Centrelink Rules for Caravan and Boat Dwellers in Australia: If you’re living on the road in a caravan, boat, or relocatable home in Australia, you may have questions about how Centrelink’s rules apply to your situation. Whether you’re a Grey Nomad enjoying life on the move, or just someone looking for an affordable living solution, understanding the ins and outs of Centrelink payments and requirements can make a world of difference. In 2025, the government continues to offer support to people living in unconventional homes, but the rules can be a bit tricky to navigate. Let’s break it down and make sure you know exactly where you stand.

Living in a caravan or boat might sound like an adventure, but it’s also a lifestyle that comes with a few unique financial considerations. Centrelink offers a variety of benefits for those in need, from Age Pensions to Rent Assistance. However, there are rules about what counts as your “home” and how your living situation affects your eligibility for these payments. This guide will give you a clear understanding of what you need to know about Centrelink’s rules for people living in mobile homes in Australia, with easy-to-follow steps, examples, and up-to-date advice.

Centrelink Rules for Caravan and Boat Dwellers in Australia

Understanding the Centrelink rules for caravan and boat dwellers in Australia is essential to ensuring that you get the financial support you need. Whether it’s understanding the assets test, applying for Rent Assistance, or keeping Centrelink updated with your living situation, staying informed and following the rules will help make the process smoother. By staying on top of your reporting and knowing what you’re eligible for, you can focus more on enjoying the freedom of your mobile lifestyle.

| Key Point | Detail |

|---|---|

| Assets Test | Your mobile home is generally exempt from the assets test, as long as you don’t own the land or mooring. |

| Rent Assistance Eligibility | Available for those paying site or mooring fees, but not if you own the land or mooring. |

| Maximum Rent Assistance | Single: Up to $184.80; Couple: Up to $174.00, depending on rent paid. |

| Reporting Requirements | Notify Centrelink within 14 days about any changes in your circumstances. |

| Extended Travel | Prolonged absence from your primary home may impact payments. |

Understanding the Centrelink Rules for Caravan and Boat Dwellers in Australia

Before diving into the nitty-gritty of how Centrelink works for caravan and boat dwellers, let’s quickly review what Centrelink is and how it functions in Australia. Centrelink is the government agency responsible for delivering social security payments, including pensions, unemployment benefits, and family support. These payments are designed to help people who are experiencing financial hardship or who need assistance due to age, disability, or other factors.

When it comes to caravans, boats, and other mobile homes, things can get a little complicated. After all, these aren’t typical houses with fixed addresses, so how do you prove that you’re eligible for benefits? The short answer: It depends on your living situation, the type of payments you’re applying for, and how long you’ve been living in your mobile home. But don’t worry, we’ll break it down so you can easily navigate these rules and get the help you need.

How Your Caravan or Boat Affects Your Assets Test?

One of the most important factors in determining your eligibility for Centrelink payments is the assets test. The assets test looks at your property and other financial holdings to see if you have too much wealth to qualify for assistance.

Good news for caravan and boat dwellers: generally, your mobile home is exempt from the assets test, meaning it won’t count as an asset if you’re applying for payments like the Age Pension or Disability Support Pension. So, if you live in a caravan or boat that is your primary place of residence, it won’t automatically disqualify you from receiving financial support. However, there are a few important caveats to keep in mind:

- Own the Land or Mooring?: If you own the land or mooring site where your mobile home is located, then the value of that land may be counted towards your assets. This could affect your eligibility for benefits.

- Rental Situation: If you rent a site at a caravan park or pay mooring fees for your boat, this won’t count against your assets, so long as you don’t own the land. This is crucial for qualifying for certain types of Centrelink support.

Rent Assistance for Caravan and Boat Dwellers

For many people living in caravans, boats, or relocatable homes, one of the key benefits they’re after is Rent Assistance. If you’re paying rent for your site or mooring, you may qualify for financial help through Commonwealth Rent Assistance (CRA).

How does it work?

Rent Assistance helps people who are paying rent for accommodation. But here’s the catch: to be eligible for CRA, you must be renting a site or mooring at a caravan park or marina. If you own the land or mooring, you won’t be eligible. The CRA amount you receive depends on how much you’re paying for rent.

Here’s how CRA payments break down:

- For Singles: If you’re paying more than $389.80 per fortnight for rent, you may qualify for up to $184.80 in CRA.

- For Couples: If you’re paying more than $464.40 per fortnight, the maximum CRA you can receive is $174.00.

It’s important to note that the CRA is designed to help with the cost of rent and does not cover the purchase price or ownership of your mobile home. If you’re living in a caravan park or on a boat that you own, you would only receive CRA if you’re renting the space itself, not the home.

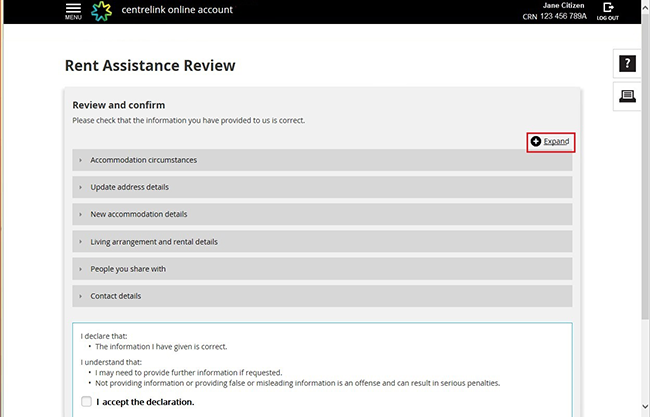

Reporting Your Situation to Centrelink

Now, let’s talk about the responsibilities you have to report to Centrelink. It’s important to keep Centrelink updated about any changes in your circumstances. If you’ve just moved into a new caravan or boat, or if you’ve changed your rent situation, you need to report this to Centrelink within 14 days. Here are some things you need to report:

- Change of Address: If you move to a new site, park, or boat location.

- Changes in Rent: If the amount of rent or mooring fees you pay changes.

- Changes in Your Personal Situation: If you get a new job, or if there’s any change to your relationship status, income, or health.

- Change in Assets: If you sell or acquire any assets, like a new boat or caravan.

If you fail to report these changes, you could face penalties or even overpayments that you’ll have to pay back. Centrelink can help guide you through the process of updating your details, so make sure you keep track of any changes that might affect your benefits.

Extended Travel and Payment Eligibility

One of the trickier aspects of living in a caravan or boat is the issue of extended travel. If you’re on the road for long periods and your caravan or boat becomes your primary home, you might be wondering how that impacts your eligibility for Centrelink payments.

In general, Centrelink has rules that allow people to travel for short periods without losing their benefits. However, if you’re away from your primary residence for more than 12 months, your mobile home might be considered a “secondary residence,” and you could lose your eligibility for some payments, including the Age Pension.

This is something to keep in mind if you’re planning to travel or move locations. Always check in with Centrelink to ensure that you’re still meeting the requirements.