$275M Inheritance Battle: When Jimmy Buffett, the legendary musician behind the Margaritaville empire, passed away in September 2023, he left behind not only an incredible legacy of songs and businesses but also a tangled web of estate issues. Buffett’s family, including his widow, Jane Buffett, and long-time accountant Richard Mozenter, found themselves embroiled in a highly publicized legal battle over his $275 million fortune. The fight over his estate offers valuable lessons for millionaires and anyone planning their own estate. In this article, we’ll dive into the key lessons from Jimmy Buffett’s inheritance battle. We’ll explore what went wrong and how you can avoid similar mistakes when it comes to estate planning. Whether you’re a high-net-worth individual or just starting to think about your legacy, the insights shared here can help you make better decisions for your future and your loved ones.

$275M Inheritance Battle

Jimmy Buffett’s costly inheritance battle serves as a cautionary tale for anyone with substantial assets. By choosing the right trustee, communicating clearly, setting up conflict resolution mechanisms, and regularly reviewing your estate plan, you can avoid similar issues in your own life. Estate planning isn’t just about distributing assets—it’s about ensuring your wishes are respected and that your family is provided for without unnecessary conflict. By learning from Buffett’s mistakes, you can safeguard your legacy and ensure a smoother transition for your loved ones.

| Key Topic | Details | Source |

|---|---|---|

| Jimmy Buffett’s Estate | $275 million at stake, involving his widow Jane Buffett and co-trustee Richard Mozenter. | Barrons |

| Legal Dispute | Jane Buffett alleges financial mismanagement and lack of transparency. Mozenter defends his actions, claiming Buffett’s instructions were clear. | People |

| Lessons for Millionaires | 1. Choose the right trustee 2. Ensure clear communication 3. Implement conflict resolution mechanisms | Stouffer Legal |

| Estate Planning Tips | Clear guidelines for trustee fees, regular updates to estate plans, and communication strategies. | Esq Wealth |

| Frequently Asked Questions | FAQ section answers common concerns on estate planning and trust management. |

The Inheritance Battle: Why It Matters

In the case of Jimmy Buffett’s estate, the situation took an unfortunate turn after his passing. Buffett’s fortune, primarily built on the Margaritaville brand, was placed in a trust to ensure that his widow, Jane Buffett, would be well taken care of. However, things quickly turned sour. Jane Buffett accused Richard Mozenter, the longtime accountant and co-trustee, of mismanaging the funds. She claims Mozenter not only withheld key financial information but also charged exorbitant fees in the millions.

Mozenter, on the other hand, argues that Buffett’s trust was set up with strict limitations, specifically intended to control Jane’s spending and decision-making. Mozenter filed a petition to remove Jane as a co-trustee, which only added fuel to the fire.

While this legal battle is still ongoing, it brings to light critical issues about trustee selection, communication, and financial transparency. And, as with most battles over big estates, it all comes down to one thing: planning.

Why Estate Planning Matters?

Estate planning isn’t just for the super-rich. While Jimmy Buffett’s case involved a $275 million inheritance, the same principles apply regardless of the size of the estate. Here are some key things every millionaire (or anyone who plans to leave a legacy) should consider when creating their estate plan.

1. Choose the Right Trustees

The role of a trustee is one of the most important elements in any estate plan. A trustee is responsible for managing and distributing assets, ensuring that the wishes of the deceased are carried out accurately. In Buffett’s case, Richard Mozenter was chosen as a trustee, but tensions between him and Jane Buffett suggest that perhaps there was a misalignment in the relationship or lack of mutual understanding.

When selecting a trustee, you want someone who is trustworthy, experienced, and knowledgeable about handling large estates. Ideally, this should be someone with whom the family has a strong relationship and can communicate openly with.

Example: If you’re creating a family trust, ensure that all family members are clear about their roles and responsibilities. Regular family meetings with the trustee can prevent misunderstandings later on.

2. Communicate Your Intentions Clearly

Jimmy Buffett’s will seemed to have unclear instructions on how the estate should be managed. This lack of clarity led to the legal dispute between Jane and Richard Mozenter. Clear communication between the grantor (the person making the estate plan), the trustees, and the beneficiaries is crucial.

You should outline everything clearly in your estate plan: from the distribution of assets to your wishes for healthcare and funeral arrangements. If your plans change, make sure to update your documents and inform your family and trustees accordingly.

Practical Tip: Hold family discussions to ensure everyone is on the same page about your wishes. This can also serve as a great opportunity to address any concerns before they become legal issues.

