What Financial Independence Really Means in 2025: In 2025, Financial Independence isn’t just a goal—it’s a movement, a lifestyle, and for many, a necessity. While the idea of quitting your job forever still draws attention, today’s FIRE (Financial Independence, Retire Early) community is shifting focus. Now, it’s less about walking away from work entirely, and more about having the freedom to choose how and when you work—and live. The traditional retirement playbook of working until 65, then riding into the sunset, is quickly becoming outdated. Rising inflation, volatile markets, and evolving job models have inspired people across generations to explore Financial Independence as a way to reclaim control in a fast-changing world.

What Financial Independence Really Means in 2025?

In 2025, Financial Independence isn’t just about retiring early—it’s about taking back control of your money, time, and future. The FIRE movement has evolved into a flexible, practical approach to building a meaningful life with less financial stress and more purpose. Whether you’re fresh out of college, midway through your career, or nearing retirement, the principles of FIRE—intentional spending, smart investing, and long-term planning—can help you create a future where you call the shots. This isn’t about escaping life. It’s about building one you don’t need a vacation from.

| Topic | Key Insights |

|---|---|

| Financial Independence (FI) | Being able to cover your living expenses without needing full-time employment |

| FIRE Movement | Stands for Financial Independence, Retire Early; a savings and investment strategy aimed at lifestyle flexibility |

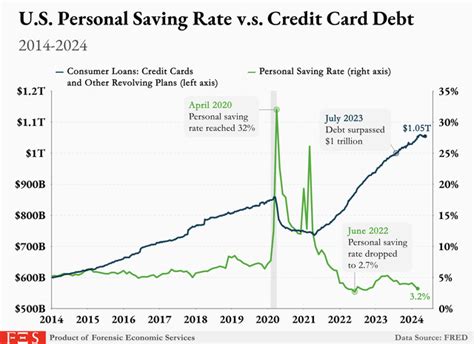

| Savings Benchmark | FIRE followers aim to save 50%–70% of income; U.S. national average is 7.6% |

| FI Number Formula | Multiply annual living expenses × 25 for a basic target using the 4% rule |

| Types of FIRE | Lean FIRE, Fat FIRE, Coast FIRE, Barista FIRE provide flexible options for different lifestyles |

| Notable Resource | FIRE Explained – Investopedia |

What Does Financial Independence Mean in 2025?

In 2025, Financial Independence (FI) means one simple thing: freedom. Not necessarily quitting your job, but knowing that you could—and still be fine. It’s about waking up in the morning and deciding what to do with your time, not being forced into a routine just to pay the bills.

FI means your income from investments, passive sources, or savings covers your lifestyle. You aren’t relying on a paycheck to survive. And you definitely don’t have to wait until you’re 65 to get there.

What Is the FIRE Movement?

The FIRE movement began in the 1990s and took off in the 2010s with the rise of blogs and forums promoting extreme savings and early retirement. But the movement has since matured and diversified. It’s no longer about living on rice and beans or retiring in your 30s. Instead, FIRE in 2025 is focused on personalized, sustainable freedom.

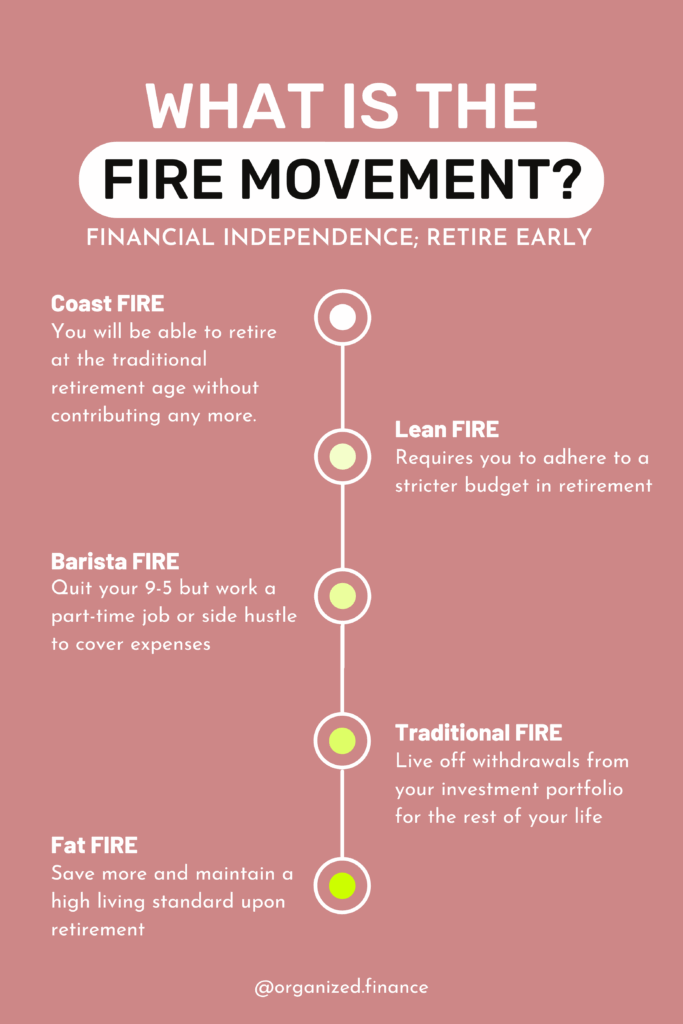

There are now multiple paths to FIRE:

- Lean FIRE: Covers bare minimum expenses, often under $35,000/year.

