$2,000 Social Security Payments Arriving in 4 Days: If you or a loved one are receiving Social Security, listen up: $2,000 Social Security payments are arriving in just 4 days—on July 9, 2025. This upcoming payment cycle affects millions of retirees, SSDI recipients, and survivors across the United States. It’s not a special one-time bonus check—but it is an important monthly benefit boosted by the 2025 Cost-of-Living Adjustment (COLA). Whether you depend on your Social Security check for rent, groceries, or just peace of mind, this guide breaks down everything you need to know. We’ll explain who qualifies, how much you might receive, what you need to do right now, and what to expect in the months ahead.

$2,000 Social Security Payments Arriving in 4 Days

With $2,000 Social Security payments arriving July 9, 2025, now is the time to get your paperwork in order. This isn’t a bonus check—it’s part of your regular, hard-earned retirement or disability benefit, slightly increased due to inflation. If your birthday falls between the 1st and 10th, and you started receiving benefits after May 1997, this payment wave is for you. Check your account, confirm your payment, and use your benefits wisely. In times of rising costs, smart money habits and timely info are your best allies.

| Key Information | Details |

|---|---|

| Payment Date | Wednesday, July 9, 2025 |

| Who Qualifies | Retirees, SSDI, and survivor beneficiaries born between 1st–10th of the month and filed after May 1, 1997 |

| Average Monthly Benefit (May 2025) | $1,903 (SSA data) |

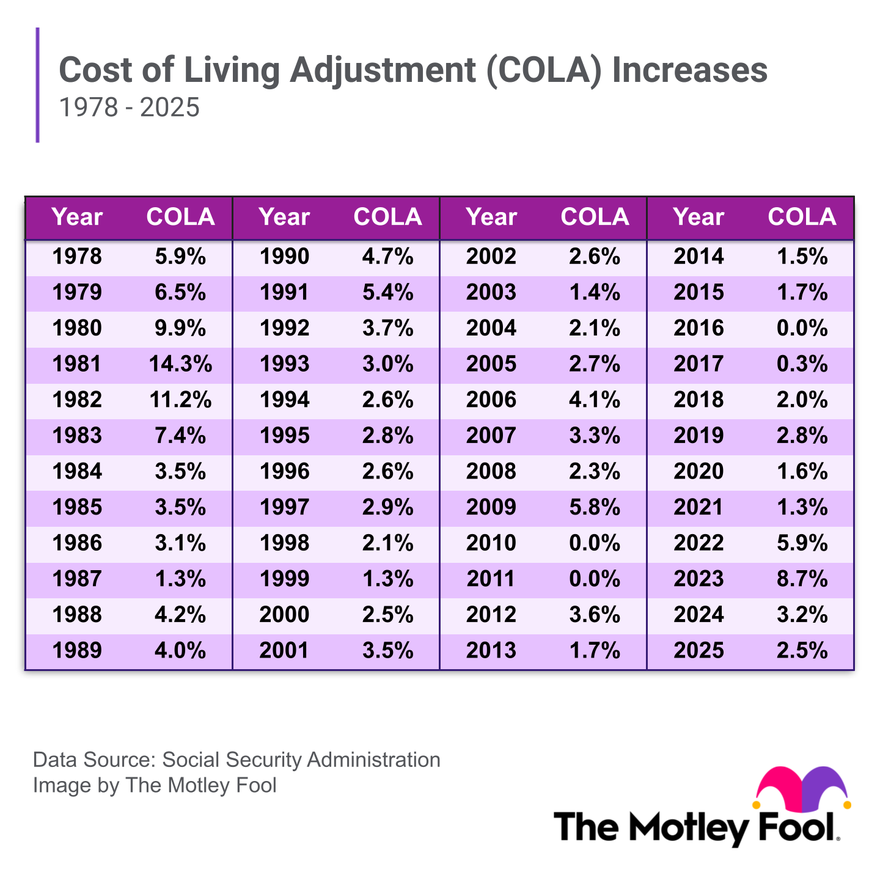

| 2025 Cost-of-Living Adjustment (COLA) | 2.5% increase |

| SSI Recipients | Paid separately on July 1, 2025 |

| What to Do Now | Check mySocialSecurity.gov, confirm banking info, know your pay date |

| Official Reference | ssa.gov |

Why This Month’s Payment Is Getting Attention?

The upcoming July 9, 2025 payment is part of the regular Social Security schedule but has drawn attention because it reflects this year’s 2.5% COLA increase. With inflation eating into household budgets, every bump in income counts.

According to the Social Security Administration (SSA), the average retired worker receives about $1,903 per month as of May 2025. For higher earners or couples, that amount can reach or exceed $2,000 monthly. So, if you’ve heard the buzz about $2,000 checks, it’s not hype—it’s based on updated COLA data and real average benefits being paid now.

Who Gets Paid on July 9, 2025?

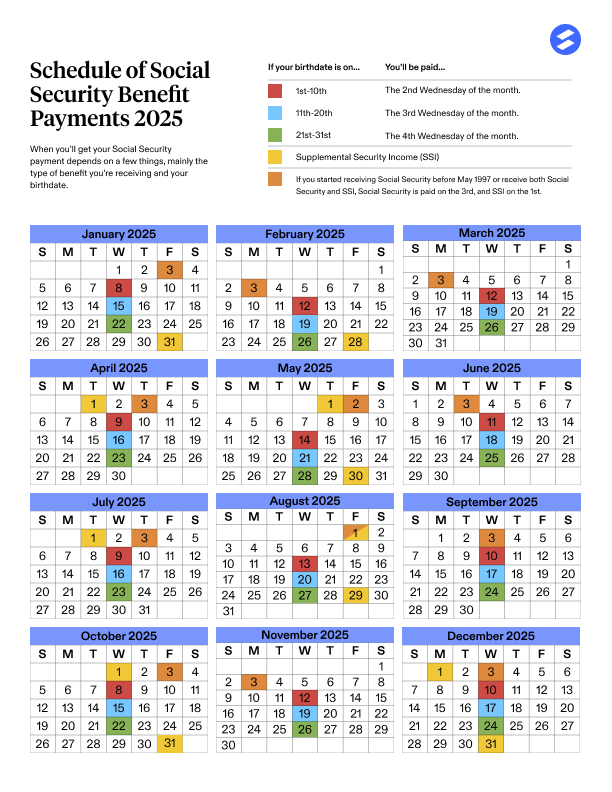

Not everyone receives Social Security on the same day. The payment schedule depends on when you were born and when you started receiving benefits.

