Recent Adjustment to Social Security Benefits: In 2025, a major adjustment to Social Security benefits shook up the retirement landscape for millions of Americans. From small-town retirees in the Midwest to city-dwelling educators and firefighters, these changes mean new possibilities—but also raise serious questions. For some, it’s a long-awaited financial relief. For others, it’s a wake-up call about the long-term viability of the Social Security system itself. Whether you’re nearing retirement, currently receiving benefits, or just planning ahead, this article will walk you through exactly what changed, why it matters, who benefits the most, and what steps you should take today.

Recent Adjustment to Social Security Benefits

The recent adjustment to Social Security benefits is more than a financial upgrade—it’s a historic correction of policies that disadvantaged millions of public servants and dual-income households. The repeal of WEP and GPO will put real dollars back into the hands of retirees who earned them. However, with this change comes new concerns: increased strain on the Social Security trust fund, tax confusion, and tighter rules around overpayments. That’s why it’s critical for beneficiaries to stay informed, update their information, and prepare for what’s next. Whether you’re 35 or 65, Social Security is a vital part of your retirement strategy. Don’t leave it to chance—review your records, speak with an advisor, and make sure you’re getting everything you’ve earned.

| Topic | Details |

|---|---|

| What Changed? | Repeal of Windfall Elimination Provision (WEP) & Government Pension Offset (GPO) |

| Effective Date | Retroactive to January 2024; payments started in early 2025 |

| Retroactive Payments | Issued February through March 2025 |

| Monthly Increases | +$360/month for retirees, +$700 for spouses, +$1,190 for survivors |

| Who Benefits Most | Public sector workers (teachers, police, firefighters), dual-income households |

| Trust Fund Impact | Forecasted depletion moved up to 2033 |

| Tax Change | Temporary deduction, not full repeal |

| Source for Updates | ssa.gov |

What Sparked the Adjustment?

For decades, many American workers who split their careers between government jobs and private-sector employment were penalized by two little-known Social Security rules: the Windfall Elimination Provision (WEP) and the Government Pension Offset (GPO).

These provisions were originally introduced to prevent people from “double-dipping” into both a government pension and full Social Security benefits. However, in practice, they unfairly reduced or eliminated benefits for millions of hard-working Americans—especially teachers, postal workers, police officers, and firefighters.

After years of advocacy, the Social Security Fairness Act was passed in January 2025, repealing both WEP and GPO. As a result, affected beneficiaries are now entitled to full Social Security benefits and may also be eligible for back pay.

Real-Life Stories: Who’s Benefiting?

To understand the impact, let’s look at two real-world examples.

Linda – Retired Teacher in Ohio

Linda worked for 28 years as a public school teacher, earning a state pension. She also worked 12 years in the private sector. Before the law changed, WEP slashed her Social Security retirement check from $980/month to $620/month.

Now, with WEP repealed, she receives the full $980/month, and she got a retroactive payment of over $1,000 covering missed benefits from January through March 2025.

Joseph – Firefighter and Surviving Spouse

Joseph’s wife worked her entire life in Social Security-covered employment. He, on the other hand, worked as a firefighter. When she passed away, the GPO cut his survivor benefits nearly in half. With the GPO repealed, Joseph now receives his full survivor benefits—adding over $1,000 to his monthly income.

These stories are becoming common across the country as affected workers receive letters from SSA and unexpected direct deposits.

Comparison Table: Before vs. After the Adjustment

| Factor | Before Repeal | After Repeal (2025) |

|---|---|---|

| WEP Impact | Benefits reduced for non-SS-covered employment | Full benefits restored |

| GPO Impact | Spousal/survivor benefits offset by two-thirds of pension | Full spousal/survivor benefits |

| Average Monthly Increase | $0–$100 | $360–$1,190 |

| Retroactive Pay | None | 3-month lump sum (Jan–Mar 2025) |

| Number Affected | 2.3M retirees | All now eligible for full benefits |

Timeline of Key Events

| Date | Event |

|---|---|

| January 5, 2025 | Social Security Fairness Act signed into law |

| February–March 2025 | Retroactive benefits issued |

| April 2025 | Increased monthly checks begin |

| July 24, 2025 | Overpayment withholding rules change |

| January 2026 | Review of Social Security trust fund status begins |

A Closer Look at the Tax Confusion

Alongside the benefit increases, the SSA sent out a controversial email in mid-2025 titled “One Big Beautiful Bill,” suggesting that taxes on Social Security had been repealed. That email, while attention-grabbing, was misleading.

