4 Financial Mistakes Americans Keep Making That Wreck Their Budgets: is more than a trending topic—it’s a serious reality that’s keeping millions in a cycle of paycheck-to-paycheck living. Whether you’re a college grad, a busy parent, or even mid-career and earning six figures, these mistakes don’t discriminate. What’s worse? Many people don’t even realize they’re doing anything wrong until it’s too late. The good news? You can fix these habits and build a better financial future—without giving up your lifestyle or peace of mind. In this article, we’ll break down each of these common financial mistakes, share expert insights, offer relatable examples, and most importantly, show you exactly how to fix them.

4 Financial Mistakes Americans Keep Making That Wreck Their Budgets

Millions of Americans are falling into the same money traps—not because they’re bad with money, but because no one taught them how to manage it. The four biggest mistakes—skipping emergency savings, credit card debt, overspending, and lack of financial education—are costing people time, peace of mind, and thousands of dollars every year. But now that you know better, you can do better. Start small. Make a plan. Stick to it. And remember: you don’t need to be rich to be financially free—you just need to be intentional.

| Mistake | Key Stat | Pro Tip |

|---|---|---|

| Skipping emergency savings | 59% can’t cover a $1,000 emergency expense | Start with $500–$1,000 and automate savings |

| Letting credit card debt grow | Americans owe over $1.17 trillion in credit card debt | Use debt avalanche or snowball method to pay it off |

| Living beyond your means | U.S. consumer spending hit $19 trillion in Dec 2023 | Track expenses, apply 50/30/20 budget rule |

| Lack of financial literacy | 60% of people lose $1,000+ due to poor money decisions | Use free learning tools from CFPB and MyMoney.gov |

| Official Resources | CFPB.gov, MyMoney.gov, Investopedia | Budget calculators, credit score education, debt guides |

Mistake #1: Skipping the Emergency Fund

You’ve probably heard this before, but it bears repeating: an emergency fund is your financial lifeline.

According to a 2024 Bankrate report, nearly 6 in 10 Americans can’t afford a $1,000 emergency without borrowing or using a credit card. That means a surprise car repair, vet bill, or dental emergency could throw their entire month—or more—off track.

Why it matters? Without a cash cushion, you’re forced to rely on high-interest loans or credit cards when the unexpected happens. And that leads to a debt spiral that’s hard to escape.

Start here:

- Open a separate savings account (not tied to your debit card).

- Set a goal of $1,000 initially, then build up to 3–6 months of living expenses.

- Automate a small portion of every paycheck ($25–$50) into this fund.

Even if money is tight, something is better than nothing. You don’t need to build your emergency fund overnight—consistency matters more than size at the beginning.

Mistake #2: Letting Credit Card Debt Spiral

Credit card debt in the U.S. hit a historic high of $1.17 trillion in 2024, according to the Federal Reserve. That means the average American household with credit card debt owes more than $7,200—and rising.

Credit card companies aren’t shy about charging interest. The average annual percentage rate (APR) now exceeds 24%, which means if you’re only making minimum payments, you’re essentially donating money to your credit card issuer every month.

Why this happens:

- People use cards to cover everyday expenses when money is tight.

- They think rewards and points will outweigh the cost.

- There’s often no clear plan to pay down balances.

What to do instead:

- List your balances and their interest rates.

- Use the avalanche method (pay off the card with the highest interest first).

- Alternatively, use the snowball method (pay off the smallest balance first for motivation).

- Freeze spending on all cards until balances are under control.

If you’re overwhelmed, consider nonprofit credit counseling through organizations like NFCC.org. They can help you organize a debt repayment plan without risking your credit score.

Mistake #3: Living Beyond Your Means

Let’s talk about the trap of lifestyle creep. You get a raise—and then upgrade your car. Or move into a pricier apartment. Or start dining out more. Sound familiar?

This is one of the most common traps Americans fall into, especially in the age of social media where comparison culture is rampant.

In December 2023 alone, American consumer spending hit an unprecedented $19 trillion, fueled by one-click shopping, buy-now-pay-later services, and flexible credit lines. It’s easier than ever to live a lifestyle you technically can’t afford.

How to stop it:

- Track every expense for 30–60 days. Use apps like YNAB, Mint, or even a spreadsheet.

