Social Security Retirement Checks Might Shrink Sooner: If you’re like most hardworking Americans, your Social Security retirement checks aren’t just some bonus—they’re a crucial part of your monthly income. But starting July 2025, millions of people across the U.S. are seeing their benefits unexpectedly slashed. Why? Because the Social Security Administration (SSA) has implemented a new rule that lets them withhold up to 50% of your check if they believe you’ve been “overpaid”—even if it was their error. This isn’t just red tape. It’s real. It’s personal. And it’s already hitting many retirees, disabled workers, survivors, and even veterans. Whether you’re already receiving benefits or you’re just planning your retirement, this is something you need to understand right now.

Social Security Retirement Checks Might Shrink Sooner

The July 2025 change to Social Security’s overpayment recovery policy is a big deal. Withholding up to 50% of monthly benefits—often with minimal notice—has created serious hardship for retirees and others who rely on their Social Security checks to survive.

While this move helps the government recover billions in past overpayments, the burden is falling squarely on the shoulders of people who didn’t even realize they were overpaid. Thankfully, you have options. From appeals to waivers to payment plans, there are ways to push back and protect your income. But the bigger lesson here is clear: the Social Security system, once considered rock solid, is facing tough times. And now, more than ever, being informed and proactive is your best defense.

| Detail | Information |

|---|---|

| Policy Change Effective Date | July 2025 |

| New Withholding Limit | Up to 50% of monthly Social Security benefits (retirement, disability, or survivors) |

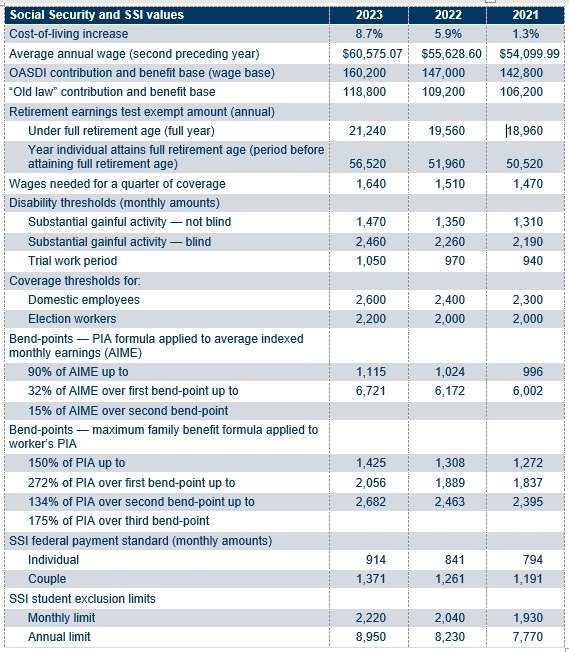

| Previous Withholding Cap | 10% (100% in rare cases for SSI) |

| Scope of Overpayments | $72 billion overpaid from 2015–2022 |

| Unrecovered Overpayments | Over $23 billion as of FY 2023 |

| Appeal Timeline | 90 days from the date of notice |

| Affected Groups | Retirees, SSDI recipients, survivors, dual-benefit recipients |

| Official Resources | SSA.gov, Appeal Form SSA-561, Waiver Form SSA-632 |

A Historical Look: Why Social Security Was Created

Back in 1935, during the Great Depression, the U.S. government created the Social Security Act to ensure that older Americans, widows, and disabled workers would never be left without income. It was a game-changer. For many of our elders today—especially in rural and Native communities—it’s still the main financial support system after retirement.

As of 2025, Social Security pays out benefits to over 70 million Americans, and for many, it’s the only stable source of monthly income.

But in recent years, mismanagement and system errors have led to billions in overpayments—money sent out by mistake. Now, the SSA is scrambling to recover those funds, and everyday folks are getting caught in the middle.

What Exactly Changed in July 2025?

In short: the SSA now has the power to withhold 50% of your monthly Social Security benefits to repay alleged overpayments.

Until now, they were generally only taking 10% per month, unless you explicitly agreed to more. In rare cases (mostly for Supplemental Security Income or SSI), they were even taking 100%. Now, with the rule change, the default withholding jumps to half your check, starting July 2025.

The SSA claims this is necessary because over the past decade, they’ve paid out a whopping $72 billion in improper payments, much of which was due to agency error—not fraud.

Example:

Let’s say you receive $1,400 a month in Social Security retirement benefits. If the SSA says you were overpaid in the past—even if it was their fault—they can now take $700 per month out of your benefits to pay it back, unless you file an appeal or request a waiver.

Why Is the SSA Doing This Now?

The short answer: money.

