$967 Social Security Payment Arrives in 12 Days: Supplemental Security Income (SSI)—that’s the main topic here—is set to deposit up to $967 for eligible individuals on Friday, August 1, 2025. That’s exact and to the point. If you qualify, this money is about to hit your account. Let’s walk through what this payment means, who’s eligible, why it’s important, and what you can do to make sure everything goes smoothly. Whether you’re a beneficiary, caregiver, case worker, financial coach, or just someone keen on staying ahead, this guide is for you. Written in a friendly, conversational tone but with the expertise and trustworthiness expected from experienced professionals, this article delivers clear insights and practical steps everyone can follow—easy enough for a ten‑year‑old to understand—and valuable enough for professionals to use in their work.

$967 Social Security Payment Arrives in 12 Days

The August 1, 2025 SSI deposit of up to $967 is more than a one-time payment—it’s part of an annual schedule with a strategic holiday adjustment around Labor Day. To stay ahead:

- Verify your direct deposit details by July 25

- Keep all life changes reported to SSA

- Add August 1, 29, and September 1 to your calendar

- Use online tools to manage banking, income, and work programs

Doing these sets you up for success—getting funds in time, avoiding confusion, and keeping peace of mind. Whether you’re a recipient or someone supporting a recipient, planning helps everyone stay calm, clear, and in control.

| Topic | Details |

|---|---|

| Payment Date | Friday, August 1, 2025 |

| Individual Benefit | Up to $967 |

| Couples Benefit | Up to $1,450 |

| Essential Person Benefit | Up to $484 |

| Who Qualifies | Age 65+ or blind/disabled; income/assets must be low (< $2,000 individual, <$3,000 couple); U.S. citizen or lawful resident; direct deposit set via SSA SSI official site |

| Next Payments | August 29 & September 1, 2025 (due to Labor Day holiday) |

| SSI vs SSDI | SSI is need-based (no work credits), SSDI is earned via work history and leads to Medicare |

| SSI Recipients & Stats | ~7.4 million receive SSI; average individual $967, couple $1,450; monthly payments total $5.3 billion (April 2025) |

| COLA Increase | 2025 Cost-of-Living Adjustment of +2.5%, matching general Social Security rise |

| New Digital Tools | SSA teleservice upgrades including remote updates to banking, income reporting, Ticket to Work resources |

| Recommended Steps | 1. Confirm bank info by July 252. Report life changes3. Plan around holiday deposit dates |

Why You’re Getting $967 on August 1 (And Who Qualifies)

What Is SSI?

Supplemental Security Income is a federal assistance program run by the Social Security Administration to support people 65+, blind, or disabled who have limited income and resources. It’s designed to help with essentials—food, housing, medicine. Unlike Social Security Disability Insurance (SSDI) or retirement benefits, SSI doesn’t depend on work history or payroll taxes; funding comes from general U.S. tax revenues. As of August 1, 2025, the maximum monthly SSI payment is $967 for individuals, $1,450 for couples, and up to $484 for essential persons providing in‑home care to someone on SSI. These rates reflect the 2.5% cost-of-living increase applied in 2025 to help recipients keep pace with inflation.

Eligibility Summary

To qualify for SSI, individuals must meet these conditions:

- Be aged 65 or older, or be legally blind, or have a disability as SSA defines it.

- Have limited countable income, generally below $2,000 for individuals or $3,000 for couples. Income includes earnings, Social Security, pensions, etc.

- Have limited assets—countable resources like cash, bank accounts, and stocks.

- Be a U.S. citizen or lawful resident and reside in one of the 50 states, District of Columbia, or certain U.S. territories.

- Have direct deposit set up in a “mySocialSecurity” account to receive electronic payments.

Note that living arrangements, shared household income, or certain gifts can affect eligibility—if income rises above these thresholds, benefits may reduce or stop.

The SSI vs SSDI Difference

A common mix-up is separating SSI from SSDI—they sound similar but work very differently:

| Feature | SSI (Supplemental Security Income) | SSDI (Social Security Disability Insurance) |

|---|---|---|

| Based On | Poverty + age/disability | Disability + sufficient work credits (payroll tax) |

| Funded By | General tax revenues | FICA payroll taxes |

| Health Insurance | Medicaid (most states) | Medicare (after 24-month waiting period) |

| Payment Timing | Month after approval | Starting 6 months post-disability determination |

| Number of Recipients | ~7.4 million | ~9.5 million |

| COLA Adjustment 2025 | +2.5% | +2.5% |

Many people receive both—this is called concurrent benefits. SSDI provides income based on past work; SSI adds need-based funds for those with low income. Together, they can offer stronger financial support than either alone. It can be tricky to navigate both, so professionals and families should carefully track combined income and impact on eligibility.

