11 Old-School Money Habits: In today’s fast-paced world, where technology is king and trends come and go in the blink of an eye, one thing remains steady: the need for smart financial habits. While it’s easy to get caught up in the latest apps, gadgets, and quick fixes to manage money, old-school money habits have stood the test of time for a reason. For Gen Z and Millennials, embracing these time-tested strategies could save them a fortune in the long run. In this article, we’ll break down 11 old-school money habits that have helped previous generations build wealth, save for the future, and achieve financial security. These strategies are as relevant today as they were decades ago, and with a little discipline and consistency, you can start using them today. Whether you’re just getting your first paycheck or you’re well into your career, these habits can have a profound impact on your financial well-being.

11 Old-School Money Habits

In a world full of financial distractions, old-school money habits are more important than ever. By adopting practices like budgeting, saving first, and avoiding high-interest debt, Gen Z and Millennials can build a solid foundation for financial success. These habits don’t require fancy apps or tricks—just a commitment to taking control of your money. Start small, stay consistent, and watch your financial future grow. Remember, the earlier you start, the more you’ll benefit from these tried-and-true financial strategies.

| Key Habit | Why It’s Important | How to Implement | Key Stat/Facts |

|---|---|---|---|

| Create a Budget | Helps track your spending and prioritize savings. | Use apps like Mint or simple spreadsheets to monitor expenses. | 64% of Americans track their spending regularly. (source: Mint) |

| Pay Yourself First | Guarantees you save before spending. | Set up automatic transfers to savings accounts. | Automatic savings leads to better financial habits. (source: Forbes) |

| Avoid High-Interest Debt | Minimizes the amount you pay in interest. | Focus on paying off credit card debts with the highest rates first. | Credit card interest rates can be as high as 25%. (source: NerdWallet) |

| Start Investing Early | Takes advantage of compound interest. | Open an IRA or contribute to a 401(k) plan. | The earlier you invest, the more you accumulate over time. |

| Embrace Frugality | Saves money on everyday expenses. | Cook at home, buy secondhand, and avoid impulse buys. | Frugal living can save you up to 40% on your monthly expenses. |

