Universal Credit Payments: The Department for Work and Pensions (DWP) has confirmed that Universal Credit payments are being issued to eligible individuals across the UK without disruption. Whether you’re a single parent juggling jobs, someone out of work due to health issues, or just needing help to make ends meet, Universal Credit (UC) remains a crucial support system for millions.

With big reforms planned for 2026, and more people depending on welfare during tough economic times, it’s more important than ever to understand what UC is, how it works, and what changes are coming. This in-depth article walks you through everything from how to apply, how much you can get, what to expect in the future—and how to make sure you’re not leaving money on the table.

Universal Credit Payments

The DWP’s confirmation that Universal Credit payments are being issued regularly and on time is a reassuring message for millions who rely on this lifeline. But as the system evolves—especially with big changes coming in 2026—it’s critical to stay informed, proactive, and engaged with your UC account and your responsibilities. Universal Credit isn’t just a safety net—it’s a flexible tool designed to help you through tough times and transition into better ones. Know your rights, stay in touch with your work coach, and get help when needed. There’s support out there—you just need to reach for it.

| Topic | Details |

|---|---|

| Program | Universal Credit (UK) |

| Authority | Department for Work and Pensions (DWP) |

| Eligibility | Low-income, unemployed, or unable to work |

| Payment Frequency | Monthly (bi-weekly in Northern Ireland) |

| Processing Time | First payment ~5 weeks from claim date |

| 2026 Updates | Increases to standard allowance; reduction in disability-related elements for new claimants |

| Support Services | Citizens Advice, Turn2Us, Scope |

| Official Source | gov.uk/universal-credit |

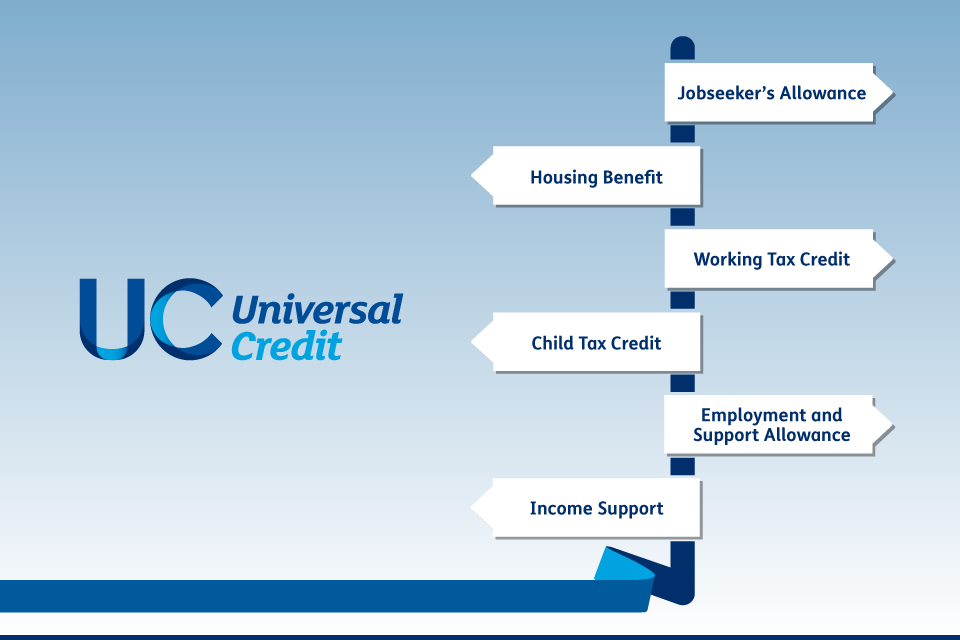

What Is Universal Credit?

Universal Credit is a monthly government payment that helps people on low income or no income cover living costs. It combines six previous benefits—including Income Support, Housing Benefit, and Working Tax Credit—into one simplified system.

This change wasn’t just about saving the government money. It was designed to make things easier for claimants, offering a one-stop-shop for support that adjusts when your circumstances change.

Universal Credit is for people who:

- Are unemployed

- Are in work but on low income

- Are too sick or disabled to work

- Have caring responsibilities

- Are in education under specific conditions

You must be over 18 and under State Pension age, though some 16–17-year-olds may also qualify under certain conditions.

How Much Can You Get?

How much you’ll receive depends on your circumstances. Here’s the standard monthly allowance for 2025:

| Situation | Monthly Standard Amount |

|---|---|

| Single, under 25 | £311.68 |

| Single, 25 or over | £393.45 |

| Couple, both under 25 | £489.23 |

| Couple, one or both 25+ | £617.60 |

You may also be eligible for additional payments for:

- Children (up to two unless exceptions apply)

- Disabilities (such as Limited Capability for Work or LCWRA)

- Housing costs

- Caring responsibilities

Example: A single parent with two children and housing costs may receive over £1,000 per month, depending on rent and additional needs.

