July 2025 Social Security Cutoff: The July 2025 Social Security Cutoff is here, and it’s shaping up to be one of the most important deadlines in recent memory for anyone receiving Social Security. Between a major policy shift on over-payment recovery and the phase-out of paper checks, millions of Americans are being asked to take action—or risk losing part or all of their benefits.

If you’re getting Social Security, whether for retirement, disability, or survivor benefits, there’s a very real chance you’ve been affected. But don’t worry—this guide is here to walk you through everything clearly, from what’s changing to what you need to do. Let’s dig into why this July matters so much—and how you can stay protected.

July 2025 Social Security Cutoff

The July 24, 2025 deadline isn’t just another date—it’s the line in the sand for millions of Americans who received over-payment notices. If you don’t take action, your benefits could be reduced dramatically. Combine that with the paper check phase-out happening in September, and 2025 is turning into a watershed year for Social Security recipients.

Take a few minutes today to:

- Check your mail

- Log in to your mySSA account

- Appeal or request a waiver if needed

- Set up direct deposit or Direct Express

The sooner you act, the more control you keep over your money—and your peace of mind.

| Highlight | Details |

|---|---|

| Over-payment Deadline | July 24, 2025 — deadline to respond to SSA over-payment notices sent in April 2025 |

| Withholding Rates | Up to 50% for Title II (retirement, disability); SSI stays at 10% |

| Paper Check Phase-Out | Starts July 2025; complete switch to digital by September 30, 2025 |

| COLA Adjustment | 2.5% increase for 2025; average benefit now ~$1,976/month |

| Direct Deposit Required | Must set up direct deposit or Direct Express card to avoid benefit disruption |

| Earnings Limit for 2025 | $23,400/year (under FRA); $62,160/year if reaching FRA |

| Fairness Act Update | Windfall Elimination and GPO repealed; retroactive payments distributed |

| Official SSA Resources | ssa.gov — Over-payments, Direct Deposit, Payment Calendar, Appeals |

1. Over-Payment Notices and July 24 Deadline

In April 2025, the Social Security Administration (SSA) sent out millions of letters to beneficiaries notifying them of over-payments. According to SSA, these over-payments resulted from errors in income reporting, eligibility changes, or system glitches.

By law, recipients had 90 days to respond—bringing us to the July 24, 2025 deadline.

If you don’t act by this date, SSA will begin automatically withholding up to 50% of your benefit every month until the debt is repaid. That means if you receive $1,400 per month, you could lose $700 per check.

Who is affected?

- Retirees on Title II Social Security (retirement, SSDI, survivor benefits)

- People with recent changes in income or marital status

- Those who didn’t report part-time work or other earnings

SSI recipients are subject to a lower withholding cap—10%—but should still respond quickly to avoid future collection actions.

