Social Security Payments: If you’re one of the millions of Americans depending on Social Security to pay your bills, keep your fridge stocked, or simply provide peace of mind during retirement or disability, you’ll want to keep an eye on Wednesday, July 9, 2025. That’s the scheduled date for Social Security payments for certain beneficiaries. In this guide, we’ll cover everything you need to know—who qualifies, how much you can expect, how Social Security works, and what to do if your check doesn’t arrive. Whether you’re a retiree, a working professional planning your future, or a caregiver helping a loved one navigate benefits, this article is packed with value, explained in plain, friendly, and professional language.

Social Security Payments

Social Security remains one of the most vital support systems for American workers and retirees. With payments scheduled for July 9, 2025, now’s the time to make sure you’re eligible, know your payment amount, and understand how the system supports you. Whether you’re living on benefits now or planning for the future, being proactive and informed is the best way to protect your financial security.

| Topic | Key Info |

|---|---|

| Payment Date | July 9, 2025 (For birth dates 1st–10th of any month) |

| Eligibility | Must be receiving SS Retirement or SSDI |

| Average Monthly Payment | $1,907 (Retirement), $1,537 (SSDI) |

| COLA 2025 Increase | +2.5% (Effective January 2025) |

| Max Monthly Retirement Benefit | $5,108 (at age 70) |

| SSI Payment Date | Already paid on July 1, 2025 |

| Official Website | ssa.gov |

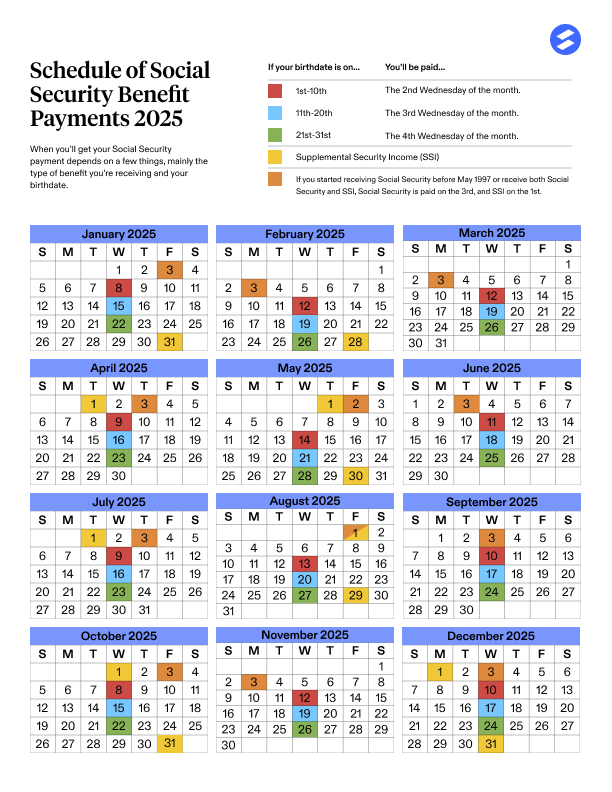

Who Will Get Paid on July 9, 2025?

The Social Security Administration (SSA) distributes payments based on your date of birth. If you were born between the 1st and 10th of any month and you receive either retirement benefits or Social Security Disability Insurance (SSDI), your next payment will hit your account on Wednesday, July 9, 2025.

Payment Schedule for July 2025

| Birthdate Range | Payment Date |

|---|---|

| 1st–10th | July 9 |

| 11th–20th | July 16 |

| 21st–31st | July 23 |

| SSI Only | July 1 |

| SS + SSI or retired before May 1997 | July 3 |

This staggered schedule allows SSA to process payments more efficiently and avoid overloading the system.

How Much Will You Receive in July 2025?

The amount you receive depends on a few key factors:

- Your lifetime earnings

- The age you began claiming benefits

- The type of benefit you’re receiving

Average Social Security Payments in 2025

| Type | Average Monthly Amount |

|---|---|

| Retirement (All Recipients) | $1,907 |

| SSDI | $1,537 |

| SSI (Individual) | $943–$967 |

| SSI (Couple) | $1,415–$1,450 |

| Maximum Retirement (Age 70) | $5,108 |

These amounts are based on Social Security Administration (SSA) data, reflecting the 2.5% Cost-of-Living Adjustment (COLA) for 2025.

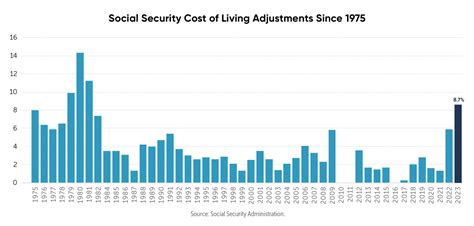

Understanding COLA: What’s the 2025 Increase?

Every year, the SSA announces a Cost-of-Living Adjustment (COLA) to ensure benefits keep pace with inflation. In 2025, beneficiaries received a 2.5% increase, a modest but helpful boost.

How COLA Affects You

Let’s say you received $1,800/month in 2024. With a 2.5% increase, your new benefit is about $1,845/month.

COLA adjustments are based on the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W).

