The 2025 Trustees Report Just Dropped: Every July, we get a financial check-up from the folks who oversee America’s biggest safety nets: Social Security and Medicare. This year’s exam — The 2025 Trustees Report — just dropped, and the prognosis isn’t great. Whether you’re 25 or 75, this report affects your future. If you’re working, it’s about what you’ll receive when you retire. If you’re already retired, it’s about whether your checks keep coming — and how much you’ll get. This isn’t some dry government memo you can ignore. It’s a blueprint for your future paychecks, your healthcare access, and your financial stability. And if you’ve been counting on Social Security as a key part of your retirement plan, you need to know what’s coming — and fast. Let’s dive into what this report really says, why it matters, and what you can do about it today.

The 2025 Trustees Report Just Dropped

The 2025 Trustees Report makes one thing clear: Social Security and Medicare are facing real, solvable problems — but the clock is ticking. If Congress acts soon, the fixes can be relatively small. If they wait until the last minute, the cuts or taxes will have to be much larger. No matter your age, now’s the time to take control of your financial future. Understand your benefits, save more, and demand accountability from those in power. This system was built to protect every American. It’s up to us to protect it in return.

| Key Point | Details |

|---|---|

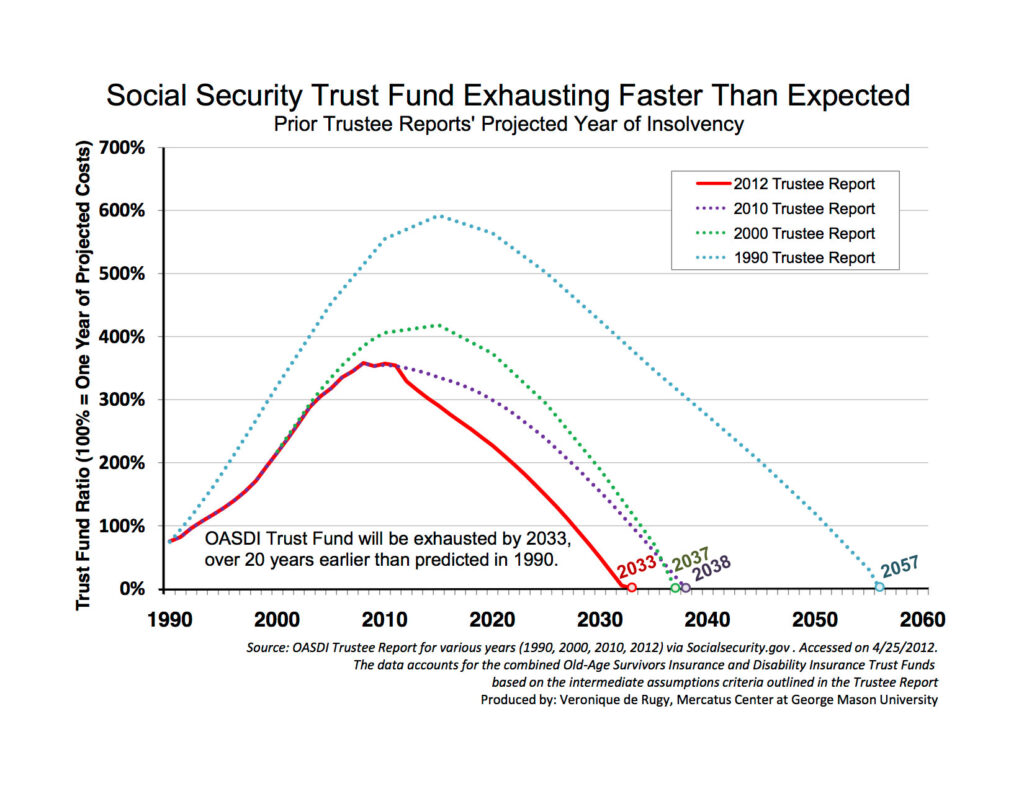

| OASI Trust Fund Insolvency | Projected for 2033 |

| Combined OASDI Insolvency | Expected by 2034 |

| Post-depletion Benefit Cut | About 23% reduction |

| Disability Insurance Trust Fund | Solvent through at least 2099 |

| Medicare Part A Insolvency | Expected in 2033 |

| Long-Term Shortfall | 3.82% of taxable payroll (~$25–26 trillion) |

| Official Report | Social Security Trustees Report 2025 |

What Is the Trustees Report?

The Trustees Report is an annual document released by the Social Security Administration (SSA) and the Centers for Medicare and Medicaid Services (CMS). It’s not just another government report—it’s the financial roadmap for Social Security and Medicare.

Every year, it answers questions like:

- Can we pay future retirement benefits?

