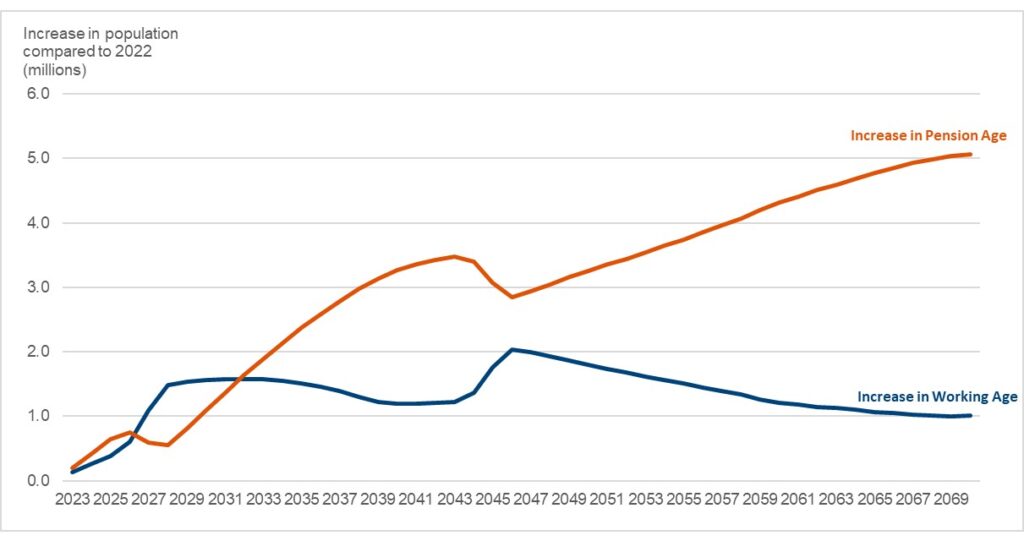

But why? In simple terms, more people are living longer, and fewer are contributing to the pension system. The UK, like many other nations, is facing a “demographic crisis,” meaning there are fewer younger people entering the workforce while the older population continues to grow. This imbalance puts a lot of financial pressure on the state pension system. To maintain the balance between working-age people and retirees, the government has to rethink when individuals can start claiming pensions.

What Does This Mean for You?

Whether you’re already thinking about retirement or you’re years away from it, understanding these changes is crucial. In the following sections, we’ll break it down:

- What is the state pension?

- How will the pension age changes affect me?

- What are the pros and cons of these changes?

- How can I prepare for the potential rise in pension age?

What is the State Pension?