In reality, what changed was the introduction of a temporary deduction for taxpayers receiving Social Security benefits:

- $6,000 for single filers

- $12,000 for joint filers

This deduction applies only to people within certain income brackets and expires at the end of 2028. It does not eliminate the tax itself—Social Security benefits may still be taxed based on income thresholds.

This confusion led many people to assume their entire benefit was now tax-free. It’s important to understand your tax situation and, if needed, speak with a CPA to make sure you’re filing correctly.

How to Check If You’re Affected by the Recent Adjustment to Social Security Benefits

If you think you might be eligible for increased benefits or back pay, follow these steps:

- Log into your SSA account

Go to ssa.gov/myaccount and review your most recent earnings statement and benefit notices. - Review your work history

If you worked in a public-sector job that didn’t pay into Social Security, and you also worked in the private sector, chances are you were affected by WEP or GPO. - Look for deposits or letters

The SSA mailed notifications to eligible beneficiaries in February and March. Many have already seen retroactive payments hit their accounts. - Contact SSA if needed

Didn’t receive what you were expecting? Call the SSA at 1-800-772-1213 or visit your local office to start a review process.

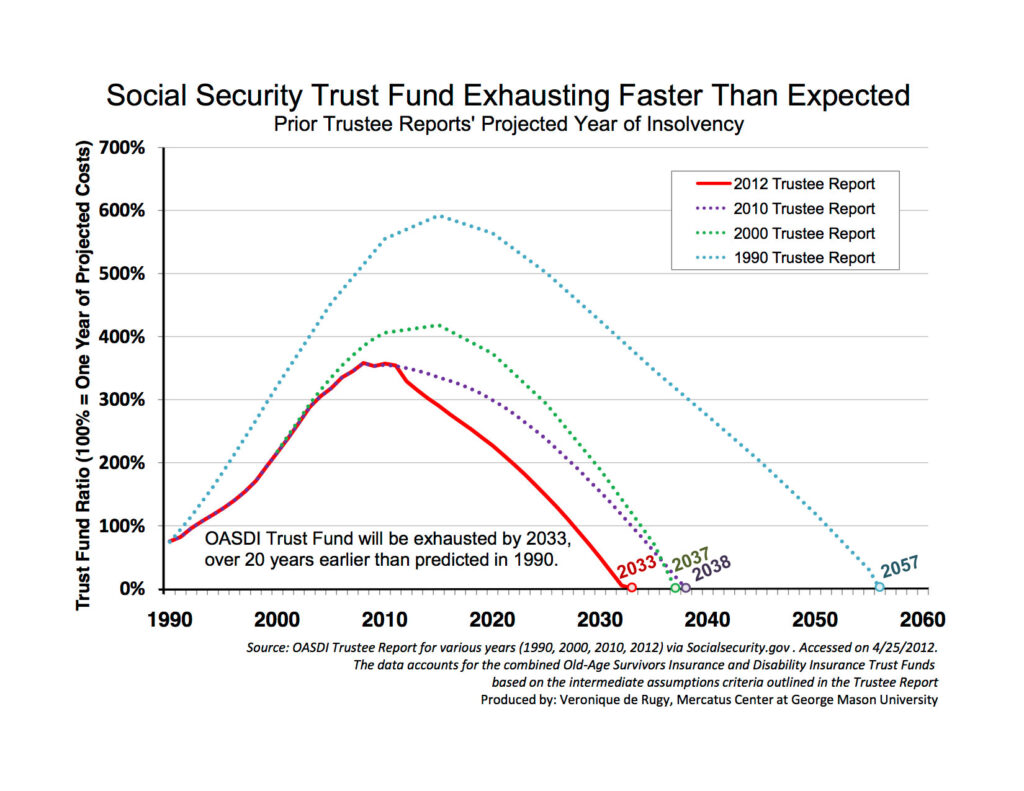

Impact on the Social Security Trust Fund

While many retirees are celebrating the repeal of WEP and GPO, economists and policy experts are raising red flags about the long-term impact on Social Security’s finances.

