Switzerland to Vote on 50% Inheritance Tax: Switzerland is making global headlines with a bold, unprecedented proposal: a 50% inheritance and gift tax on fortunes over CHF 50 million. The nation will vote on this groundbreaking tax policy on November 30, 2025. If passed, this would shift the alpine country’s long-standing reputation as a tax haven — and send shockwaves through global wealth circles. Whether you’re a tax advisor, wealth manager, economist, or just someone trying to understand what this all means, this referendum could mark a historic shift in how nations handle inherited wealth and who really foots the bill for climate change.

Switzerland to Vote on 50% Inheritance Tax

The November 30, 2025, vote could reshape Switzerland’s role in global finance. A 50% inheritance tax targeting billionaires is an aggressive step — one meant to raise climate funds and reduce wealth inequality. Whether it passes or not, the ripple effects will be felt far beyond the Swiss Alps. For families, advisors, and professionals in the global wealth space, this is a clear signal: the days of untouched inheritance may be coming to an end. Smart planning, transparent strategy, and cross-border awareness are more critical than ever.

| Feature | Details |

|---|---|

| Vote Date | November 30, 2025 |

| Proposed Tax Rate | 50% federal inheritance and gift tax |

| Who Pays? | Estates and gifts over CHF 50 million (~USD 61–63 million) |

| Exemptions? | None — applies even to spouses, children, and businesses |

| Revenue Usage | Climate protection, renewable energy, and environmental projects |

| Proposed By | Young Socialists (JUSO), supported by climate and equity advocates |

| Opposed By | Swiss Federal Council, Parliament, business lobbies, and private banks |

| Official Info | Swiss Confederation – Federal Votes |

Why This Inheritance Tax Proposal Is a Big Deal?

Switzerland has long been associated with financial privacy, favorable tax laws, and elite banking. That’s why a 50% inheritance tax at the federal level is grabbing global attention. This isn’t just a policy debate — it’s a potential paradigm shift.

The proposal was spearheaded by the Young Socialists (JUSO), Switzerland’s left-leaning youth political movement, who gathered over 100,000 signatures to trigger a national vote. Their mission: reduce inequality and fund the climate transition by taxing extreme wealth.

Their message is simple: Why should billionaire families pass on massive fortunes tax-free, while everyday people struggle with climate disasters, healthcare costs, and inflation?

How tSwitzerland to Vote on 50% Inheritance Tax Would Work?

Unlike Switzerland’s current setup, where inheritance taxes are determined by each canton (local jurisdiction), this new law would standardize a nationwide tax that kicks in at:

- CHF 50 million (~USD 61 million)

- Applies to inheritances and large gifts

- No exceptions for family, spouses, or business-related transfers

This would directly affect only the wealthiest 0.04% of the population, but has far-reaching implications for:

- Tax planning

- Global estate strategies

- Philanthropic and corporate structures

Wealth transfers would be taxed even if they’re indirect, such as through family trusts or foreign-held companies, so long as they involve a Swiss resident or citizen.

