1 in 4 Older Americans Are Postponing Retirement:Retirement—it’s supposed to be that well-deserved break after decades of hard work. Yet, for many older Americans, this dream is being delayed. In fact, 1 in 4 Americans over 50 are now postponing their retirement plans. If you’re one of them, you’re definitely not alone. The reasons behind this trend go beyond just wanting to work a little longer. They’re deeply rooted in financial realities, rising living costs, and even concerns about healthcare. In this article, we’ll explore why this is happening, what it means for both individuals and the economy, and what you can do about it.

1 in 4 Older Americans Are Postponing Retirement

The trend of older Americans postponing retirement is more than just a financial issue—it’s a challenge for individuals, the economy, and policymakers alike. However, with the right planning, you can ensure a more secure and comfortable retirement, even if you need to work longer than expected. By starting to save, adjusting your budget, and exploring new income streams, you can set yourself up for success, regardless of when you choose to retire.

| Key Points | Details |

|---|---|

| Statistic | 1 in 4 older Americans are postponing retirement (AARP Survey, 2024) |

| Primary Reasons | Financial insecurity, rising living costs, health concerns, and Social Security uncertainty |

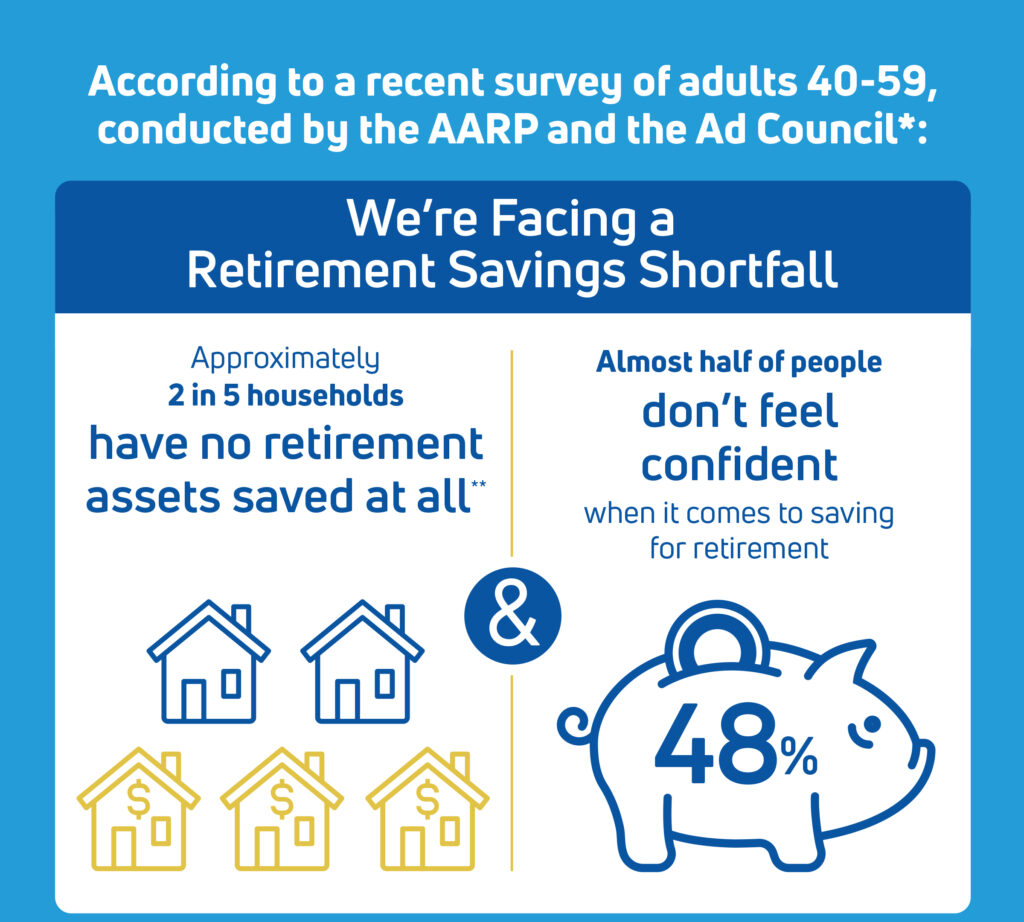

| Retirement Savings | 20% of adults 50+ have no retirement savings, and 61% worry they won’t have enough for retirement (AARP 2024) |

| Economic Impact | A rising number of older workers may increase job competition and strain public resources |

