Centrelink Cash Boost Hits Millions of Aussie Bank Accounts: That’s the real-deal headline. From July 1, 2025, Centrelink started crediting a 2.4% indexation increase across multiple welfare payments. Whether you’re getting JobSeeker, Age Pension, Youth Allowance, Parenting Payment, or Family Tax Benefit—you should see a little extra in your bank account soon. And the best part? You don’t have to fill out a form or call anyone, as long as your MyGov and Centrelink details are correct. This article dives deep—from what indexation means, who qualifies, how the increases were calculated, real examples, expert insights, case studies, and pros-only guidance. It’s packed with facts, figures, and tools to help everyday folks and professionals alike.

Centrelink Cash Boost Hits Millions of Aussie Bank Accounts

As of July 1, 2025, over 2.4 million Australians began receiving an automatic 2.4% cash boost in Centrelink payments—as part of a long-term strategy to keep welfare aligned with rising costs. For many, that means a few extra dollars each fortnight—enough to ease a bill, save a bit, or pay for after-school care. For professionals—social workers, financial planners, HR staff—this update means profiles and budgets need adjusting, case files need reviewing, and clients need clear guidance.

What you can do next:

- Encourage recipients to verify their bank details on MyGov.

- Update all internal documents and digital resources with the new rates.

- Use this moment to improve client financial resilience and knowledge.

- Watch economic trends—if CPI spikes again, another boost is likely in January 2026.

In tough economic times, every dollar helps—and knowing what’s coming makes a difference. This indexation is more than math—it’s a step toward financial justice and real-world relief.

| Key Point | Details | Source / Impact |

|---|---|---|

| Indexation Rate | 2.4% increase from July 1, 2025 | Services Australia |

| Eligible Payments | JobSeeker, Youth Allowance, Age Pension, DSP, Parenting, Family Tax, Carer, ABSTUDY, Special Benefit, Paid Parental Leave | 9News |

| Sample Increases | FTB A for teens: $295.82/fortnight; Newborn: +$48; JobSeeker 60+ ≈ $771.50 fortnight | Case-study examples |

| Inflation Context | ~3.2% CPI in 2024–25, wages slowing | ABS CPI |

| Professional Impact | Calls for updating budgets, training staff, advocating policy | Good practice for advisors & social workers |

What Is Indexation—and Why It Matters

What Indexation Does

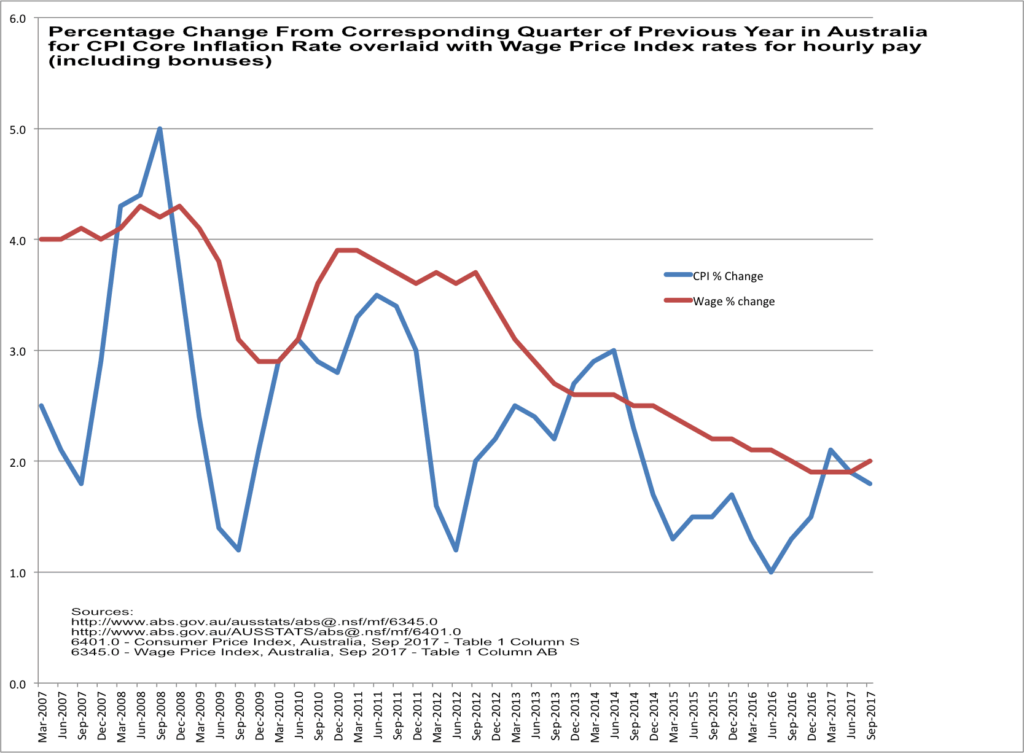

Indexation is like a financial safety net—when prices go up, benefits go up too, to help recipients keep up. The 2.4% increase is grounded in two key Australian economic indicators:

- Consumer Price Index (CPI): Tracks everyday price changes, like bread and electricity.

- Wage Price Index (WPI): Measures wage growth across the economy.

By combining CPI and WPI, the government ensures increases are fair and timely. This July 2025 round is the final scheduled boost for the year—after increments in January and March.

