2026 Tax Cuts Are Coming: The year 2026 will usher in some exciting changes to the U.S. tax system, thanks to a major tax overhaul known as the One Big Beautiful Bill. While tax cuts are typically associated with putting more money in taxpayers’ pockets, this bill has a range of implications that could affect how much you pay and who gets the biggest share of the savings. In this article, we’ll explore the specifics of the 2026 tax cuts, who benefits the most, and how these changes might impact your personal finances. Whether you’re a business owner, a senior citizen, or someone just trying to make sense of it all, we’ll break down the information into bite-sized pieces that anyone can understand.

2026 Tax Cuts Are Coming

The 2026 tax cuts will bring significant changes to the U.S. tax system, and they promise savings for many—though not everyone will benefit equally. High-income households will see the biggest reductions, while lower-income earners may face mixed results. The key to navigating these changes is to plan ahead, consult professionals, and stay informed about how the law impacts you. With the right planning and guidance, you can make sure that the One Big Beautiful Bill works in your favor. Keep an eye on updates, and be proactive to maximize your savings.

| Key Fact | Data & Details |

|---|---|

| Tax Savings for the Average American | On average, Americans can expect to save $2,900 starting in 2026, with top earners saving up to $12,540. |

| Top Earners’ Benefits | Households earning over $217,000 could see 60% of the total tax savings. |

| Low-Income Households | Households earning less than $34,600 may see a slight tax increase due to the loss of certain health care subsidies. |

| Child Tax Credit | The Child Tax Credit will increase to $2,200 per child and rise to $2,500 per child by 2028. |

| SALT Deduction Cap | State and Local Tax (SALT) deductions will rise to $40,000 for households earning less than $500,000 through 2029. |

| Medicaid Cuts | The bill proposes $912 billion in cuts to Medicaid, which may affect healthcare services. |

| Trump Accounts | Parents will receive a $1,000 deposit per child born between 2025 and 2028 for tax-deferred education or home down payment funds. |

| Seniors | Seniors aged 65+ can expect a $6,000 increase in the standard deduction. |

| SALT Deduction Phase-Out | After 2029, the SALT deduction cap will return to $10,000 |