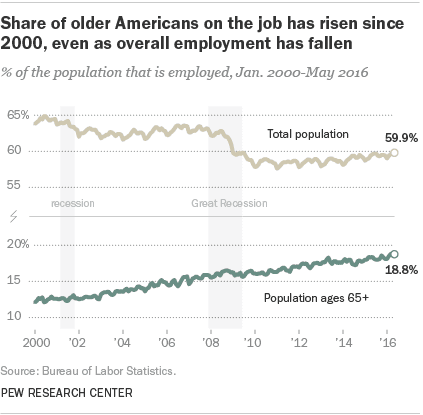

| Aging Workforce | 65+ workforce participation has grown from 11% in 1987 to 19% in 2023 (Investopedia) |

| What You Can Do | Start saving now, adjust spending habits, or explore new retirement plans (AARP, Investopedia) |

Why Are Older Americans Postponing Retirement?

First, let’s dive into what’s behind this growing trend. People work their whole lives for retirement, but recent changes in the economy, healthcare, and job market have forced many to reconsider.

1. Financial Insecurity

If you’ve been watching the news, you know inflation is no joke. Prices for everything from groceries to gas have been skyrocketing. In fact, 70% of older Americans are concerned that their expenses are rising faster than their incomes, according to a 2024 survey by AARP. When you’re living on a fixed income—or worse, no income at all from retirement savings—keeping up with inflation can be a real struggle.

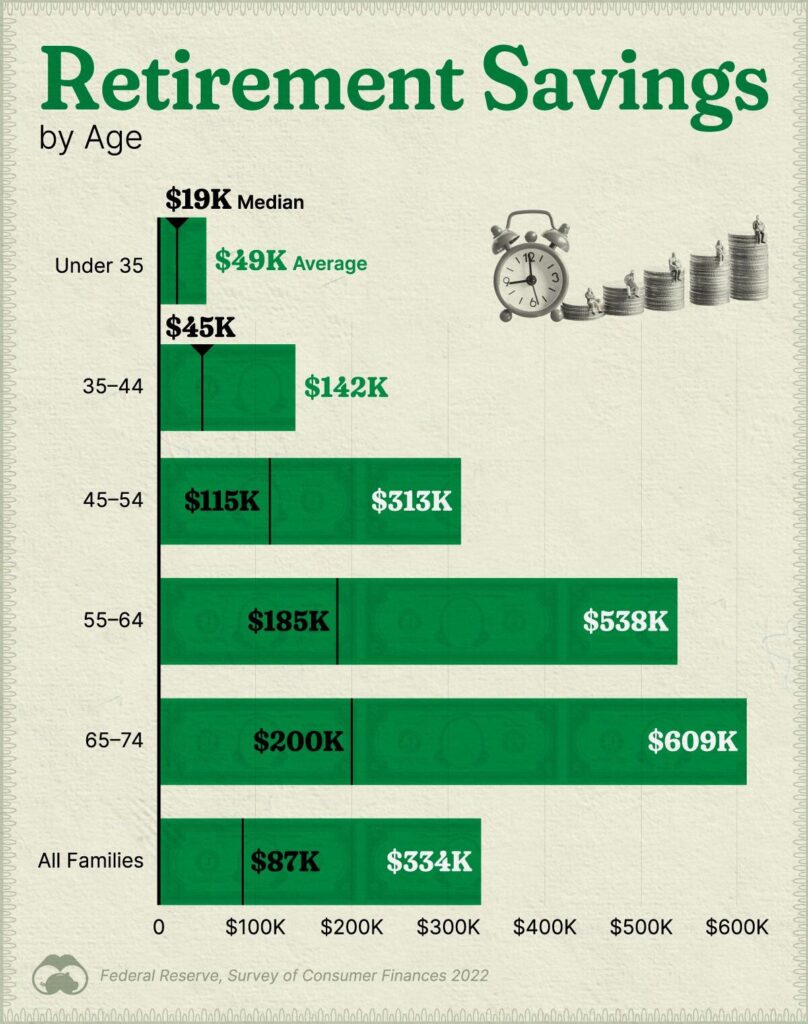

Additionally, many older adults simply don’t have enough saved for retirement. According to AARP, 20% of Americans aged 50 and older have no retirement savings at all. This lack of savings is a serious issue, especially considering that 61% of people in this age group are worried they won’t have enough to support themselves in their golden years. This means that postponing retirement is a practical move for many, forcing them to keep working just to get by.

