2026 Social Security COLA Forecast: If you’re among the 71 million Americans depending on Social Security, one question has likely crossed your mind this year: “How much will my benefits go up in 2026?” As of May 2025, the 2026 Social Security COLA forecast has been updated to a 2.5% increase, according to the respected watchdog group The Senior Citizens League (TSCL).

While a 2.5% bump may not sound huge—especially after the 8.7% jump we saw in 2023—it’s a crucial adjustment for many older Americans trying to keep up with inflation. Whether you’re a retiree, veteran, or disabled worker, this modest boost in benefits could impact your financial planning heading into the new year. Let’s break it all down: what this forecast really means, how it’s calculated, and what you can do to prepare. We’ll also look at historical trends, expert insights, and real-world examples to help you make the most of every dollar.

2026 Social Security COLA Forecast

The updated 2026 Social Security COLA forecast of 2.5% signals a moderate increase in benefits for millions of Americans. It reflects a slowly cooling economy, persistent inflation in key areas, and the challenges of using CPI-W to measure senior needs. Though not a dramatic adjustment, it’s one retirees can plan around. Whether you’re reviewing your retirement budget or just looking to stretch your dollars a bit further, understanding COLA helps you take control of your financial future. The final figure will be released in October 2025—so keep an eye out, plan smart, and make your benefits work for you.

| Topic | Details |

|---|---|

| 2026 COLA Forecast | 2.5% (updated May 2025) |

| Monthly Increase Estimate | $48–$75 per beneficiary, depending on income |

| Last Year’s COLA (2025) | 2.5% |

| Highest COLA Since 2000 | 8.7% in 2023 |

| Calculation Basis | CPI-W inflation index (July–Sept 2025) |

| Final Announcement Date | October 2025 |

| Data Source | The Senior Citizens League |

What Is COLA and Why Is It Important?

COLA, short for Cost-of-Living Adjustment, is a mechanism used by the Social Security Administration (SSA) to ensure that benefit payments keep pace with inflation. It’s designed to protect beneficiaries from losing purchasing power as the cost of living rises.

Every year, the SSA examines the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W) for the third quarter (July through September). If prices are up from the previous year, benefits go up too. If they stay flat or fall, there may be no increase.

For beneficiaries living on fixed incomes, this annual adjustment can mean the difference between getting by and falling behind.

What’s Driving the 2026 Social Security COLA Forecast?

The 2.5% COLA projection is based on inflation data through the first half of 2025. Analysts from TSCL and others have been monitoring trends in food, housing, transportation, and healthcare costs to forecast this year’s adjustment.

Cooling but Persistent Inflation

Although inflation has moderated compared to 2022 and 2023, it hasn’t disappeared. Prices for everyday essentials like food, rent, and utilities remain significantly higher than pre-pandemic levels. The Federal Reserve’s efforts to tame inflation through interest rate hikes have helped, but core inflation remains sticky in sectors that affect seniors most—particularly healthcare and housing.

CPI-W Limitations

The CPI-W isn’t perfect. It reflects spending habits of working Americans, not retirees. This means it underrepresents categories like healthcare—where older adults tend to spend a larger portion of their income. Many experts, including advocacy groups like The National Committee to Preserve Social Security and Medicare, argue that a new index, such as the CPI-E (Elder Index), should be used instead.

Data Gaps and Budget Cuts

Recent changes at the Bureau of Labor Statistics have reduced the scope of price tracking, potentially impacting the reliability of inflation readings. These cuts may make it more difficult to produce precise COLA estimates moving forward.