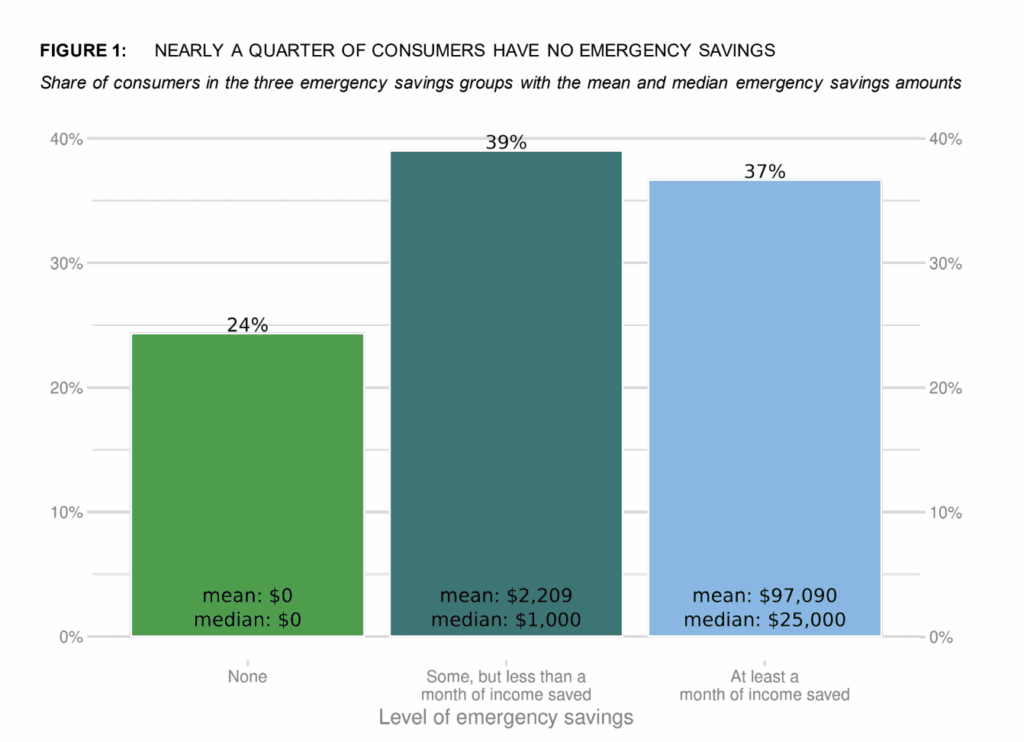

| Build an Emergency Fund | Provides security during unexpected financial setbacks. | Aim for 3-6 months’ worth of expenses in an emergency account. | 39% of Americans couldn’t cover a $400 emergency. (source: Federal Reserve) |

| Utilize Employer Benefits | Maximizes your savings with matching contributions. | Take advantage of employer retirement plans and health savings accounts (HSAs). | Employers match 3.5% of employee contributions on average. |

| Invest in Financial Education | Helps make informed decisions and avoid costly mistakes. | Read books, take courses, or listen to podcasts about personal finance. | 41% of Americans feel financially illiterate. (source: National Endowment for Financial Education) |

| Practice Mindful Spending | Ensures purchases align with long-term financial goals. | Ask yourself if you really need an item before buying it. | 63% of people regret impulse buys. (source: Forbes) |

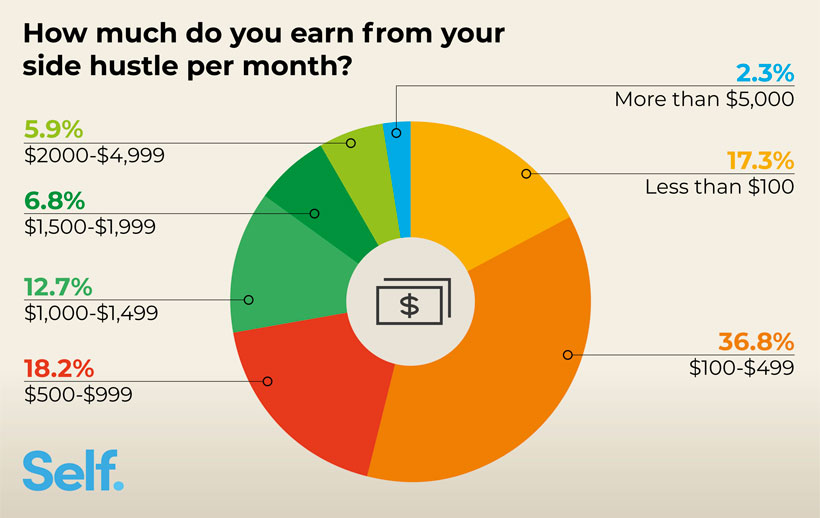

| Diversify Income Streams | Reduces financial risks and increases overall earnings. | Look into side hustles or freelance opportunities. | 45% of U.S. workers have a side job. (source: Gallup) |

| Plan for the Long Term | Helps you set clear financial goals and work towards them. | Create a financial plan that includes saving for retirement, buying a home, etc. | People with a written plan are 2x more likely to achieve their goals. (source: SmartAsset) |

