8 Weird Money Habits We All Pretend Are Normal: Ever find yourself buying something just because it’s on sale? Or maybe you’ve caught yourself thinking, “I can handle the minimum payment, so I’m fine.” Sound familiar? If so, don’t worry — you’re not alone. Many of us have money habits that feel “normal” because we see everyone doing them. But the truth is, a lot of these behaviors are actually working against us. They’re not just quirky — they’re financially harmful. In this guide, we’re breaking down 8 of the weirdest, most common money habits people assume are fine — but that can quietly drain your bank account. Whether you’re fresh out of school or managing a household, you’ll walk away with new insights and smart fixes.

8 Weird Money Habits We All Pretend Are Normal

The truth is, many of our so-called “normal” money habits are doing us more harm than good. But once you identify them, you can break the cycle. Whether it’s setting up automatic savings, trimming down delivery orders, or having real financial conversations, these small changes lead to big results over time. If you’ve fallen into some of these traps — no judgment. The good news is: it’s never too late to shift gears and start building a healthier relationship with your money.

| Habit | Why It’s a Problem | Better Alternative |

|---|---|---|

| Saving what’s left over | Usually nothing is left | Pay yourself first |

| Ignoring maintenance costs | Surprise bills ruin budgets | Budget 1-4% for upkeep |

| No emergency fund | Debt trap waiting to happen | Build 3–6 months of savings |

| “Can pay” vs. “Can afford” | Leads to overspending | Consider total cost, not just payments |

| Lifestyle inflation | Kills long-term wealth | Keep lifestyle flat, invest the difference |

| Overusing delivery apps | Significantly increases food costs | Cook more meals at home |

| Letting food spoil | Wastes hundreds annually | Shop with a plan, prep meals |

| Stretching out loans | You pay way more over time | Choose shorter terms or pay more upfront |

8 Weird Money Habits We All Pretend Are Normal

1. Saving Whatever’s Left Over

What it is: You pay your bills, spend your money, and if anything is left at the end of the month — you save it. Sounds practical, right?

Why it’s a problem: For most people, there’s rarely anything left over. Lifestyle creep, impulse buys, and unexpected costs eat up that leftover cash before you even realize it.

Better approach: Flip the script. Pay yourself first. The moment you get paid, set aside a fixed percentage — even if it’s just 5% or $20 per paycheck — into savings or a retirement account.

Pro tip: Automate this with your bank or use savings apps like Chime, Ally, or Digit.

2. Confusing “Can Pay” With “Can Afford”

What it is: You buy a new car or gadget because the monthly payment “fits” into your budget — without looking at the full cost.

Why it’s a problem: It’s easy to overcommit when you’re just focused on monthly payments. You may end up paying thousands more in interest over time.

Real-life example: A $40,000 car financed over 7 years at 6% interest ends up costing over $47,000. If your budget’s tight, that extra $7,000 could have gone to savings or investing.

Fix it: Before buying, ask yourself: “Would I still buy this if I had to pay for it in full?” If not, it’s probably a stretch.

3. Ignoring Maintenance and Upkeep Costs

What it is: You budget for the purchase price of a house, car, or appliance — but forget to include the cost of keeping it running.

Why it matters: Maintenance is inevitable. A home needs repairs. A car needs brakes, oil, and tires. Your AC will eventually go out.

Cost breakdown: Experts recommend setting aside 1–4% of your home’s value per year for maintenance. For a $300,000 home, that’s $3,000–$12,000 per year.

Tip: Add a “future expenses” line in your budget. Consider a separate sinking fund for car repairs, home upkeep, and health bills.

4. Letting Groceries Go to Waste

What it is: You go grocery shopping with big dreams of meal-prepping. Then life gets busy, and the food rots in the fridge.

The cost: The average American household throws away nearly $1,500 worth of food every year (USDA).

Why it happens: Overbuying. Lack of a meal plan. And too many “aspirational” purchases (looking at you, organic kale).

How to fix it:

- Shop with a list.

- Plan meals based on your actual schedule.

- Use meal planning apps like Mealime or Paprika.

- Store perishables properly and freeze what you won’t eat soon.