Historical Context

In March 2025, more than 5 million Australians received increased payments as part of earlier indexation. Now, over 2.4 million recipients benefit in July—continuing a consistent effort to maintain living standards in line with inflation.

This disciplined schedule helps avoid sharp cliffs in living standards for vulnerable people.

Who Gets the Cash Boost—and How Much?

All current Centrelink recipients are covered. Here’s the full list:

- JobSeeker Payment

- Youth Allowance (students and apprentices)

- Austudy and ABSTUDY (for Aboriginal and Torres Strait Islander students)

- Parenting Payment (single and partnered)

- Age Pension

- Disability Support Pension (DSP)

- Carer Payment

- Family Tax Benefit A & B

- Paid Parental Leave

- Newborn Supplement

- Multiple Birth Allowance

- Special Benefit

Real‑Life Examples

- Family Tax Benefit A

- Child under 13: modest boost in line with base rate

- Child aged 13+: new rate of $295.82 per fortnight

- Newborn Supplement

- Additional $48 over 13 weeks, helping newborn families with expenses

- JobSeeker 60+

- New fortnightly rate around $771.50, putting more in the pocket for older Australians

- Carer Payment

- As costs for medical supplies, transport, and healthy food climb, this increase means real support for carers

Australia’s Cost-of-Living Reality: The Big Picture

According to the Australian Bureau of Statistics, inflation averaged 3.2% in late 2024 and early 2025. Rising rents, power bills, fuel costs, and education fees all pile up—even small increases matter. Around 40% of low-income earners report difficulty covering unexpected expenses. This 2.4% boost helps, but doesn’t completely offset costs—table shows approximate cost rises:

| Item | 12‑month % increase |

|---|---|

| Grocery basket | ~4.5% |

| Energy costs | ~5.0% |

| Rents (capital cities) | ~3.8% |

| Fuel | ~2.1% |

For families paying rent and bills, or carers facing frequent doctor visits, every dollar counts.

Expert Insights

“Even small indexed increases can prevent families falling behind,” says Dr. Emma Lewis, economist at Aussie Institute for Social Research. “It’s not glamour money—it’s about dignity and staying afloat.”

Policy analyst Tom Nguyen adds:

“Indexation keeps structural integrity. If we let payments lag, we deepen poverty.”

These voices show that what may seem modest helps thousands manage essentials—from medicine to transport.

Case Study: The Patels (A Family Snapshot)

Meet the Patel family from Brisbane:

- Mum, Geeta – a single parent and nurse

- Two kids: 15 and 9

- Receives Family Tax Benefit A and B, plus Paid Parental Leave (from last year)

Before July 2025

- FTB A for the 15-year-old: ~$289/fortnight

- Newborn Supplement: $0 (since baby past age limit)

From July 1, 2025

- FTB A for 15-year-old jumped to $295.82 (+$6.82 fortnightly = +$138/year)

- Paid Parental Leave cap boosted, helping slightly with childcare

- Tech-savvy Geeta updates her MyGov app herself

Impact:

- Extra $6.82 helps top up an online tutoring service

- Simpler paperwork, no call center visits, just direct bank deposit

How to Make Sure You Get Centrelink Cash Boost?

- Check eligibility – confirmed if you were on Centrelink before July 1.

- Update details – MyGov login → Centrelink → Personal Details: bank, address, contact.

- Watch your deposit – July 1–15 is typical window.

- If missing by July 16 –

- Call Service Australia (find CRN ready)

- Visit a Centrelink service income

- Use MyGov “Report a problem” function

Tips for Professionals

If you’re in social work, financial counseling, HR, or NGO staffing, here’s how this affects you:

- Update advice guides with new payment figures

- Revise cashflow and budget templates for client planning

- Hold staff refresher sessions on indexation and entitlement

- Advise clients on combining payments with wage work

- Advocate to policymakers using current indexed data

Eligibility Checklist (At‑a‑Glance)

- Current Centrelink recipient

- Bank details up-to-date in MyGov

- Full mutual-eligibility if required (e.g., JobSeeker work test)

- Resident in Australia (check specific absences for some payments)

- Not under health or document review processes

Paid Parental Leave Cap Changes

A small but important section for new parents: the Paid Parental Leave caps now stand at:

- $180,007 (individual combined income limit)

- $373,094 (family combined income limit)

These caps determine if you can receive the full $993.45/fortnight paid leave amount. They’ve been raised from previous lower thresholds, meaning a few more families will now qualify for full-rate leave.

From Super to Solar: Big Centrelink and Tax Changes That Took Effect on July 1

Centrelink Rules for Caravan and Boat Dwellers in Australia—What You Must Know in 2025

Centrelink and ATO Send Urgent July 1 Warning to Tax Return Filers—How to Avoid Costly Mistakes

Why This Is More Than Just Extra Dollars

Indexation sends a message: “Help is meant to keep working.” That’s big for morale and trust in our welfare system. For families, it’s a buffer that can help cover annual doctor visits or school costs. For advisers and policy staff, it helps cement the credibility of budgeting tools and poverty measures.

Pro Tip

When discussing client budgets, always include new Centrelink rates and inflation outlooks—especially when prices keep jumping. Think ahead: energy and rental costs may rise again, so this boost should be seen as a temporary bridge.