Eligibility Criteria for Social Security Payments

To receive a payment on July 9, 2025, you must meet the following criteria:

- You are receiving Social Security Retirement or SSDI benefits

- Your birthday is between the 1st and 10th of any month

- You are not receiving only Supplemental Security Income (SSI) (which is paid separately)

Let’s take a closer look at eligibility for each type of benefit.

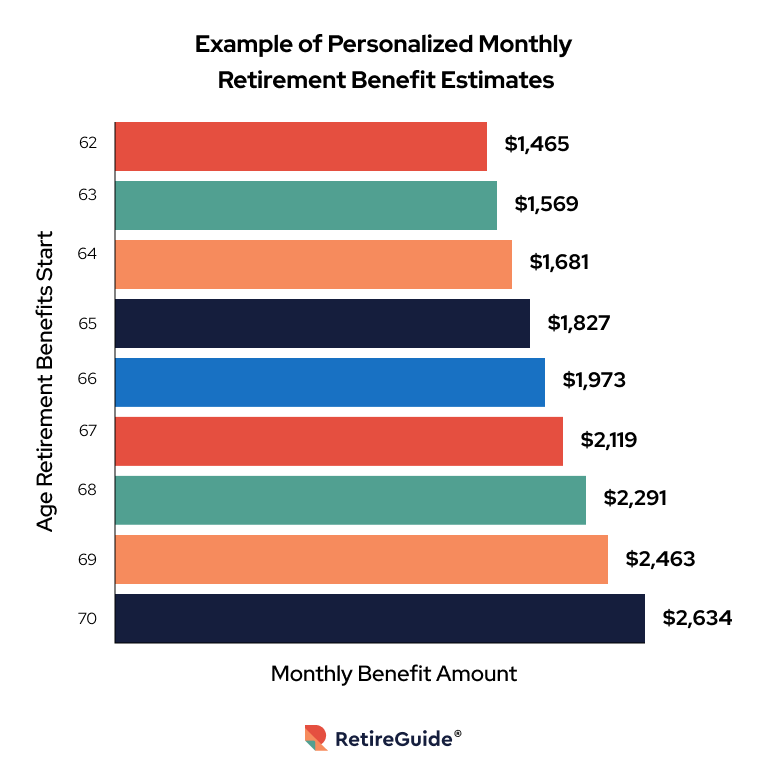

Retirement Benefits

- You must have earned at least 40 credits (approximately 10 years of work)

- You can start receiving benefits at age 62, but benefits increase the longer you wait (up to age 70)

- Your benefit is calculated based on your highest 35 years of earnings

SSDI (Social Security Disability Insurance)

- Must have a qualifying disability that prevents substantial work

- Must have earned enough recent work credits

- There is typically a 5-month waiting period before benefits begin

SSI (Supplemental Security Income)

- For low-income individuals who are 65+, blind, or disabled

- No work history is required

- Must meet income and asset limits ($2,000 for individuals, $3,000 for couples)

What If You Don’t Receive Your Social Security Payments on Time?

While most payments arrive on time, delays can happen—especially if you recently changed banks or addresses.

Steps to Take If Your Check Is Late

- Wait 3 business days after July 9

- Log in to your MySSA account to check your payment status

- Contact your bank or financial institution

- If still unresolved, call the SSA at 1-800-772-1213 (TTY: 1-800-325-0778)

Tip: Sign up for direct deposit to receive your funds faster and more securely.

The Bigger Picture: How Many Americans Rely on Social Security?

According to the Social Security Administration, nearly 71 million Americans receive some form of benefit, including:

- 50 million retirees

- 9 million disabled workers

- 6 million survivors of deceased workers

- Over 7 million SSI recipients

For roughly 1 in 5 Americans, Social Security represents a critical source of income. For nearly half of seniors, it makes up 90% or more of their income. That’s why staying informed about your benefits is so important.

The History of Social Security

The Social Security Act was signed into law by President Franklin D. Roosevelt in 1935 during the Great Depression. Its purpose was to provide a financial safety net for aging Americans and others in need.

Over the decades, the program expanded to include disability insurance, survivor benefits, and Supplemental Security Income (SSI).

While it remains one of the most popular and effective social programs in U.S. history, Social Security faces long-term challenges due to demographic shifts and funding concerns.

How Social Security Is Funded?

Social Security is primarily funded through payroll taxes collected under the Federal Insurance Contributions Act (FICA):

- Workers pay 6.2% of their wages

- Employers match with another 6.2%

- Self-employed individuals pay the full 12.4%

These funds go into the Social Security Trust Fund, which is then used to pay benefits to current recipients.

Proposed Reforms and Future Outlook

The Social Security Trust Fund is projected to be depleted by 2034 if no changes are made. After that, incoming tax revenue would only be enough to pay about 80% of scheduled benefits.

Possible reform proposals include:

- Raising the payroll tax cap (currently $168,600 in 2025)

- Gradually increasing the full retirement age

- Reducing benefits for higher-income recipients

The 2025 Trustees Report Just Dropped — What It Reveals About Social Security’s Future

$2,000 Social Security Payments Arriving in 4 Days—Check If You Qualify Now

No Taxes on Social Security? Here’s What the White House Just Confirmed