28 Days Left to Receive August SSI Payments: If you’re wondering why there are two SSI payments in August 2025 and none in September, you’re not alone. With exactly 28 days left until the first payment hits your account, now’s the perfect time to double-check your status, prepare your budget, and make sure you don’t miss out on any benefits.

The Supplemental Security Income (SSI) program provides vital financial support to millions of Americans. For many seniors, people with disabilities, and low-income families, these monthly checks are the difference between keeping the lights on and falling behind. But this year, the SSI calendar throws in a twist. A federal holiday is shifting the usual schedule, resulting in two payments in August—and zero in September. Let’s break down exactly what’s happening, how much you can expect, and what you should do right now to stay prepared.

28 Days Left to Receive August SSI Payments

With 28 days left until your August SSI payments arrive, it’s the perfect time to prepare. Two deposits will hit in August—August 1 and August 29—and none will arrive in September. This isn’t a mistake; it’s a scheduled adjustment due to Labor Day. If you receive SSI or help manage it for someone else, remember: the August 29 check covers next month. Be sure to budget wisely and protect your benefits. SSI is a critical lifeline for millions. With the right information and planning, you can stay ahead and stay secure.

| Topic | Details |

|---|---|

| Next SSI Payment | August 1, 2025 |

| Second August Payment | August 29, 2025 (September’s check issued early) |

| No September Payment | Due to early deposit |

| Monthly SSI Amounts (2025) | $967 (individual), $1,450 (couple), $484 (essential persons) |

| Eligibility | U.S. citizen or legal resident with limited income; must be 65+, blind, or disabled |

| SSA Contact | SSA.gov, Phone: 1-800-772-1213 |

What Is SSI and Who Is Eligible?

Supplemental Security Income (SSI) is a federal benefits program that provides monthly payments to individuals who have limited income and resources and meet one or more of the following conditions:

- Are 65 years or older

- Are blind

- Have a qualifying disability

- Are U.S. citizens or certain qualified non-citizens

Unlike Social Security Disability Insurance (SSDI), SSI is not based on your work history. Instead, it’s a needs-based program that helps recipients pay for essentials such as rent, food, medication, and utilities.

To qualify in 2025, individuals must have resources below $2,000, and couples must have less than $3,000 in resources. These limits include savings, investments, and personal property (excluding your primary residence and one vehicle).

Why Are There Two SSI Payments in August and None in September?

This happens due to a simple calendar rule: When the 1st of any month falls on a weekend or federal holiday, the Social Security Administration (SSA) issues payments on the prior business day.

This year, September 1, 2025, lands on Labor Day (a federal holiday). So, the SSA will release the September payment early—on Friday, August 29.

Here’s the payment schedule:

- August 1, 2025: Regular August payment

- August 29, 2025: September payment (early)

- No SSI payment in September: Because it was paid in advance

This isn’t the first time this has happened, and it won’t be the last. The same thing occurred in:

- December 2022 (January check came early)

- March 2024 (April check came early)

- December 2025 (January 2026 check will come early)

This system may feel confusing, but it’s part of SSA’s standard process to ensure payments don’t fall on non-banking days.

How Much Will You Receive In August SSI Payments?

The maximum SSI benefit amounts for 2025, after the latest Cost-of-Living Adjustment (COLA), are:

| Recipient Type | Monthly Maximum |

|---|---|

| Individual | $967 |

| Married Couple (both eligible) | $1,450 |

| Essential Person (caregiver) | $484 |

These amounts can be higher in states that offer state supplemental payments. For example, California, New York, and New Jersey provide additional monthly SSI money.

Real-Life Example: How This Impacts People

Let’s look at a practical example:

Tom, a 68-year-old retired factory worker in Ohio, gets $941 per month in SSI. On August 1, his regular payment will land. On August 29, his September payment will be deposited early. But in September, Tom won’t see another check.

Tom uses this money to pay rent, buy groceries, and cover his electric bill. Knowing he won’t get a payment in September, Tom sets aside part of the August 29 deposit to avoid running short before the October 1 payment comes in.

Step-by-Step: What You Should Do Now

1. Check Your Direct Deposit

If you already receive SSI, log in to your bank account or your My Social Security account to confirm your payment history and verify future deposits.

2. Update Your Information

If your bank account, mailing address, or living situation has changed, contact SSA immediately. This prevents delays or misrouted payments.

