50 Smart Money Moves to Make Before 2025 Ends: As 2025 races toward the finish line, your financial checklist deserves just as much attention as your holiday plans. This year, more than ever, it’s critical to get strategic with your retirement savings, tax planning, budgeting, and debt payoff. Why? Because missing certain financial deadlines could cost you real money. If you’re wondering where to start, you’re not alone. The good news is, we’ve rounded up 50 smart money moves to make before 2025 ends—each one designed to help you build wealth, reduce stress, and avoid regret. Whether you’re just out of college or heading into retirement, this guide breaks everything down step-by-step in a way that makes sense for beginners but still delivers expert value for seasoned pros.

50 Smart Money Moves to Make Before 2025 Ends

The clock is ticking, but you still have time to take control of your financial future. These 50 money moves are designed to help you save more, owe less, and feel more secure as we move into 2026. Whether it’s reviewing your budget or maxing your 401(k), small actions can lead to massive wins. You don’t have to do everything at once. Just pick 3 to 5 actions today and build momentum. Your future self will thank you—with interest.

| Category | Details |

|---|---|

| Focus | Personal finance planning before 2025 ends |

| Top Priorities | Retirement savings, tax efficiency, budgeting, debt payoff |

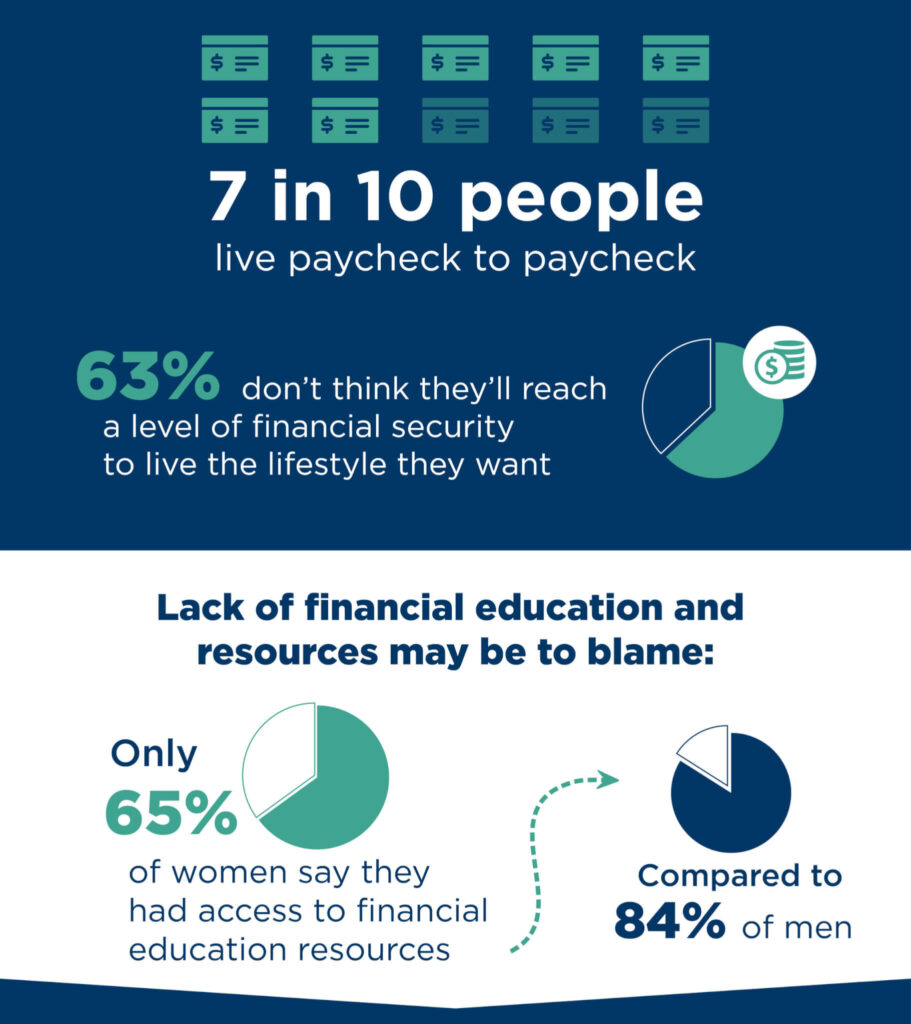

| Stat to Know | 63% of U.S. adults live paycheck-to-paycheck (LendingClub, 2024) |