When and How Are Payments Made?

Universal Credit is paid directly into your bank account once a month. In Northern Ireland and parts of Scotland, you can request bi-weekly payments.

For first-time claimants, the wait time for your first payment is typically five weeks. If that sounds like a stretch, you can apply for an advance, which you’ll repay in small deductions from future payments.

After your first payment, future ones arrive on the same date every month—unless your payment day falls on a weekend or bank holiday, in which case it’s issued earlier.

How to Apply for Universal Credit Payments?

Here’s how to get started, step by step:

Step 1: Create an account

Go to gov.uk/apply-universal-credit and sign up for an online account.

Step 2: Fill out your claim

You’ll need:

- National Insurance number

- Housing and rent details

- Bank account info

- Income and savings

- Childcare costs (if applicable)

Step 3: Attend your work coach interview

This can be in-person or online. You’ll set up your Claimant Commitment, which outlines what you agree to do in exchange for receiving benefits (like job searching or training).

Step 4: Receive your payment

Your first payment arrives about five weeks after you file. If you need help sooner, request an advance during the online application.

Changes Coming in 2026: What You Need to Know

The government is rolling out major changes through the Universal Credit and PIP Reform Bill, which is expected to take effect in April 2026.

Here’s what’s changing:

- Standard Allowance Increases: The base amount of UC will rise annually, tied to inflation plus 0.5%, until at least 2030.

- Reduced Disability Elements: New claimants will see reductions in LCWRA (Limited Capability for Work and Work-Related Activity) elements, which could mean up to £390 less per month in some cases.

- Grandfathering Rules: If you’re already claiming disability components before April 2026, you’ll keep your current rate.

- No Immediate Change to PIP: Personal Independence Payment (PIP) reforms have been paused for further consultation.

These changes aim to encourage work and simplify the system—but many disability advocates have expressed concerns about reduced support for those with fluctuating or invisible conditions.

Deductions, Overpayments, and Debt: What to Watch Out For

Sometimes, your payment may be lower than expected. Here’s why that might happen:

Advance Repayments: If you requested an advance, part of your monthly UC will go toward paying it back—usually over 12 to 24 months.

Benefit Overpayments: If the DWP overpays you, even by mistake, they will recover that money—often by deducting a portion of future payments.

Third-Party Deductions: The DWP can take money to cover debts like unpaid rent, utilities, or council tax.

Sanctions: If you fail to meet your Claimant Commitment—such as not attending job interviews—you could see your payment reduced or temporarily stopped.

Pro Tip: Always report changes in your income or circumstances immediately through your UC online journal to avoid overpayments.

Work Requirements and the Claimant Commitment

Most UC recipients must sign a Claimant Commitment—an agreement with your work coach outlining what you’ll do to prepare for or look for work.

Work requirements vary depending on your situation:

- Full work search: If you’re healthy and child-free, expect to job-hunt 35 hours per week.

- Limited work search: If you have young children, caring responsibilities, or health issues, your commitment may be lighter.

Refusing to comply can lead to sanctions, which reduce your payments temporarily. If you’re sanctioned unfairly, you can appeal—starting with a “mandatory reconsideration.”

Where to Get Help

You don’t have to navigate UC alone. These trusted services offer free, confidential support:

- Citizens Advice – Help with applications and appeals.

- Turn2Us – Online benefit calculators and grant search tools.

- Scope – Expert disability-related benefit advice.

- MoneyHelper – Free budgeting tools and debt guidance.

- DWP Contact Page – For phone support and appointments.

DWP Confirms Payment Update for 24 July— Check Who Could Be Affected

New DWP £200 Cost of Living Boost Announced—Here’s Who Qualifies

PIP Claimants Warned About Taking Holidays Abroad—What You Need to Know

Real-Life Case Studies

Sam, 34, Brighton – Part-Time Barista

Sam’s hours were cut post-pandemic. UC helps cover rent and food while he retrains in digital marketing. He’s using his online journal to keep track of job applications.

Lena, 42, Glasgow – Full-Time Carer

Caring for her autistic son, Lena receives UC and Carer’s Allowance. She’s exempt from job-seeking but keeps in touch with her work coach for any changes.

Ali, 25, Birmingham – Recent Graduate

Ali moved out for his first job, but it didn’t last. He turned to UC while looking for new work, using budgeting apps and guidance from Citizens Advice to stretch his payment.