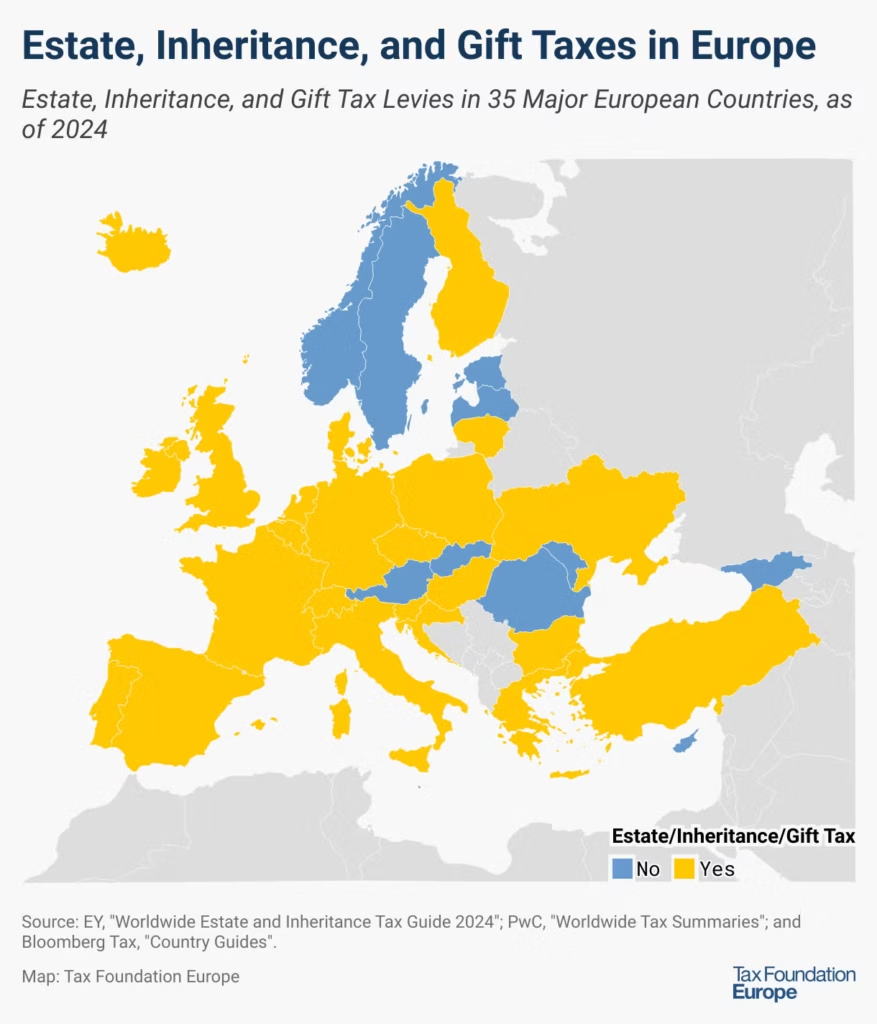

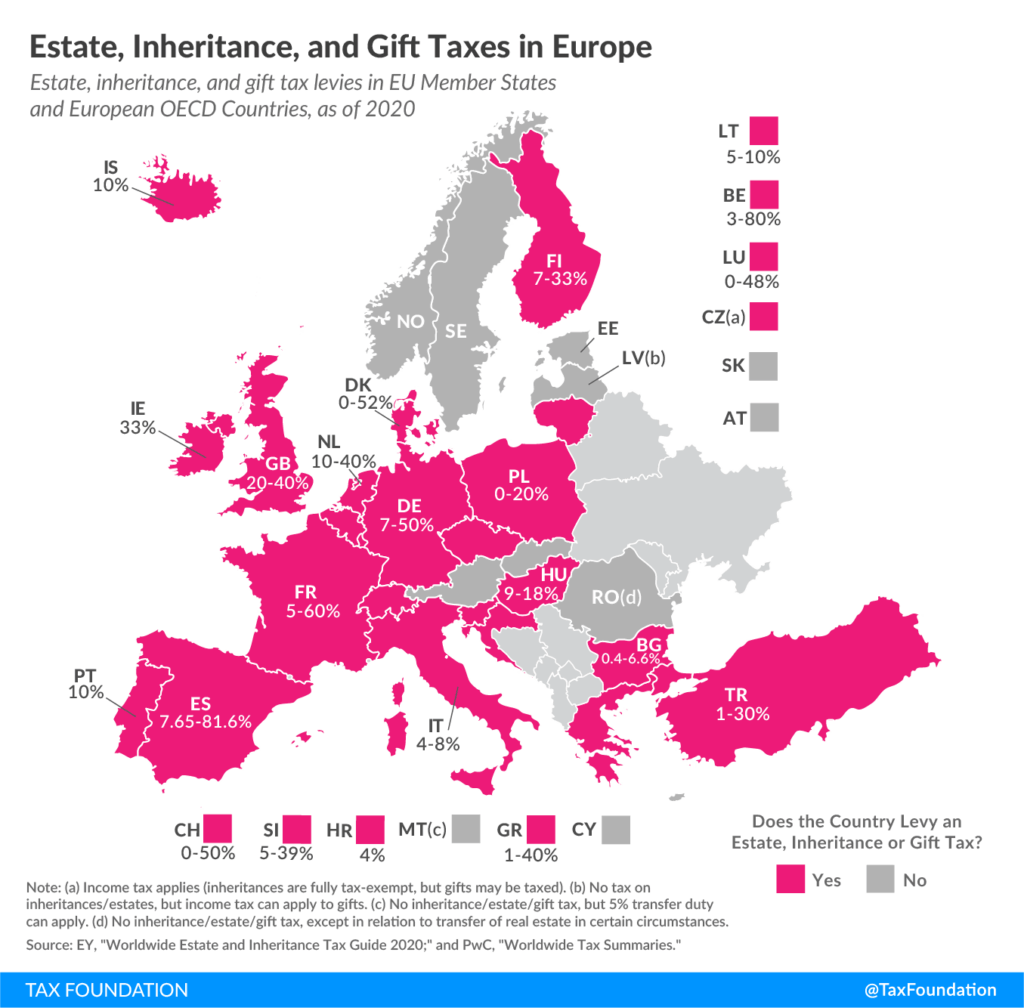

Global Context: How Does This Compare?

While it might sound radical, Switzerland is actually playing catch-up when compared with other Western countries:

| Country | Inheritance Tax Rate | Exemption Threshold | Notable Notes |

|---|---|---|---|

| USA | 40% | ~$13.6M per individual | Applies to estate above threshold |

| France | Up to 60% | Very low | Heavily taxed for distant relatives |

| Germany | Up to 50% | Varies by relationship | Common inheritance tax system |

| UK | 40% | £325,000 | Exceptions for spouses, family homes |

| Norway/Sweden | 0% | N/A | Abolished inheritance tax entirely |

If the Swiss measure passes, it would make Switzerland one of the strictest jurisdictions for inheritance taxation, rivaling France.