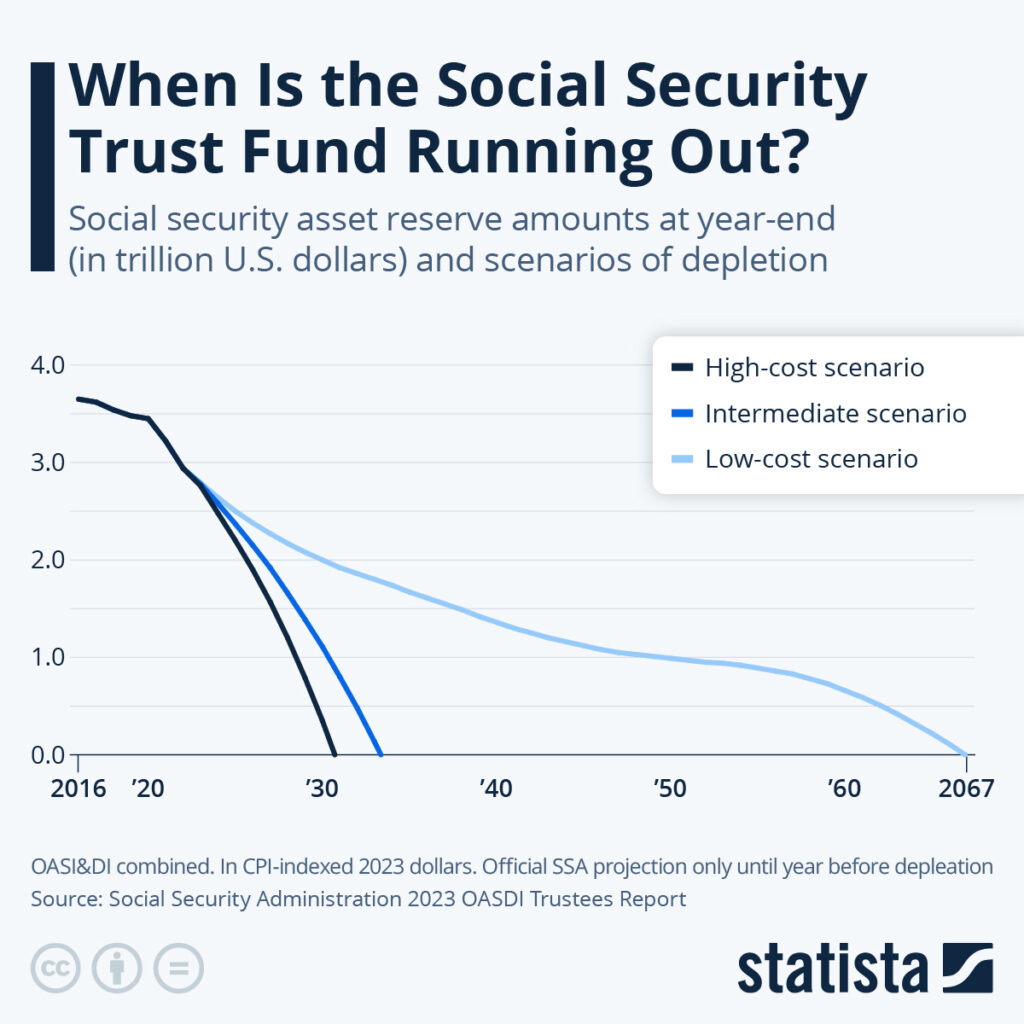

According to the 2025 Trustees Report, the OASI (Old-Age and Survivors Insurance) trust fund is now projected to run out by 2033, a full year earlier than previously expected.

When that happens, the program will rely solely on incoming payroll taxes, which will only cover about 81% of scheduled benefits unless new funding is authorized.

This has intensified the debate over possible reforms, including:

- Raising the payroll tax cap

- Increasing the full retirement age

- Means-testing benefits

What to Do Next?

If you or someone in your family may be impacted, here’s your checklist:

- Check your SSA account online

- Confirm receipt of any retroactive payments

- Review your 2025 tax documents carefully

- Use SSA tools to estimate your updated benefits

- Talk to a retirement or tax planner

Trump’s ‘Big Beautiful Bill’ Sparks Debate Over Social Security and Benefits

$5,108 Social Security Checks Arrive in July—Here’s Who Qualifies

Social Security Sends Out Urgent Email Over Trump Tax Bill Confusion – Check Details!