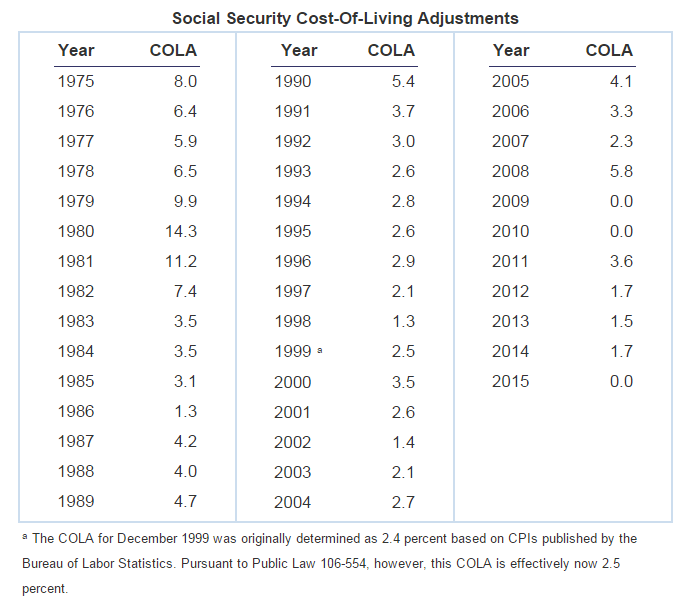

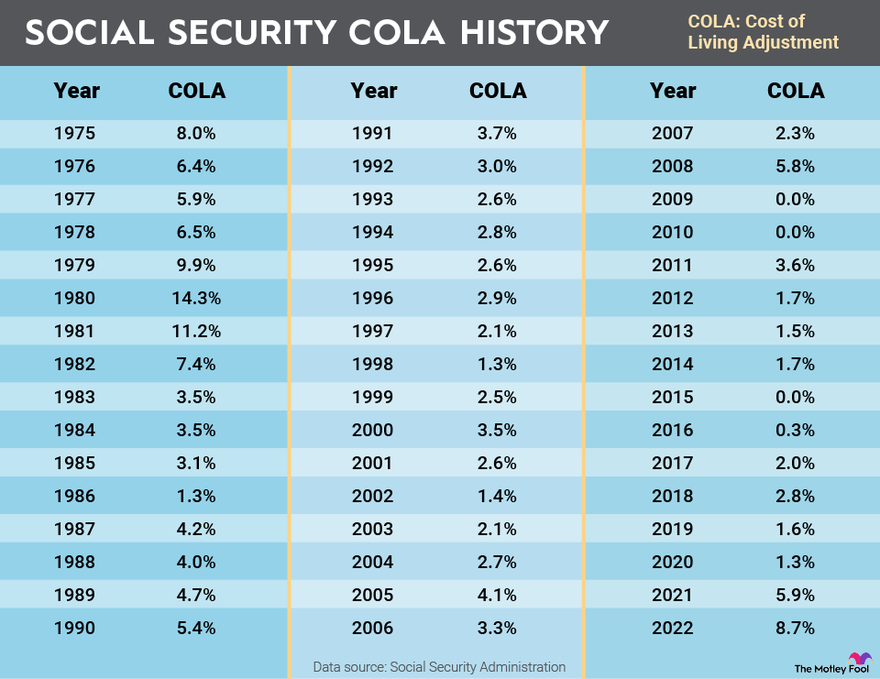

Historical Context: COLA Trends Over Time

Let’s put 2.5% in perspective. Here’s a look at recent COLA adjustments:

| Year | COLA (%) |

|---|---|

| 2026 (Forecast) | 2.5% |

| 2025 | 2.5% |

| 2024 | 3.2% |

| 2023 | 8.7% |

| 2022 | 5.9% |

| 2021 | 1.3% |

| 2020 | 1.6% |

| 2019 | 2.8% |

| 2018 | 2.0% |

The average COLA over the past decade has hovered around 2%, with notable exceptions during periods of economic disruption.

Real-World Impact: What a 2.5% COLA Means for You

Here’s what the 2026 COLA could look like in real dollar terms:

| Current Monthly Benefit | Estimated Increase | New Total (2026) |

|---|---|---|

| $1,500 | $37.50 | $1,537.50 |

| $2,000 | $50.00 | $2,050.00 |

| $2,500 | $62.50 | $2,562.50 |

| $3,000 | $75.00 | $3,075.00 |

For the average retired worker receiving around $1,900/month, a 2.5% increase would yield roughly $47.50 extra per month—or about $570 per year.

It’s not life-changing money, but for many households, it covers a few extra grocery runs, rising prescription costs, or a small utility bill.

What Experts Are Saying?

Industry professionals and retirement policy advocates have mixed feelings about the COLA forecast.

Mary Johnson, a policy analyst at The Senior Citizens League, notes:

“While a 2.5% COLA provides some relief, it still falls short of the actual cost increases older Americans are experiencing. We’re urging Congress to consider better inflation indexing for seniors.”

Max Richtman, President and CEO of the National Committee to Preserve Social Security and Medicare, adds:

“We believe the CPI-E would give a more accurate picture of senior spending. The current system underestimates the impact of inflation on older Americans.”

How to Prepare for the 2026 Social Security COLA Forecast?

Even a modest increase can improve your financial picture—if you plan ahead. Here’s what to do:

1. Review Your Budget

Factor in the expected COLA and look for opportunities to reduce unnecessary spending. Online tools and spreadsheets can help.

2. Check the SSA Estimator

Use the official SSA Benefits Estimator to calculate your 2026 payment.

3. Watch Medicare Premiums

Increases to Medicare Part B premiums can eat into your COLA.

4. Speak With a Financial Advisor

For those withdrawing from IRAs or other retirement accounts, understand how COLA affects tax brackets and income thresholds.

Real Voices: What Beneficiaries Are Saying

Linda T., 68, retired postal worker from Georgia:

“I appreciate every bit of help, but the rent on my senior apartment has gone up $150 in the last two years. A 2.5% COLA doesn’t even come close.”

Robert H., 73, veteran and cancer survivor in New Mexico:

“The increase covers my new prescriptions, but that’s about it. We need something fairer.”

These stories echo across the country: every little increase matters—but many feel the system isn’t keeping pace with reality.

Resources to Help You Navigate Social Security

| Resource | Description |

|---|---|

| SSA COLA Info | Official SSA page on COLA adjustments |

| SSA Estimator | Tool to estimate your 2026 benefits |

| Medicare Info | Premiums, deductibles, and updates |

| The Senior Citizens League | Advocacy group for retirees |

| National Council on Aging | Help with benefits and programs |

2026 COLA Estimate Is In—Here’s How Much Social Security Could Increase

This Week’s Social Security Checks: How Some Retirees Could Receive Up to $5,108—Are You Eligible?

Trump’s ‘Big Beautiful Bill’ Sparks Debate Over Social Security and Benefits