Backdated State Pension Payments: State pension payments are a lifeline for many people in their retirement years. However, millions of individuals in the UK have been underpaid, particularly in recent years, due to various administrative errors. This has led to backdated payments for those who are eligible. If you’re wondering if you qualify for a backdated state pension, this article breaks down everything you need to know. We’ll cover the ins and outs of how to check if you qualify, who is most likely affected, how to claim, and how much you could be owed.

In 2025, thousands of pensioners are still discovering that they are entitled to backdated state pension payments. These payments can range from a few hundred to several thousand pounds, depending on your circumstances. Many people, especially married women and widowed pensioners, have been significantly underpaid due to errors in the system. So, if you think you might have been affected, it’s worth checking. Let’s walk through it step by step.

Backdated State Pension Payments

Backdated state pension payments represent a significant sum for many people in the UK. If you are a married woman, widow, or someone over 80, it’s essential to review your pension records and ensure you’re receiving all the payments you’re entitled to. The DWP is currently in the process of rectifying many of these issues, but if you haven’t heard anything yet, it’s worth checking for yourself. If you believe you’ve been underpaid, don’t wait—contact the DWP today to find out how much you might be owed. And remember, organizations like Age UK and Citizens Advice are here to guide you through the process. Take action now and make sure you’re receiving the pension you deserve!

| Key Point | Details |

|---|---|

| Eligibility Groups | Married women, widows, individuals over 80 |

| Average Back Payment | £5,553 for married women, £11,725 for widows, £2,203 for those over 80 |

| Total Owed | Over £804.7 million identified by DWP |

| Steps to Check | Review pension history, contact DWP, gather documents |

| Important Contact Information | DWP Pension Service: 0800 731 7898 |

| Key Sources | GOV.UK, DWP, Age UK |

Who Is Most Likely Affected by Backdated Payments?

Married Women (Category BL)

A large number of married women in the UK have been significantly underpaid over the years. This issue arises when a woman’s pension entitlement is based on her husband’s National Insurance record. Specifically, if you are a married woman and you were entitled to 60% of your husband’s basic State Pension, you may not have received the correct amount. This could be due to the DWP’s failure to automatically apply the uplift.

According to reports, on average, married women affected by this underpayment could be owed around £5,553 in backdated payments. If this sounds like you or someone you know, it’s essential to check your State Pension records.

Widowed Pensioners

Many widowed pensioners have also been underpaid because their pensions were not properly reassessed to reflect their deceased spouse’s entitlements. The pension should be recalculated to reflect what you would have received if your spouse were still alive. Unfortunately, due to administrative errors, these recalculations were often overlooked.

On average, widows could be owed approximately £11,725 in backdated payments, depending on how long the error persisted. The underpayment could go back for years, so if you’re a widow, it’s crucial to check if your pension has been adjusted properly.

Individuals Over 80 (Category D)

People who are 80 or older are entitled to a minimum pension under the rules of the State Pension Payment system, regardless of their National Insurance contributions. However, some of these individuals missed out on the additional payments they were owed. For individuals over 80, this mistake may mean they were denied extra top-ups that should have been added to their pension.

For those affected, the average back payment is £2,203, but this can vary. If you fall into this category, it’s worth reviewing your pension details to ensure you’re receiving all the benefits you’re entitled to.

How to Check If You Qualify for Backdated State Pension Payments?

Step 1: Review Your Pension History

Before contacting the Department for Work and Pensions (DWP), it’s a good idea to review your State Pension records. You can do this by requesting your State Pension statement, which will give you an overview of how much you’re currently receiving and whether there are any discrepancies.

How to Check:

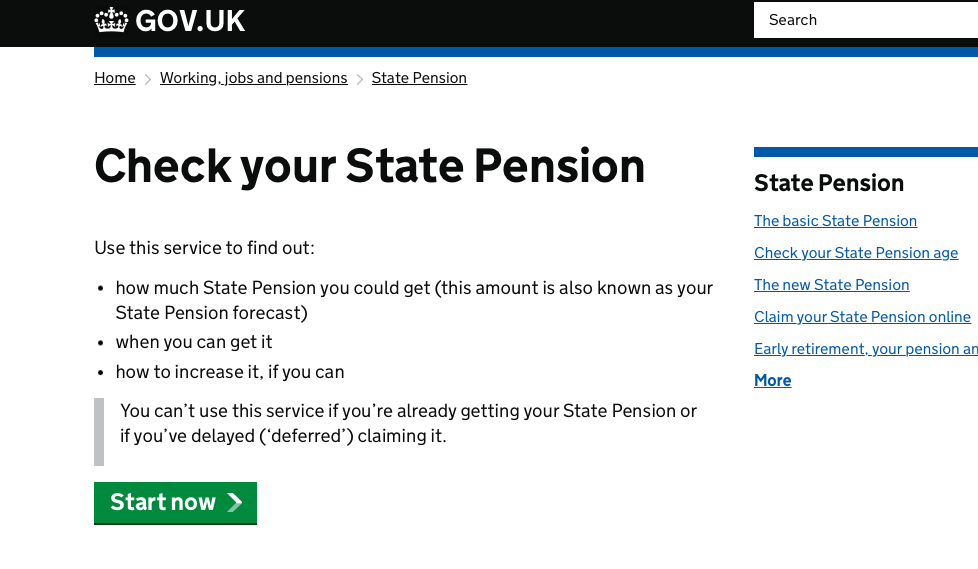

- Visit the GOV.UK State Pension page.

- You can also check if you’re on track to get the full State Pension by using their online tools.

If you’re a married woman, widow, or over 80, pay close attention to the details of your pension to see if you should be receiving more.

Step 2: Contact the DWP Pension Service

Once you’ve reviewed your pension history and believe you may be entitled to backdated state pension payments, contact the DWP Pension Service. They can help you understand if you qualify for any additional payments and guide you through the process.

Contact Info:

- Call the Pension Service at 0800 731 7898 for those in the UK.

- For those living abroad, call the International Pension Centre at +44 191 218 7777.

Make sure to have all relevant documents ready, such as your National Insurance number, marriage certificate (if applicable), and your spouse’s pension information (for widows). This will help speed up the process.

Step 3: Gather Documents

When contacting the DWP, you’ll need to provide a few key documents to support your claim. These could include:

- Your marriage or civil partnership certificate if you’re a married woman.

- Your spouse’s death certificate and any related pension information if you’re a widow.

- Your National Insurance number and any previous pension paperwork you’ve received.

The more documents you have, the easier it will be for the DWP to verify your claim.

Step 4: Seek Assistance If Needed

Navigating through the State Pension Payment system can be tricky, especially if you’re dealing with backdated payments. Fortunately, there are organizations that can help you along the way. Age UK, Citizens Advice, and other support groups offer assistance in understanding your entitlement and filing claims.

How Much Could You Be Owed?

Depending on your situation, backdated state pension payments can vary widely. Let’s break down the average amounts owed:

- Married Women (Category BL): £5,553 – Many women didn’t receive the uplift from their spouse’s National Insurance contributions.

- Widows: £11,725 – A common issue for widowed pensioners is the failure to adjust pensions after the death of a spouse.

- Individuals Over 80 (Category D): £2,203 – This is for individuals who missed out on their minimum pension top-up.

If you fall into one of these groups, it’s important to act quickly to secure any payments you may be owed. In some cases, individuals have received up to £12,000 in backdated payments.