- Call SSA at 1-800-772-1213

- Visit your local SSA office

- Log in to your MySSA profile

3. Budget Accordingly

Avoid the common mistake of treating the August 29 deposit as “extra” money. It’s not.

4. Protect Yourself from Scams

Scammers love confusion around government payments. Remember:

- The SSA will never ask for personal details over the phone or by email.

- If you get a suspicious call, hang up and report it to the SSA Office of the Inspector General.

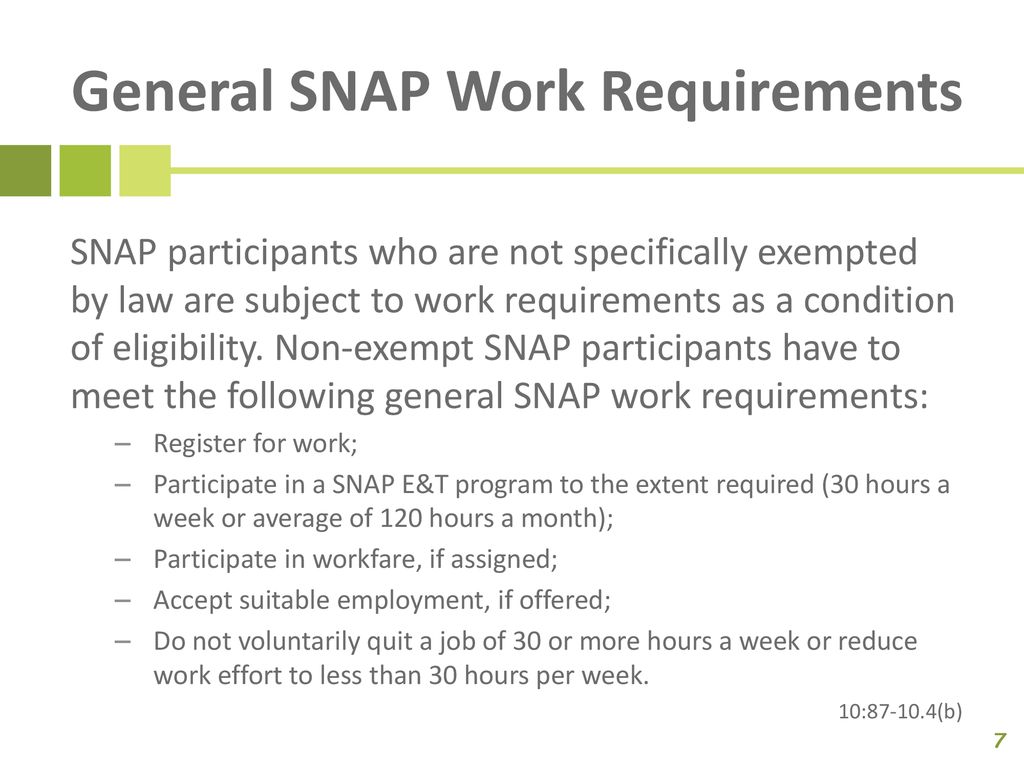

Will This Affect Other Benefits?

SSI recipients often receive additional assistance like:

- SNAP (food stamps)

- Medicaid

- Housing vouchers

- Utility assistance

The early payment in August will not disqualify you, but be careful if your state requires income reporting. List the September SSI payment as income for September—even if it arrives in August.

What About Children, Veterans, or Payees?

Children Receiving SSI

Over 1 million U.S. children receive SSI for qualifying disabilities. They will also receive both August payments as scheduled.

Veterans

Some veterans qualify for both VA disability and SSI. Payments follow the same rules. Receiving two SSI payments in August is normal and will not impact VA benefits.

Representative Payees

If you manage benefits for someone else, you will receive both deposits in the managed account. Be sure to record both properly and maintain receipts for how the funds are used

Glossary: SSI Terms Made Simple

SSI (Supplemental Security Income): Federal program providing monthly payments to low-income people who are aged, blind, or disabled.

SSA (Social Security Administration): The federal agency that manages SSI, SSDI, and retirement benefits.

COLA (Cost-of-Living Adjustment): Yearly adjustment to benefits based on inflation.

Essential Person: Someone who lives with and cares for an SSI recipient.

Representative Payee: A person or organization managing SSI payments on behalf of another recipient.

What’s Inside the New “Big, Beautiful Bill” That Could Transform Social Security Forever