2026 COLA Estimate Is In: The 2026 Social Security Cost-of-Living Adjustment (COLA) is projected to rise by 2.5%, according to the latest forecast by the Senior Citizens League (TSCL). This means your Social Security benefits could see a modest increase in the coming year, just like they did in 2025.

This adjustment is designed to help retirees and beneficiaries keep up with the rising cost of everyday living—things like groceries, rent, medical bills, and transportation. But how exactly is COLA calculated, and is a 2.5% bump really enough when inflation is still hanging around? In this comprehensive guide, we’ll break down what COLA is, how it works, what the 2026 estimate means for you, and how you can prepare financially. Whether you’re a retiree, planning for retirement, or supporting a loved one on Social Security, this article will give you the clear, trustworthy information you need.

2026 COLA Estimate Is In

The 2026 Social Security COLA is forecasted to increase benefits by 2.5%, a modest but helpful adjustment that could bring around $576 more annually to the average retiree. While it may not fully offset the real-world costs many seniors face, it’s still a step in the right direction. Staying informed, updating your budget, and using available tools and programs can help you make the most of your increase. And if you believe the system could be fairer, don’t hesitate to raise your voice—advocacy matters, especially when it affects your bottom line.

| Feature | Details |

|---|---|

| Projected 2026 COLA | 2.5% (based on May 2025 inflation trends) |

| Current Average Benefit | $1,907/month for retired workers (as of 2025) |

| Expected Monthly Increase | Approximately $48/month |

| Estimated Annual Increase | $576/year per recipient |

| Official Source | Senior Citizens League |

| Next Official Announcement | October 2025, by the Social Security Administration |

| Inflation Index Used | CPI-W (Consumer Price Index for Urban Wage Earners and Clerical Workers) |

| Tools | My Social Security Account Calculator |

What Is COLA and Why Does It Matter?

Cost-of-Living Adjustments, or COLAs, are annual increases to Social Security benefits. The idea is simple: as the cost of living rises, so should the amount of money you receive each month.

COLAs are meant to preserve the purchasing power of Social Security. If prices for groceries, rent, or medicine go up 3% in a year, then your check ideally increases by 3% too. Otherwise, your money wouldn’t go as far.

But there’s a catch: the government uses the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W) to measure inflation. That doesn’t always reflect what seniors actually spend money on. For instance, CPI-W underrepresents healthcare and housing costs—two of the biggest expenses for older adults.

How Is COLA Calculated?

Each year, the Social Security Administration (SSA) uses inflation data from the third quarter (July to September) to determine the next year’s COLA. They compare the average CPI-W from those months to the same period in the previous year.

Here’s the basic formula:

- If the CPI-W rises, COLA rises by that same percentage.

- If the CPI-W stays flat or drops, there may be no increase at all.

This method has led to some years with no COLA increase (2010, 2011, and 2016), even though seniors still faced higher personal costs.

What Does a 2.5% COLA Mean in Real Terms?

Let’s look at a few real-world examples to understand the impact of a 2.5% COLA:

Example 1 – Retired Worker

- Monthly benefit in 2025: $1,900

- 2026 increase (2.5%): $47.50

- New monthly benefit: $1,947.50

Example 2 – Married Couple on Social Security

- Combined monthly benefit: $3,400

- Monthly increase: $85

- Annual increase: Over $1,000

While the dollar amounts might not seem life-changing, they can help cover annual increases in essentials like electricity, groceries, or Medicare premiums.

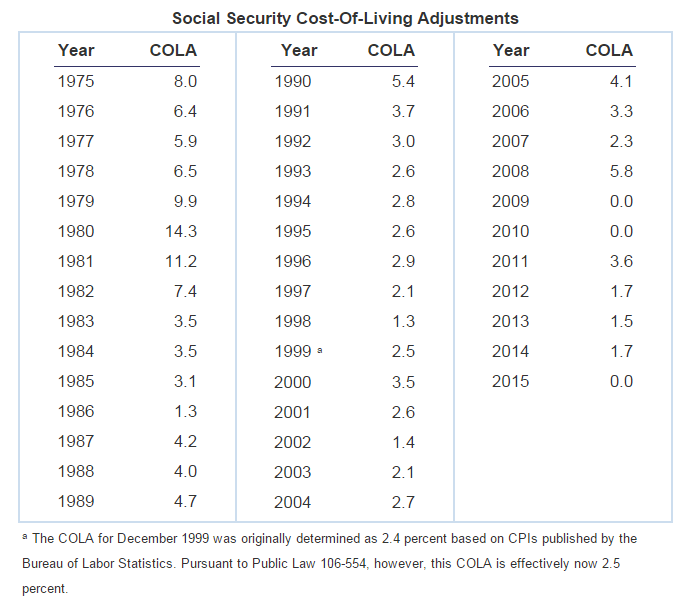

Historical COLA Rates: Past 10 Years

To understand how 2.5% stacks up, here’s a look at COLA rates from the past decade:

| Year | COLA (%) |

|---|---|

| 2016 | 0.0% |

| 2017 | 0.3% |

| 2018 | 2.0% |

| 2019 | 2.8% |

| 2020 | 1.6% |

| 2021 | 1.3% |

| 2022 | 5.9% |

| 2023 | 8.7% |

| 2024 | 3.2% |

| 2025 | 2.5% |

| 2026 | 2.5% (projected) |

As you can see, the past few years have been volatile, especially during the COVID-19 pandemic and following inflation spikes. The projected 2026 rate reflects a return to more stable, modest adjustments.

Is 2.5% Enough to Keep Up With Inflation?

This is the million-dollar question.

While 2.5% is aligned with recent average COLAs, it may not be sufficient for seniors facing rising out-of-pocket costs, especially in areas like:

- Healthcare premiums and prescriptions

- Homeowner insurance and rent

- Grocery and utility bills

According to TSCL, more than 79% of older adults say COLA doesn’t accurately reflect their rising expenses. That’s largely because CPI-W is based on the spending patterns of working adults, not retirees.

Why Not Use CPI-E Instead of CPI-W?

Many advocates, including groups like AARP, support replacing CPI-W with the CPI-E (Consumer Price Index for the Elderly), which more accurately reflects senior expenses. CPI-E gives more weight to medical care and housing—costs that matter most to retirees.

Switching to CPI-E could result in larger COLAs over time, but Congress would need to pass legislation for the change to happen. If you’re interested in supporting this idea, consider contacting your local representative or signing petitions through advocacy organizations.

Real-Life Impact: 3 Scenarios

Linda, 72 – Retired Librarian

Linda receives $2,100/month in Social Security. A 2.5% bump gives her $52.50 more per month. She plans to put that into a heating fund for the winter and help with medication costs.

Joe, 66 – Part-time Worker

Joe receives $1,650/month and uses Medicare Advantage. His monthly COLA increase will be around $41.25. With rising co-pays, he’s using the extra funds to offset his new dental plan premium.

Maria & Paul, Disabled Couple on SSDI

Together, they receive $2,800/month. With a 2.5% COLA, their benefits increase by $70/month. They’re using it to cover increasing grocery bills and a recent rise in their internet and phone bundle.

How to Make the Most of Your 2026 COLA Estimate Is In

Even a modest increase can stretch far if used wisely. Here are a few tips:

- Re-evaluate Your Budget

Update your expenses, especially for recurring categories like utilities, groceries, and prescriptions. A budget refresh ensures you’re spending your new income wisely. - Plan for Rising Healthcare Costs

Check for updates on Medicare Part B premiums, which may rise in 2026 and offset part of your COLA. - Use Free Tools

SSA offers calculators and benefit estimators at ssa.gov/myaccount. Use them to model your updated monthly benefit. - Pay Down Debt

Use your extra funds to chip away at high-interest loans or credit cards. - Save What You Can

If your budget allows, set aside even a portion of the increase for emergencies. A small buffer can provide big peace of mind.

Additional Support for Low-Income Seniors

If you’re living on a tight budget, there are several programs that can help beyond COLA:

- SNAP (Supplemental Nutrition Assistance Program): fns.usda.gov/snap

- LIHEAP (Low-Income Energy Assistance): acf.hhs.gov/ocs/programs/liheap

- Medicare Extra Help: ssa.gov/benefits/medicare/prescriptionhelp

These resources can ease the burden of food, heating, and medical expenses, especially if your COLA doesn’t go far enough.

Age 65? You Could Get a $1,611 Social Security Payment This July – Check Eligibility Criteria!

July 2025 Social Security Payments: Important Dates Every Washington State Resident Should Know

Millions of Americans Could See Their Social Security Checks Cut by 50 Percent