- Fat FIRE: Allows for a higher standard of living with luxury or flexibility.

- Coast FIRE: You save aggressively early on, then let compound interest carry you the rest of the way.

- Barista FIRE: You work part-time or freelance to cover basics while your investments grow.

FIRE is no longer just about retiring early—it’s about building a life you don’t need to escape from.

A Real-Life Example: Sara’s Journey to Coast FIRE

Take Sara, a 34-year-old graphic designer living in Colorado. After working corporate for a decade, she saved aggressively for seven years, investing over $200,000 in low-cost index funds. She’s now gone “Coast FIRE,” working 20 hours a week as a freelancer while her portfolio compounds in the background.

“I’m not ‘retired,’ but I’ve bought myself freedom. I spend my mornings hiking with my dog, then design logos in the afternoon. My money works even when I’m offline.”

Sara’s story is common in 2025—FIRE is becoming more fluid, personal, and mental-health-focused.

Step-by-Step: How to Achieve Financial Independence in 2025?

Step 1: Know Your FIRE Number

Your FIRE number is how much money you need to generate income forever.

Formula:

Annual Expenses × 25 = FIRE Number

So, if your annual cost of living is $45,000:

- $45,000 × 25 = $1,125,000

This is based on the 4% rule, which assumes you can safely withdraw 4% of your portfolio each year without running out of money.

Pro Tip: Want to be more conservative? Use 3.5% instead.

Step 2: Track & Cut Your Expenses

You can’t fix what you don’t measure. Start by tracking every dollar.

Top tools:

- Mint

- YNAB

- Empower

Then find ways to reduce:

- Housing: House-hack, downsize, or move to a LCOL (low-cost-of-living) area.

- Transportation: Use public transport or buy used cars.

- Food: Cook at home, meal prep, limit delivery apps.

Step 3: Save & Invest Aggressively

High savings rates fuel FIRE. Aim for 30%–70% of your income.

Then invest in:

- Low-fee index funds: VTSAX, VTI, FZROX

- ETFs and Roth IRAs

- 401(k) and HSA accounts for tax advantages

- Brokerage accounts for accessible funds

Diversify between stocks, real estate, and fixed income.

Always prioritize tax-advantaged accounts first!

Step 4: Build Multiple Income Streams

Relying on one job? That’s risky.

FIRE-friendly income streams:

- Dividend stocks

- REITs (real estate investment trusts)

- Rental properties

- Freelancing, consulting, coaching

- Digital products (courses, eBooks, templates)

In 2025, remote work and digital entrepreneurship make these easier than ever.

Step 5: Prepare for Healthcare, Taxes, and Life

Early retirees don’t get Medicare. So, you’ll need:

- ACA plans (based on income)

- Health Savings Accounts (HSAs)

- Emergency funds of 6–12 months of expenses

Tax planning:

- Use a Roth IRA ladder to access retirement funds early without penalty.

- Harvest capital gains strategically.

- Consider moving to a no-income-tax state (like Florida or Texas).

Work with a fiduciary CFP or tax advisor to avoid costly mistakes.

Tools, Resources & Must-Reads

Books:

- The Simple Path to Wealth – JL Collins

- Quit Like a Millionaire – Kristy Shen

- Your Money or Your Life – Vicki Robin

Podcasts:

- ChooseFI

- Afford Anything

- The FI Show

Blogs:

- Mr. Money Mustache

- Our Next Life

- Frugalwoods

Communities:

- Reddit r/financialindependence

- Facebook groups

- Local FI meetups

FIRE for Different Careers

Tech Professionals: High income, stock options, ideal for Fat FIRE.

Teachers & Public Workers: Leverage pensions, summers off for side hustles.

Healthcare Workers: High-paying but stressful jobs—perfect for Barista FIRE transitions.

Tradespeople: Can earn solid income without debt; invest in real estate.

Freelancers & Creatives: Build scalable passive income while working anywhere.

Pros and Cons of FIRE

Pros:

- More freedom

- Less financial stress

- Flexible work options

- Time for passion projects and family

Cons:

- Requires sacrifice early on

- Healthcare is complex

- Market risks

- Can be isolating if peers aren’t on the same path