- Apply the 50/30/20 rule:

- 50% for needs (housing, utilities, groceries)

- 30% for wants (shopping, entertainment, dining out)

- 20% for savings or debt repayment

- Set spending caps on your lifestyle expenses like eating out, clothing, and subscriptions.

Also, set short-term financial goals like paying off a specific debt or saving for a vacation—this helps curb emotional or impulsive spending.

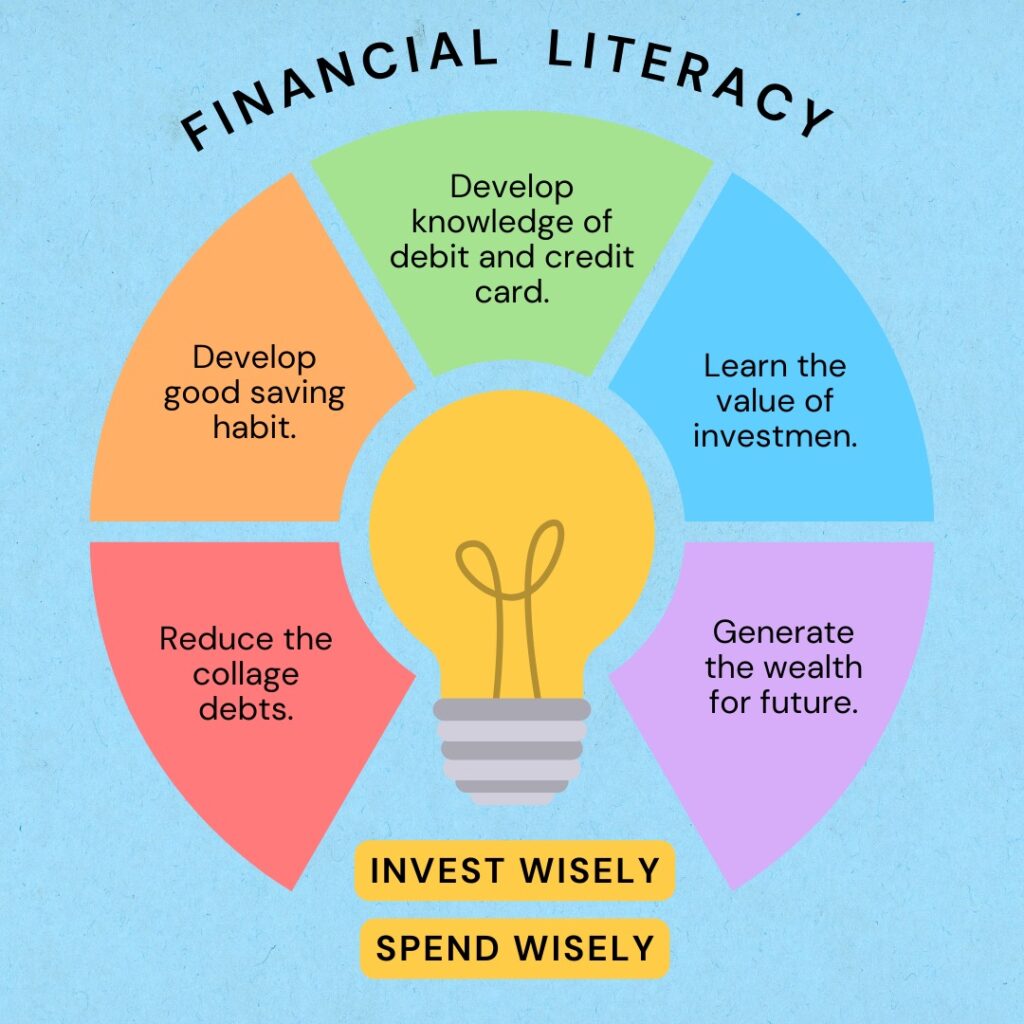

Mistake #4: Lack of Financial Literacy

In many parts of the country, students still graduate high school without being taught how to balance a budget, understand interest rates, or manage credit. That gap in education doesn’t magically fix itself in adulthood.

According to a recent survey from Experian, nearly 60% of Americans admit they’ve lost over $1,000 due to financial missteps—most of which could’ve been avoided with a basic understanding of personal finance.