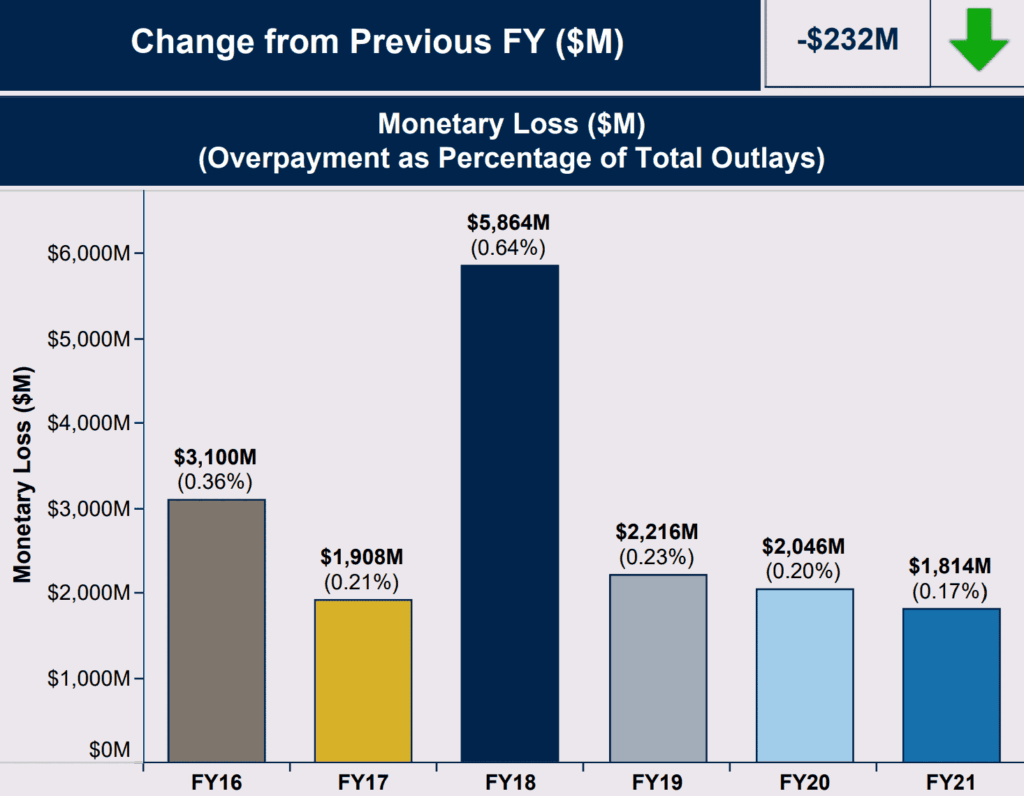

SSA is currently recovering more than $23 billion in over-payments nationwide, according to a 2024 Inspector General report. Much of this is tied to administrative errors—not fraud—but it’s still treated as debt unless proven otherwise.

2. Responding to an Over-Payment: Options You Have

If you received a letter, don’t panic—you have options. The most common responses include:

Appeal (Form SSA-561):

You can appeal if you believe the over-payment was incorrect. While the appeal is pending, SSA won’t reduce your checks.

Request a Waiver (Form SSA-632-BK):

You may request to waive the debt entirely if:

- You didn’t cause the over-payment

- Paying it back would cause you hardship

Repayment Plan:

If you acknowledge the debt but can’t afford a 50% reduction, you can request monthly payments as low as $10 depending on your income.

Tip: Always submit documentation (medical bills, income statements) to show financial hardship when requesting a waiver or reduced payment.

3. Paper Checks Going Away: September 30 Final Deadline

Starting July 2025, SSA will begin enforcing its move away from paper checks in favor of direct digital methods. The final cutoff date is September 30, 2025.

After that date, people still receiving paper checks may have their benefits delayed or suspended unless they switch to:

- Direct Deposit: Linked to your bank or credit union

- Direct Express® Debit Mastercard®: A government-issued card that doesn’t require a bank account

Direct Express is especially helpful for unbanked and underbanked individuals.

SSA data shows over 485,000 Americans still use paper checks. The agency is working to reduce fraud, mail theft, and administrative costs.