11 Old-School Money Habits That Could Save Gen Z and Millennials a Fortune

1. Create a Budget and Stick to It

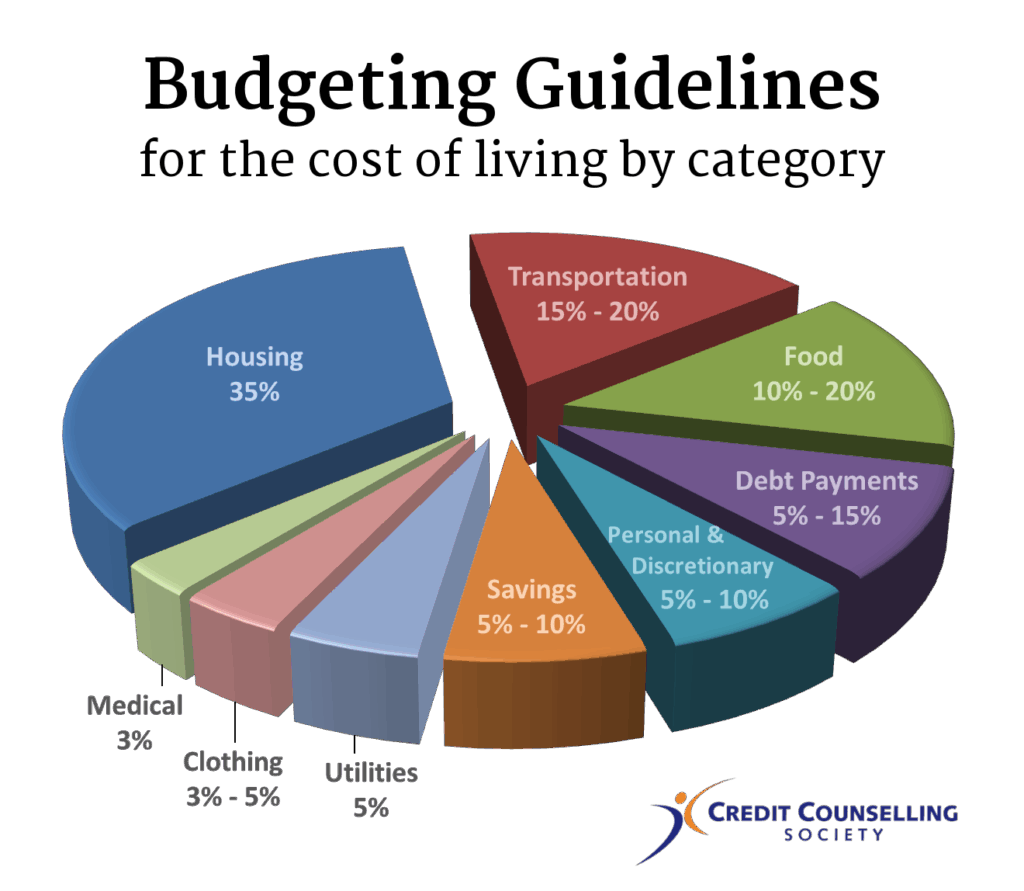

One of the most important financial habits that anyone, regardless of their age, can adopt is creating and sticking to a budget. Budgeting allows you to track your spending, save money, and make sure you’re not living paycheck to paycheck. In fact, according to Mint, 64% of Americans track their spending regularly. If you’re not budgeting yet, it’s time to start.

How to Implement:

- Use Apps: Apps like Mint, YNAB (You Need a Budget), or even good ol’ spreadsheets can help you keep an eye on your income and expenses.

- Follow the 50/30/20 Rule: This is a simple rule that splits your income into three categories: 50% for needs (like rent and utilities), 30% for wants (entertainment, dining out), and 20% for savings or debt repayment.

- Track Everything: Don’t forget to include small expenses—those add up!

By understanding exactly where your money is going, you can make adjustments to ensure you’re saving and not overspending.

2. Pay Yourself First

Paying yourself first means prioritizing savings and investments before anything else. You might be thinking, “What about bills?” Of course, you need to pay your rent or mortgage first, but after that, make sure to put aside a portion of your income for your future. Set up automatic transfers to a savings account or retirement fund.

How to Implement:

- Automate Savings: Most banks allow you to set up automatic transfers to your savings account every payday. This way, the money goes straight to savings before you can spend it.

- Start Small: Even if you start with just 5% or 10% of your paycheck, you’ll see it grow over time.

By paying yourself first, you ensure that you’re building a financial cushion, which will come in handy when you need it most.

3. Avoid High-Interest Debt

One of the fastest ways to fall into a financial hole is to rack up high-interest debt. Credit card companies charge interest rates as high as 25%, and it can take years to pay off balances if you’re only paying the minimum.