2. Rising Living Costs

It’s no surprise that the cost of living continues to rise. Rent, healthcare, and everyday necessities have all become significantly more expensive. The pandemic didn’t help, either—it caused delays in job opportunities, disrupted wages, and led to major shifts in the job market. Older Americans are feeling these financial pressures more than most, and many are choosing to stay in the workforce longer to meet these growing needs. This, in turn, puts off their retirement plans.

For instance, in 2023, 19% of Americans aged 65 and older were still working. This is nearly double the percentage of older workers in 1987 (11%), according to Investopedia. The increase in workers over 65 is a direct result of both rising costs and limited retirement funds.

3. Health and Employment Factors

Many older adults also face health challenges that can impact their ability to work. It’s not unusual for someone in their 60s or 70s to find themselves struggling with chronic conditions that require more medical attention. However, while health problems can make retirement seem appealing, they can also drive people to continue working to afford healthcare costs.

Additionally, some older Americans are sticking to their jobs simply because they enjoy working, or they feel a sense of responsibility to their employers. This is particularly true for those in careers that they’re passionate about. Social Security concerns also play a role here—some older individuals may want to continue working to maximize their Social Security benefits, especially if they feel uncertain about the program’s future.

4. Social Security Uncertainty

Social Security has been a cornerstone of retirement for many Americans, but its future is uncertain. The Social Security trust fund is expected to be depleted by 2033, which could lead to reductions in benefits for future retirees. As a result, many older Americans are choosing to delay their retirement in hopes that they can secure a larger monthly payout or at least ensure that their Social Security benefits will last.

Broader Economic Implications of 1 in 4 Older Americans Are Postponing Retirement

The delay in retirement doesn’t only affect the individuals making this decision—it also impacts the broader economy.

1. Impact on the Workforce

As more older adults stay in the workforce, the dynamics of hiring and job competition shift. Younger job seekers may find it harder to break into the market, as older workers are holding onto their jobs longer. While this isn’t necessarily bad for older workers (who might be financially secure in their current roles), it does pose a challenge for younger generations looking to start their careers. Employers may also face difficulty managing a workforce that is more diverse in terms of age and experience.

2. Economic Strain

The rising number of older Americans who are postponing retirement is also placing a strain on public resources, especially healthcare systems. As people live longer, the costs associated with healthcare continue to climb. This burden may increase the need for government spending on programs like Medicare, Medicaid, and Social Security. If a significant portion of the population remains in the workforce longer, it could place additional stress on these programs, particularly if benefits are reduced.

3. Policy Challenges

This trend has led to debates about what can be done to ensure the financial security of older Americans. Policymakers are being urged to make reforms to both Social Security and healthcare systems to ensure that the aging population has the financial means to retire comfortably.

What You Can Do: A Practical Guide for Postponing Retirement

If you’re one of the millions of Americans who are facing a delayed retirement, here are a few practical steps you can take to help you along the way.

1. Start Saving Now

The best time to start saving for retirement is as early as possible, but it’s never too late. If you haven’t been able to save much for retirement, start now! Open an IRA, 401(k), or another retirement account. Take advantage of employer matching contributions, if available. Even small contributions can add up over time.

2. Reevaluate Your Budget

Take a close look at your expenses. Are there any areas where you can cut back? Reducing unnecessary spending and increasing your savings rate can help give you more financial freedom down the line. Consider downshifting your lifestyle by making small adjustments, like cutting back on eating out or reducing subscriptions you don’t need.

3. Explore Alternative Income Streams

If you’re concerned about not having enough retirement savings, consider starting a side hustle or exploring other income opportunities. This can help supplement your retirement savings and provide a buffer if you need to postpone your retirement.

4. Plan for Healthcare

Healthcare is one of the largest expenses in retirement. If you’re planning to retire early, make sure you’re prepared for the costs of health insurance. If you’re delaying retirement, consider ways to reduce your medical expenses. Shop for health insurance plans that suit your needs and budget, and explore options like Health Savings Accounts (HSAs).

4 Financial Mistakes Americans Keep Making That Wreck Their Budgets

Millions of Americans Could See Their Social Security Checks Cut by 50 Percent

Here’s the Average Social Security Payment for July 2025, Plus What Might Change in 2026