UK’s Retirement System Faces Pressure: The UK’s retirement system is facing significant pressure. With an aging population, rising life expectancy, and a shrinking workforce, the government may have no choice but to raise the state pension age yet again. The current pension system, while providing support for retirees, is being pushed to the limit. In this article, we will break down why this issue is so pressing, what the potential consequences could be, and why raising the pension age is becoming a likely solution. Let’s dive into the details.

UK’s Retirement System Faces Pressure

The pressure on the UK’s retirement system is undeniable. As the population ages and fewer people contribute to the system, the government faces difficult decisions. Raising the pension age is one option, but it’s crucial that it is done in a way that supports older workers and accounts for health disparities. By making smart, gradual changes, the government can ensure that the system remains viable for future generations. This issue may be complex, but with the right policies, the UK can maintain a strong and fair pension system for all.

| Key Point | Details |

|---|---|

| Aging Population | By 2050, one in four people in the UK will be over 65, significantly increasing the dependency ratio. |

| Rising Life Expectancy | Life expectancy has been increasing, with people living longer and claiming pensions for more years. |

| Workforce Participation | The working-age population is shrinking, with fewer people contributing to the pension system due to declining birth rates. |

| State Pension Costs | State pension expenditure in 2024-25 is projected at £165.9 billion, with £137.5 billion allocated to pensions alone. |

| Health and Economic Factors | Disparities in health and economic conditions affect the ability of older workers to continue in the workforce, which raises concerns about extending pension ages. |

Understanding the Pressure on the UK’s Retirement System

In simple terms, the UK’s retirement system is under a lot of stress right now. As people are living longer, the number of individuals relying on the state pension is growing fast. On the flip side, there are fewer younger people entering the workforce to fund these pensions. Imagine trying to fill a bucket that has a hole in the bottom—no matter how much you pour in, it’s not enough to keep it full.

