The Truth About Social Security Taxes: The truth about Social Security taxes in 2025 may surprise you. With new legislation and a flurry of headlines, many Americans believe they’ll never pay taxes on their benefits again. But is that true? Let’s set the record straight in this guide—written to be friendly, accurate, and easy to understand, yet detailed enough for professionals managing retirement income. Whether you’re 65, planning for it, or advising someone who is, the information here can help you make smart choices and save on taxes.

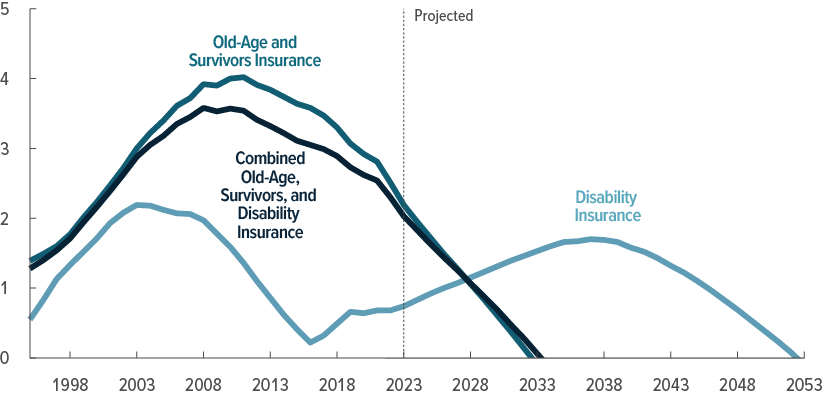

Social Security is one of the most important income sources for retirees, yet its taxation rules remain misunderstood. The recent “Senior Deduction” has sparked confusion and political spin, but behind the noise lies a need for practical, clear-headed tax planning. Understanding how benefits are taxed—and what you can do about it—can make a meaningful difference in how long your retirement savings last.

The Truth About Social Security Taxes

The truth about Social Security taxes in 2025 is this: They’re still here, but you have more tools than ever to reduce them. The $6,000 senior deduction is helpful, but temporary. For lasting results, planning ahead matters—especially with Roth conversions, QCDs, and smart income timing. Don’t wait until tax season to figure this out. Make your plan now, adjust it annually, and talk with a tax advisor who understands retirement income.

| Feature | Details |

|---|---|

| Senior Deduction (2025–2028) | Up to $6,000 per individual aged 65+; $12,000 for couples. Phases out above $75K (single) and $150K (joint). |

| Payroll Tax Rate (2025) | 6.2% employee share up to $176,100; self-employed pay 12.4%. |