How to Implement:

- Pay Off High-Interest Debt First: Use the debt avalanche method. Pay off the debt with the highest interest rate first, then move on to the next.

- Consolidate Debt: If you have multiple high-interest debts, consider consolidating them into a loan with a lower interest rate.

Cutting down on debt can free up money for saving, investing, and future goals.

4. Start Investing Early

The earlier you start investing, the better. Thanks to compound interest, even small contributions can add up to significant wealth over time. Starting early allows you to take advantage of market growth, even if you can’t contribute much at first.

How to Implement:

- Open an IRA: Individual Retirement Accounts (IRAs) allow you to grow your money tax-free, so consider opening one as soon as possible.

- Contribute to Your 401(k): If your employer offers a 401(k) plan, especially with matching contributions, you should take advantage of it.

5. Embrace Frugality

Frugality isn’t about being cheap; it’s about being mindful of how you spend. By being more intentional with your money, you can save hundreds (if not thousands) each year. Simple habits like cooking at home, buying secondhand, and avoiding impulse buys can have a big impact.

How to Implement:

- Meal Prep: Avoid eating out by meal prepping for the week. Cooking at home is almost always cheaper and healthier.

- Shop Smart: Look for discounts, buy in bulk, and check secondhand stores for clothes and furniture.

6. Build an Emergency Fund

An emergency fund is your safety net for unexpected events like medical bills, car repairs, or job loss. Aim for 3-6 months’ worth of expenses in a savings account that’s easily accessible.

How to Implement:

- Set a Goal: Start with a smaller goal, like saving $1,000, and then build from there.

- Deposit Regularly: Make a habit of adding to your emergency fund every month.

7. Utilize Employer Benefits

Many employers offer retirement plans, health benefits, and matching contributions. These benefits are essentially free money, and you should take full advantage of them.

How to Implement:

- Max Out Your 401(k): If your employer matches contributions, try to contribute enough to take full advantage of that match.

- Use Health Savings Accounts (HSAs): If available, contribute to an HSA for tax-free savings on medical expenses.

8. Invest in Financial Education

Many people make financial mistakes because they don’t fully understand how money works. By educating yourself about finance, you can make smarter decisions and avoid costly pitfalls.

How to Implement:

- Books and Podcasts: Read books like The Richest Man in Babylon or Rich Dad Poor Dad, and listen to finance podcasts such as The Dave Ramsey Show.

- Online Courses: There are many free or low-cost online courses on financial literacy available on platforms like Coursera or Khan Academy.

9. Practice Mindful Spending

It’s easy to get caught up in the excitement of a sale or the next trendy gadget, but being mindful about your purchases can save you money in the long run.

How to Implement:

- Wait Before You Buy: When you feel the urge to buy something, wait 24-48 hours. Often, the impulse will pass, and you’ll realize you don’t need the item.

- Set Spending Limits: Give yourself a monthly “fun money” budget. Once it’s gone, no more discretionary spending until next month.

10. Diversify Income Streams

Relying solely on your job can be risky. If the economy takes a hit or your company downsizes, you could find yourself in financial trouble.

How to Implement:

- Side Hustles: Look into freelance writing, pet-sitting, or selling handmade goods online.

- Invest in Stocks or Real Estate: If you have the capital, diversifying through real estate or stock investments can provide additional income.

11. Plan for the Long Term

It’s easy to get distracted by short-term goals, but long-term financial planning is where the real success lies.

How to Implement:

- Set Clear Financial Goals: Whether it’s saving for a house, retirement, or a child’s education, having clear goals will help you stay focused and motivated.

- Review Your Plan Regularly: Check in on your goals every few months and adjust as necessary to stay on track.

Expert Offers Guidance for Couples Planning Retirement With Limited Savings

Millennial Who Achieved Early Retirement Reveals Harsh Truth About FIRE Lifestyle

Gen Z Is Saving for Retirement Early, But Employers May Be Falling Behind