Trump’s Big Beautiful Bill Promises to End Social Security Taxes: “No more taxes on Social Security!” That’s the campaign promise behind Donald Trump’s latest legislative push — the Big Beautiful Bill. Announced in mid-2025, the bill claims to remove a major burden from seniors by supposedly ending the taxation of Social Security benefits. But does it really deliver on that promise? The short answer: not exactly.

Although the bill brings real tax relief for many retirees, it doesn’t fully eliminate federal taxes on Social Security income. In fact, millions of seniors will still owe taxes under the new rules. Critics argue that the bill’s marketing is more about gaining political favor than offering comprehensive reform. Let’s break it all down in a way that’s easy to understand — whether you’re 10 years old or managing a retirement portfolio.

Trump’s Big Beautiful Bill Promises to End Social Security Taxes

Trump’s Big Beautiful Bill may be a political crowd-pleaser, but it falls short of its headline promise. Yes, it offers real tax relief to many seniors — particularly middle-income retirees who still owe federal income tax. But the bill does not eliminate the tax, nor does it solve Social Security’s deeper problems. With a $30 billion annual price tag and no replacement revenue stream, the bill may further weaken the program it’s trying to help. That makes it a short-term win with long-term consequences. Whether you’re preparing your taxes or planning your retirement, this bill is a reminder that policy details matter — and that understanding what’s in a law is more important than how it’s branded.

| Feature | Details |

|---|---|

| Bill Name | Big Beautiful Bill |

| Claim | Ends taxes on Social Security benefits |

| Actual Policy Change | Introduces a $6,000 individual / $12,000 couple deduction for taxpayers age 65+ |

| Primary Beneficiaries | Retirees with moderate to high income |

| Remaining Taxpayers | ~24 million Americans still taxed on benefits |

| Estimated Cost to Government | ~$30 billion per year in lost tax revenue |

| Projected Impact on Social Security Trust Fund | Speeds up insolvency from 2033 to 2032 |

| Fact-Checker Verdict | “Mostly False” – PolitiFact |

| Official Bill Resource | Congress.gov – H.R.8452 |

What the “Big Beautiful Bill” Actually Does?

Despite headlines suggesting that all taxes on Social Security are gone, this bill doesn’t actually remove the tax. Instead, it introduces a new standard deduction specifically for seniors:

- $6,000 per individual age 65 and older

- $12,000 per married couple if both are over 65

This deduction reduces a retiree’s taxable income, which in turn may eliminate or reduce the portion of Social Security benefits that are subject to taxation. But the key point is that the tax itself still exists — it’s just that fewer people will end up paying it.

So, is this a tax break? Yes.

Is it a full repeal? No.

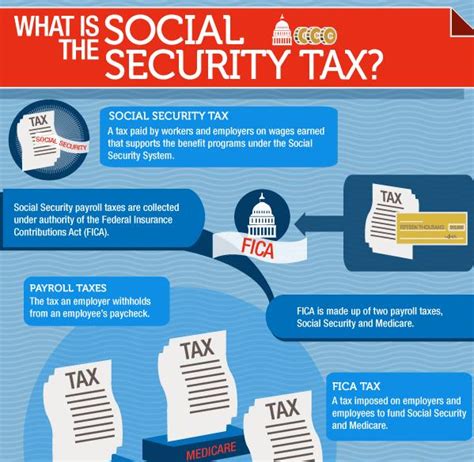

How Social Security Taxes Work (And Why They Exist)?

To really understand the bill, it helps to know how Social Security benefits are taxed in the first place.

Originally, Social Security was tax-free when it was created in 1935. But in the early 1980s, as the system began to face funding shortfalls, Congress approved measures to tax a portion of benefits to support the Social Security Trust Fund.

Today, up to 85% of your Social Security benefits can be subject to federal income tax — but only if your combined income exceeds certain thresholds.

Current Income Thresholds

| Filing Status | Combined Income | Taxable Portion |

|---|---|---|

| Single | Under $25,000 | 0% |

| Single | $25,000–$34,000 | Up to 50% |

| Single | Over $34,000 | Up to 85% |

| Married (Joint) | Under $32,000 | 0% |

| Married (Joint) | $32,000–$44,000 | Up to 50% |

| Married (Joint) | Over $44,000 | Up to 85% |

Combined income = Adjusted Gross Income + Nontaxable Interest + 50% of Social Security benefits.

Who Actually Benefits from the New Deduction?

The new senior deduction helps certain groups more than others. Let’s look at who gains the most:

Major Winners:

- Moderate-income retirees who are just above the current tax threshold.

- Retirees with part-time jobs or pensions in addition to Social Security.

- Upper-middle-class seniors who pay federal taxes but are not in the top income brackets.

Who Gains Little or Nothing:

- Low-income seniors who already pay zero tax — the deduction doesn’t help them further.

- High-income retirees — some still exceed the threshold even with the deduction.

- Disabled workers under 65 — the deduction doesn’t apply until age 65.

A Real-Life Example:

Linda is 70 years old and earns $18,000 per year from Social Security and $12,000 from a small pension. Before this bill, she had to pay tax on about half her Social Security. With the new $6,000 deduction, her taxable income drops low enough that she now owes zero federal income tax.

But Mike, a retired attorney earning $95,000 from pensions and investments, still pays tax on 85% of his Social Security, even with the deduction.

What Do Experts Say?

Not everyone is clapping for this tax change.

Maya MacGuineas, President of the Committee for a Responsible Federal Budget, says:

“The deduction may help retirees in the short term, but it’s an empty promise in the long run. It speeds up the collapse of Social Security’s trust fund without solving the underlying revenue issue.”

Andrew Biggs, a conservative economist, noted:

“It’s a sugar high. Politically popular but fiscally reckless if it’s not paired with reforms or new funding sources.”

The Bigger Picture: Social Security’s Financial Future

The Social Security Trust Fund is not in good shape. According to the Social Security Administration’s 2025 Trustees Report, the fund will run out of reserves by 2033. After that, benefits may automatically be cut by 23–25% unless Congress acts.

The Big Beautiful Bill is estimated to cost the federal government $30 billion annually in lost tax revenue. Without a plan to make up for that revenue, this deduction could:

- Bring forward the insolvency date to 2032

- Worsen the long-term deficit

- Increase pressure for benefit cuts or higher payroll taxes

So while retirees benefit now, younger generations may face reduced benefits or increased taxes down the line.

How to Take Advantage of Trump’s Big Beautiful Bill Promises to End Social Security Taxes

Step 1: Confirm Your Age

You must be 65 or older during the tax year to qualify for the new deduction.

Step 2: Recalculate Your Taxable Income

Subtract the deduction from your Adjusted Gross Income (AGI) to see if your income falls below the taxable threshold for Social Security.

Step 3: Use Available Tools

- IRS Tax Withholding Estimator: irs.gov

- My Social Security Account: ssa.gov

- Free tax help for seniors: AARP Foundation Tax-Aide

Historical Context: What Past Presidents Did

This isn’t the first time a president tried to shake up Social Security taxation.

- Ronald Reagan (1983): Allowed up to 50% of benefits to be taxed.

- Bill Clinton (1993): Increased it to up to 85% for high-income seniors.

- Barack Obama (2009–2016): Proposed raising the cap on taxable wages.

- Donald Trump (2020): Temporarily deferred payroll taxes during COVID-19, though the program was never made permanent.

Now, with this deduction, Trump aims to court senior voters again — but without the structural changes needed to protect the program’s future.