Social Security Recipients Might See Their Payments Slashed by 50%: If you’re receiving Social Security and noticed a serious dip in your monthly check—or got a surprising letter from the Social Security Administration (SSA)—you’re not alone. Starting in 2025, a major policy change is shaking up retirement, disability, and survivor benefits. Some recipients are seeing up to a 50% cut in their monthly benefits. And no, this isn’t due to budget cuts, fraud, or a clerical error on your part. It’s happening because of something most folks didn’t even realize was building up for years: SSA overpayments.

Social Security Recipients Might See Their Payments Slashed by 50%

This Social Security policy change is real, it’s widespread, and it’s affecting some of the most vulnerable Americans. If you’re facing a 50% cut in benefits due to an SSA overpayment claim, remember: you have options. You can appeal, negotiate a lower rate, or even get the debt waived altogether. But the key is to act quickly and document everything. The sooner you respond, the better your chances of keeping your monthly income intact.

| Key Info | Data / Insights |

|---|---|

| Issue | Social Security payments cut by up to 50% due to overpayment recovery |

| People Affected | Over 2 million recipients impacted by new withholding rules |

| Start Date | April 25, 2025 – New notices issued under the updated policy |

| Type of Benefits Impacted | Title II: Retirement (SS), Disability (SSDI), Survivor Benefits |

| Withholding Limit | 50% of monthly benefits (up from the previous 10% limit) |

| Response Deadline | 90 days from the date on your overpayment notice |

| How to Respond | Appeal the overpayment, request a waiver, or apply for a reduced monthly deduction using official SSA forms |

| SSA Official Website | https://www.ssa.gov |

What’s the Real Story Behind the 50% Benefit Cut?

Let’s start with the basics. The SSA provides monthly income to retirees, people with disabilities, and surviving family members of deceased workers. Millions of Americans rely on these payments to stay afloat—paying for food, housing, medical bills, and essentials.

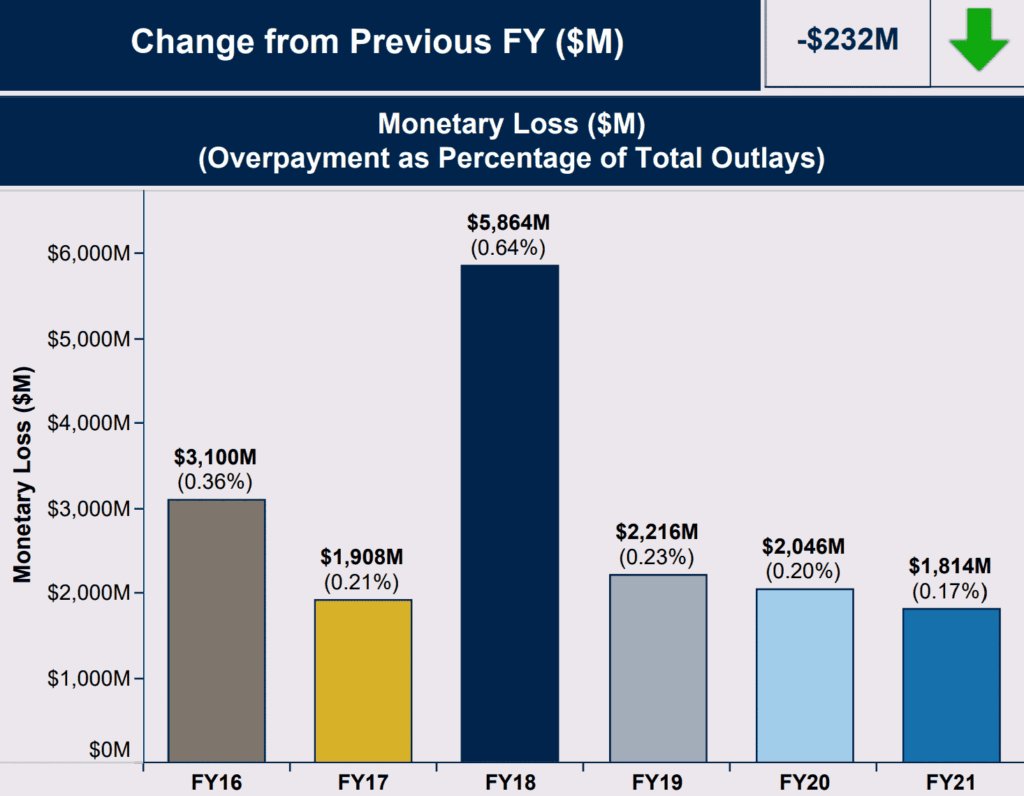

But what many recipients didn’t know is that for years, the SSA has been overpaying benefits due to administrative mistakes, delays in processing income updates, and flawed internal systems. According to the SSA Office of the Inspector General, between 2015 and 2022, over $72 billion in overpayments were issued, and more than $23 billion remains unpaid as of early 2025.