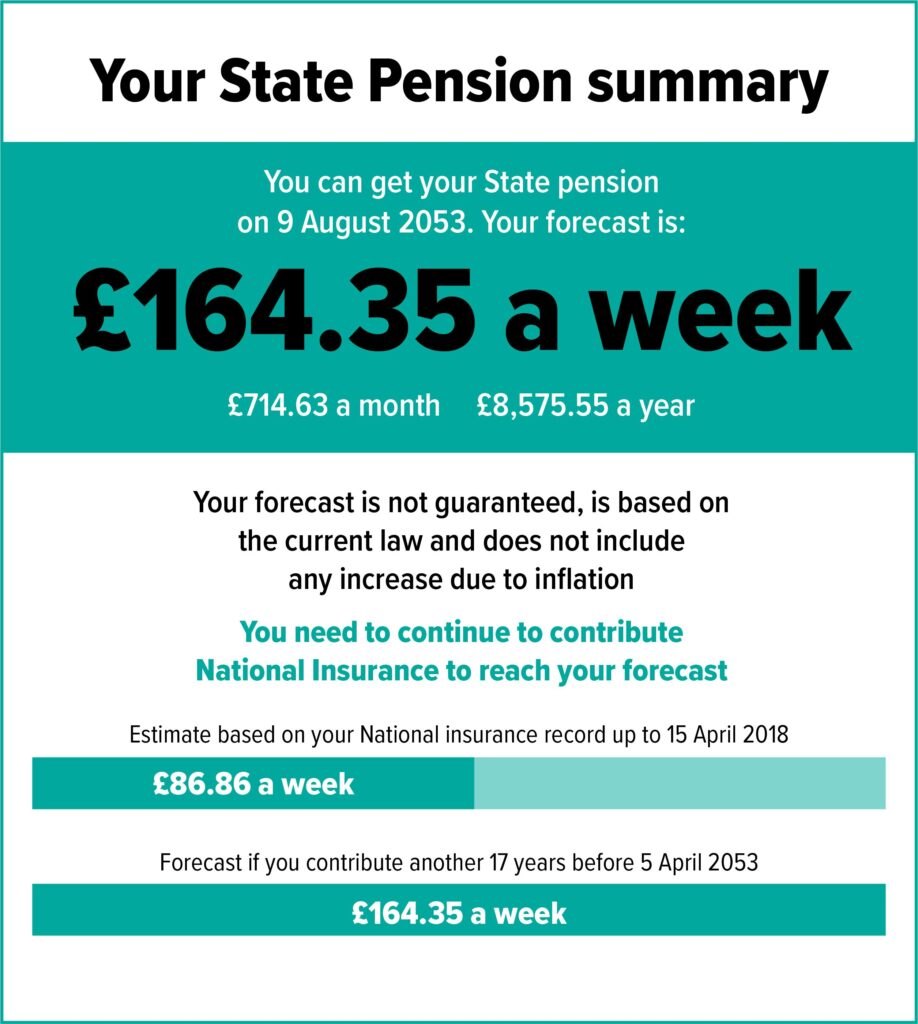

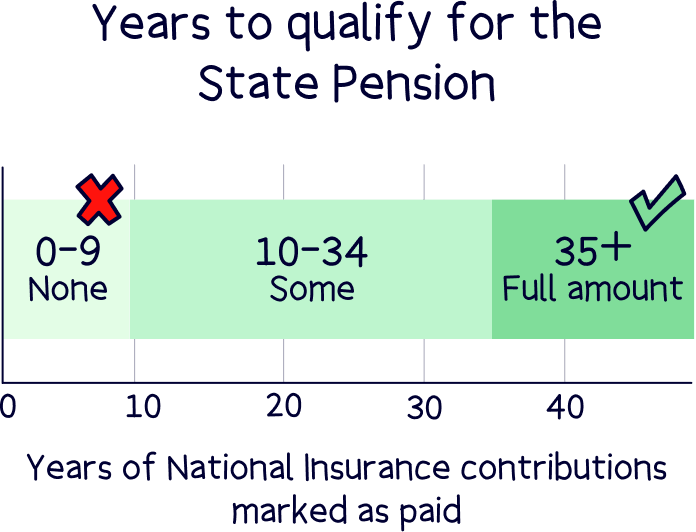

In the UK, the state pension is a regular payment from the government that individuals can receive once they reach a certain age. The amount you receive depends on how many years you’ve worked and contributed to the National Insurance system. It’s designed to provide a basic income in retirement, helping to cover essential living costs.

For example, a person who has contributed the required number of years to National Insurance will receive the full state pension amount, which is around £203.85 per week (as of 2025/2026). However, this amount can vary based on your work history and National Insurance contributions. If you haven’t contributed enough, you could receive a smaller amount or no pension at all.

The state pension is intended to supplement other retirement savings, such as workplace pensions and personal savings. It’s not typically enough to fully support a person in retirement, but it helps to cover basic living expenses like food, utilities, and housing.

How Will the Pension Age Changes Affect Me?

Raising the pension age will directly impact millions of people, particularly those currently approaching retirement. If you were planning to start receiving your state pension at 66, the new pension age could delay that benefit.

For example:

- If you were born between April 1960 and March 1961, your state pension age is already set to rise to 67.

- If you’re younger than that, it could be delayed even further, potentially until age 68 or beyond.

This change might affect those who were relying on early access to the pension as part of their financial planning. If you’ve already started to reduce your working hours or have plans to retire early, these changes could have a significant impact on your financial situation.

The Long-Term Picture:

By 2050, experts predict that the state pension age could reach 71, largely due to the growing life expectancy in the UK. People are living longer, healthier lives, and as a result, the government believes that people can work longer and contribute more to their pensions before drawing benefits. If the state pension age were to rise to 71 by 2050, it would provide a longer working life for many individuals, allowing them to contribute more to their pensions and reducing the financial burden on the state.

However, it’s important to note that this increase will not affect everyone equally. People in physically demanding jobs, or those who have less access to healthcare, might find it more difficult to continue working into their late 60s and early 70s.

What Are the Pros and Cons of These Changes?

