$5,108 Social Security Checks: If you’ve been hearing about $5,108 Social Security checks going out in July 2025, you’re not alone. The buzz is real—but not everyone is eligible for that kind of money.

These checks represent the maximum monthly retirement benefit possible under the Social Security system in 2025. Only a small group of Americans will qualify, but understanding who gets what, when, and why is essential for anyone planning their financial future. In this in-depth guide, we’ll explain who qualifies, how the payment schedule works, recent policy updates, and how you can maximize your own benefits, no matter your age or income level.

$5,108 Social Security Checks

While only a small group of Americans will receive the $5,108 Social Security checks in July 2025, everyone can take steps to improve their own retirement outlook. From understanding how your benefits are calculated to delaying retirement and maximizing spousal benefits, smart planning pays off. Make sure to stay informed, check your SSA account, and talk to a retirement planner if you need help navigating the system. Social Security isn’t just a government program—it’s one of the most important retirement tools you’ll ever use.

| Topic | Details |

|---|---|

| Maximum Monthly Benefit | $5,108 (2025, for those who delay benefits to age 70) |

| Average Retirement Benefit | Around $1,900–$2,000 per month |

| Eligibility for $5,108 | 35 years of max earnings + delayed benefits to age 70 |

| Payment Dates (July 2025) | July 1, 3, 9, 16, 23 (based on birthdate or benefit type) |

| 2025 COLA Adjustment | 2.5% increase across all Social Security benefits |

| Overpayment Withholding Policy | Rises to 50% of monthly check after July 24, 2025 |

| Official SSA Resource | ssa.gov |

How Social Security Works: A Simple Overview

Social Security is a federal program designed to provide retirement income, disability assistance, and survivor benefits. It’s funded by FICA payroll taxes, which most workers pay throughout their careers.

To qualify for Social Security retirement benefits, you must earn 40 work credits, typically equivalent to 10 years of work.

Your monthly benefit amount is based on:

- Your 35 highest earning years

- Your age when you start collecting

- Whether you’ve paid the maximum taxable income into Social Security

The maximum wage subject to Social Security taxes in 2025 is $176,100. Workers who consistently earn that amount over 35 years—and who delay retirement until age 70—are the ones who qualify for the $5,108 monthly benefit.

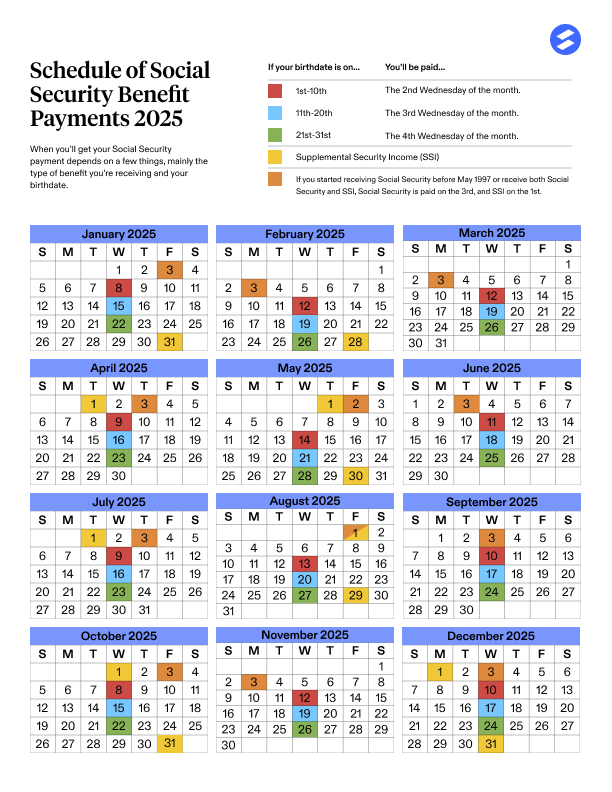

July 2025 Payment Schedule

The Social Security Administration pays benefits on a staggered schedule each month, depending on:

- Your birth date

- When you first started receiving benefits

- The type of benefits you receive (retirement, SSI, SSDI, or survivor)

Full July 2025 Schedule:

- July 1 – For those receiving Supplemental Security Income (SSI) only

- July 3 – For individuals who began receiving benefits before May 1997 or receive both SSI and Social Security

- July 9 – If your birthday falls between the 1st and 10th

- July 16 – If your birthday falls between the 11th and 20th

- July 23 – If your birthday falls between the 21st and 31st

Who Qualifies for the $5,108 Benefit?