Understanding the 2026 Tax Cuts

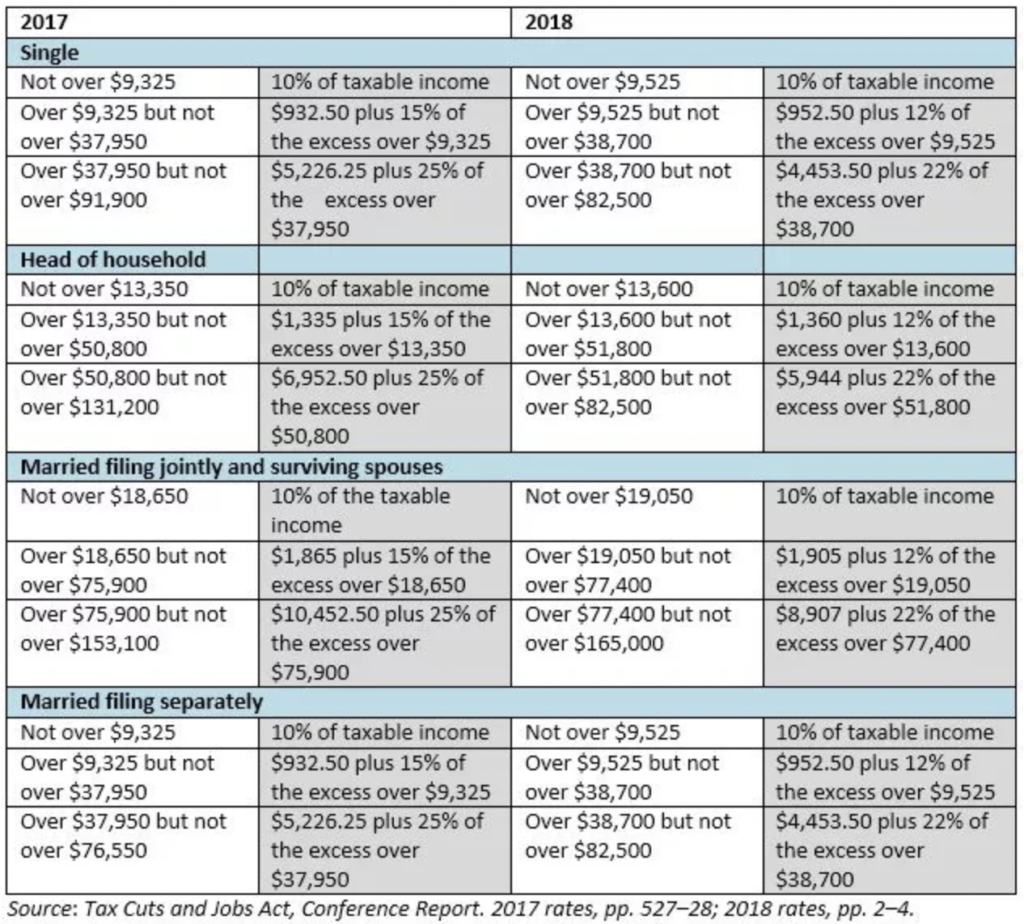

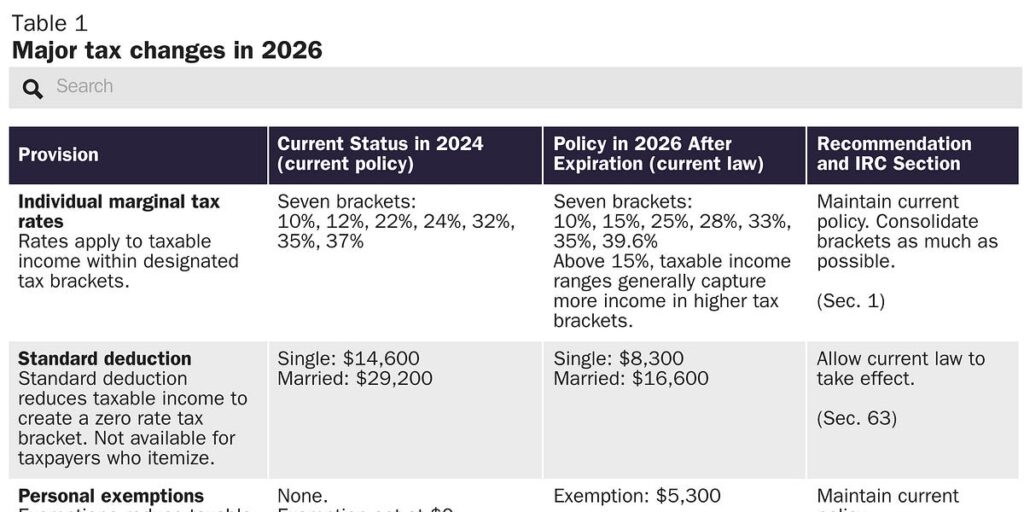

The One Big Beautiful Bill makes significant changes to the U.S. tax code starting in 2026, most notably by extending tax cuts that were first introduced in the 2017 Tax Cuts and Jobs Act. This is not just about cutting tax rates but also modifying key deductions and credits to support American families, seniors, and businesses. Here’s what the bill brings to the table:

Permanent Provisions from the 2017 Tax Cuts and Jobs Act

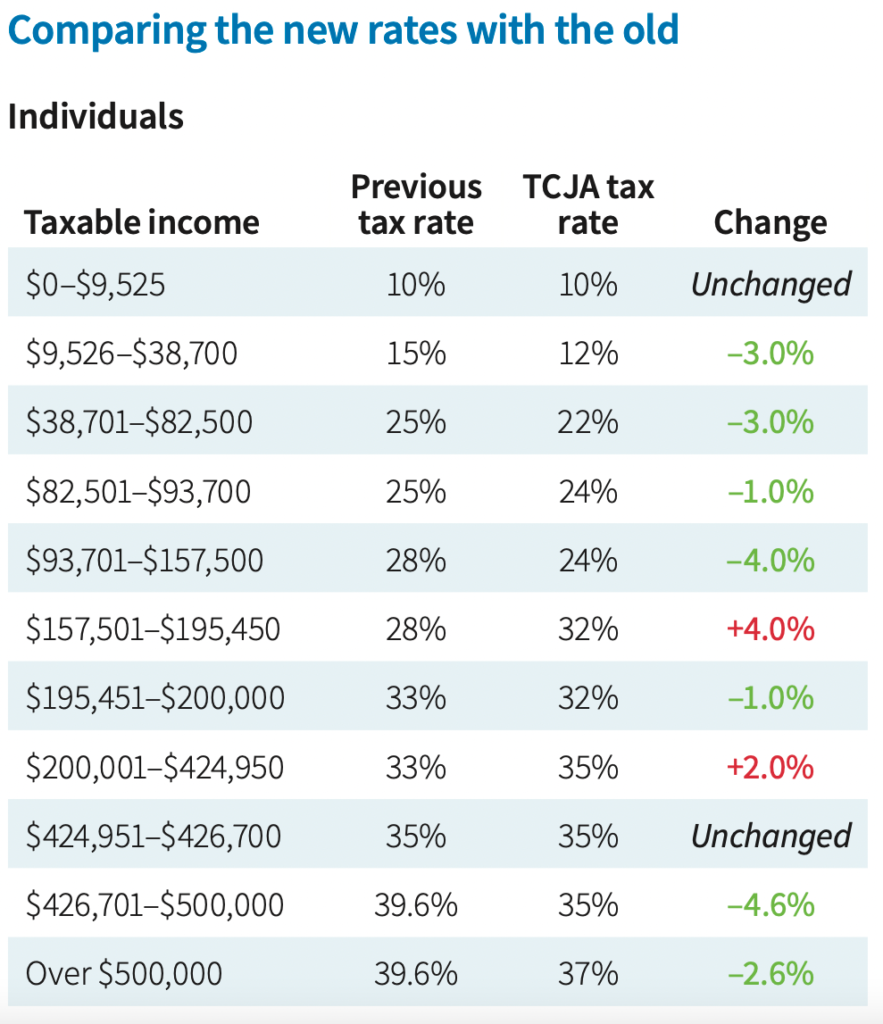

- Individual Tax Rates: The tax cuts on individual income, such as the reduced tax brackets and the elimination of personal exemptions, are now permanent. This means that tax rates for most income groups will remain low.