- Will there be enough money for Medicare services?

- What needs to be fixed to avoid cuts?

This year’s report paints a familiar — and increasingly urgent — picture: without legislative action, key parts of Social Security and Medicare will be unable to meet full benefit obligations within the next decade.

What’s Social Security Again?

In simple terms, Social Security is a federal insurance program. It provides financial support to three main groups:

- Retirees aged 62 or older

- Disabled individuals unable to work

- Survivors and dependents of deceased workers

Funded by payroll taxes — 12.4% split between employee and employer — Social Security isn’t a savings account. Instead, today’s workers pay for today’s retirees. That system works when there are more workers than retirees. But today, that ratio is shrinking fast.

In the 1950s, there were 16 workers per retiree. In 2025, it’s closer to 2.7. That gap creates a funding shortfall.

What’s Actually in the The 2025 Trustees Report Just Dropped?

Here’s what the 2025 Trustees Report found:

- The Old-Age and Survivors Insurance (OASI) Trust Fund, which pays retirement and survivor benefits, will be depleted in 2033.

- The Disability Insurance (DI) Trust Fund is better off, projected to stay solvent through 2099.

- If the OASI and DI funds were combined, the system could pay full benefits until 2034, then drop to about 81% of scheduled benefits.

- Medicare Part A, which covers hospital insurance, will also run out in 2033.

If nothing changes, Social Security would have to cut benefits across the board by about 23% starting in 2034. That means someone expecting $1,800 a month could receive only about $1,380.

What’s Causing the Problem?

1. Demographics Are Shifting

The U.S. population is aging fast. Baby Boomers are retiring at a rate of about 10,000 per day. At the same time, birth rates are declining, meaning fewer workers are contributing taxes to the system.

2. People Are Living Longer

Longevity is a good thing, but it also means the government must pay benefits for a longer period. That stretches the Social Security trust fund further than it was designed to go.