| Deadline Watch | Dec. 31, 2025 for most tax & savings deadlines |

| IRS Limits | 401(k): $23,000, IRA: $7,000, HSA: $4,150 (individual) |

| Energy Credits | $7,500 for EVs, 30% for solar (expires Dec. 31, 2025) |

| Official Resource | IRS.gov Contribution Limits |

Why These Money Moves Matter Now?

The end of the year isn’t just for reflection—it’s for taking action that impacts your wallet. Waiting until January 2026 means missing key opportunities for tax deductions, retirement growth, and energy savings.

Here’s the kicker: Most money moves take just 30 minutes or less to initiate. From maxing out a 401(k) to canceling an unused subscription, it’s the little things that can lead to big gains. Don’t leave money on the table.

The Complete 50 Smart Money Moves to Make Before 2025 Ends Financial Checklist

1. Maximize Tax-Advantaged Accounts

- Contribute the maximum to your 401(k), IRA, and HSA before Dec. 31.

- If you’re 50+, take advantage of catch-up contributions—an extra $7,500 for 401(k)s and $1,000 for IRAs.

2. Open an IRA or Roth IRA

- If you haven’t started an IRA, now is the time.

- You have until April 15, 2026 to contribute for 2025, but why wait?

3. Set Up an Emergency Fund

- Aim for 3–6 months of essential expenses in a high-yield savings account.

- Online banks like Ally or Marcus by Goldman Sachs offer competitive rates.

4. Review or Create a Budget

- Use a zero-based budget or the 50/30/20 rule.

- Track spending with apps like YNAB, Rocket Money, or Goodbudget.

5. Use Your FSA Funds

- Most Flexible Spending Account (FSA) funds expire on Dec. 31.

- Schedule dental visits, buy prescription glasses, or stock up on eligible over-the-counter items.

6. Spend HSA Wisely or Let It Grow

- Unlike FSAs, HSA balances roll over. Still, consider using funds for year-end medical costs tax-free.

7. Check Your Withholdings

- Use the IRS Tax Withholding Estimator to avoid a surprise bill or refund.

- Adjust your W-4 if needed.

8. Take Required Minimum Distributions (RMDs)

- If you’re 73 or older, you must withdraw RMDs from traditional retirement accounts before Dec. 31.

- Use the IRS RMD Calculator.

9. Consider a Roth IRA Conversion

- Convert pre-tax retirement funds to a Roth IRA during a low-income year to reduce future taxes.

10. Check Retirement Plan Fees

- High fees can eat into your savings.

- Compare your plan’s expense ratio to industry benchmarks (aim for under 0.50%).

Cutting Costs and Killing Debt

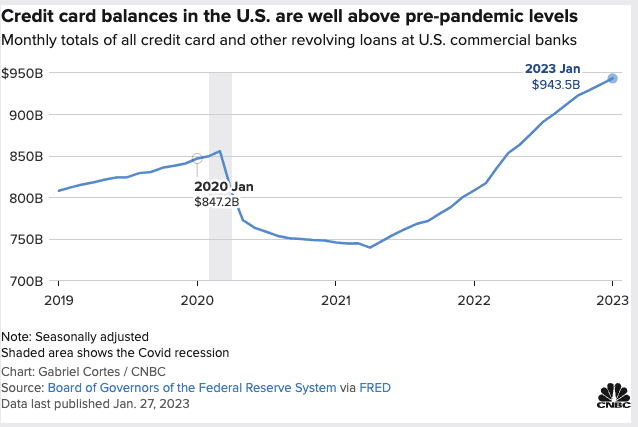

11. Pay Down High-Interest Credit Cards

- Prioritize any balance with interest rates above 18%.

