1 in 10 Families Hit With Inheritance Tax Bills Over £500,000 : Inheritance tax (IHT) bills in the UK are rising sharply, with nearly 1 in 10 families facing hefty tax burdens exceeding £500,000. This growing trend has many concerned about whether they could be affected, especially given the complexity and potential financial strain. Understanding how inheritance tax works, who it impacts the most, and the strategies available to reduce liability is crucial in protecting your hard-earned assets.

1 in 10 Families Hit With Inheritance Tax Bills Over £500,000

Inheritance tax can be a complex and overwhelming subject, but by understanding the rules, staying ahead of changes, and planning wisely, you can significantly reduce your liability. Whether you’re planning for a high-value property, business, or pension, proactive strategies like gifting, setting up trusts, and life insurance can help protect your family’s future. As with anything financial, the best advice is to start early and review regularly. Don’t wait until it’s too late—get professional advice, and make sure you’re ready for whatever comes next.

| Topic | Details |

|---|---|

| Current IHT statistics | 10% of estates hit with IHT bills over £500,000 in 2021-22. |

| Future Projections | 3,500 estates may face £500,000+ IHT bills by 2025-26. |

| Frozen Tax Thresholds | Nil-rate band (£325,000) and residence nil-rate band (£175,000) haven’t increased in years. |

| Tax Impact of Pensions | Pensions will be subject to IHT starting in 2027, expanding the tax base. |

| IHT Planning Tips | Lifetime gifts, trusts, and life insurance policies can help manage your IHT liability. |

| Key Resources | MoneyWeek and The Times for more in-depth insights. |

IHT, or inheritance tax, is often a tough pill to swallow, especially when families have worked hard to build up their estates. But with careful planning and proactive steps, you can minimize its impact. Let’s dive deeper into how IHT works, who’s most at risk, and the key strategies to reduce this tax burden.

The Rise of Inheritance Tax Bills in the UK

Recent statistics show a significant increase in the number of estates subject to inheritance tax (IHT). In the 2021-22 tax year, nearly 10% of estates hit with IHT bills faced liabilities of £500,000 or more. If you think about it, that’s a pretty massive chunk of money. For some estates, that bill can even top £1 million! Experts predict that over 3,500 estates could face inheritance tax bills exceeding £500,000 by 2025-26.

But why are these taxes climbing? For one, the thresholds for IHT haven’t budged in years. The nil-rate band (the amount of an estate that is exempt from tax) remains at £325,000, and the residence nil-rate band stands at £175,000. So, while asset prices, like property, keep rising, the exemptions stay the same, which means more estates are pushed into the IHT net.

Starting in April 2027, things are going to get even trickier. Pensions will be included in inheritance tax calculations, potentially bringing thousands more estates into the taxable category. If you’ve got a big pension pot, it’s time to take a closer look at your plans.

Why 1 in 10 Families Hit With Inheritance Tax Bills Over £500,000?

The Frozen Tax Thresholds

IHT is calculated on the value of your estate above a certain threshold. In the UK, the nil-rate band (NRB) is set at £325,000, and the residence nil-rate band (RNRB) for a home passed to children or grandchildren is £175,000. These thresholds have been frozen for several years, meaning they haven’t increased with inflation.

For example, if your estate is worth £500,000, you could be below the threshold, and no inheritance tax would be due. But if your estate rises in value due to the increased value of property or investments, you might suddenly cross the threshold, and a large portion could be taxed at 40%.

So, What’s Pushing More People Over the Threshold?

The most significant factor is the rise in property values. In the last decade, housing prices in many areas of the UK have skyrocketed, and this has put more people in a situation where they’re now facing inheritance tax they hadn’t expected.

Another factor is the growing value of investments like stocks, bonds, and pensions. If you’ve been fortunate enough to see your portfolio grow, you could find your estate reaching the point where inheritance tax becomes a concern.