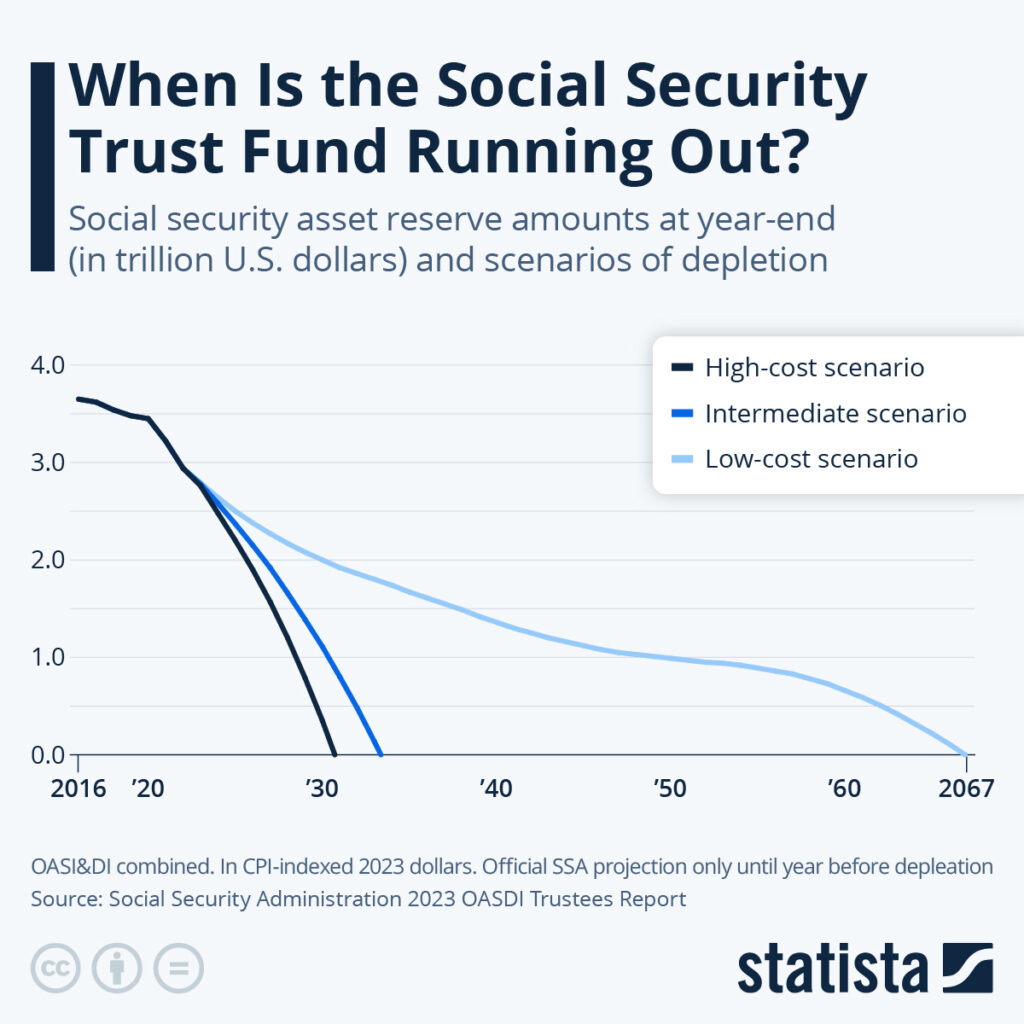

The Social Security trust fund is projected to run out by 2033 or 2034, at which point benefits could be automatically cut by about 20% if Congress doesn’t act.

To reduce future losses and show they’re being responsible stewards of taxpayer funds, the SSA is now getting aggressive about collecting back what they say they’re owed.

According to a 2024 report by the Social Security Office of the Inspector General:

- Over $23 billion in overpayments remained uncollected as of the end of 2023.

- Many of these were caused by internal SSA mistakes, not fraud.

- Some individuals received overpayment notices years after the fact, without explanation.

Who’s Most Affected by the New Rule?

This rule affects a wide swath of beneficiaries, including:

- Retirees receiving standard Social Security benefits

- People with disabilities receiving SSDI

- Widows, widowers, and survivors receiving benefits from deceased spouses

- SSI recipients, who are subject to even stricter rules (up to 100% withholding)

- Veterans receiving both VA and SSA benefits

- Dual beneficiaries who receive more than one type of Social Security payment

According to analysts, residents of Florida, Texas, California, New York, and Arizona are among the most affected due to higher concentrations of retirees and disabled workers.

What You Should Do If Your Social Security Retirement Checks Might Shrink Sooner

If your check shrank in July, don’t panic—but do act fast. Here’s what you need to do:

Step 1: Check for a Notice

SSA began mailing overpayment letters in April 2025. If you didn’t get one, log into your SSA account online to check for alerts: SSA.gov/myaccount

Step 2: Understand the Amount

The letter should explain:

- The total overpayment amount

- The months/years involved

- The reason for the overpayment

- Your options (appeal, waiver, or repayment plan)

Step 3: Appeal the Decision

You have the right to dispute the overpayment.

- Fill out Form SSA-561 (Request for Reconsideration)

- Submit within 90 days of the date on your notice

- You don’t need a lawyer, but it can help, especially for complex cases

Step 4: Apply for a Waiver

Even if the SSA is right that you were overpaid, you can ask them to waive the debt if:

- You were not at fault

- Paying it back would cause financial hardship

Use Form SSA-632 to request a waiver.

Tip: Include documentation like utility bills, rent, food expenses, and medical costs to prove hardship.

Step 5: Request a Lower Repayment Plan

If you’re denied a waiver, you can still request a smaller repayment amount—say $50 or $100/month instead of 50% of your benefit.

This requires a written request or a phone call to 1-800-772-1213.

Why This Matters for Financial Planning?

Whether you’re 25 or 75, this change shows just how fragile the Social Security system has become. It’s more important than ever to:

- Regularly review your SSA earnings record

- Keep your address and contact info up to date

- Set aside emergency savings, even during retirement

- Have multiple income streams where possible (pensions, IRAs, 401(k)s, annuities)

This is especially true for rural and Native communities, where access to financial planning is often limited.

Some Social Security Recipients Could See Payments Slashed in Half— Check Why!

July 2025 Social Security Payments: Important Dates Every Washington State Resident Should Know

28 Days Left to Receive August SSI Payments—Are You on the List?

Checklist: What You Should Do Today

- Check your SSA payment for July or later

- Log into your SSA account online

- Review any letters from SSA

- File an appeal or waiver if necessary

- Contact a legal or benefits advocate for assistance

- Monitor your SSA correspondence regularly going forward