Why August 1—and What Happens Next

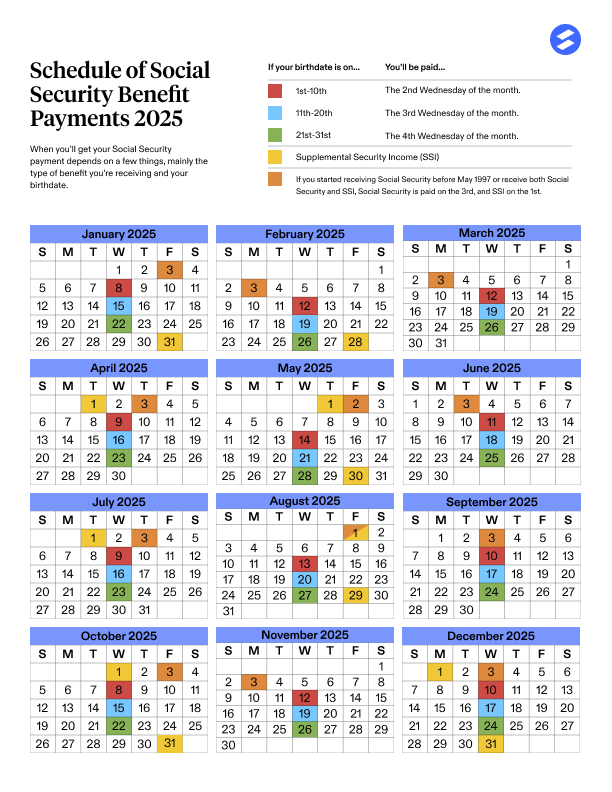

Regular SSI Payment Calendar

SSI payments are typically issued on the first of each month. If the first isn’t a business day, deposits are moved to the next available date.

For August 2025, since August 1 is a Friday and not a federal holiday, this month’s SSI payment will hit bank accounts as scheduled.

Double Payment Near Labor Day

Labor Day in 2025 is Monday, September 1. To avoid depositing on the holiday, SSA will make two payments in a short span:

- August 29, 2025

- September 1, 2025

You’re not getting extra money—you’re just seeing the September deposit early. It helps spread things out, but remember to plan accordingly to avoid confusion.

Numbers You Need to Know

Here’s a snapshot of SSI program stats:

- Roughly 7,423,856 people were receiving SSI as of December 2024.

- Average individual SSI payment is $967; average couple benefit is $1,450.

- Total SSI payouts in April 2025: $5.3 billion. In comparison, Social Security Retirement and Disability paid $134.5 billion in the same month.

