$45 Million in Unclaimed Stimulus Payments: The summer of 2025 is shaping up to be a season of financial relief for many Americans, with a whopping $45 million in unclaimed stimulus payments on the way. For individuals who missed out on these funds in the past, this is an unexpected second chance to collect money that was rightfully theirs. But, who qualifies? And how can you ensure you don’t miss out on this financial boost? Let’s break it all down so you can stay informed and prepared.

$45 Million in Unclaimed Stimulus Payments

There’s no reason to miss out on these unclaimed stimulus payments this summer. Whether you live in Illinois, Alaska, or another state, now’s the time to check whether you’re eligible for a surprise check. With the right information and timely action, you could find yourself with some unexpected extra cash—just in time for the summer.

| Key Data & Facts | Details |

|---|---|

| Total Amount for Stimulus Payments | $45 million in unclaimed funds to be distributed across various states. |

| Eligible States for Stimulus Payments | Illinois, Alaska, and other states with programs to distribute funds. |

| IRS Recovery Rebate Credit | $2.4 billion in funds sent out to 1 million taxpayers who missed out on the Recovery Rebate. |

| Alaska Permanent Fund Dividend (PFD) | Alaska residents to receive up to $1,702 per person, starting July 17, 2025. |

| Illinois Enhanced Money Match Program | Approximately 600,000 Illinois residents eligible for surprise checks of $50 or less. |

| Key IRS Deadline | April 15, 2025, was the deadline to claim the IRS stimulus checks. |

| Official Source – The Sun | For more information on these programs, check official resources. |

The Return of Unclaimed Stimulus Payments

The $45 million in unclaimed stimulus funds is being distributed across several states in the United States this summer. These payments are a continuation of the government’s ongoing efforts to provide financial assistance to those in need. You may have heard of stimulus checks before, but did you know there are still a considerable number of unclaimed funds waiting for their rightful recipients?

The good news is, this summer is your chance to claim those uncollected payments. Whether you live in Illinois, Alaska, or another state, there are programs aimed at redistributing these funds. The government has earmarked these stimulus checks for residents who missed their chance to claim them earlier, but the clock is ticking. If you don’t act soon, you could miss out again.

Let’s explore how this works, which states are involved, and what you need to do to get your hands on this unclaimed cash.

How $45 Million in Unclaimed Stimulus Payments Works: The Basics

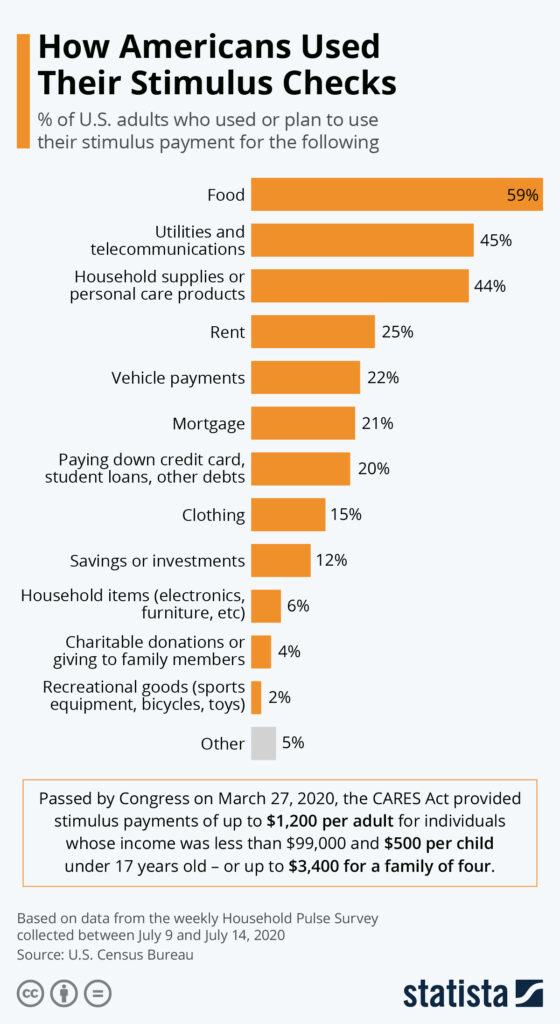

Stimulus payments are a form of financial relief that the government distributes to help individuals and families recover from challenging times, such as during the COVID-19 pandemic. However, not everyone claimed these funds when they were first available. As a result, a substantial amount of money is still sitting in government coffers, waiting to be sent out.

This summer, several states have launched programs to send out unclaimed stimulus payments to the people who missed them in previous years. These payments range from small amounts (often under $100) to larger sums, depending on the state and the program.

In some cases, you don’t even have to apply for the funds; they’ll be sent directly to your mailbox if you’re eligible. In other cases, you may need to take action and submit a claim.

Let’s break down some of the most notable programs.

Stimulus Programs by State

Illinois: Enhanced Money Match Program

Illinois has a program called the Enhanced Money Match Program, where unclaimed funds will be sent out to eligible residents automatically. If you filed taxes in the past but didn’t claim all the stimulus funds you were entitled to, you might be in luck. The state’s Treasurer’s Office has identified over 600,000 people who are eligible for payments ranging from $50 to more.

The good news? You don’t need to do anything. These payments will be mailed to the address the state has on file. The checks started going out in late June 2025, and they will continue to be distributed through the summer. If you’re one of the lucky recipients, you’ll find a surprise check arriving in your mailbox soon.