Here’s who will receive their July payment on Wednesday, July 9, 2025:

- You were born between the 1st and 10th of any month

- You began receiving benefits after May 1997

- You currently receive retirement, disability (SSDI), or survivor benefits

If you receive SSI (Supplemental Security Income) only, your payment already arrived on July 1. SSI follows a separate calendar, and these mid-month payments do not apply to you unless you also receive other Social Security benefits.

Understanding the Social Security Payment Schedule

The SSA has a rolling payment calendar:

- Born on 1st–10th: Paid on the 2nd Wednesday

- Born on 11th–20th: Paid on the 3rd Wednesday

- Born on 21st–31st: Paid on the 4th Wednesday

But this only applies if you started receiving benefits after May 1, 1997. If you started before that date, your benefit usually arrives on the 3rd of the month, regardless of birth date.

This structure helps the SSA manage payment processing and bank systems, reducing the chance of overload or error.

How Much Will You Receive?

Your monthly benefit is unique and depends on:

- Your 35 highest-earning years

- Your age at retirement

- COLA adjustments

- Marital or survivor benefits

In May 2025, the average monthly retirement benefit was $1,903, up from $1,783 in January 2024. This reflects the 2.5% COLA, which applies to both Social Security and SSI recipients.

High earners who delayed retirement until age 70 may receive more than $4,000 monthly, while early filers (age 62) often receive less than $1,500. Survivor and spousal benefits vary depending on eligibility.

Real-Life Example

Let’s say Sam, a 69-year-old retiree from North Carolina, worked for 40 years earning above-average wages. He claimed benefits at his full retirement age of 67. Before the COLA increase, his monthly check was $1,950. After the 2.5% increase, his July check will be approximately $1,998.75—almost $2,000.

His wife Lisa, who never worked outside the home, receives spousal benefits equal to 50% of Sam’s amount, or about $999.38 monthly.

Together, they’re receiving nearly $3,000 per month—just from Social Security.

How to Confirm Your Eligibility and Payment Date

To confirm your upcoming payment:

- Log in to mySocialSecurity.gov

- Click on “Benefits and Payments”

- View your payment schedule and amount

- Confirm or update your bank routing number

- Download your benefit verification letter if needed

If anything looks off—such as a misspelled name, outdated bank info, or a missing benefit record—correct it ASAP through your online account or call SSA at 1-800-772-1213.

Tax Considerations: Will You Owe the IRS?

Surprisingly, Social Security benefits may be taxable. It depends on your total income—including pensions, savings, investments, and part-time work.

You might owe taxes if:

- You’re single and your combined income exceeds $25,000

- You’re married (filing jointly) and your combined income exceeds $32,000

If you’d like to avoid a tax bill later, you can have SSA withhold federal taxes by submitting Form W-4V.

What to Do If Your Payment Is Late?

Missing a payment can be stressful, but don’t panic. Here’s what to do:

- Wait three business days after July 9 before taking action.

- Check with your bank to see if the funds are in a holding queue.

- Log in to your SSA account to confirm your payment was issued.

- Contact the SSA by calling 1-800-772-1213 if nothing shows by July 14.

Common causes for delays include bank account changes, outdated mailing addresses, or suspended payments due to ineligibility or failed contact verification.

What If You Need More Income?

Sometimes, Social Security alone doesn’t cut it. If you’re struggling, consider:

- Applying for Supplemental Security Income (SSI) if you’re below income thresholds

- Exploring state-level senior assistance programs like food stamps or Medicaid

- Consulting a financial advisor about annuities or part-time work

- Using reverse mortgages (cautiously) if you own your home

- Checking eligibility for energy or utility bill assistance

Tips for Using Your $2,000 Social Security Payments Arriving in 4 Days Wisely

Receiving nearly $2,000 per month is a blessing—but only if you use it wisely. Here’s how to make it go further:

- Set up autopay for essential bills like rent, utilities, and insurance.

- Keep an emergency fund equal to 1–2 months of benefits.

- Use a budgeting app like YNAB or EveryDollar to track spending.

- Avoid payday loans or high-interest credit cards.

- Ask for senior discounts on transportation, healthcare, and shopping.

- Sign up for Medicare Advantage or supplemental plans to reduce medical costs.

Future Outlook: What to Expect in 2026 and Beyond

While the 2025 COLA was set at 2.5%, inflation may rise or fall in the coming years. Social Security COLA updates are announced each October for the following year.

Here’s what retirees should watch for:

- 2026 COLA announcement in October 2025

- Potential policy changes regarding Social Security funding

- Discussions around raising the Full Retirement Age (FRA)

- Expansion of means-tested programs like SSI or Medicare Part D

Why Some Social Security Recipients Might See Their Payments Slashed by 50%

Trump’s New Tax Bill Could Reshape How Social Security Benefits Are Taxed

Trump’s Claim That His Bill Ends Social Security Taxes Debunked by Experts