- Use snowball or avalanche methods to stay motivated.

12. Consolidate Debt

- Consider a 0% APR balance transfer card or a low-interest personal loan.

- Always factor in balance transfer fees.

13. Refinance Student Loans

- If your interest rate is over 6%, refinancing might save you thousands.

14. Cancel Unused Subscriptions

- Audit your digital services and ditch what you don’t use.

- Apps like Rocket Money make this simple.

15. Negotiate Your Bills

- Call your cell provider, cable company, or insurer to request discounts or promotions.

Investment, Taxes & Wealth Building

16. Rebalance Your Portfolio

- Adjust your asset mix to align with your risk tolerance and goals.

17. Harvest Tax Losses

- Sell underperforming assets to offset capital gains.

- Don’t forget the 30-day wash-sale rule.

18. Check for Capital Gains Distributions

- Mutual funds often distribute gains in Q4—consider investing after the payout.

19. Open a Brokerage Account

- If you’ve maxed out tax-advantaged accounts, start a taxable investment account for extra savings.

20. Use Robo-Advisors

- Platforms like Betterment or Wealthfront handle rebalancing, tax-loss harvesting, and more for a low fee.

Real Estate and Homeownership Moves

21. Make an Extra Mortgage Payment

- Doing this once a year could save you years of interest.

22. Appeal Your Property Taxes

- Check your home’s valuation. If it’s inflated, file an appeal to lower your tax bill.

23. Claim Home Energy Credits

- 30% tax credit for solar panels or energy-efficient upgrades.

- File IRS Form 5695 when claiming.

24. Re-shop Homeowners Insurance

- Rates have spiked in many states—get quotes from 3+ providers.

Smart Giving and Estate Planning

25. Make Year-End Donations

- Qualified Charitable Distributions (QCDs) from an IRA count toward RMDs and reduce your taxable income.

26. Gift Up to $19,000 Tax-Free

- You can gift this amount per person in 2025 without reporting it to the IRS.

27. Set Up a Donor-Advised Fund

- Contribute now, decide later. Great for big charitable giving years.

28. Review or Create a Will

- Over 55% of Americans don’t have one. Don’t let your family be unprepared.

Boosting Financial Security

29. Get Life Insurance (or Review It)

- Term life is affordable and essential if you have dependents.

30. Check Your Credit Report

- Pull all 3 reports free at AnnualCreditReport.com.

31. Freeze Your Credit

- Prevent identity theft by freezing your reports with Equifax, Experian, and TransUnion.

32. Use a Password Manager

- Apps like 1Password or LastPass protect your financial logins.

Bonus Pro Tips for 2025

33. Meet with a CFP®

- A Certified Financial Planner can optimize your taxes, investments, and goals.

34. Plan for Big 2026 Goals

- Want to buy a home, travel, or start a business? Budget now.

35. Audit Your Paycheck Deductions

- Health, dental, disability—make sure your elections are still what you want.

36. Invest Your Raises

- If you got a bump this year, funnel it straight into savings or investments.

37. Evaluate College Savings

- Use a 529 plan for tax-free education savings.

38. Save Windfalls (Not Spend Them)

- Got a bonus or refund? Stash 80%, enjoy 20%.

39. Set SMART Financial Goals

- Specific, Measurable, Achievable, Relevant, and Time-bound.

40. Track Net Worth Quarterly

- Use apps like Empower (formerly Personal Capital) to see your progress.

7 Days Too Short? How a Marriage Rule Is Denying Americans Survivor Benefits

Sick of Rising Prices? ‘Revenge Saving’ Is the Bold Money Move Everyone’s Trying

Revenge Saving Is the Viral Trend Everyone’s Copying — Are You Missing Out?