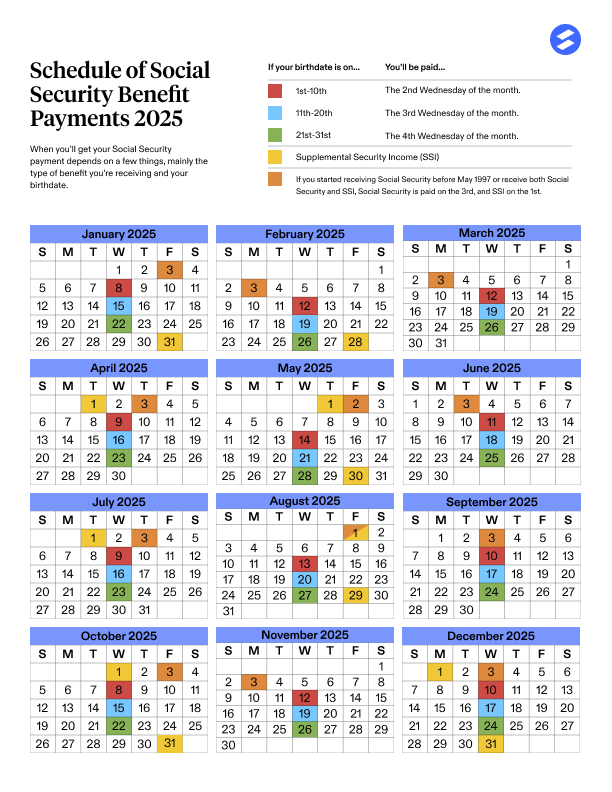

4. July 2025 Social Security Cutoff Payment Dates

For clarity, here’s when you should expect your check based on your birth date and benefit type:

- July 1 – SSI Recipients

- July 3 – Those who started benefits before May 1997

- July 9 – Birthday 1st to 10th

- July 16 – Birthday 11th to 20th

- July 23 – Birthday 21st to 31st

If you haven’t received your payment by the following Monday, SSA recommends contacting them directly or checking your mySSA account online.

5. Other Big Changes in 2025

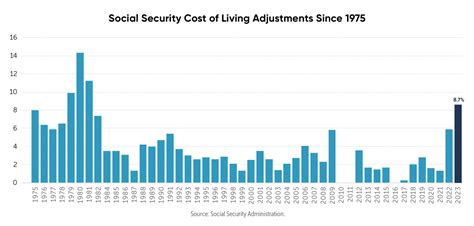

Cost-of-Living Adjustment (COLA)

In January 2025, SSA applied a 2.5% COLA, raising the average monthly retirement benefit to $1,976. This modest bump helped keep pace with inflation but was less than the 8.7% adjustment seen in 2023.

Windfall Elimination Provision (WEP) and Government Pension Offset (GPO) Repeal

Thanks to new legislation passed in 2024, both WEP and GPO were repealed. These laws previously reduced benefits for people who worked in both public-sector and private-sector jobs.

SSA has since issued over $7.5 billion in back payments to 1.1 million beneficiaries. If you worked in education, police/fire service, or overseas—and had your Social Security benefits reduced—this change likely affects you.

2025 Earnings Limit

If you’re under Full Retirement Age (FRA) and still working:

- You can earn up to $23,400 without penalty

- Beyond that, SSA deducts $1 for every $2 you earn

If you reach FRA in 2025:

- You can earn up to $62,160

- After that, SSA deducts $1 for every $3 earned

Once you pass your FRA, there are no limits on what you can earn.

6. Real Life Impact: Who’s Hurting the Most?

Many Americans living paycheck-to-paycheck are feeling the sting of this policy change.

- A couple in Ohio saw their monthly check drop from $1,100 to $500 due to a repayment plan they didn’t fully understand.

- Rural residents in New Mexico reported delays switching from paper checks due to lack of broadband and nearby SSA offices.

- Retired educators in Texas received over-payment letters after their pensions triggered a re-review of past payments.

The stakes are high. A 50% benefit cut—even temporarily—can mean:

- Skipped rent or utility payments

- Missed medications

- Delayed access to food or caregiving support

7. Government Response & Congressional Oversight

In early 2025, Congress held hearings into SSA’s aggressive over-payment recovery process. Lawmakers from both parties have called for:

- Improved communication about notices and deadlines

- A permanent cap on withholdings (possibly 10%)

- An automated notification system tied to major life events (like marriage, job changes)

As of July 2025, legislation is pending that would require SSA to contact beneficiaries through multiple channels (mail, text, email) and provide clearer appeal instructions.

8. Tips to Stay Ahead

- Open all mail from SSA immediately

- Create or log in to your mySSA account monthly

- Keep SSA updated with any income, marriage, or address changes

- Avoid delays by setting up direct deposit or Direct Express ASAP

- If in doubt, visit a local office or call SSA directly at 1-800-772-1213

Some Social Security Recipients Could See Payments Slashed in Half— Check Why!

Why Some Social Security Recipients Might See Their Payments Slashed by 50%

Social Security Sends Out Urgent Email Over Trump Tax Bill Confusion – Check Details!