3. Set Up Conflict Resolution Mechanisms

One of the most overlooked elements of estate planning is ensuring there are ways to resolve disputes before they happen. In the case of Jimmy Buffett, it would have been beneficial to include a mediation clause in the trust. This clause could outline how disagreements should be handled, whether through mediation or arbitration, to avoid costly and time-consuming litigation.

Tip: Work with an experienced estate attorney to draft conflict-resolution provisions in your trust documents. This could save your heirs from unnecessary legal battles.

Additional Lessons from Similar Estate Disputes

A History of High-Profile Estate Disputes

The Buffett case isn’t unique. High-profile estate battles have been a part of American celebrity culture for years. Take Prince, for instance. When the famous musician passed away unexpectedly in 2016, he didn’t leave a will, resulting in a chaotic and lengthy legal battle over his $300 million estate. Similarly, Aretha Franklin faced estate challenges after she passed away in 2018, with family members fighting over her assets due to an unclear estate plan.

These cases highlight how lack of planning, or unclear plans, can lead to lengthy court battles, family discord, and financial strain.

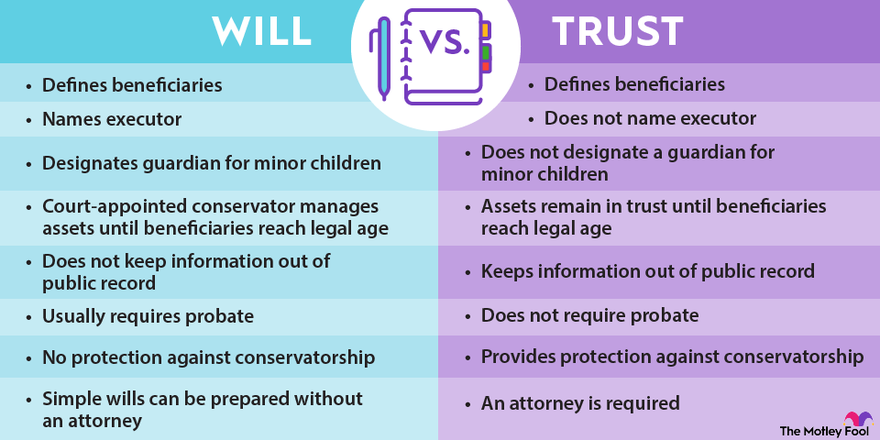

Trust vs. Will: What’s the Difference?

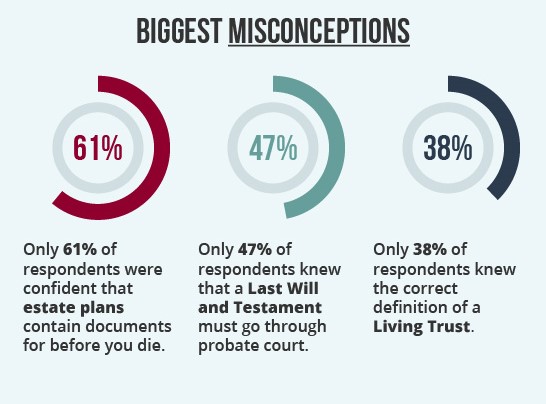

A will directs the distribution of your assets after your death, while a trust allows for more control over how assets are handled before and after death. Trusts are often the preferred choice for high-net-worth individuals because they allow assets to pass outside of probate court, offering privacy and efficiency. However, if not properly managed, trusts can still lead to disputes, as seen with Buffett’s case.

Example: Buffett likely chose a trust to ensure his widow would be taken care of. However, trusts require active management, which can create friction if trustees and beneficiaries are not in sync. A well-crafted will could have offered a simpler solution in this case.