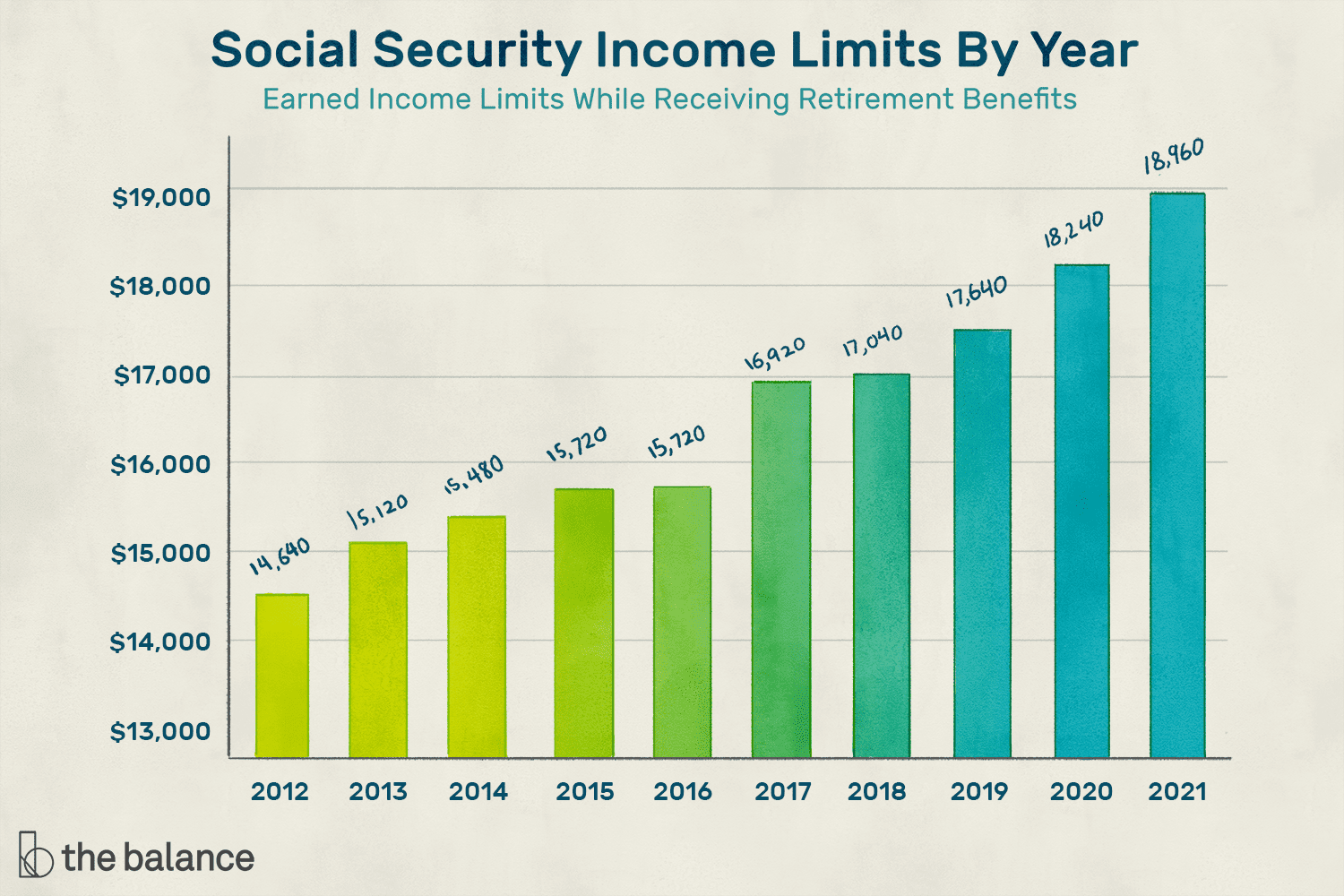

- The 2.5% COLA for 2025 followed 2022’s increase of 5.9%, 2023’s 8.7%, and reflects ongoing inflation pressures.

These numbers are critical for understanding how the program fits into the broader public safety net landscape.

New Digital Tools & Teleservice Updates

SSA has recently enhanced its online and teleservice offerings to help people manage SSI more easily:

- Online Banking Updates

Now recipients can update direct deposit info, check payment history, and verify future dates via “mySocialSecurity” without paper forms. - Income/Resource Reporting

New online portals let you report changes like work, income, or living arrangements. Essential for keeping benefits in check. - Ticket to Work Program Access

The SSA partners with national and state agencies to connect recipients with training, job placement, and benefits planning support via webinars and virtual appointments. - Remote Service Phone Tools

SSA offices now support phone and video help for appointments, forms, and caseworker consults. Great for folks in rural areas or with mobility limits.

These improvements help modernize SSI delivery—faster, easier, and more accurate.

Step-by-Step: What You Should Do As $967 Social Security Payment Arrives in 12 Days

Step 1: Confirm Your Banking — Deadline: July 25

Before July 25, log into mySocialSecurity and double-check:

- Routing and account numbers are current and correct.

- Direct deposit is active.

- Your preferred bank account is set (you can only have one).

Miss this, and your August 1 payment might go to the wrong place—leading to delays or complications.

Step 2: Report Life Changes Immediately

Notify SSA if you:

- Start or stop work, get a raise, or receive other income.

- Move, change households, or someone new moves in.

- Release a vehicle, property, or resources.

- Change citizenship or residency status.

Timely reporting avoids overpayments and prevents future audits or repayment demands.

Step 3: Mark Payment Dates on Your Calendar

- August 1 – August payment

- August 29 – September payment (early due to holiday)

- September 1 – Another September payment

Knowing these dates helps you budget for rent, meds, and other bills so there are no surprises.

Step 4: Track & Troubleshoot

If your payment doesn’t show up:

- Wait two business days after expected date.

- If still no deposit, call SSA: 1‑800‑772‑1213. Have your Social Security number and bank info ready.

These steps help you stay on track and avoid unnecessary stress.

Social Security Introduces New Rules in July That Will Impact Monthly Payments Across the US

Average July Social Security Payments by Age Group From 62 to 67 Across the US

Recent Adjustment to Social Security Benefits Raises Questions- Check Details!

Real-Life Impact

For Individuals & Families

That $967? It can cover groceries, rent, or medicine. Knowing your payment dates helps you manage bills and make plans—especially with the double payments near Labor Day.

For Employers & Job Coaches

If you’re helping someone transition back into work, keep SSI and SSDI earnings rules in mind. Work incentives like trial work periods and Ticket to Work offer support during job starts, helping prevent sudden loss of benefits.

For Case Workers & Financial Advisors

Use this guide to remind clients about July 25 bank deadlines and the holiday pay schedule. Encourage them to use online tools for direct deposit, income reporting, and Ticket to Work options. That’s how you empower safe, informed progress.

Broader Trends & What’s Ahead

Inflation Adjustments

The 2.5% COLA for 2025 helps SSI and Social Security match rising costs. Expect a new COLA announcement in October or November, reflecting last year’s inflation trends.

Policy & Legislation Watch

Congress occasionally updates SSI asset limits or eligibility rules. Advocates keep an eye on any potential expansions or restrictions—especially around poverty thresholds or living situations.

Technology Trends

SSA is steadily moving services online—remote signing, video appointments, and paperless communication. That’s beneficial for rural clients, wheelchair users, and communities with limited local SSA office access.

Community Partnerships

Nonprofit agencies are partnering with SSA to help beneficiaries navigate Ticket to Work, affordable housing, and health resources. If you work in such agencies, coordinate when July and end-of-summer payments are due—it boosts readiness and confidence.