A Closer Look at Social Security’s Financial Outlook: Security’s financial outlook for 2025 is raising alarms across the United States—and not just for retirees. Whether you’re drawing benefits today, contributing through your paycheck, or just starting your career, this system impacts your financial future more than most folks realize.

For nearly 90 years, Social Security has stood as a pillar of economic security for millions of Americans. But with the release of the 2025 Trustees Report, the foundation is showing cracks. If nothing changes, the Old-Age and Survivors Insurance (OASI) trust fund will run out of reserves by 2033. When that happens, benefits could be cut by about 23% across the board. Now, don’t panic—this isn’t the end of Social Security. But it is a clear call for action. Understanding what’s going on, what’s being proposed, and how to prepare is critical.

A Closer Look at Social Security’s Financial Outlook

Social Security has served as the backbone of American retirement for nearly a century. But the 2025 outlook tells us we can’t afford to ignore it any longer. The system isn’t falling apart overnight—but it’s headed for serious strain. The good news? We can fix it—but only if we act early and smart. Whether you’re collecting benefits or just entering the workforce, take charge of your financial future now. Educate yourself, plan ahead, and support thoughtful reform. This system was built for all of us, and it’s going to take all of us to keep it strong.

| Topic | Details |

|---|---|

| Main Concern | Social Security trust fund projected to be depleted by 2033 |

| Potential Impact | 23% cut in benefits if no reforms are made |

| 75-Year Shortfall | Equivalent to 1.3% of GDP or 3.82% of taxable payroll |

| Contributing Factors | Aging population, lower birth rates, stagnant wages, longer life expectancy |

| Fixes Being Considered | Raising taxes, increasing retirement age, changing benefit formulas, investing in stocks |

| Official Info | SSA 2025 Trustees Report |

How Social Security Works?

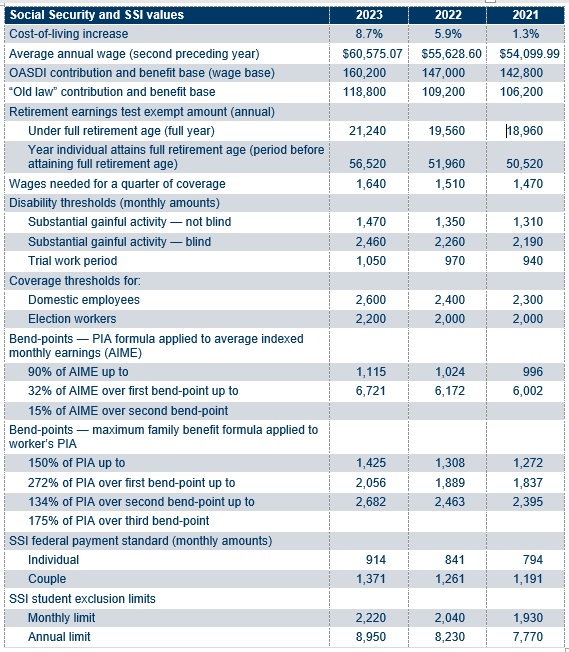

Social Security is funded primarily through payroll taxes paid by workers and employers. When you see FICA on your paycheck, that’s what you’re paying into—6.2% from you, and 6.2% from your employer, on earnings up to $168,600 (as of 2025).

That money isn’t sitting in a vault somewhere with your name on it. It goes directly to current retirees. This “pay-as-you-go” system worked fine when we had more workers than retirees. But that balance is now out of whack.

In the 1950s, there were 16 workers for every retiree. In 2025, it’s about 2.7. By 2035, it could drop closer to 2.3. Fewer workers + more retirees = financial strain.

What the 2025 Report Tells Us About A Closer Look at Social Security’s Financial Outlook

Every year, the Social Security Trustees release a report assessing the health of the system. This year’s report, released in June 2025, says:

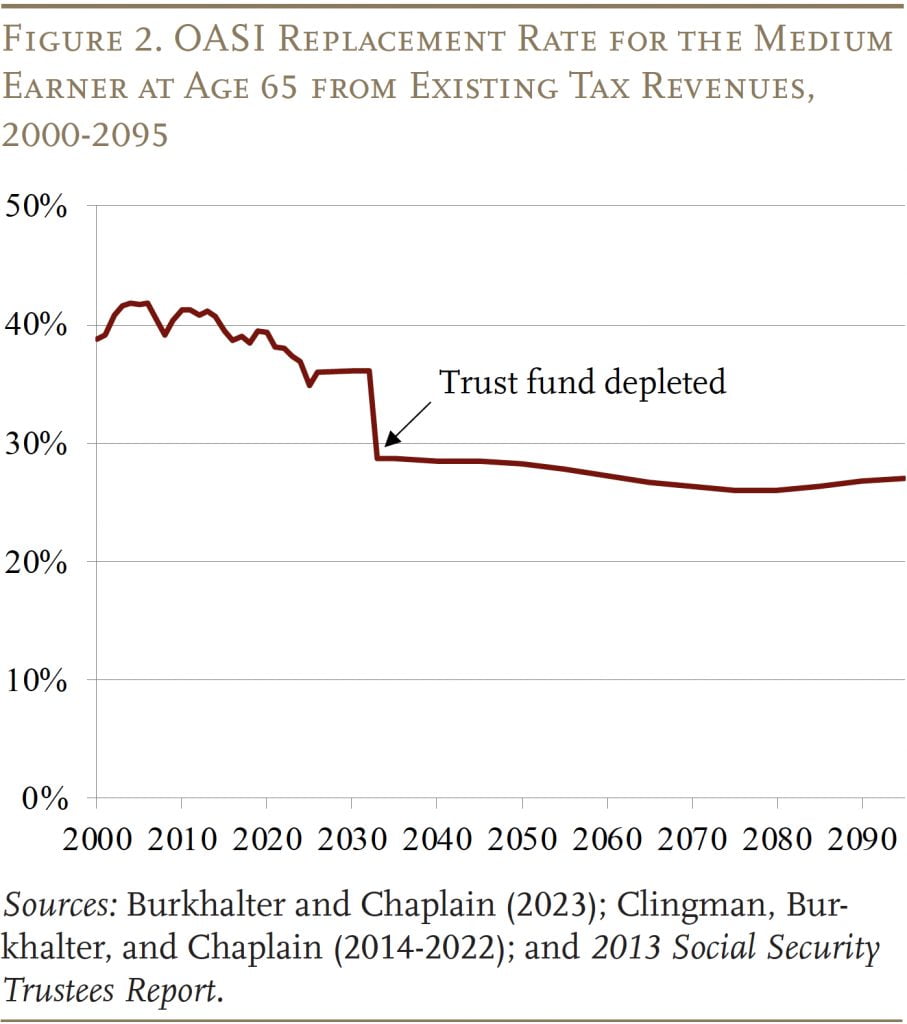

- The Old-Age and Survivors Insurance (OASI) trust fund will be depleted by 2033.

- If that happens, Social Security can only pay 77% of promised benefits using incoming payroll taxes.

- If OASI is merged with the Disability Insurance (DI) trust fund, the depletion year moves to 2034, with about 81% of benefits payable.

- The 75-year shortfall is 3.82% of taxable payroll, up from 3.50% last year.

- To restore long-term solvency, immediate action is needed.

This isn’t news out of nowhere—it’s been building for years. But the window for action is shrinking fast.

What’s Causing the Shortfall?

Here’s a breakdown of the key drivers:

1. Aging Population

The Baby Boomer generation (those born between 1946 and 1964) is retiring in droves. By the end of 2025, over 11,000 Americans will turn 65 every single day. More retirees = more benefit payouts.

2. Longer Life Expectancy

People live longer than they did when Social Security was created. In 1940, the average American lived to about 61. Today, it’s around 79. That’s more years drawing benefits.

3. Lower Birth Rates

We’re not having as many kids. That means fewer future workers paying into the system. It’s simple math.

4. Wage Stagnation

Wages have not kept pace with inflation for many workers, reducing the growth of payroll tax revenues.

5. Recent Policy Changes

Laws like the Social Security Fairness Act, which repealed parts of WEP and GPO (Windfall Elimination Provision and Government Pension Offset), are expected to increase benefit payouts without generating offsetting revenue.

What Could Happen If We Do Nothing?

If Congress takes no action, here’s what to expect starting in 2033:

- Automatic 23% cut in benefits

- Retirees receiving $1,800/month could drop to about $1,385/month

- Surviving spouses, children of deceased workers, and disabled Americans would also see reduced checks

- Financial insecurity among older Americans would surge

Even current retirees would be affected—not just future ones.

Real-Life Example: How It Affects You

Let’s say you’re Maria, a 62-year-old teacher planning to retire at 67. You expect about $2,200 a month from Social Security. If no fix happens, your check could drop to $1,694. Over a 20-year retirement, that’s more than $121,000 in lost income.

Or take Jordan, a 35-year-old graphic designer. You’re paying into the system now, but you’re unsure if it’ll be there when you need it. The truth? It will be there—just possibly at reduced levels.

What Can Be Done to Fix It?

There’s no shortage of ideas—some politically easier than others. Here’s what’s on the table:

Raise the Payroll Tax Rate

Increasing the payroll tax from 12.4% to 14.4% could fully fund Social Security for the next 75 years.

Lift or Eliminate the Wage Cap

As of 2025, income above $168,600 isn’t taxed for Social Security. Eliminating that cap would bring in billions annually.

Gradually Raise the Retirement Age

It’s now 67 for full benefits. Raising it to 68 or 69 over time could save money, though it may be harder on people in physically demanding jobs.

Adjust the Benefit Formula

Some propose reducing benefits for high-income retirees or changing how cost-of-living adjustments (COLAs) are calculated.

Invest in Equities

Currently, Social Security trust funds are only invested in government securities. A bipartisan proposal in 2025 suggests creating a sovereign wealth fund to invest $1.5 trillion in stocks and bonds. That could boost returns—but also adds market risk.

What You Can Do Right Now?

Even though policy changes are out of your hands, there are steps you can take:

1. Start or Increase Retirement Savings

Use employer-sponsored plans like 401(k)s, or contribute to Roth IRAs. Compound interest is your best friend.

2. Delay Claiming Benefits

If possible, wait until age 70 to claim benefits. For every year you delay past full retirement age, your benefit increases by about 8%.

3. Use Planning Tools

Visit the Social Security Quick Calculator or My Social Security Account to get accurate estimates.

4. Get Professional Advice

A certified financial planner can help you build a plan that considers all your income sources—including Social Security.

Trump’s ‘Big Beautiful Bill’ Sparks Debate Over Social Security and Benefits

Why Your Social Security Retirement Checks Might Shrink Sooner Than Expected- Check Details

Inside Trump’s ‘Big Beautiful Bill’ and Its Impact on Your Social Security

Glossary: Common Social Security Terms

OASI – Old-Age and Survivors Insurance (retirement and survivor benefits)

FICA – Federal Insurance Contributions Act (payroll tax funding Social Security)

COLA – Cost-of-Living Adjustment

WEP/GPO – Rules affecting public sector employees’ benefits

Trust Fund Depletion – When reserves are gone, and only tax revenue is left