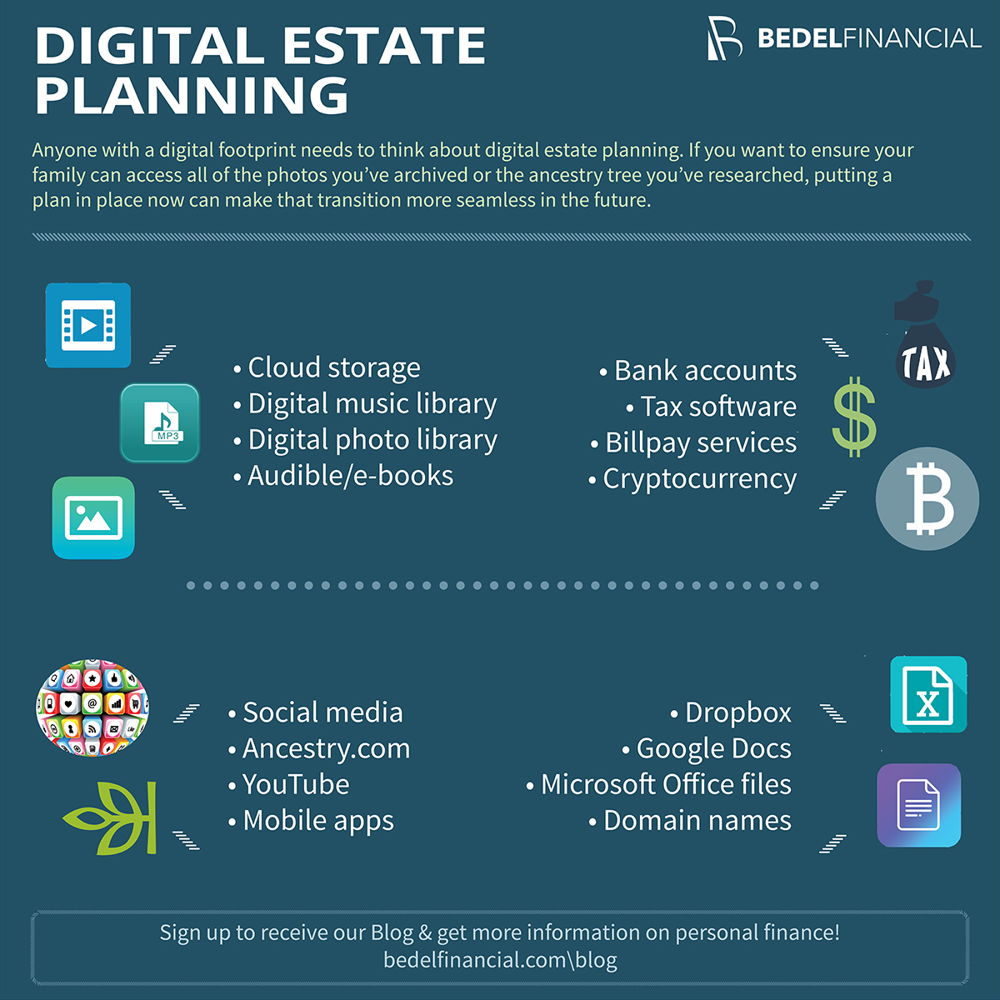

The Role of Digital Assets

In the digital age, planning for digital assets is becoming increasingly important. Buffett’s estate might not have dealt with cryptocurrency or social media accounts, but today’s estates often do. It’s essential to include provisions for digital assets in your estate plan, from online businesses to social media accounts to cryptocurrencies like Bitcoin.

Tip: Add a digital asset clause to your estate plan, listing all accounts and how they should be handled. Consider using a password manager to store this sensitive information securely.

Practical Steps for Effective Estate Planning

If you’re inspired by Jimmy Buffett’s story and want to avoid falling into the same trap, here are some practical steps you can take to secure your legacy:

Step 1: Choose the Right Trustees

When selecting trustees, consider their ability to act impartially and their experience in managing finances. It’s common to appoint a financial advisor or an attorney who specializes in estate planning. However, don’t overlook personal relationships. Ideally, the person or institution should have a solid understanding of your family dynamics and be able to act in the best interest of everyone involved.

Recommendation: Consider appointing a corporate trustee if you’re not sure about family members’ ability to manage the estate. Corporate trustees bring an added level of professionalism and objectivity.

Step 2: Make Sure Your Wishes Are Clearly Written

Clarity is key. Every part of your estate plan should be clear and easy to understand. This includes specifying how assets are to be divided, who gets what, and how debts will be settled. If there are any complicated assets, such as business interests, ensure those are carefully outlined as well.

Tip: Work with an estate planner to review all aspects of your estate to ensure everything is documented accurately.

Step 3: Review and Update Regularly

Life changes. Your assets, your family dynamics, and even your wishes might change over time. Make sure to review and update your estate plan regularly, particularly after major life events such as births, deaths, marriages, or divorces.

Tip: Set a reminder to review your estate plan every 3-5 years or after any major life change.

Step 4: Set Clear Guidelines for Trustee Compensation

One of the issues that arose in Buffett’s estate dispute was the compensation of trustees. Mozenter’s fees—reportedly more than $1.7 million in 2024 alone—were a significant point of contention. To prevent this kind of situation, it’s important to clearly define how trustees will be compensated in the estate documents.

Recommendation: Work with your estate planner to define a clear, reasonable compensation structure for your trustees. This will help avoid misunderstandings later on.

Samsung Heirs Sell Villa in Seoul to Help Cover Inheritance Tax- What Does It Mean?

Sick of Rising Prices? ‘Revenge Saving’ Is the Bold Money Move Everyone’s Trying

Switzerland to Vote on 50% Inheritance Tax for Billionaires in Groundbreaking Referendum