3. Revenue Limits

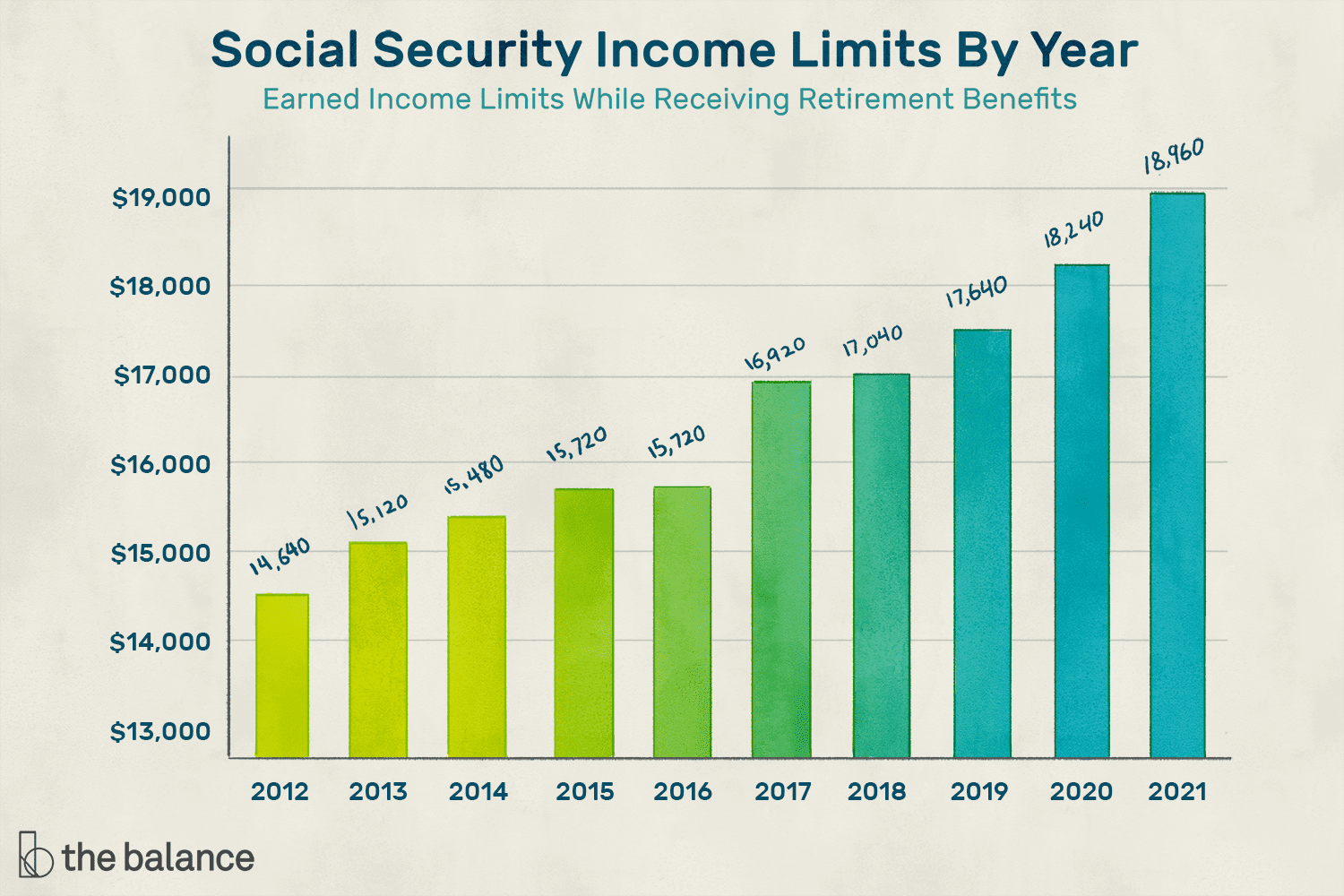

Social Security taxes only apply to earnings up to a certain amount — $168,600 in 2025. Earnings above that aren’t taxed for Social Security purposes, meaning high earners stop contributing early in the year.

4. Legislative Changes

The Social Security Fairness Act passed in late 2024 eliminated the Windfall Elimination Provision (WEP) and Government Pension Offset (GPO). While these changes increased fairness for some retirees, they also added long-term costs to the system.

What Happens If Congress Does Nothing?

This is the key issue. If lawmakers don’t act, then:

- Retirees in 2034 and beyond will get only about 77 cents on the dollar.

- The government would be legally prohibited from borrowing to make up the difference.

- Medicare recipients may see 11% automatic cuts in hospital coverage.

And if you’re younger? Expect a smaller safety net unless major changes are made soon.

What Could Be Done to Fix It?

Thankfully, Social Security can be saved — but the solutions will require tough choices.

Option 1: Raise or Remove the Payroll Tax Cap

Right now, income above $168,600 isn’t taxed for Social Security. Removing this cap would force high earners to pay more.

Estimated impact: Restores up to 70% of the shortfall.

Option 2: Increase Payroll Tax Rates

Raising the current 12.4% payroll tax (split between worker and employer) to 15% could close the gap entirely.

Estimated impact: Solves 100% of funding issue over 75 years.

Option 3: Raise the Full Retirement Age

Currently, full retirement age is 67 for people born after 1960. Increasing it gradually to 68 or 69 would reduce outflows.

Downside: This disproportionately affects lower-income workers and manual laborers who may not be able to work longer.

Option 4: Reduce Benefits for High-Income Retirees

This “means testing” idea would scale back benefits for wealthier retirees while protecting lower-income recipients.

Option 5: Use a Mix of All the Above

Many bipartisan reform proposals — like the Simpson-Bowles Plan or the Social Security 2100 Act — recommend a blend of tax increases and benefit adjustments.

How Are Different Generations Affected?

Baby Boomers (Born 1946–1964)

Most are already retired or close to it. They’re unlikely to face benefit cuts if Congress acts quickly.

Generation X (Born 1965–1980)

Next in line for retirement. This group may face modest changes, such as a higher retirement age or smaller cost-of-living adjustments.

Millennials (Born 1981–1996)

Millennials may have to pay more in and receive less out unless reforms are passed. Financial planners recommend increasing private savings through 401(k)s and Roth IRAs.

Gen Z (Born 1997–2012)

For young workers, Social Security will still exist — but supplemental savings will be critical. Compound interest is on your side if you start early.

Real-Life Scenario

Let’s say Jane is 45 and earns $70,000 a year. She expects to retire at 67 and receive $2,200/month from Social Security. If no changes are made and she retires in 2047, her monthly check could drop to about $1,700.

That’s a loss of $6,000 per year — not because she did anything wrong, but because Congress failed to fix the system.

What Should You Do Now?

Here’s how to get ahead of the curve — regardless of your age or career.

- Check Your Social Security Statement

Create a free account at SSA.gov/myaccount to view your earnings and projected benefits. - Boost Private Retirement Savings

Start (or increase) contributions to a 401(k), IRA, or brokerage account. Aim to replace 70-80% of your income in retirement. - Stay Informed

Follow developments in Congress. Support proposals that strengthen the program long-term. - Talk to a Financial Advisor

A certified financial planner can help you run projections and adjust your savings goals accordingly. - Contact Your Representatives

Call or write your lawmakers to push for reform. Every year of delay makes the problem harder to fix.