Topics many adults struggle with:

- How credit scores are calculated

- How compound interest works

- When to refinance loans or mortgages

- How to compare insurance or investment products

Easy ways to learn more:

- Take a free online course at MyMoney.gov

- Use educational content at ConsumerFinance.gov

- Follow reputable experts on YouTube, like Graham Stephan or The Budgetnista

Even 20–30 minutes per week of reading or watching can compound over time and help you avoid costly mistakes.

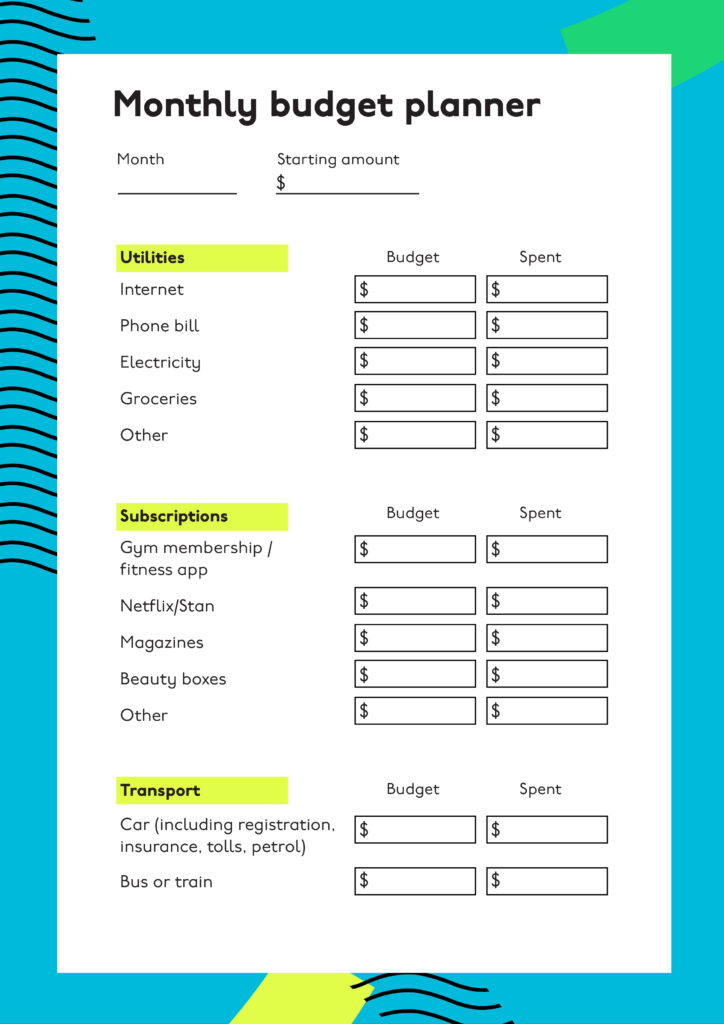

Bonus Mistake: Not Having a Budget (Or Ignoring It)

Budgeting might not sound exciting, but it’s one of the most powerful financial tools you can use. Yet, only 32% of U.S. households maintain a monthly budget, according to the U.S. Bank.

Without a budget, it’s easy to overspend, miss due dates, or lose track of savings goals.

Fix this today:

- List your total monthly income.

- Track fixed expenses (rent, utilities, insurance).

- Set limits for variable spending (groceries, fun, gas).

- Choose a tool that works for you—YNAB, Mint, or old-school pen and paper.

Treat your budget like a money GPS. It doesn’t restrict you—it directs you toward your goals.

Step-by-Step Action Plan For These 4 Financial Mistakes Americans Keep Making That Wreck Their Budgets

If you’re ready to get your finances on track, here’s a simple roadmap:

- Track your expenses for one month to see where your money’s going.

- Build a starter emergency fund of $500–$1,000.

- Create a monthly budget using the 50/30/20 rule.

- Make a debt repayment plan and stick to it.

- Automate your savings and bill payments.

- Spend 20 minutes per week learning about personal finance.

- Review your finances monthly to stay on track and make adjustments.

Some Social Security Recipients Could See Payments Slashed in Half— Check Why!

Columbia to Pay $9 Million for Misleading US News Rankings With Fake Data

The 2025 Trustees Report Just Dropped — What It Reveals About Social Security’s Future