Now, the SSA is trying to collect. Starting April 25, 2025, the agency began sending overpayment notices under a new policy that allows them to withhold up to 50% of monthly Social Security (Title II) benefits.

Why the Sudden Social Security Recipients Might See Their Payments Slashed by 50% Change?

Previously, when someone was overpaid, SSA typically withheld 10% of their monthly benefit until the debt was repaid. That was the standard—even if the error wasn’t the recipient’s fault.

But in early 2025, the SSA announced a rule change, increasing the maximum withholding to 50%—a move that stunned both seniors and advocacy groups. In fact, the original proposal was to allow 100% garnishment, but after public backlash, the agency dialed it back to 50%.

According to the SSA, this change was necessary to help “ensure program integrity.” But critics argue it’s an unfair burden to place on people who depend on every penny of their monthly check—especially when many overpayments were caused by government errors.

How Overpayments Happen: It’s Not Always Your Fault

Overpayments can happen for several reasons:

- Delayed processing of income updates or work activity

- Missed or inaccurate disability reviews

- Errors when calculating benefits for spouses or survivors

- System lags in reflecting life changes (like marriage, divorce, or death of a spouse)

In many cases, recipients had no way of knowing they were being overpaid—sometimes for years. The overpayment is often discovered only after a system review or audit.

That means someone could have unknowingly received “extra” money, spent it on rent, food, or bills, and is now being told to pay back thousands of dollars—with half their income on the line.

Real-Life Stories Show the Strain

Consider this example:

Jim, a 66-year-old retiree from Ohio, received a letter saying he was overpaid $9,800 between 2020 and 2023. The cause? A delayed update when he took on a part-time job for six months. “I reported it,” he said. “They told me it wouldn’t affect my check. Now they say it did—and want me to pay it all back.”

Maria, a 51-year-old on SSDI in California, had her benefit slashed from $1,400 to $700 without warning. She later found out the SSA had mailed an overpayment letter to her old address, which she had updated online a year earlier.

These aren’t isolated cases. In fact, the SSA Inspector General reports that 1 in 10 overpayment notices involve recipients who had no prior warning before garnishment began.

Step-by-Step: What You Can Do If You Receive a Notice

Step 1: Read the Letter in Full

SSA will send a written notice explaining:

- The amount of the overpayment

- The date range it covers

- The reason for the overpayment

- The actions they plan to take (e.g., 50% withholding)

Step 2: Mark Your Calendar

You have exactly 90 days from the date on the notice to respond before deductions begin. Do not miss this window. It’s your best shot to appeal, ask for help, or set up a lower payment plan.

Step 3: Choose Your Response Option

A. Request a Waiver

If the overpayment was not your fault and repaying it would cause financial hardship, you can request a waiver using SSA Form SSA-632-BK. If approved, you won’t have to pay anything back.

B. Ask for a Lower Withholding Rate

If the 50% cut is too much, you can request smaller monthly deductions with SSA Form SSA-634. Provide documentation of your monthly expenses, income, and any hardship you’re facing.

C. Appeal the Overpayment Decision

You can challenge the accuracy of the overpayment claim using SSA Form SSA-561. Maybe they miscalculated, or maybe your income was reported correctly. Either way, you have the right to ask for a full review.

How to Submit Your Forms?

- Online: If you have a My Social Security account, you can submit most forms electronically.

- By Mail: Send your completed forms to the address on your notice. Make copies and get proof of delivery.

- In Person: Visit your local SSA office.

If possible, get help from a legal aid agency, nonprofit, or social worker.

Will This Affect My Medicare or Taxes?

Here’s what stays the same:

- Medicare premiums are still deducted from your gross benefit amount. The SSA withholding won’t affect eligibility or Part B/C premiums.

- Income taxes on Social Security are calculated based on your total benefit, not the reduced amount after withholding.

So while you may receive less in hand, your benefit on paper hasn’t changed. That means your tax liability might not decrease, even if your actual spending money does.

Government Response and Public Backlash

The 50% policy sparked immediate concern on Capitol Hill and among advocacy groups.

A bipartisan group of lawmakers in Congress has since called on SSA to pause collections and conduct case-by-case reviews before garnishing benefits. Some have proposed legislation to limit withholding to no more than 10% unless a beneficiary agrees to more.

Meanwhile, several watchdog groups argue that SSA’s tech systems and staffing levels are too outdated to manage these recoveries fairly. In some cases, beneficiaries had reported income changes years earlier, but the system didn’t process them until much later.