- Standard Deduction: The standard deduction will continue to be high, allowing taxpayers to reduce their taxable income significantly without having to itemize. This simplifies the process for many.

Enhanced Child Tax Credit

The Child Tax Credit increases to $2,200 per child. Furthermore, this credit will be adjusted for inflation, making it a valuable tool for parents. By 2028, the credit will rise further to $2,500 per child, providing even greater financial relief.

State and Local Tax (SALT) Deduction Changes

Previously, the SALT deduction was capped at $10,000. The new bill will increase this cap to $40,000 for households earning less than $500,000 through 2029. After 2029, the deduction cap will return to $10,000, so high-income earners should take advantage of this while it lasts.

Who Benefits the Most?

The One Big Beautiful Bill is designed to benefit a variety of income groups, but the extent of the benefit depends largely on your income bracket. Here’s a breakdown:

1. High-Income Households (Top 20%)

Households earning over $217,000 will receive about 60% of the total tax savings under the new bill. These households will benefit from the permanent tax cuts and the higher SALT deduction. The average savings for this group will be around $12,540 annually. For example, a family making $300,000 might see a significant reduction in their tax bill thanks to the combination of the higher deduction and increased child tax credits.

2. Middle-Income Households

Middle-income households will see more modest savings, typically ranging from $1,000 to $3,000. Families with children or seniors will benefit the most, thanks to the Child Tax Credit increase and the additional standard deduction for seniors aged 65+. For example, a family making $75,000 could see a savings of about $2,500 per year.

3. Low-Income Households

Households making less than $34,600 may experience a slight tax increase due to the loss of certain healthcare subsidies. Although the overall tax cuts will benefit many, these households might find themselves in a position where their tax burden increases slightly, primarily due to changes in healthcare funding.

Special Provisions You Should Know About

The One Big Beautiful Bill isn’t all about tax rates—it also includes temporary provisions that might benefit specific groups of people:

No Tax on Tips and Overtime

If you earn tips or receive overtime pay, the bill allows you to deduct up to $25,000 of such income from federal taxes. Keep in mind, this does not exempt you from Social Security, Medicare, or state taxes. This provision can help reduce your taxable income if you work in the service industry.

Car Loan Interest Deduction

If you’re purchasing a new U.S.-assembled vehicle, you can deduct up to $10,000 of the interest on your loan. This is a temporary provision that will benefit middle-income and upper-middle-income households who are buying a new car. However, this benefit phases out for those earning over $100,000 (individuals) or $200,000 (couples).

Trump Accounts

Parents of children born between 2025 and 2028 will receive a $1,000 deposit in a tax-deferred Trump Account. These funds can be used for educational expenses, job training, or even a down payment on a home. Parents can also contribute up to $5,000 annually to these accounts, providing a valuable savings tool.

Risks and Drawbacks of the 2026 Tax Cuts

While the One Big Beautiful Bill offers many benefits, there are some risks and potential downsides:

- Increased Deficit: The bill is expected to raise the federal deficit by $4.1 to $5.5 trillion over the next decade. This could lead to future tax increases or cuts in other programs to make up for the lost revenue.

- Healthcare and Medicaid Cuts: The bill proposes $912 billion in cuts to Medicaid, which could have a significant impact on low-income Americans who rely on this program for healthcare.

- Uneven Impact: As previously mentioned, higher-income households will benefit the most, while low-income households may face increased taxes in some cases.

How to Prepare for 2026 Tax Cuts Are Coming?

So, how can you get ready for the upcoming changes?

- Consult a Tax Professional: It’s always a good idea to speak with a tax professional who can help you navigate these changes. They can also advise on adjusting withholding or planning for the Child Tax Credit.

- Adjust Your Financial Plans: Consider how these changes will affect your savings, spending, and investments. For example, if you’re expecting a larger tax refund, it might be a good idea to put that money into a savings account or retirement plan.

- Take Advantage of Temporary Provisions: If you’re eligible for Trump Accounts, or if you work in a tipped or overtime job, make sure you understand how these provisions work and take full advantage of them.

Trump’s New Tax Bill Could Reshape How Social Security Benefits Are Taxed

Social Security Sends Out Urgent Email Over Trump Tax Bill Confusion – Check Details!

Inside Trump’s ‘Big Beautiful Bill’ and Its Impact on Your Social Security