Only a small portion of retirees will receive the full $5,108 in 2025. You must meet three major criteria:

- Work for at least 35 years

- Earn the Social Security taxable maximum each of those years

- Delay claiming benefits until age 70

Let’s put that in perspective. The maximum taxable wage in 2025 is $176,100, but this number changes every year due to inflation. So to qualify, a person would need to have earned the maximum wage threshold annually for 35 years straight—a feat usually reserved for high-income earners such as executives, physicians, attorneys, or long-serving professionals in high-paying sectors.

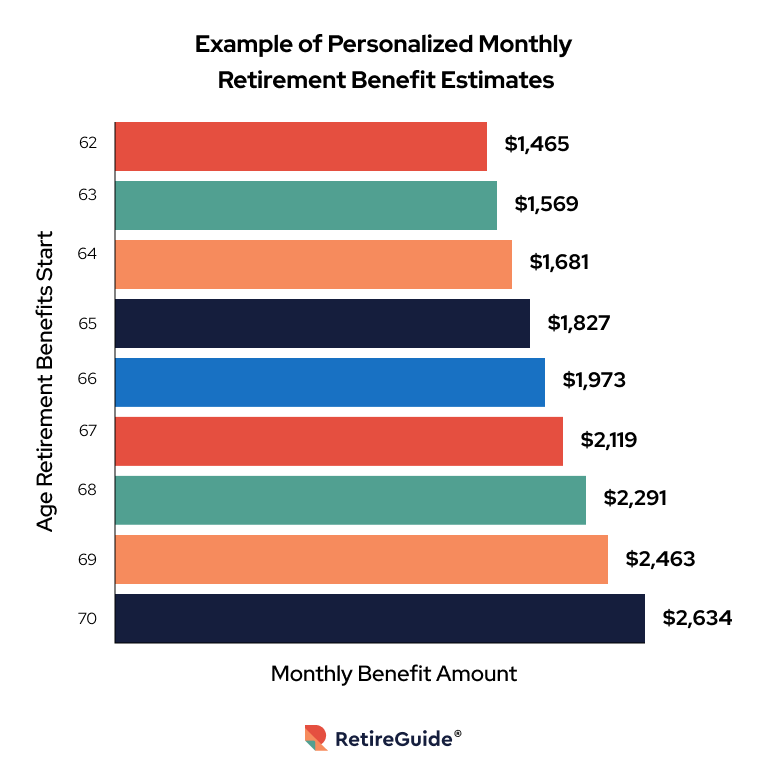

Most Americans receive significantly less. According to the SSA’s 2025 estimates:

- The average monthly retirement check is about $1,907

- The average SSDI check is about $1,537

- The maximum SSI payment is around $943 for individuals

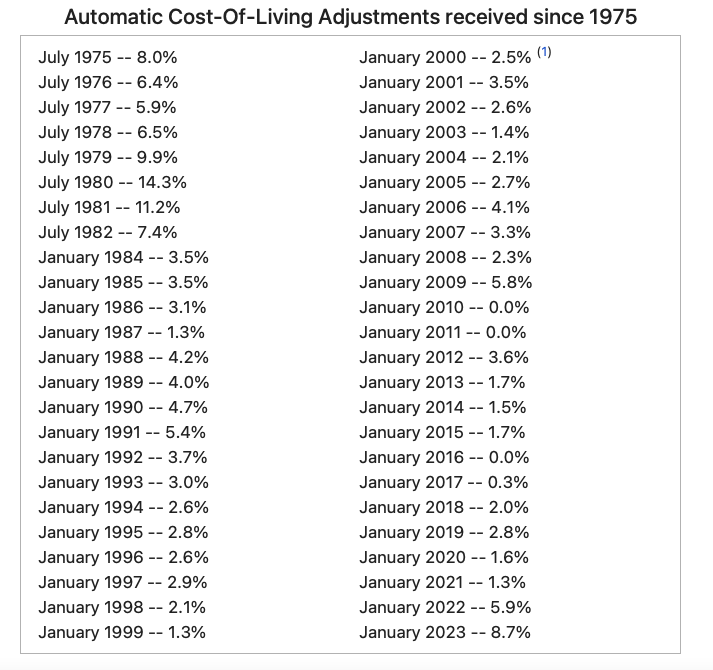

What Is COLA and How It Affects Your Check?

Each year, Social Security benefits are adjusted to keep up with inflation. This is called the Cost-of-Living Adjustment (COLA).

For 2025, the COLA is 2.5%, which means:

- All Social Security checks are 2.5% higher than in 2024

- For someone receiving $2,000/month in 2024, they’ll now receive $2,050/month

The COLA is based on changes in the Consumer Price Index (CPI-W) and is meant to help retirees maintain purchasing power as the cost of goods and services rises.

Changes to Overpayment Rules in July 2025

A major policy shift kicks in July 24, 2025, regarding overpayments. If SSA determines that you’ve been overpaid benefits—whether by mistake or through a change in eligibility—they will:

- Withhold up to 50% of your monthly check (up from the previous 10%)

- Apply this rule to any overpayments issued after April 25, 2025

- SSI recipients will still have only 10% withheld

If you’re impacted by this, you can request:

- A waiver (if it wasn’t your fault and repayment causes hardship)

- A payment plan to make smaller, manageable payments

How to Maximize Your $5,108 Social Security Checks?

Not everyone will hit the $5,108 max—but there are several smart strategies that can help increase your monthly benefit:

1. Delay Your Claim

Every year you delay benefits past age 62 increases your monthly payout by about 8%, up until age 70.

2. Work for More Than 35 Years

Your Social Security is based on the average of your highest 35 years of earnings. If you work fewer than 35 years, the SSA averages in zeros—which lowers your check.

3. Monitor Your Earnings Record

Log into your My Social Security account regularly to confirm your income history is accurate. Any errors could reduce your future benefit.

4. Understand Spousal and Survivor Benefits

If you’re married, divorced, or widowed, you may be eligible for up to 50% of your spouse’s benefit or even full survivor benefits. The rules are complex, but potentially valuable.

Real-Life Examples

Example 1: John – The High Earner

- Worked for 40 years as a tech executive

- Consistently earned above the taxable maximum

- Claimed benefits at 70

Monthly Benefit: $5,108

Example 2: Maria – Middle Income Earner

- Worked as a public school teacher for 35 years

- Claimed benefits at 62 to retire early

- Did not pay into Social Security during years in a pension-covered role

Monthly Benefit: $1,400

These two examples show just how wide the range of benefits can be depending on income, timing, and career structure.

Impact on Younger Workers

Millennials and Gen Z might wonder: Will Social Security still be there when I retire?

According to the 2024 Trustees Report, the Social Security Trust Fund is projected to be depleted by 2033, at which point only about 79% of promised benefits will be payable—unless Congress acts.

That doesn’t mean Social Security is going away, but it does mean younger workers should:

- Save independently for retirement

- Diversify income sources

- Stay up to date on Social Security reforms

The 2025 Trustees Report Just Dropped — What It Reveals About Social Security’s Future

$2,000 Social Security Payments Arriving in 4 Days—Check If You Qualify Now

No Taxes on Social Security? Here’s What the White House Just Confirmed