Upcoming Changes

As we mentioned earlier, pensions will become part of the IHT calculation starting in April 2027. That means if you’ve been planning to leave a large pension pot to your family, it could now be taxed. Some experts believe that this will add thousands more estates to the tax net, so it’s crucial to review your pension arrangements well before the change hits.

Who Is Most at Risk?

Inheritance tax doesn’t hit everyone equally, but there are certain groups that are more likely to face larger bills.

High-Value Property Owners

If you own a high-value home, you’re more likely to see an inheritance tax bill. For example, let’s say your home is worth £700,000. Even though you might have the residence nil-rate band of £175,000, you’ll still be above the threshold, and some of your property’s value will be subject to IHT.

Business Owners and Farmers

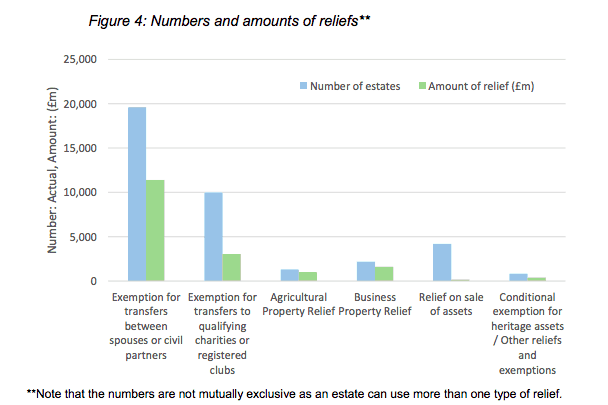

Another group particularly affected by inheritance tax are business owners and farmers. There are reliefs available, such as Business Property Relief and Agricultural Property Relief, but these aren’t automatic and can be subject to change. The recent reduction in these reliefs has made it even more challenging for these individuals to pass on their family business or land without significant tax liabilities.

Families with Significant Investments or Pensions

As you can imagine, families with high-value investments, retirement savings, and pensions are also at risk. With the changes coming in 2027, it’s important to start planning now.

Practical Advice: How to Reduce Inheritance Tax Liability

1. Lifetime Gifts

One way to reduce the value of your estate is by making lifetime gifts. If you give away assets while you’re still alive, they won’t be counted as part of your estate when you pass away. But here’s the catch: gifts made within seven years of death may still be subject to IHT. So, be sure to plan ahead and give wisely.

2. Set Up a Trust

Another option to reduce inheritance tax is setting up a trust. Trusts allow you to transfer assets to beneficiaries without those assets being included in your estate. There are several types of trusts, such as discretionary trusts, which can be particularly helpful in managing your estate and minimizing taxes.

3. Life Insurance Policies

Taking out a whole-of-life insurance policy written into a trust can be another great strategy. The policy can provide the funds needed to pay for inheritance tax, saving your family from having to sell assets. The best part? The life insurance payout isn’t included in the value of your estate for IHT purposes.

4. Plan Your Pensions Carefully

As we mentioned earlier, pensions will be included in IHT calculations starting in 2027. If you’ve got a sizable pension pot, it’s essential to review your arrangements now. Work with a financial advisor to find the best strategies to protect your pension from IHT.

5. Use Gifts and Allowances

In the UK, there are certain gifts and allowances that can help reduce the value of your estate. For example, you can give away £3,000 worth of gifts each tax year without triggering IHT, and this can be increased if you haven’t used up the previous year’s allowance.

6. Charitable Donations

If you’re a philanthropist or just passionate about causes close to your heart, consider leaving charitable donations in your will. Not only will you make a positive impact, but charitable donations can be deducted from your estate for IHT purposes. You may even qualify for a reduced IHT rate (36%) if at least 10% of your estate is donated to charity.

M&S Takes a Stand for Farmers in Inheritance Tax Battle Against UK Labour Ministers

UK Revives Pensions Commission Amid Savings Crisis — What It Means for Your Retirement

UK Set to Raise State Pension Age Beyond 67 as Life Expectancy Grows