Pros:

- Sustainability of the Pension System: With longer life expectancies, the current pension system could become unsustainable unless changes are made. Raising the pension age helps balance the pension system by ensuring there are enough contributions from working individuals. This will help the system remain financially viable for future generations.

- More Working Years for Healthy Individuals: With many people staying healthy into their 70s, raising the pension age allows people to work longer if they choose, contributing more to their pensions and savings. Many individuals today remain active and capable of working well beyond traditional retirement age, and raising the pension age gives them the option to do so.

- Increased Longevity Means Longer Retirement: People are retiring earlier than ever before, and with a higher pension age, people can continue to work and earn money for longer, potentially improving their overall retirement savings. This may allow retirees to live more comfortably and have more financial freedom in their later years.

Cons:

- Health Inequalities: The most significant downside of increasing the pension age is the potential health inequality. Many people, especially in lower-income groups, do not remain healthy enough to work until age 68, 70, or 71. This change could disproportionately affect those in poorer health, leading to economic hardship.

- Financial Hardship: Raising the pension age could delay financial security for many retirees, especially for those without substantial private savings or other retirement plans. It may increase the financial strain on people who have not had the opportunity to save adequately for retirement.

- Regional Disparities: Certain regions in the UK, particularly those with lower life expectancies, may feel the effects of the pension age increase more harshly. People in areas with higher mortality rates may struggle more with the extended working years.

How Can I Prepare for the Potential Rise in Pension Age?

There’s no doubt that preparing for an uncertain retirement age can be stressful, but there are several steps you can take to ensure you’re financially ready:

- Review Your Retirement Plans: If you’re already in your 30s, 40s, or 50s, now is the time to start planning for a potential delayed retirement. Assess your current savings and pension contributions, and make sure you’re setting aside enough to maintain your lifestyle later in life. The earlier you start, the better prepared you’ll be.

- Increase Private Savings: If the state pension will be delayed, you’ll need other sources of income to cover your retirement. This might mean contributing more to a workplace pension or setting up a personal pension plan. Consider starting an Individual Savings Account (ISA) or increasing your investment in stocks and shares to supplement your retirement savings.

- Consider Additional Investments: Explore other investment options like stocks, bonds, and real estate that can help grow your wealth and ensure you have sufficient funds when you retire. Real estate, in particular, can provide both a stable income (through rent) and potential appreciation.

- Stay Healthy: Staying physically and mentally healthy could mean more years of productivity and less financial stress later in life. Regular exercise, proper nutrition, and mental well-being are key factors that can help you work longer. Preventative health measures like regular check-ups, stress management, and staying socially active can all contribute to a longer, healthier life.

- Stay Informed: Keep an eye on government updates regarding the pension age and any other changes in retirement policies. Many websites also have pension calculators that can help you understand exactly how the pension changes will impact you.

Alternatives to the State Pension

While the state pension provides a basic income in retirement, it’s often not enough to maintain a comfortable lifestyle. Here’s a quick look at other options to supplement your state pension:

- Workplace Pensions: Most UK employers are required to offer a pension scheme, where both you and your employer contribute. Make sure you’re enrolled in this and consider increasing your contributions if possible. If you’re self-employed or run your own business, you should consider setting up a pension scheme for yourself.

- Personal Pensions: If you’re self-employed or want additional savings, personal pensions allow you to make contributions and benefit from tax relief. You can set up a private pension through a bank or pension provider, with various options to suit different risk profiles.

- Individual Savings Accounts (ISAs): ISAs are a tax-efficient way to save or invest money. Though not specifically for retirement, they can be a useful addition to your retirement savings. Stocks and shares ISAs, in particular, offer potential long-term growth.

- Investing in Stocks and Bonds: For those looking for higher returns, investing in the stock market or bonds can provide an additional income source in retirement. These investments come with more risk, but they also have the potential for greater rewards.

Global Perspective on Pension Age Increases

The trend of raising the pension age isn’t unique to the UK. Many other countries are grappling with similar issues of aging populations and pension sustainability. For example, in Germany, the pension age is set to rise to 67 by 2031, while France has already implemented plans to increase the retirement age to 64 by 2030. These global shifts reflect a common challenge: ensuring that pension systems can support an aging population without burdening the working-age generation too much.

UK’s Retirement System Faces Pressure—Why the Government May Need to Raise the Pension Age Again?

New DWP £200 Cost of Living Boost Announced—Here’s Who Qualifies

Pensioners Born Before This Date Could Be Owed Extra Monthly Payments