The Demographic Shift: Why the Ageing Population is Causing Trouble

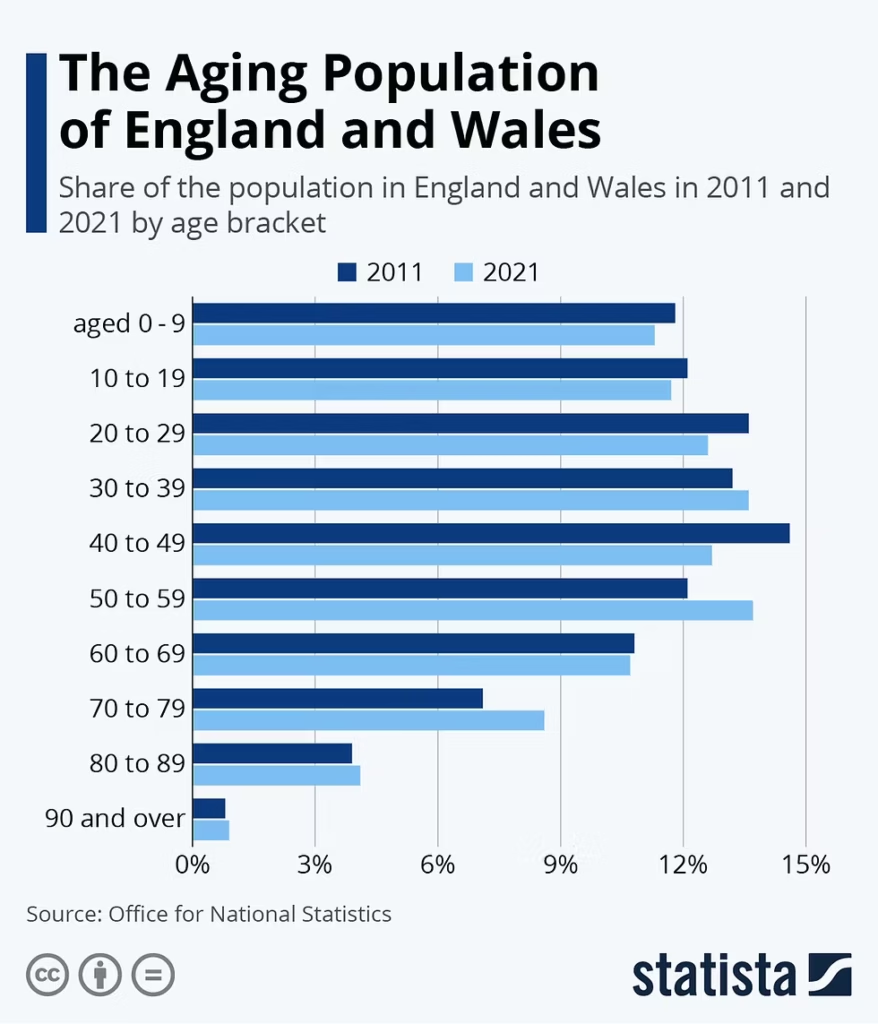

Let’s look at the numbers. The UK is getting older. In 2020, around 18% of the population was over 65, and by 2050, that figure is expected to rise to 24%. That retirement system means by mid-century, one in every four people will be retired. These retirees will need their pensions to live, and this puts more strain on the system because there are fewer workers to support them.

It’s not just that people are getting older, though. People are also living longer. Life expectancy in the UK has steadily risen over the years. Back in 1951, the average life expectancy was just under 70 years. Today, it’s about 81 for women and 79 for men. So, folks are not only retiring earlier but are also collecting their pension for a longer period of time.

This is a problem because the longer someone lives, the more they draw from the pension system. If this trend continues, the system could collapse under its own weight. The government is facing tough decisions on how to ensure it remains sustainable.

Why Raising the Pension Age is On the Table?

Here’s where the idea of raising the state pension age comes in. To keep the retirement system from going bankrupt, the UK government has to either reduce benefits or increase the age at which people start receiving them. Right now, the state pension age is set to rise to 67 by 2028, but some experts say that won’t be enough. In fact, they suggest that raising the pension age to 70 or 71 might be necessary.

Raising the pension age makes sense from a financial perspective. If people are working longer, they’re contributing to the National Insurance fund for a longer period, which means the government has more money to cover pension payouts. But, of course, this decision isn’t as straightforward as it sounds. Let’s break down why.

The Economic Factor: Fewer Workers, More Retirees

The UK is also experiencing a decline in birth rates, which is causing the working-age population to shrink. Fewer babies are being born, and fewer young people are entering the workforce. This has led to a lower number of people paying into the system. Meanwhile, the number of retirees is increasing.

For example, the National Insurance fund is primarily funded by the contributions of working individuals. However, fewer workers mean less money flowing into the fund. At the same time, retirees are living longer, meaning the government has to pay out pensions for a longer period.

According to the Office for National Statistics (ONS), there were around 11.8 million people aged 65 and over in 2021, and this number is projected to increase by 50% over the next two decades. This puts a huge financial strain on the pension system, making it harder for the government to maintain its current level of pension benefits without taking drastic measures.