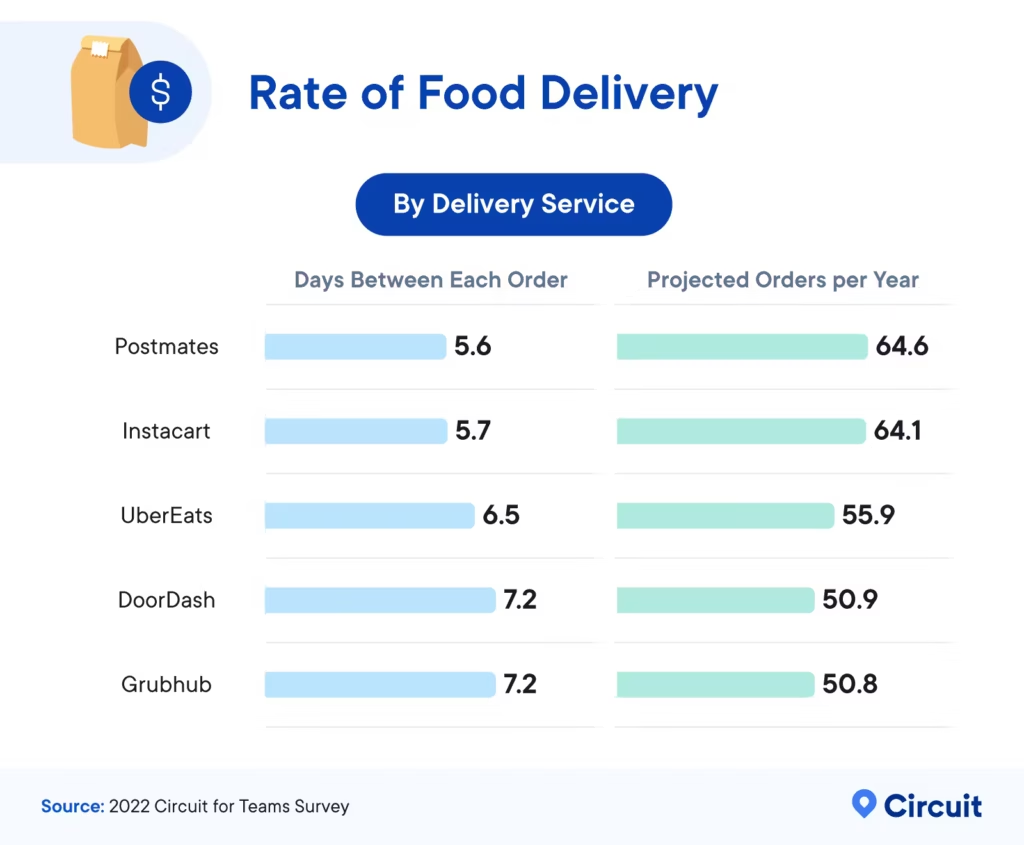

5. Overusing Food Delivery

What it is: Using DoorDash, Uber Eats, or Grubhub for the sake of convenience — sometimes several times a week.

Why it’s harmful: Delivery adds 40–60% on top of meal prices. Plus service fees, tips, and inflated menu pricing.

Reality check: A $14 burrito could end up costing $28 after taxes, fees, and tips.

Fix: Save delivery for emergencies or special occasions. Batch cook or freeze meals for busy nights. Keep affordable ready-to-eat options on hand.