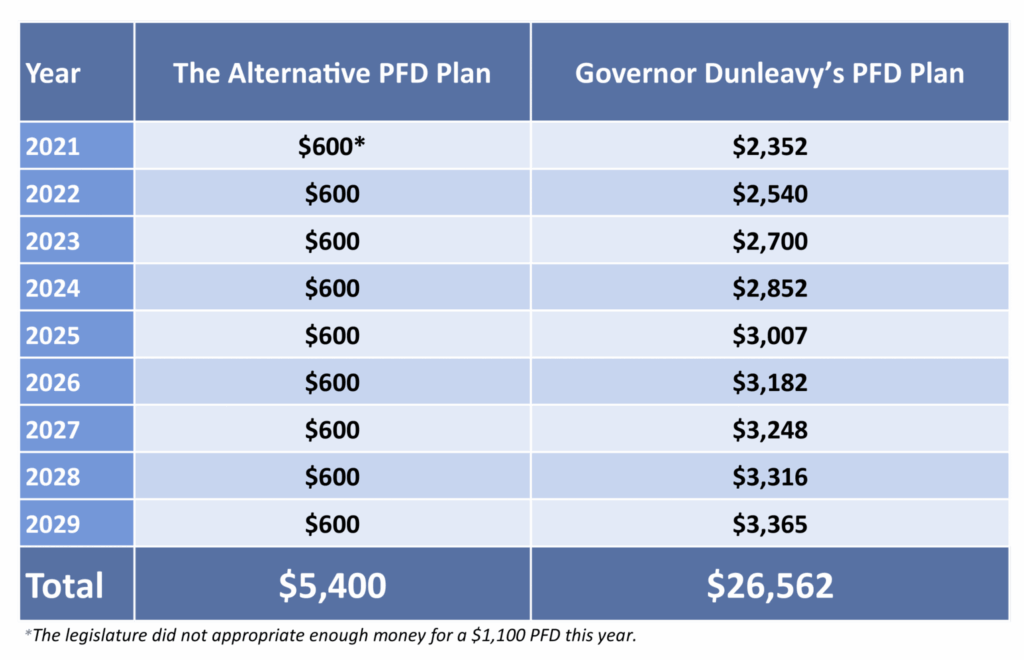

Alaska: Permanent Fund Dividend (PFD)

Alaska has one of the most well-known programs for returning funds to its residents: the Permanent Fund Dividend (PFD). Every year, the state sends out a payment to its residents from the Alaska Permanent Fund, which is funded by oil revenues. This year, Alaska residents are set to receive $1,702 each, with $1,440 being the regular dividend and $262 being a one-time energy relief bonus.

To qualify for this payment, residents must have lived in Alaska for the entire 2023 calendar year and meet other eligibility criteria. Applications must be filed, and if your application is marked as “Eligible-Not Paid”, you can expect to receive your payment starting July 17, 2025. The second payout will be processed by August 21 for residents who apply by August 13.

IRS Recovery Rebate Credit

The IRS has identified over 1 million taxpayers who missed out on claiming the Recovery Rebate Credit during the 2021 tax filing season. If you were one of those individuals, don’t worry! The IRS is automatically issuing payments up to $1,400 per person as a final round of relief. In total, about $2.4 billion is being sent out to those who are eligible.

If you missed the deadline to claim these funds, unfortunately, it’s too late now. The cutoff was April 15, 2025, and after that, no further claims will be accepted.

Other State Programs

While Illinois and Alaska are leading the charge, there are other states offering financial relief through various programs as well. States like California, Georgia, and Colorado are also implementing stimulus relief efforts that may overlap with the unclaimed stimulus payments. For instance:

- California offers checks ranging from $350 to $725, depending on income and family size, with payments starting in 2025.

- Georgia has provided up to $500 in tax rebates for individuals who filed state income tax returns for 2021 and 2022.

- Colorado is offering TABOR refunds (Taxpayer’s Bill of Rights) to eligible residents, with checks starting in late summer.

How to Ensure You Get Part of Your $45 Million in Unclaimed Stimulus Payments?

If you think you may be eligible for one of these stimulus programs, the first thing you need to do is check the official resources in your state. Each program has specific eligibility requirements, and in some cases, you may need to file a claim or complete a form to ensure you receive your payment.

- Illinois: If you’re a resident of Illinois, check with the state’s Treasurer’s Office to confirm whether you’re eligible for a surprise check.

- Alaska: For Alaska residents, you can verify your eligibility and apply for the PFD by visiting the Alaska Permanent Fund Dividend website.

- IRS Recovery Rebate Credit: If you missed out on the Recovery Rebate Credit, check the IRS’s website for updates. The deadline to claim has passed, but keep an eye on other relief programs that may be available in the future.

- Other States: Make sure to check with your state’s official website for further updates on stimulus checks and relief funds.

Common Mistakes to Avoid

- Missing Deadlines: Pay attention to key dates like April 15, 2025, for the Recovery Rebate Credit.

- Incorrect Information: Ensure that the address and banking details the government has on file are up-to-date, so your payment reaches you without issue.

- Not Checking: If you’re unsure whether you’re eligible, check with your state or the IRS for guidance.

Real-Life Example: Mary from Illinois

Take Mary, a 32-year-old resident of Chicago. She had filed her taxes in 2021, but for some reason, her stimulus check was never sent out. When she heard about the Enhanced Money Match Program, she was excited, but confused about how it worked. Mary did some research and found out that the Illinois Treasurer’s Office was sending out surprise checks to those who didn’t claim their funds. She didn’t need to do anything – her check was automatically mailed to her address. A month later, she received her $50 check in the mail!

Mary’s story is just one example of how easy it can be to receive unclaimed funds if you’re in the right place at the right time.

4 Financial Mistakes Americans Keep Making That Wreck Their Budgets

Trump’s ‘Big Beautiful Bill’ Could Reshape Social Security for Millions of Americans

Expert Offers Guidance for Couples Planning Retirement With Limited Savings