What Supporters and Opponents Are Saying

Supporters Argue:

- Wealth inequality is widening. In Switzerland, the richest 1% own over 43% of the wealth.

- Taxing inherited wealth is fairer than taxing labor or consumption.

- The climate crisis needs bold financing — and this could raise billions of CHF annually.

“Why should climate-vulnerable communities foot the bill, while heirs get tax-free castles?”

— Mara Maier, JUSO President

Opponents Warn:

- Switzerland risks becoming less attractive to wealthy investors.

- Families could relocate assets or legal residency to avoid taxes.

- Small family-run businesses may be forced to sell assets to meet tax obligations.

“Even a failed vote sends a damaging message. Switzerland thrives on stability.”

— Daniel Hügli, Tax Lawyer, Zurich

Case Study: UK’s “Non-Dom” Exodus

A similar story unfolded in the United Kingdom in 2022, when the government cracked down on “non-domiciled” tax privileges. Over 1,400 ultra-rich families left London for more favorable jurisdictions like Monaco, UAE, and Switzerland.

That policy shift resulted in:

- Decreased property values in high-end London neighborhoods

- A surge in relocation consulting firms

- More scrutiny on inheritance and estate taxation

Many are now asking: If Switzerland introduces this law, where will the world’s billionaires go next?

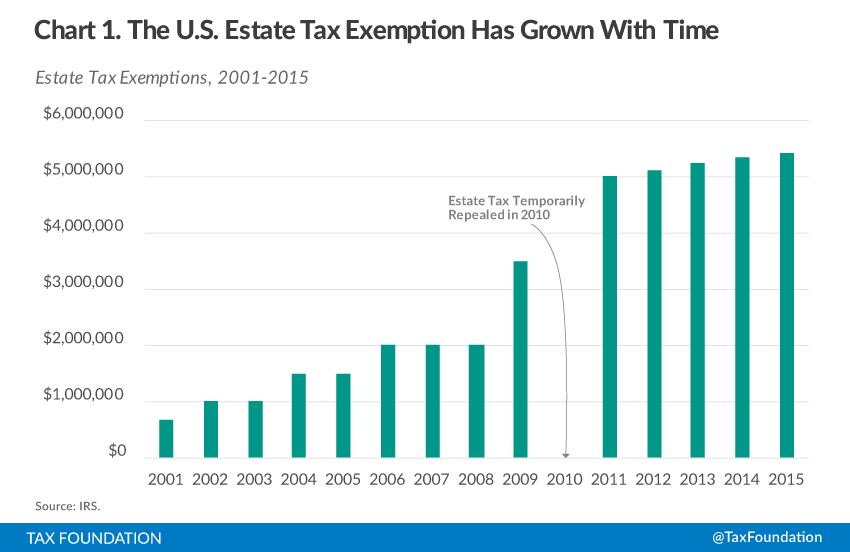

What This Means for Americans and International Families?

This vote isn’t just about Switzerland — it could be a blueprint for wealth taxation worldwide.

Families with dual Swiss–U.S. citizenship, global business holdings, or multi-jurisdictional trusts should prepare now:

- Review your estate plan and asset structures

- Consult a cross-border tax advisor

- Explore alternative jurisdictions and residency planning

Wealth managers in cities like New York, Miami, Los Angeles, and Houston are already fielding calls from clients with Swiss exposure, asking what this vote could mean for their families.

Practical Advice for Professionals

Wealth Managers

- Audit client exposure to Swiss real estate or banking

- Explore new trusts or offshore structures

Estate Planners

- Consider asset segmentation for generational planning

- Create strategies that limit taxable thresholds

Corporate Lawyers

- Reevaluate ownership of family firms

- Structure inheritance through charitable entities or holding companies

Climate NGOs and Policy Experts

- Monitor funding pipelines this tax could unlock

- Develop plans to deploy funds efficiently if approved

Possible Outcomes

If It Passes:

- Implementation by 2027

- Federal authority oversees asset reporting and collection

- Massive interest from global media, watchdog groups, and governments

If It Fails:

- Likely to spark a wave of similar initiatives in Switzerland or EU nations

- Could influence public sentiment on global wealth reform

Even a narrow defeat could serve as a moral victory for advocates of progressive taxation.

Future Ripple Effects

If this referendum gains traction — even without passing — it could:

- Inspire U.S. state-level wealth tax proposals, particularly in California or Massachusetts

- Influence global bodies like the OECD, which already proposes minimum corporate tax rules

- Shift public discourse toward climate equity and responsible inheritance

The world is watching how this plays out, especially as governments grapple with climate financing, budget deficits, and social unrest linked to wealth disparity.