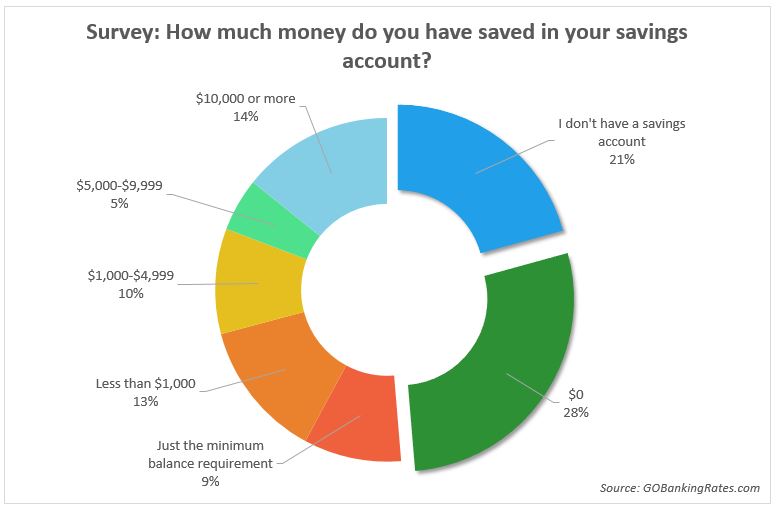

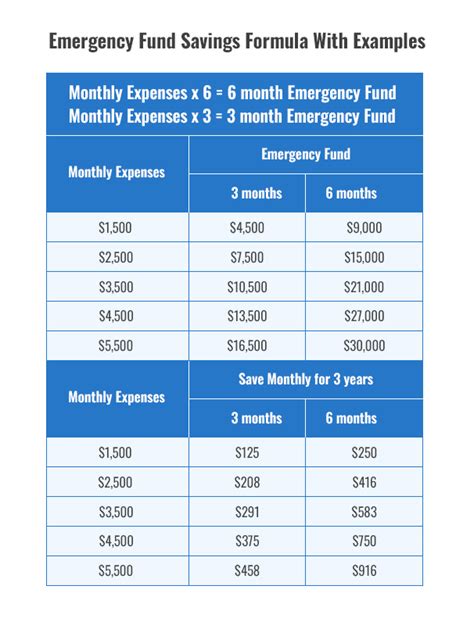

6. Skipping an Emergency Fund

What it is: Living paycheck to paycheck with no financial cushion.

The danger: One car repair, medical bill, or job loss can force you into credit card debt or payday loans.

Stats to know: Nearly 57% of Americans can’t cover a $1,000 emergency (Bankrate, 2023).

Your goal: Start with $500. Work up to 3–6 months’ worth of essential expenses.

Tools: Use a high-yield savings account like those from Marcus, SoFi, or Discover.

7. Lifestyle Inflation

What it is: Every time your income goes up, so do your expenses. You get a raise and immediately upgrade your car, apartment, or wardrobe.

Why it’s sneaky: You feel richer but aren’t building wealth. You’re stuck on the treadmill.

Better mindset: Keep your lifestyle stable while increasing your savings and investing rate. That’s how real wealth builds.

Example: Instead of upgrading your car after a raise, invest the difference. A $300 monthly car upgrade over 10 years could turn into $57,000+ if invested at 8%.

8. Stretching Out Loans Just to Lower Payments

What it is: Opting for longer-term loans (like 72 or 84 months) to make the monthly bill smaller.

Why it’s costly: Longer loans = more interest + being in debt longer. And if the value of the car drops faster than you pay it off, you’re underwater.

Better option: Choose the shortest term you can afford — or save up and pay more upfront. Consider buying used to avoid early depreciation.

Bonus Habits Worth Breaking

9. Spaving (Spending to Save)

What it is: Buying extra stuff just to hit a sale or free shipping minimum.

Truth bomb: You’re not saving. You’re just spending more.

Fix it: Stick to your list. Ask, “Would I still buy this at full price?”

10. Avoiding Money Talks

What it is: Not discussing finances with your spouse, kids, or roommates.

Why it hurts: Lack of communication leads to overspending, misunderstandings, and debt.

What to do: Set a monthly “money date.” Use tools like Honeydue or Zeta to manage shared expenses.

11. FOMO Investing

What it is: Throwing money into crypto, meme stocks, or hot tips because “everyone else is doing it.”

Why it’s dangerous: No strategy, just vibes — and vibes don’t build portfolios.

Fix: Build a strong foundation first: emergency fund, no bad debt, retirement contributions. Then invest wisely with long-term goals.

4 Financial Mistakes Americans Keep Making That Wreck Their Budgets

Lack of Succession Planning Among Financial Advisers May Pose Unexpected Risks to Clients

US Online Spending Jumps by $24.1 Billion as Deep Discounts Drive Summer Sales