The Cost of State Pensions

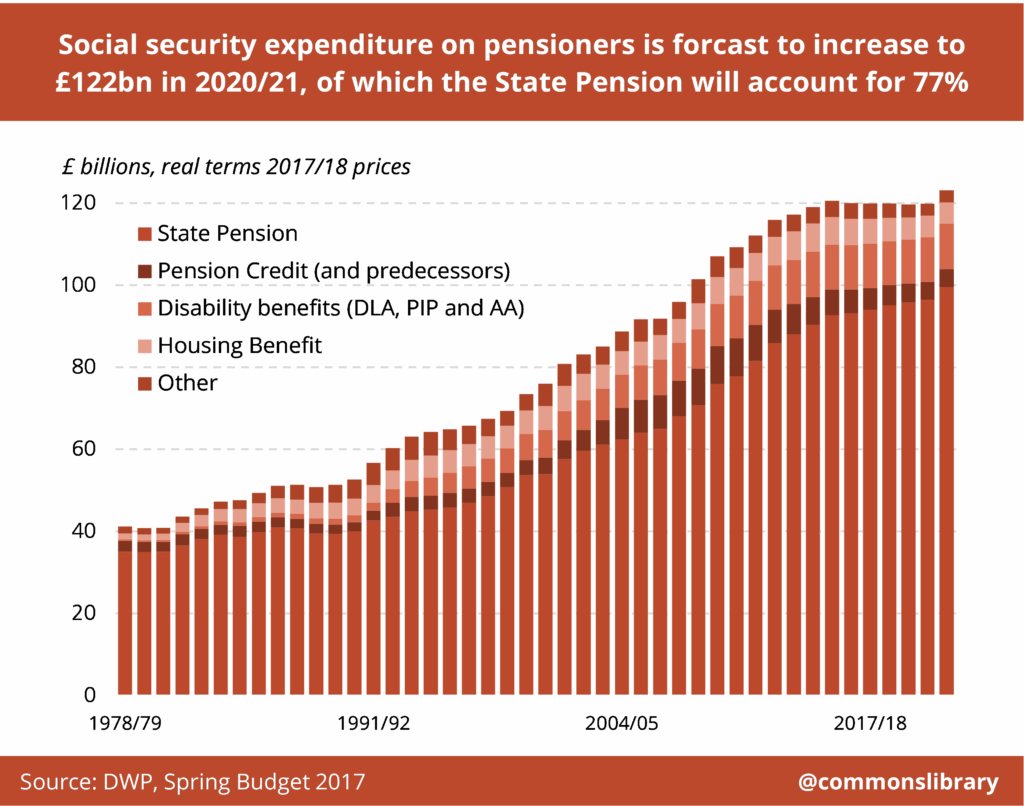

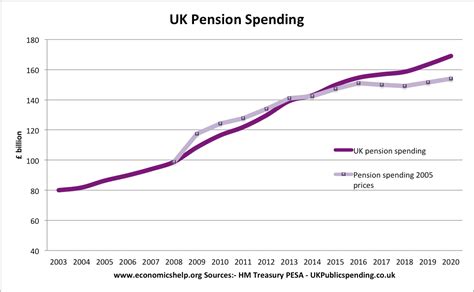

The cost of the state pension system is also on the rise. Under the current “triple lock” policy, pensions are guaranteed to rise each year by the highest of inflation, wage growth, or 2.5%. While this has been a good deal for pensioners, it has added a significant financial burden on the government.

For example, in the 2024-25 financial year, the UK government is expected to spend £165.9 billion on pension-related expenditures, with £137.5 billion of that going to state pensions. That’s a lot of money—more than half of the entire UK government’s spending is on pensions. This is why experts are warning that if the government doesn’t make some tough decisions, including raising the pension age, the system could become unsustainable.

Health Issues and Workforce Participation

Another important factor in this debate is the health of older workers. Many people who are in their 60s and early 70s may not be able to continue working because of health issues. According to research from the Centre for Ageing Better, about 50% of adults over the age of 70 are no longer able to work due to disability or health concerns. This creates an issue for the government, as it raises questions about how much they should be expected to work before they are eligible for their pensions.

Raising the retirement system pension age may also disproportionately impact those in manual labor jobs or low-income sectors. These individuals often work in physically demanding jobs that take a toll on their bodies over time. Forcing them to work longer without offering adequate support could lead to increased poverty among older adults.

Practical Solutions: What Can Be Done On UK’s Retirement System Faces Pressure?

It’s clear that the state pension age may need to rise to ensure the retirement system’s sustainability. However, this solution must be balanced with policies that take into account the health and economic disparities that exist among older workers. Here are some practical steps the government could take:

- Gradual Increases in Pension Age: Rather than making abrupt changes, the government could implement gradual increases in the pension age. This would give people time to adjust and plan for their retirement.

- Flexible Retirement Options: Some individuals may want to continue working past the retirement age, while others may need to retire earlier due to health issues. Offering more flexible retirement options could help address these concerns.

- Support for Older Workers: Providing additional support for older workers, including retraining programs and healthcare services, could help those who want to remain in the workforce for longer.

- Addressing Health Inequalities: The government should focus on reducing health inequalities by providing more resources to those in lower-income or physically demanding jobs, helping them work longer if possible.

The Social Impact of Delaying Retirement

One factor often overlooked in discussions about raising the pension age is its social impact. Retirement is not just a financial matter—it is a life transition. Many people look forward to retirement as a time to relax, travel, or pursue passions that they didn’t have time for during their working years. Delaying this transition could affect their mental and emotional well-being.

Moreover, older workers may face social isolation. As people age, they often lose contact with peers who have retired, and staying in the workforce longer could potentially delay opportunities for social engagement and fulfillment that are crucial for well-being.