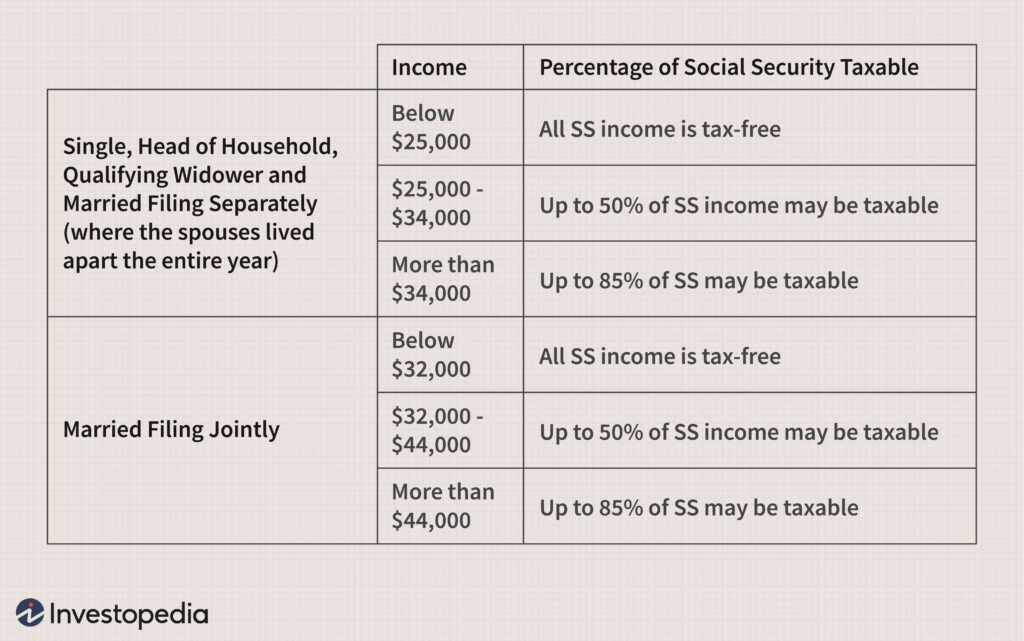

| Social Security Tax Thresholds | Combined income below $25K (single) / $32K (joint): 0% tax; up to 85% taxed above $34K/$44K. |

| Average Monthly Benefit | ~$1,976/month post 2.5% COLA in 2025. |

| Who Pays Tax on Benefits? | Over 56% of beneficiaries pay some income tax on their Social Security. |

| Official SSA Website | ssa.gov |

A Short History: How Social Security Became Taxable

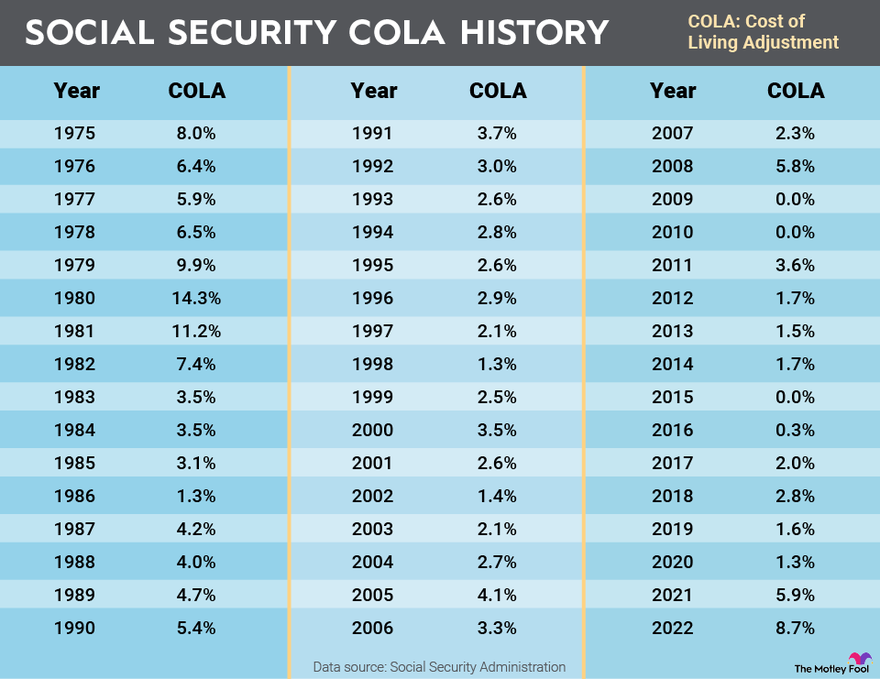

When Social Security was launched in 1935, benefits were entirely tax-free. But as the program grew and costs increased, the government introduced taxation on benefits in 1983 under President Reagan. This tax applied to higher-income retirees.

In 1993, Congress expanded the law to tax up to 85% of Social Security benefits. Here’s the kicker—those thresholds were never adjusted for inflation. As income rose over the decades, more and more retirees were pushed into tax-paying territory.

Understanding How Social Security Taxes Work in 2025

Contrary to some political claims, Social Security is still taxable—but only if your total income exceeds certain levels.

The government uses a calculation called combined income to determine how much of your benefits are taxable.

How to Calculate Combined Income:

Combined Income = Adjusted Gross Income (AGI)

+ Nontaxable interest (e.g. municipal bonds)

+ ½ of your Social Security benefits

Taxation Tiers:

| Filing Status | Combined Income | % of Benefits Taxed |

|---|---|---|

| Single | Less than $25,000 | 0% |

| $25,000–$34,000 | Up to 50% | |

| Over $34,000 | Up to 85% | |

| Married Joint | Less than $32,000 | 0% |

| $32,000–$44,000 | Up to 50% | |

| Over $44,000 | Up to 85% |

The IRS will never tax more than 85% of your benefits. That said, for many retirees, a significant portion of their benefits ends up taxed—unless they plan smartly.

The New Senior Deduction: What It Is (And Isn’t)

In 2025, the new tax legislation introduced a “Senior Bonus” deduction—up to $6,000 per person over 65, or $12,000 for married couples filing jointly.

But there are limits:

- Single taxpayers begin losing this deduction at $75,000 AGI.

- Married couples see a phase-out beginning at $150,000 AGI.

- The deduction disappears completely for high-income retirees above $175,000 (single) and $250,000 (joint).

This deduction applies to all types of income, not just Social Security, making it broadly helpful. But it doesn’t eliminate taxes on benefits—it simply gives more room before income becomes taxable.

Real-Life Example: How It Works

Meet Bob and Nancy, both age 67, retired.

- Social Security: $36,000 combined

- IRA withdrawals: $20,000

- Interest and dividends: $2,000

Combined Income = $20,000 + $2,000 + $18,000 (½ of SS) = $40,000

Under IRS rules, up to 50% of their benefits may be taxed.

Now, apply:

- $12,000 senior deduction

- $30,000 standard deduction (married filing jointly)

Total deductions = $42,000

That wipes out their taxable income—they owe no federal income tax, despite having taxable income on paper.

Strategies to Reduce or Eliminate The Truth About Social Security Taxes

There are smart, legal ways to reduce how much Social Security is taxed—some of which must be done years in advance.

1. Delay Social Security Benefits

Waiting until age 70 not only increases your benefit by about 8% per year but also lets you withdraw from other sources earlier—keeping your Social Security tax-free longer.

2. Use Roth IRAs and Roth 401(k)s

Withdrawals from Roth accounts don’t count toward combined income. That means more flexibility and less tax on your benefits.

Consider Roth conversions between ages 60–70 when your income may be temporarily lower.

3. Use Qualified Charitable Distributions (QCDs)

If you’re 70½ or older, you can donate up to $100,000 per year directly from your IRA to charity. That money is excluded from income entirely.

4. Manage IRA Withdrawals Carefully

Avoid large withdrawals that bump you over the taxation threshold. Instead, consider “filling up” the lower brackets annually and spreading income evenly.

5. Consider Municipal Bonds

Interest from municipal bonds is generally tax-free, but still counts in the “combined income” formula. Consider pairing them with Roth accounts for optimal balance.

Mistakes to Avoid

Even well-meaning retirees fall into these traps:

- Claiming Social Security at 62 when they don’t need the income

- Forgetting Required Minimum Distributions (RMDs) begin at age 73 (2025 rules)

- Ignoring Roth conversions until it’s too late

- Not coordinating with a tax planner

- Not tracking their combined income yearly

Checklist: What to Do Each Year

☐ Review your total income sources (IRA, pensions, dividends)

☐ Calculate your combined income

☐ Apply the senior deduction if over 65

☐ Consider QCDs if over 70½

☐ Review Roth conversion opportunities

☐ Work with a tax pro to estimate your Social Security tax liability

☐ Adjust withdrawals to stay under key thresholds

State Taxes: Don’t Forget Local Rules

Twelve states currently tax Social Security benefits, including Colorado, Connecticut, Kansas, Minnesota, and Utah. Each has different rules. You can view a complete, up-to-date list on Kiplinger’s State Tax Map.

If you’re planning to move in retirement, consider a tax-friendly state like Florida, Texas, or Tennessee, which don’t tax Social Security or retirement income.

Trump’s New Tax Bill Could Reshape How Social Security Benefits Are Taxed

Social Security Sends Out Urgent Email Over Trump Tax Bill Confusion – Check Details!

Some Social Security Recipients Could See Payments Slashed in Half— Check Why!